2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:37

The result of the bank's work is primarily associated with a competent "game" in the exchange rates. And since this is a game, there is always someone who loses. However, in the case of the bank, not only he suffers, but also his customers. Therefore, a depositor, like no one else, should be interested in what the bank's currency position is, because it will determine the possible losses or losses associated with a change in the exchange rate. And his whole future fate depends on this!

So what is a foreign exchange position, and how does it affect the efficiency of a bank?

First of all, this is the ratio of the requirements and liabilities of the bank, calculated on a separate currency, with which it makes transactions. At the same time, it can be open and closed. An open currency position means that the amounts of claims and liabilities for this particular currency do not match, i.e. in the event of a change in its exchange rate, the bank will have a profit or loss. There are long and short open currency positions. If the currency position is long, then the bank's receivables exceed the accounts payable, i.e. he wins with promotionthe exchange rate of a foreign currency, and will lose - if it decreases. A short position, in turn, implies the exact opposite: the bank's obligations to its creditors exceed the claims to its debtors, so it is not an increase, but a fall in the exchange rate that is beneficial.

Many, of course, have now thought that it is much better for the currency position to be closed: and there is no need to worry about any risks, however, how then to get such a desired high profit? Of course, this is a profit of a speculative nature, behind which there is a skillful game on exchange rates and which is not stable. However, do not rush to worry, because the state regulates the maximum size of a bank's open position depending on the amount of its assets. In addition, the bank itself is interested in the correct determination of currency risk, and, therefore, monitors changes in market conditions.

In fact, even the worst-case scenario for a bank will not affect you in any way as its client and depositor, because even in this case, your deposit would be paid to you from the reserve or authorized fund of the bank. Moreover, the bank constantly monitors the forecasts of the dynamics of the exchange rates with which it works. Also, a constant recalculation of open positions into closed positions is carried out by converting liabilities and claims first into one of the freely convertible currencies, and then into the national currency. In 2012, the Central Bank of the Russian Federation established that an open foreign exchange position cannot exceed the size of the bank's capital by more thanthan 10%, and the amount of open positions - 20%.

As you can see from these figures, the bank's foreign exchange position is tightly regulated by the state, and the situation when assets and liabilities for a particular currency are not equal is subject to special attention, so bank customers definitely have no reason to worry. However, reading at your leisure about banking, currency risks and types of currency positions of the bank will definitely not hurt you!

Recommended:

Vacuum packaging of fish is a guarantee of its long-term preservation

Vacuum packaging of fish can significantly extend the shelf life if it is done with preliminary displacement of air from the chamber with special gas mixtures prepared for each product

Reliability is Technical reliability. Reliability factor

Modern man cannot imagine his existence without various mechanisms that simplify life and make it much safer

The official currency of Morocco. Country currency. Its origin and appearance

The official currency of Morocco. Country currency. Its origin and appearance. Where and how to change currency. Moroccan dirham to US dollar exchange rate

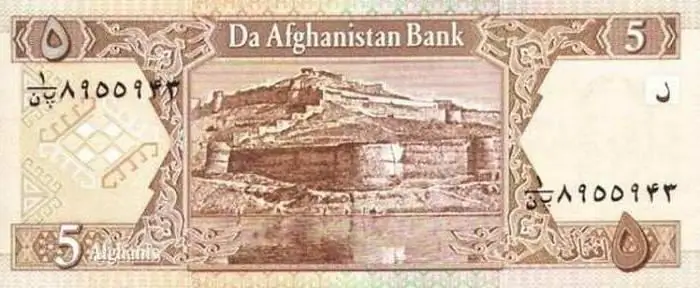

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

Type of bank guarantee. Securing a bank guarantee

One of the ways to secure financial obligations, when a credit institution, at the request of the principal, must make payment to the beneficiary, are bank guarantees. These conditions are written in the contract. A bank guarantee can be considered a payment document only if it is drawn up in strict accordance with applicable law