2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Under the investment project is understood the program of activities that are associated with the commission of capital investments, as well as its subsequent reimbursement and mandatory profit. During planning, they certainly prescribe the stages of an investment project, the competent study of which determines its success.

Investment project and its main stages

Before investing money, the investor must carefully study the development plan of the selected project. That is why its creators carefully approach the development of each stage of its development. To date, the following 4 stages of the life cycle of an investment project can be distinguished:

pre-investment;

investment;

exploitation of newly created objects;

liquidation-analytical (not typical for all projects)

In international practice, only the first three stages are usually distinguished. Each of these phases requires mandatory regulation and control.

Project planning

There are many tasks set before the development of an investment project, but one global task is to prepare information that will be enough to make an informed investment decision.

For the purpose of modeling, the selected investment project is considered in a time base, in which the research horizon (the selected period that is being analyzed) should be divided into equal intervals. They are called planning intervals.

For any investment activity, administration is introduced, which includes the following 4 stages:

- Market research.

- Work planning and project development.

- Project implementation.

- Evaluation and analysis of the results that have been achieved since the end of the project.

What work is done during planning?

At this stage, the following procedures are mandatory:

goals are formed, as well as subgoals of investment activity;

market research in progress;

possible projects are identified;

economic evaluation in progress;

triple options while modeling various constraints (e.g. resources or time, while constraints can be both social and economic in nature);

forming a full-fledged investment portfolio

Implementation steps

Project implementation stages will certainly includeinvestment, direct implementation of the project, as well as the elimination of any of its consequences. Each of these stages involves the solution of certain problems. So, for example, during execution, production and sales are carried out, as well as costs are calculated and the necessary ongoing financing is provided. As you move through the stages and stages of the investment project, there is a gradual refinement of the idea of work, and new information is added. Thanks to this, we can talk about a kind of intermediate finish at each of these stages. Investors can use the results obtained for further planning the feasibility of investing money. The start of the next depends on the successful completion of each stage.

Pre-investment stage

The implementation of the project depends on the quality implementation of the first stage, because here the assessment of the possibility of its implementation takes place. Legal, production and marketing aspects are taken into account. Information about the macroeconomic environment of the project is used as initial information. The existing tax conditions, the technology available, as well as the intended markets for the finished product or service, are certainly taken into account. There can be a lot of such moments, they depend on the type of business chosen.

The result of the work at the first stage should be a ready-made structured description of the chosen project idea, as well as an exact time schedule in which it will be implemented.

The pre-investment stage of an investment project includesseveral stages. The first of these is to search for concepts for possible investments.

Basics for creating an investment concept

The search for investment concepts by organizations of various profiles can be carried out on the basis of the following classification of initial assumptions (they are standard for international practice):

- The availability of natural resources (such as minerals) that are suitable for processing and further use in production. A very wide range of such resources is possible, from plants that are suitable for pharmaceutical purposes to oil and gas.

- Existing agricultural production with an analysis of its capabilities and traditions. Thanks to this, it is possible to determine the development potential of this area, as well as the range of projects, the implementation of which is possible.

- Assessing the likely shifts that may occur in the future under the influence of socio-economic or demographic factors. Also, such an assessment is carried out taking into account the appearance of new products on the market.

- Imports (especially its structure and volumes), which suggests possible impetus for the development of projects that can be aimed at bringing domestic goods to the market to replace imported ones. By the way, their creation can be supported by the government.

- Analysis of experience, as well as existing development trends typical for other industries. In particular, industries with similar resources and a similar level are taken into account.social and economic development.

- Accounting for needs that already exist or are expected to arise. Both global and domestic economies are taken into account.

- Analysis of information about the planned increase in production for industries that are consumers. As well as taking into account the growing demand for a product or service that is already being produced.

- Potential for diversification of production, taking into account a single base of raw materials.

- Various general economic conditions, among which may be the creation of a favorable investment climate by the state.

What does pre-project preparation include?

Before this stage of the investment project, the task is to develop a business plan. This document must necessarily spell out all aspects of the commercial organization being created with an analysis of possible problems that may arise in the future, and determining ways to solve them.

The structure of such a project should be clearly defined. It may include the following sections (they analyze possible solutions to problems in these areas):

Existing market potential and production capacities are being carefully studied to meet the planned production volume

Analysis of the structure, as well as the amount of existing or possible overhead costs

The technical background of the manufacturing organization is taken into account

Opportunityplacement of new production facilities

Amounts of resources that are used for production

Proper organization of the work process, as well as remuneration of workers

Financial support for the project. In this case, the amounts needed for investment are taken into account, as well as the likely costs of production. Also in this section, ways to obtain investment resources are prescribed, as well as possible achievable profit from such investments

Legal forms of existence of the created object. This refers to the organizational and legal part

How is the final preparation of an investment project carried out?

At this stage, the financial and feasibility study documents for the project are being prepared very precisely, which provides an alternative consideration of possible problems that are associated with many aspects of the investment:

commercial;

technical;

financial

At this stage of the investment project, it is extremely important to determine the scope of the project (this may be the number of products that are planned for release, or indicators in the service sector). The problem statement is very important at this stage of the work. All types of work are planned very accurately. Moreover, all works are indicated, without which the implementation of the project will be impossible.

This is where the performance of an investment is measured and the possible cost of capital that can be raised is determined. As a starting pointinformation used:

production costs currently available;

capital investment schedule;

need for working capital;

discount rate

Results are most often presented in the form of tables showing the performance of investments.

After that, the most suitable project financing scheme is selected, as well as an assessment of the effectiveness of investments from the point of view of the project owner. It is impossible to make such documentation without information about loan repayment schedules, interest rates, and dividend payments.

