2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Most of us have a stereotype that an investor must be incredibly rich, accomplished and no longer young. In fact, absolutely anyone can become an investor. To do this, you just need not to keep savings under your pillow or on a deposit with meager interest, but to make money really work.

To make your money work effectively, you need to stock up on knowledge. A selection of the best books on investing will help with this. Really interesting and useful literature written by ordinary people who have come a long way in investing.

"Rich Dad Poor Dad" - Robert Kiyosaki

It's not quite right to call this book a guide to investing. But this is, of course, a thing from which you should start your journey into the world of prosperity and prosperity. The book explains clearly and with real examples what is the difference between poor and rich people - in their habits and judgments. It has long been known that rich people have a special mindset that allows them not to lose their composure intime of risky cash transactions, approach any transaction with a cold mind and find advantages for yourself in seemingly hopeless situations. While poverty, or rather the habit of poverty, is inherited. And there is nothing surprising in this. Parents teach their children by word of mouth and by example how they think money should be earned and how money should be spent. Children grow up and become part of the same vicious circle of "salary-bills-expenses-debt".

Robert Kiyosaki's book Rich Dad Poor Dad tells you how to break this deadlock and break out of the vicious circle of the so-called "rat race". This term in the book refers to the need to work for a private company or the state, spending everything you earn on paying off loans and servicing your life. After all, this is the scenario most of us live in, remaining at the end of life with only a beggarly pension.

The Smart Investor - Benjamin Graham

Benjamin Graham back in the middle of the last century developed the method of "value investing", which remains relevant to this day. For more than half a century, The Intelligent Investor has been considered one of the best books on investing for beginners. This work has rightly earned fame for a long time as a handbook of a successful investor and even the bible of the stock market

In The Intelligent Investor, Benjamin Graham consistently lays out everything that is important for an investor to know: what is "Mr. Market" and howit operates according to the laws, what is the difference between long-term investments and active speculation in the stock market, what is a passive or active investor, and how to build an investment portfolio in such a way that money works according to the most convenient scenario for you. The content, among other things, provides very revealing real-life examples.

Warren Buffett, one of the world's largest investors, appreciated this book so much that he even wrote a foreword for the fourth edition. It says that the book "The Intelligent Investor" by Benjamin Graham, read by him at the age of 19, turned Buffett's life upside down. The fact that the biggest investor considers it to be the best book on investing ever written is the best review and recommended reading.

"The Path to Financial Freedom". Author B. Schaefer

Bodo Schaefer is one of the world's most famous financial consultants, an expert in achieving financial independence, a business coach and the author of the most popular motivational books. The key word is "motivational" - this book belongs to this category. Bodo Schäfer's Path to Financial Freedom is replete with appealing slogans and wise quotes, as well as examples from the author's own experience. The examples are very illustrative. Bodo at one time managed to gain financial independence himself, but this did not happen immediately. Like most successful investors and consultants, he tried his hand in private business more than once and suffered failures and bankruptcies. The ability to keep up in any situationhands, and looking for the opportunity to move on to success is the key to succeeding in any business. This is especially true for investments, because in the stock market at any time, due to a rash decision, you can lose everything.

Summarizing, we can say that the book "The Path to Financial Freedom" by Bodo Schaefer is perfect for those who want to improve their financial situation, but for some reason are not confident in their abilities or are afraid to take the wrong step. This author knows how to find the right words for such people and push them to action.

Warren Buffett's Investing Rules - Jeremy Miller

Already mentioned in this article, Warren Buffett is the most famous and largest investor in the world. Today he has passed 87 years, and by this venerable age he has reached a fortune of about 84 billion dollars. Here is a man from whom there is much to learn. But, unfortunately, Buffett himself does not write books. There is no doubt: if I wrote, these would be the best books on investing.

But Warren Buffett has been actively involved in investing since 1956, at the same time he organizes a joint investment business with partners - Buffett Partnership Limited. Every six months, the neat and scrupulous Buffett analyzed his actions and sent his partners a report on the company's activities with a detailed description of the methods of the most successful investment and other conclusions about working with securities. Not so long ago, financial analyst Jeremy Miller analyzed the activities of the largest and richest investor. He sorted Buffett's letterspartners by topic, taking as a basis the most successful period of the company's activity. This is how this book turned out, which should be read not only by novice investors, but also by all thinking and inquisitive people.

"Against the gods. Taming Risk” - P. Bernstein

When it comes to investing, you can't do without risks. Another thing is that each investor chooses his own strategy of behavior. If you want to earn quickly and a lot - be prepared to take risks “like a hussar”. If you are afraid of losing part of your investment and do not like risk, choose more conservative and long-term, but less profitable strategies. Risk, the main component of the exchange game, is the subject of this book by Peter Bernstein. How to treat the risk factor, what mechanisms exist for working with it, how you can make money on the risk and how not to be afraid of it - all this is extremely fascinatingly set out on the pages of Peter Bernstein's book “Against the Gods. Taming risk.”

"Prudent Asset Allocation" - William Bernstein

This book will be good not so much for novice investors, who may find it a little heavy, but for players already active on the stock exchange. It describes how to build your investment portfolio in the best possible way, in what proportions and in what assets you should invest money, depending on what the investor's financial goals are. In a word, "Reasonable Asset Allocation" is a collection of effective solutions on how to increase profitability and reduce risks. This approachwill be of interest to long-term investors. But it is precisely such investors, if we analyze real examples, that achieve the greatest success.

