2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

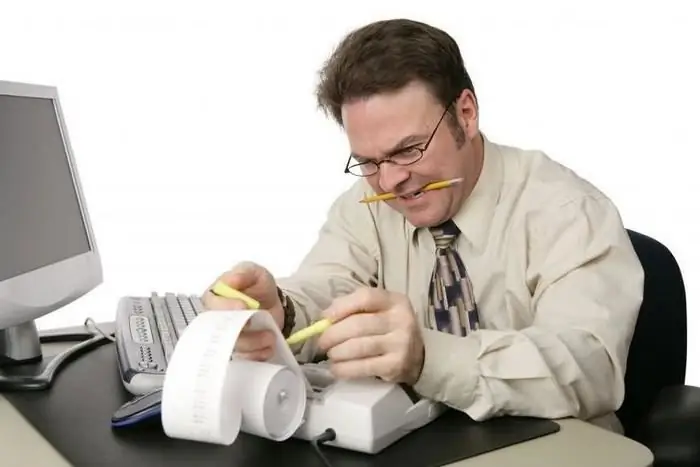

The printer ran out of ink again, the last roll of fax paper was left in the reception area, the light bulb burned out in the hallway? No problem - a prudent supplier (or just a staff member) has the right stock and will fix these problems in time!

This accountable person is appointed by order of the director. Having collected applications for all departments and sections, he fills out an application for an advance payment for the purchase of goods and materials. Then he rushes to shops, warehouses, and if necessary, he is sent to another city. Having purchased the necessary material, within three days after the business trip or the period specified in the application, he submits the AO-1 report with supporting documentation to the accounting department. On the title page, he fills in the name of the organization, division, full name, personnel number, position, purpose of the advance. On the back in the table (columns 1-6), the accountable person enters the details of the expenditure documents with the amount and, summing up the bottom line, puts his signature with a transcript. In return, the accountant issues him a receipt that the report has been accepted and verified. For its part, the accountant, having assigned a serial number to the report, compares the data with the filed original documentsand fill in boxes 7-9. Then, on the first sheet, he puts down the balances from the previous report, the amount received, expenses and displays the result for approval.

It should be taken into account that any error in AO-1 or inconsistency with the Procedure for processing cash transactions will necessarily be revealed by an audit of settlements with accountable persons.

The scrupulous auditor will analyze the monthly balances (account 71) carried over to the next period (suddenly the accountant somewhere underestimated the balance, and this is called unreasonable write-off). Then he will compare the issuance and return of the sub-report with the cash register, paying attention to whether the accountable person received an advance payment without reporting on the previous one. A deep check will also affect the attached documents. Each of them must contain the necessary details. It is possible to pay for work or services, to receive goods and materials from a third-party organization only on the basis of an invoice, invoice, stub from a receipt order, cash and sales receipt. Checking the same operation, but with an individual, the auditor will request a purchase act under the sales contract and an expense order.

The inspector will pay special attention to the need for business trips for employees, the coincidence of goals with the attached orders, the availability of supporting documents, the correspondence of the business trip period from the certificate to the number of days for payment, the dates in hotel receipts and travel tickets for which the accountable person reports. Calculations of norms of apartment and daily allowances will be subject to mandatory control. The final stage of checking travel allowances is the groupinglist of all violations.

The most time-consuming stage of the audit is the reconciliation of advance reports with journal No. 7, which presents the entire accounting of settlements with accountable persons. According to this register, the auditor will painstakingly verify the correct entry of data for each report. The total turnover on the loan must match the debit data of accounts 50, 51, 55, with the credit amounts of accounts 60, 26, 10, etc.

Recommended:

Cafe business plan: an example with calculations. Open a cafe from scratch: a sample business plan with calculations. Ready-made cafe business plan

There are situations when there is an idea of organizing your enterprise, a desire and opportunities to implement it, and for practical implementation you need only a suitable business organization scheme. In such cases, you can focus on the cafe business plan

Report for husband. Financial report to husband

Home finances are a subject of controversy and problems in many families. Very often, husbands require their wives to be fully accountable for where the money was spent. This article will tell you everything about how to keep a family budget and whether it is worth reporting to your spouse for spending

Advance report: postings in 1C. Advance report: accounting entries

Article on the rules for compiling advance reports, accounting entries reflecting transactions for the purchase of goods and services for cash, as well as travel expenses in the accounting of the enterprise

Advance report is Advance report: sample filling

Expense report is a document that confirms the expenditure of funds issued to accountable employees. It is drawn up by the recipient of money and submitted to the accounting department for verification

Advance report on a business trip. Advance report form

To account for funds that are issued to employees of the organization for travel or other needs, a special form is used. It's called a travel expense report. This document is proof of the use of money. The basis for the issuance of funds is the order of the head