2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:36

Now the certificate of the chief accountant is often asked from applicants who wish to fill a vacant position. And its absence may prompt a potential employer to think about the lack of a sufficient level of professionalism. That is why current professionals are advised to focus their efforts on obtaining a certificate of chief accountant. In the future, this can be a serious step up the career ladder.

What is this?

The certificate of the chief accountant is needed so that the specialist can document his professional competence. Its presence allows you to perform the work of the fifth level in accordance with the requirements that apply to professional accountants.

Passports are divided into two types:

- for commercial companies;

- forgovernment organizations.

Why do I need a certificate of chief accountant?

The work of an accountant has become more difficult in recent years. This is justified by a large number of changes in legislation. Performing daily work duties, the accountant does not find extra time to follow them.

However, employers are not interested in hiring unqualified specialists who make mistakes in their professional activities. That is why the certificate of the chief accountant is needed for both. It allows a specialist to confirm qualifications, and gives the employer confidence that he is hiring a worthy candidate.

After the introduction of a professional standard for accountants, a large number of companies require a certificate when hiring employees. A similar condition may apply to new employees or existing ones.

A certificate of a professional chief accountant to some extent acts as a guarantee that the candidate is more mobile and has better qualifications compared to colleagues who do not have the corresponding document. This creates some kind of advantage when moving up the career ladder or getting the desired position.

The profession of an accountant implies the need to keep track of changes. Insufficient competence of a specialist may result in fines for the employer. That is why having a certificate will confirm your knowledge and increase your attractiveness in the eyes of your superiors.

Requirements forobtaining an accountant's certificate

It is curious that the document is not issued to everyone. To obtain it, individuals must meet a whole list of requirements. It is worth familiarizing yourself with them in advance.

- Higher education in economics.

- Three years of experience in one of the senior positions.

- Possible secondary vocational education with five years of work experience.

- No conviction for economic crimes allowed.

Fulfillment of these requirements allows you to apply for a certificate of chief accountant. However, the corresponding document will be issued only upon successful completion of the qualifying exam.

How to get?

Specialists who want to get a certificate of chief accountant will need a serious attitude. Because the whole process is quite long and complicated. It includes several steps:

- training;

- interim certification;

- qualification exam.

Training

Specialists who apply for this document must first of all be trained. Training for the certificate of the chief accountant can be completed at an accredited center at the IPA of Russia. It also includes auditors. Certification of accountants has been carried out for more than two decades - since 1997.

During the training period, applicants will learn the procedure for issuing a document. As well as the features of joining the number of active members of the IPB of Russia. The same accredited center musthelp with paperwork, as well as their subsequent transfer to the territorial IPB.

Training can also be done in other institutions. There are vocational training centers with a license, as well as accreditation of the Institute of Biosecurity of Russia. Based on these documents, organizations can issue certificates.

Intermediate certification

According to the results of vocational training, knowledge is tested. In fact, this is just an intermediate certification. So to speak, a rehearsal before the real exam. Conducted in the same center where the accountant studied.

However, in some cases, applicants can go through it on the website of the IBP. This opportunity is provided for specialists who have mastered the entire curriculum using materials previously developed by the ISP.

To obtain admission, the applicant must not only provide a completed package of documents, but also pay an entrance fee to the territorial Institute of Security. It is at this institute that you need to clarify the nuances - for example, what documents should be provided and what details to pay for.

Qualifying exam

This is the final stage for those who are interested in obtaining a certificate of chief accountant. Only those who successfully passed the previous certification are allowed to take the exam.

In fact, they receive the certificate of the chief accountant remotely. Electronic testing accountants hand over on the website of the IPB. In this case, the organizer is the territorial institution. After successfully passing the test, the candidate is issued a certificate,and are also recognized as an active member of the Russian ISP.

If the qualification fails after the first attempt, the candidate is allowed to retake it twice. There is some time limit. For two retakes, the accountant is given no more than three months from the date of the first test.

Important nuances

It is not enough just to get a certificate of chief accountant once and safely forget about it. You will have to spend forty hours annually on training in order for the document to remain valid. That is why having such a certificate seriously increases the competitiveness of an accountant in the labor market.

Information about candidates who have successfully passed the qualifying exam is entered into the Unified Register. From it, the employer can learn a lot about his employee, namely: the date of entry into the ISP, the moment of the last advanced training. Information is stored for five years.

The validity period of the certificate is three years. If during this period the accountant regularly made contributions and timely improved his qualifications, the document will be extended for the same period. In this case, you will not have to retake the exam.

Recommended:

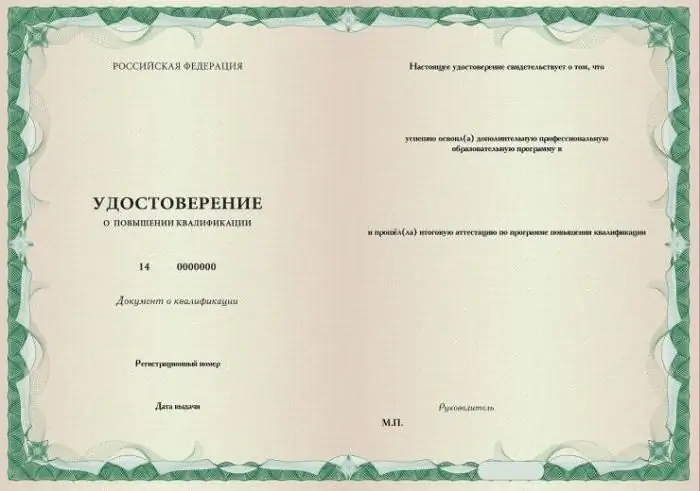

Certificate of advanced training: sample, form and filling rules

In the process of professional activity, it is necessary to periodically improve the level of training. Time passes - technologies, standards and requirements for the work of specialists are constantly changing. A certificate of professional development is a guarantee of high professionalism of an employee. Here you can find a sample and form of a certificate of advanced training, as well as familiarize yourself with the rules for filling it out

Qualification requirements of the leading accountant. Job description of a leading accountant (example)

One of the most important and significant positions in the enterprise is an accountant. It is he who is responsible for all finances and calculations. It is believed that only with a good accountant can a company become successful

Job description of the deputy chief accountant: duties, rights, requirements and functions

In most cases, employers impose certain requirements on applicants for this position. Among them, the main one is the presence of a diploma of graduation from a higher educational institution in the field of accounting and accounting. In addition, the employee must have at least five years of experience in this field

Responsibilities of a payroll accountant. Payroll accountant: duties and rights at a glance

There are many current vacancies in the economic field. True, the most popular today is the "payroll accountant." This is because in every company, organization or firm they give out a salary. Accordingly, a professional in this field will always be in demand

Assistant chief accountant: appointment, conditions of admission, job descriptions and scope of work performed

Any state, budgetary or commercial enterprise carries out its activities within the framework of accounting and reporting by the chief accountant. It is rather difficult for one person, and even in a large-scale company, to comprehend the full range of duties assigned to the chief accountant. Therefore, each head of the accounting department takes a mandatory personnel unit to help him - an assistant to the chief accountant