"The richest man in Babylon" - George Samuel Clason

The fact that history is our best teacher is perfectly confirmed by this book. It turns out that the secret to achieving personal financial freedom and independence was known in ancient Babylon. The author is based on long-term studies of ancient sources and derives the basic timeless laws of financial literacy. These laws were relevant in Babylon long before our era, in Veliky Novgorod at the dawn of our era, they remain in force even now. The book is also unique in that all the necessary investment knowledge is presented in a very interesting manner - like a parable. This makes reading doubly useful and instructive.

“The mechanism of trading. How to build a business on the stock exchange? - Timofey Martynov

Unfortunately, the Russian investment market is much younger than the American or European one, therefore, in comparison with Western ones, such financial literature is rather scarce. However, even among our authors there are worthy works that quite claim to be the best book on investing. Among them is the book by Timofey Martynov, a successful stock player and experienced investor.

The book is intended for existing investors who are familiar with the mechanisms of transactions in the stock market. Beginners will also find it useful to knowcontent, but in order to understand all the nuances set forth in the book, it is better to immediately apply the knowledge gained in practice. The whole algorithm of actions is set out by Timofey Martynov with skill: when is it best to enter into a deal, what market analysis to use in what situation, and talks about common pitfalls in investing on the stock exchange. In general, the book is very applied and gives a lot of practical advice.

What distinguishes books on investing by Russian authors is that all the examples are based on our realities. The book describes examples of working with Russian stocks and indices. After all, the Russian financial market has its own specifics, which must be taken into account.

Where to start?

So, you know the key and most useful books on investing. If you are just on the threshold of the path to financial literacy and independence, start with Kiyosaki and Schaefer. If you have already developed some financial principles for yourself and have some kind of investment portfolio, even if it is a bank account and several dozen bonds, you can already consider yourself an investor. Therefore, it will be more interesting for you to get to know and read the works of Graham, Buffett and Bernstein. Well, if you are no longer a beginner in stock market operations, give preference to applied literature, such as the book “Japanese Candlesticks” by Steve Nison or the mentioned book by Martynov “The Mechanism of Trading”.

If you arm yourself with the necessary knowledge in a timely manner and do not give vent to emotions and momentary impulses, you will have a great future in investing. It remains only to wish everyone successful investments and financial independence.

Recommended:

Warren Buffett is the best investor in the world. Biography, books, sayings, the path of the "oracle from Omaha"

Warren Buffett is called the Oracle of Omaha by his compatriots for a reason. This financier and businessman has a paradoxical sense of economic processes. In addition, he leads his investment company with a firm hand, where like-minded people work

How to read steel grades

Alphanumeric codes are used throughout the former Soviet Union. This definition of the steel grade is very convenient and understandable, the number means the percentage of impurities, and the letter means the chemical element

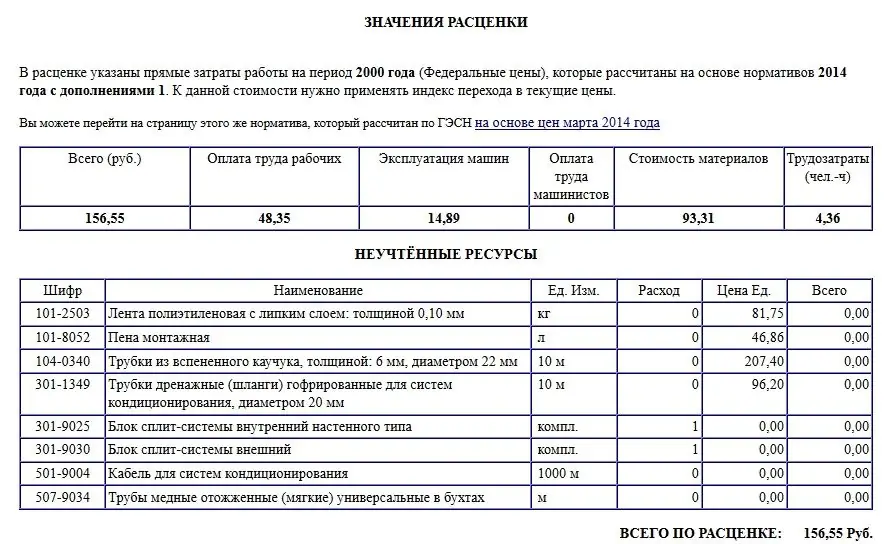

Step by step instructions on how to read estimates. An example estimate for the installation of a split system

How to understand the estimates? Examples of estimates for installation. Drawing up an estimate using the example of a local estimate calculation for the installation of a split system. Completion of estimates for installation work. Regulatory documents for determining the cost of construction products in the territory of the Russian Federation

Best Trading Books: Reading List for Beginner Traders

To succeed in trading, you need not only to master its technical basics, but also to constantly improve and improve your trading skills, as well as learn how to apply psychology in stock trading. The best assistants and teachers for beginners can be books for learning trading, which will not only enrich them with the necessary knowledge, but also help increase motivation to achieve goals

Best books by Alexander Elder

Alexander Elder is a well-known professional trader, consultant and stock trading expert. Author of numerous articles and books on the subject. Published in 1993, Elder's work en titled "How to play and win on the stock exchange" became an international bestseller (translated into 12 languages) and went through several editions. In the professional environment, the book received great recognition. But this is not the only work of a trader that is worthy of attention. The article will present the best books of Alexander Elder