2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

The wave of bankruptcies of construction companies hit hard on equity holders who dreamed of their own new housing. Each shareholder is the most injured party, which not only lost its money, but also for a long time parted with its desire to move into a new apartment. How not to fall into the trap of false promises of developers? Let's try to formulate the main rules for working with representatives of construction companies.

Who are equity holders

First of all, let's deal with the terminology. Developers are construction organizations and their representatives offering to buy an apartment in an unfinished residential building. As a rule, apartments at this stage are relatively inexpensive, but you cannot move into such housing. Developers have the right to offer apartments for sale at any stage of construction.

A shareholder is a person who has the right to a part (share) of a house under construction, usually limited to the living space on which he is going to move in after the building is put into operation. Both parties - both the developer and the shareholder - are interested in the construction of a residential building. Then the latter can move intoapartment, and the developer - to receive money.

The main document of the shareholder

First of all, you should make sure that the construction company works within the framework of 214-FZ. It is this federal law that forms the relationship "shareholder-developer" and explains the correct procedure for the interaction of those who seek to buy an apartment and those who must build it.

Agreement for Participation in Shared Construction (DDU) is a document that must be signed by both the developer and the shareholder. This rule is enshrined in law and must be followed. It is DDU that allows the future buyer of an apartment to count on a refund in the event of bankruptcy of a construction organization. The shareholder needs to clearly remember that only DDU is a guarantor and is accepted in court. Why are developers not in a hurry to draw up a DDU, but offer completely different documents for signing?

Preliminary contract: cheating for a shareholder

A simple and reliable way to deceive a future tenant is to offer him for signing not an agreement on participation in shared construction, but “almost the same” document, supposedly guaranteeing all the rights of the future tenant. This document may have different titles. The most common name is "preliminary contract". The essence of such a document is as follows.

The preliminary contract is proposed to be concluded for the period of construction, promising full partnership in return. It is understood that the contract of sale will be concluded with the shareholder only after the construction of a new house is completed and this residential property will be commissioned inoperation.

But, as a rule, lawyers do not find any hint of co-investor protection in preliminary contracts. These documents are not registered anywhere and can be torn apart unilaterally. The preliminary agreement does not provide for any monetary transactions at all - all mutual settlements are regulated by the equity participation agreement. As a result, the deceived equity holder does not receive the most important thing - the guarantees that are available in the law on shared construction. Contributor:

- not insured against double sales of the same living space;

- has no chance to make claims on the quality and timing of construction;

- does not have legal methods of pressure on the developer.

Moreover, lawyers warn that preliminary agreements could be considered a sham deal.

Promissory note scheme

In the case of a bill of exchange scheme, the investor-client must conclude two contracts - a preliminary contract and a bill of sale. At first glance, it is the bill of exchange that serves as a guarantor of reliable relations, and this payment document will be used for mutual settlement under the main contract. But the promissory note will also not be accepted by the court as a guarantee obligation: the developer has every right to refuse to sign the main contract to the equity holder of the residential complex, return the money on the promissory note, and sell the apartment to another person.

What to look for when preparing documents?

Before you buy an apartment in a new building, you should make sure thatthe developer has received a building permit and has a valid civil liability insurance policy. Such a policy can be a bank guarantee or a full-fledged agreement with the insurer.

If the developer proposes to conclude a DDU, you should make sure that the media or the Internet have detailed project documentation for future development. The developer is obliged to publish construction plans 14 days before the signing of the first DDU agreement. Only a lawyer can verify the legality of the construction. Therefore, it would be useful to request a form of an agreement, statutory, permitting documents, project documentation and check these papers with a qualified lawyer.

The next step in the analysis of the developer's reliability is the study of public opinion. It is best to understand the assessment of the activities of a construction company from the reviews of equity holders posted on the network. The developer must have a sound reputation, relevant experience in carrying out construction work and already commissioned new buildings, the quality of construction of which can be judged.

Explore the history of new home construction from the time the permit was issued to the present. Perhaps the crisis in the economy forced the construction company to suspend the construction of the new building. And the property that's up for sale already belongs to some shareholder who's just trying to save his money.

Visit the site

You should definitely visit the construction site where the new building is being built. Near the construction site on the fence there is information about the developer, customer, approximate termsdelivery of the object for residential use. It is necessary to check the data of the information board with the information presented in the DDU. The slightest discrepancy can serve as a basis for terminating the contract by the shareholder - this is a direct appeal to the court for a refund and compensation. Discuss all doubtful points with your lawyer or address to the hotline of local authorities.

We hope that these simple tips will help you get your long-awaited housing on time and without delay. Good luck!

Recommended:

How to become richer? How to become more successful and richer? How the rich got rich: what is the secret of successful people

Many extremely interesting conclusions can be drawn from the attitude to life and work in the modern world of oligarchs. However, you should not get hung up on how to become richer, because for each person this problem is solved in its own way. God grant you to have so much money so that you do not feel their significance, ceasing to keep petty calculations, because that's when you can feel happy

Who does not want to know a lot, or Which bank does not check credit history

We receive money with a black mark in the dossier: which bank does not check credit history? Where can you find such a lender, and where does nothing shine for you?

How to become an actor? How to become a famous actor without education

Perhaps, each of us at least once in a lifetime had a desire to become an actor. Moreover, as a rule, we “try on” not the life of artists of a small theater, but the stellar role of world-famous celebrities. We will talk about how to become an actor today. After all, one desire is not enough, you also need to know where to start, which doors to knock on

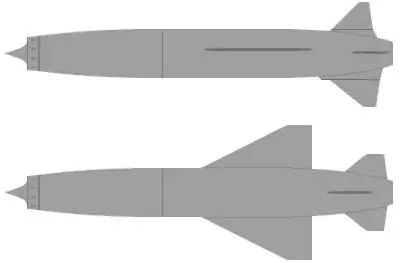

The guidance system of the Granit missile has not become outdated in three decades

Granit missiles can operate autonomously, be guided by satellites of a space constellation, or carry out a massive attack. In the latter case, several control systems work together, using radio channels as an interface

How do I become an Avon coordinator if I am a representative? What does it take to become an Avon coordinator?

"How do I become an Avon coordinator if I am a representative?". This is one of the most frequently asked questions among those who happened to get acquainted with the products of this company. Looks like it's time to climb up the corporate ladder. And you have come to the right place: now you will learn what it takes to become an Avon Coordinator