2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Banking systems are an integral part of various economic models. However, there may be significant differences between them.

Banking system

Before proceeding to the study of what types of world banking systems are, it is worth understanding the definition itself. This terminology is used to describe the totality of non-bank credit institutions and banks themselves, which operate within the framework of one legal and financial and credit mechanism.

This system includes both the national bank and private structures, including various credit and settlement centers. The key function of the national bank is to carry out the state currency and emission policy. It is the center of the country's reserve system.

The banking system may also be related to those specialized companies that provide the activities of credit institutions.

System Components

Within the framework of the topic "Banking system - concept, types, levels, elements", it is worth considering the institutional components that form the system.

You can start with credit institutions. This is a legal entity whose main purpose is to obtainincome through banking operations. To carry out such activities, a license is required, which is issued by the central bank. Moreover, all operations of such organizations are carried out in strict accordance with national legislation.

If we talk about Russia, the laws of the Russian Federation allow you to open credit institutions using any form of ownership. It is also possible to form various associations and unions focused on protecting the interests of their members, while leaving aside the tasks associated with making a profit.

Understanding what the banking system is, its elements and types, it is worth determining the next institutional component, which is its constituent. It's about the bank. This term should be understood as a credit institution that has the right to carry out certain financial transactions in strict accordance with the legislation of the Russian Federation. Such operations include the following services and processes:

- opening and maintaining bank accounts for legal entities and individuals;

- attracting funds from various persons into deposits;

- placement of these funds at your own expense and on your behalf on the terms of urgency, payment and repayment.

It is important to understand the following fact: if even one of the operations listed above is absent in the activities of an organization, it is considered a non-bank structure.

Foreign bank. The term is used in some countries to refer to a credit institution that has been recognized as a bankbased on the laws of the state where it was registered.

Non-bank credit organization is also part of the overall system. As its distinguishing feature, one can define the possibility of carrying out certain banking operations, which are provided for by national legislation.

Market model

The types of the banking system include various forms of its organization. One of the common types is market. This system has the following characteristic features: the state is not a monopoly in the field of banking and its influence on various credit structures is limited to establishing the main parameters and principles of development.

With this model, decentralization of banking sector management operates. There is also no mutual responsibility: the state is not responsible for the financial results of the activities of the above-mentioned organizations, and private credit institutions, in turn, are not responsible for the operations carried out by the state.

Also, under such a system, the state has an obligation to maintain order in the national economy. This fact, as well as a large number of private credit organizations in the system, lead to the need to form a central bank or an organization that will perform its functions. One of the main tasks of such a bank is to monitor other structures that are involved in credit relations.

The following fact deserves attention: the status of the centralbank is so special that it is singled out as a separate banking type of financial system or, more precisely, a level. It is for this reason that market systems are in fact always multi-level.

Accounting and distribution model

This type of banking organization is used mainly in those countries where the democratic system is unpopular.

This system is characterized by a state monopoly on the establishment of banking institutions and operations. The distinctive qualities of this model include the appointment of bank managers by the state and the definition of state responsibility for the results that were obtained as a result of banking activities.

As a result, with this model, the range of credit institutions is quite narrow. This means that either a small number of credit institutions that specialize on an industry basis, or a single state-owned bank is engaged in the provision of banking services.

System levels

Considering the types of construction of the banking system, it is necessary to take into account the fact that some of them are based on the principle of determining the order of relationships that are formed between various credit institutions.

We are talking about multi-level and single-level banking systems.

The one-tier model is used mainly in countries with a totalitarian system, where one state-owned bank operates. Suchthe model is also relevant at the initial stage of development of the banking system.

As for the multi-level system, it is characterized by the differentiation of credit institutions by levels. At the same time, the central bank is always in first place, regardless of the number of allocated levels and credit institutions in general.

The system in Russia

If you pay attention to the types of the banking system of the Russian Federation, you can come to the conclusion that a multi-level model operates on the territory of the CIS. At the same time, this system has the following structure: the Bank of Russia, various credit organizations, as well as representative offices and branches of foreign banks.

But the Russian banking system is not limited to this. The types that it includes imply the operation on the territory of the state of specialized organizations that do not carry out banking operations. At the same time, such organizations are focused on ensuring the activities of credit structures and banks.

Given that the modern banking system of Russia is a system of the type corresponding to the market model, the direction of credit activity, functioning under it, consists of several levels:

- central bank;

- banking sector (savings, mortgage and commercial banks);

- insurance sector (pension funds, non-bank specialized credit institutions and insurance companies).

American and Japanese models

There are other areas in which the bankingsystem. Their types differ markedly depending on the region.

The American model is characterized by the parallel operation of the Federal Reserve System, as well as investment, savings, commercial banks and judiciary savings associations.

The Japanese banking system looks somewhat different. The types of financial institutions operating in this country can be described as follows: central bank, postal savings banks and commercial banks.

Conclusion

With all the abundance of possible models thanks to which the banking system can be organized, it makes sense to define types that involve several levels as more progressive.

Recommended:

Information and reference system: types and examples. What is an information and reference system?

Dissemination of information, its further collection and processing within modern society is due to special resources: human, financial, technical and others. At some point, this data is collected in one place, structured according to predetermined criteria, combined into special databases convenient for use

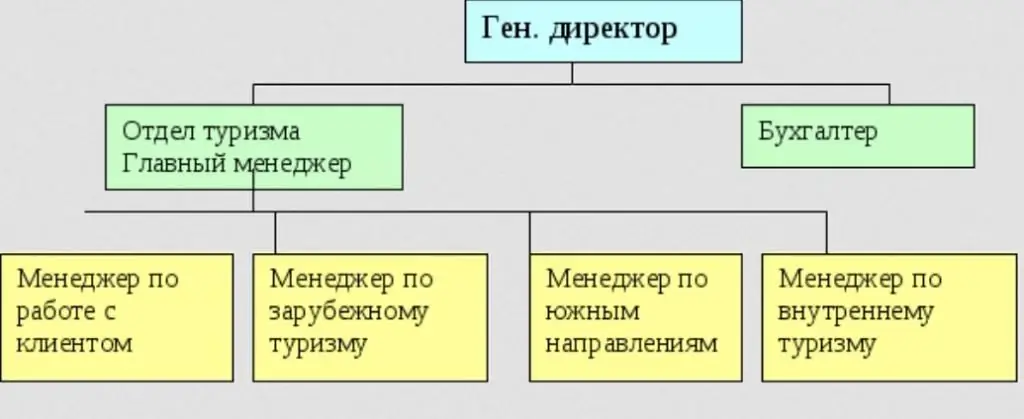

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Interbank settlements and their importance in the banking system

Interbank settlements take place when the recipient and the payer are account holders in different banks. All transactions between financial institutions through correspondent accounts are organized in two ways: using centralized and decentralized systems

Reserves of banks and their formation. Required bank reserves and their norm

Bank reserves ensure the availability of funds for the uninterrupted fulfillment of payment obligations regarding the return of deposits to depositors and settlements with other financial institutions. In other words, they act as a guarantee

Banking is a remote banking service. "Client-Bank" system

Banking service is constantly improving. It gets better every year. Now banks offer a new service system called banking. What it is? How does it work? What features does it offer? Read about all the features of this type of service in this article