Final project review

The factors of the external environment are taken into account, as well as the situation within the company. If these factors are negatively assessed, the project may either be postponed or rejected.

If a positive decision was made, the investment phase begins.

Investment stage

The investment stage of the project includes the introduction of investments, the total amount of which, on average, tends to be 75-90% of the volume of investments that was originally planned. It is this stage that is considered the basis for the successful implementation of the project.

Depending on which investment object is considered, the project may include a diverse set of activities. Time and labor costs may also vary.

Provided that we are talking about an investment portfolio that must be formed on the stockexchange, an investor to buy it most often just needs to click the mouse several times and fill out the registration form.

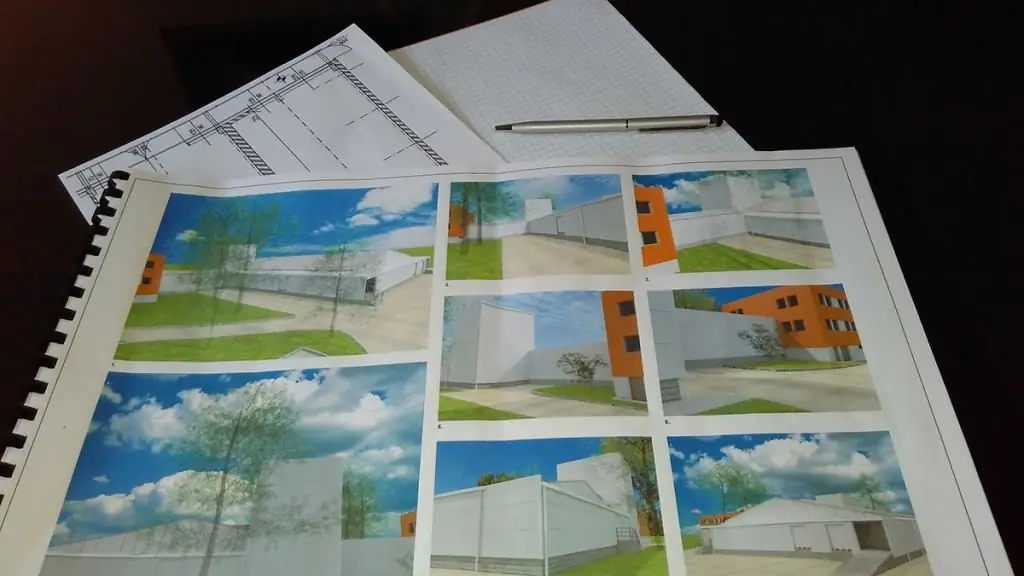

Provided that the object of investment is the construction of a building, the implementation of the stages of an investment and construction project is a very complex and lengthy process, which includes numerous stages. Here the investor must carry out the following manipulations:

select contractors who will develop all the necessary documentation for the project;

select the best suppliers of the necessary materials and equipment;

find a construction company to do the work

It is worth noting that in practice, very few investors deal with all the issues that were listed above. Usually the choice stops at one company, which receives the status of a general contractor. It is this selected company that subsequently organizes work with subcontractors, and also controls all stages of the implementation of the investment project.

Operating stage

Very often sources call this stage post-investment. Here the exploitation of the acquired asset begins, the first income arrives. Often there are situations when the project does not make a profit at first, but this will not come as a surprise to experienced investors. In addition, even at the stage of evaluating investment projects, the costs for this stage are laid down, amounting to 10% of the total investment.

Stage durationoperation under different conditions may be different in each case. In many ways, the operational stage of an investment project depends on the quality of the investments that have been made. If the preliminary calculations and investor expectations were correct, then this stage could continue for many decades. If the investment was not justified, then the operational stage could be reduced to several months.

The logical apogee of this stage of the investment project implementation is that the investor has achieved the programmed goals.

Liquidation stage

Various reasons can cause the beginning of the liquidation stage. Among them may be:

- When opportunities for further development are exhausted.

- A favorable commercial offer received by the owner of the asset.

- The curtailment of investments may be due to the fact that the project did not live up to expectations.

Even at the stage of development of investment projects, the existence of such a stage is expected. It is always associated with the analysis of information that was obtained during the implementation of the project. As a result, specific conclusions can be drawn about inaccuracies and errors, due to which the maximum profit was not obtained.

Features of the stages of investment projects

Investment analysis is carried out by many methods, but any of them involves considering the project as an independent object of the economy. Therefore, it is assumed that in the first two stages of an investment project, it should be considered separately fromother activities of the enterprise.

The correct choice of financing scheme is also important. And the overall assessment of the project is to ensure that all the necessary information is presented in such a form, which is sufficient to make a decision and draw a conclusion about the feasibility of investment.

Recommended:

Investment design. Life cycle and efficiency of the investment project

Investment design is carried out in order to determine the object of investment of financial resources, which will allow receiving dividends in the future. The document drawn up at the same time has some similarities with a business plan, but at the same time, the project allows you to most fully cover the information and get a solution to a particular economic problem

Investment phase of the project. Economic efficiency of the investment project

The investment phase of the project is its implementation and completion. Accompanied by a large amount of consulting and engineering work, which are an integral part of management. Such a project phase is a set of certain stages. Allocate definition, legislative, financial and organizational components

Evaluation of investment projects. Risk assessment of an investment project. Criteria for evaluating investment projects

An investor, before deciding to invest in business development, as a rule, first studies the project for prospects. Based on what criteria?

Project implementation methods. Methods and tools for project implementation

The term "project" has a specific practical meaning. Under it is understood something once conceived. The project is a task with some initial data and goals (required outcomes)

Investment: investment multiplier. Investment multiplier effect

The investment multiplier is a coefficient that shows the change in gross product along with investment. Its effect can be seen by considering a specific example