2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Few people have a clear idea of what settlement and clearing organizations are. But this does not change the following fact: such financial structures perform objectively important work. Therefore, their activities and features deserve attention.

Key concepts

If we talk about clearing activity, it should be noted that it is mainly connected with the definition of mutual obligations. In fact, we are talking about the offset of applications for the supply of securities and the settlements that are performed on them.

It can also be said that a clearing organization is a banking-type financial structure that acts as a competent intermediary between buyers and sellers. That is, it takes over the buying process, acting on behalf of a specific person or company intending to purchase securities and vice versa. Such mediation allows for full control over the fulfillment of the obligations of both parties, which significantly increases the degree of security of the transaction.

Clearing services become relevant immediately after the conclusion of a transaction between the twoparties in both the stock market and the OTC market.

As for the process of transferring a transaction, for which the term “innovation” is used, it can take from several weeks (over-the-counter markets) to several seconds (stock markets).

Often a clearing organization is a division of exchanges where securities are traded, which allows the latter to exercise full control over various transactions.

Requirements in Russia

Clearing activity in the territory of the Russian Federation is legal, but at the same time, an organization providing such services must comply with certain standards and fulfill key requirements.

So, the functions of a clearing organization can only be performed by a business entity that was established in full compliance with Russian law. At the same time, the right to transfer powers to a sole executor, for example, a manager of a structure, is initially blocked.

Those requirements that are fixed in the Federal legislation regarding activities in the field of clearing apply to the central counterparty.

At the same time, there are a number of areas in which clearing companies do not have the right to be active:

- insurance, trade and production activities;

- participation in non-state pension and mutual investment funds;

- maintaining the register of securities holders;

- management of equity investment funds;

- activities associated with a specialized depository of investmentfunds.

It is worth remembering the financial statements. It must be provided in consolidated form by both the clearing house and the central counterparty. As for the annual report, it is necessary to display the accounting for 12 months.

The company providing clearing services can dispose of its property in any way. This means that the purchase of securities with own funds is also allowed.

Possible combination of activities

It is worth knowing that a clearing organization is a structure that, in addition to its main activity, can act as an organizer of trading. But this opportunity is available only if several conditions are met:

- refusal to participate in depositary, brokerage and dealer activities in the stock market;

- loss of the right to act in the status of a central counterparty;

- ban on securities management.

If an organization plans to combine the provision of clearing services with activities as a broker, manager or dealer in the stock market, then it cannot be a central counterparty.

Also, when a clearing organization carries out any activity other than the main one, it is obliged to create one, and, if necessary, several structural divisions, and separate ones. Subsequently, clearing will be carried out through them.

Goals

Any organization operating in the field of clearing is focusedto achieve several key goals. They look like this:

- reduction of the time required for settlements;

- reduction in the level of costs associated with settlement services for RBC participants;

- maximum reduction of risks accompanying settlements within clearing activities.

Obviously, such organizations make transactions easier and more reliable, and this is what attracts a lot of customers to them.

In this case, it is worth understanding the following: in order to achieve the above goals, a license from the Central Bank is required, which gives the right to service any settlement operations at a particular RBC. In most cases, such companies are registered as an LLC, although other legal forms are possible.

It makes sense to mention that a clearing organization is a structure that can work both with one securities market and with several. Moreover, the format of activity is sometimes not only national, but also international.

Key features

After the trade organizer enters into an agreement with the clearing house, some activity is expected from the organization. The essence of the latter can be reduced to a set of actual functions for which clearing exists:

- checking the presence of the initial margin on the trading participant's account;

- receiving orders in the trading system and their subsequent registration;

- acceptance of applications-offers accepted from clients;

- registration of the transaction that was concluded;

- reconciliation after acceptance of bids for a counter bid;

- ensuring the full and accurate fulfillment of the obligations of both parties involved in the transaction;

- determination of the size of the variation margin and its transfer;

- formation of guarantee (special) funds;

- ensuring the final settlement between those counterparties that were specified in the contract.

By performing these functions, the clearing organization can represent the interests of two parties with their prior consent. Moreover, it has already become obvious that without reconciliation of each concluded transaction, the level of failure of the latter will increase significantly. As a result, large investors will face absolutely unnecessary difficulties. For this reason, the functions that clearing organizations perform in the securities market are relevant and even necessary.

How the organization's capital is formed

A company that has chosen the field of clearing, of course, should make a profit. And such a commercial structure forms its capital with the help of the following sources of income:

- registration and transaction support;

- circulation of funds owned by the organization itself;

- selling information;

- profit from the sale of calculation technologies used by the company and software, including.

It will be fair to say that it is the clearing organizations that occupy one of the centralplaces in derivatives trading. We are talking about stock options and futures contracts. It is worth clarifying the point that reconciliation systems will have noticeable differences in different markets. This fact is explained by the different volumes of transactions, the cost of transactions and the specific market structure.

Types of netting

The activities of clearing organizations include the execution of transactions during which netting is used, and of two types: multilateral and bilateral.

In the first case, both parties calculate their obligations or claims within a specified period. To determine the position (balance), the difference between the participant's obligation and his claim is fixed. This type of transaction is the most common. In this case, if the balance is not equal to zero, then the position is considered open and closed in the opposite situation.

Bilateral netting is based on the pairwise calculation of mutual claims when using securities or cash. Since it is extremely rare to see stocks and currencies offsetting at the same time within the same market, this form is rarely used.

The situation in Russia

If you pay attention to the exchanges operating in the CIS, you will notice that the vast majority of them independently perform the functions typical of clearing organizations. At the same time, the situation is diametrically opposite in the West.

It is worth noting that in Russia they resort to the services of third-party creditorganizations, but only for cash payments based on the results of clearing and in the amount of net positions. Exchanges could do this part of the work on their own, but they do not have such an opportunity due to the limitation of the areas of activity of non-credit organizations by Russian law.

As a result, in the vastness of the Russian Federation, for full-fledged clearing activities, exchanges need the services of only controlled or subsidiaries of NPOs.

Nevertheless, a clearing organization is a form of activity available in Russia that is considered legal if there is a license. The latter is issued by the Central Bank.

Results

Based on the above information, we can make an obvious conclusion: the activity in the field of clearing is relevant and will remain so as long as deals are made in the securities markets, as well as in foreign exchange.

Recommended:

Clearing is The concept, types and functions of clearing

In financial and banking activities, there are a lot of terms, the essence of which is difficult to understand by name. One of them is clearing. In simple words, the exchange procedure. Companies, banks, countries can exchange goods, services, securities. A clearing company is an intermediary that brings together sellers and buyers

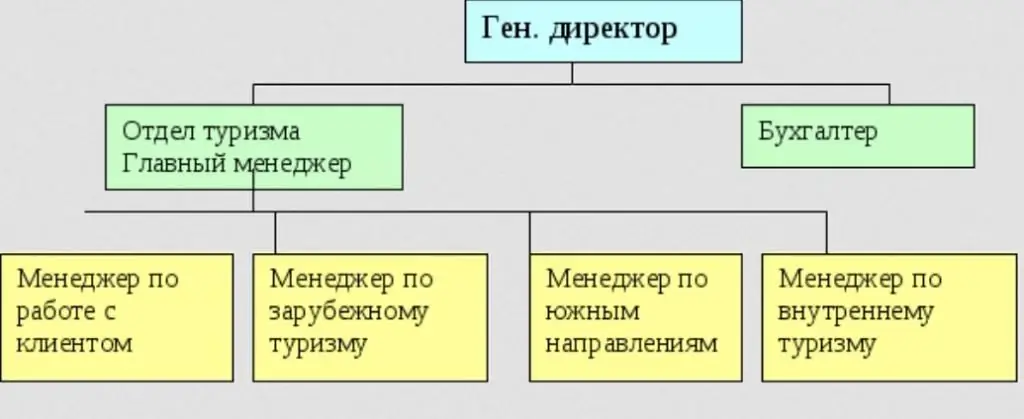

Line manager: definition, managerial activities, tasks and functions

Line manager is the head of a separate division, business or production. With the help of the management apparatus entrusted to him, he coordinates the work of subordinate employees, makes key decisions related to the functioning of his department

Mission and goals of the company: definition, features of activities and implementation

In the process of work, the management of the enterprise makes various decisions. They relate, in particular, to the range of products, the markets to which it is supposed to enter, the issues of strengthening one's position in the competition, the choice of the optimal technology, materials, etc. Activities that are aimed at solving these problems are called the business policy of the enterprise

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

How to manage a housing and communal services management company? Licensing, organization and activities of the management company in the field of housing and communal services

Today, there is no competition in the field of housing management in the modern domestic market. And most of those companies that exist are often lacking initiative or even problematic. And this despite the fact that the management company, on the contrary, is designed to improve this area and ensure the rational use of funds. It is the question of how to manage a housing and communal services management company that this article is devoted to