2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Each company has the opportunity to independently choose the system and form of tax and accounting. The prevailing principles for the formation of accounting data are: reliability, transparency, accessibility of perception, the possibility of obtaining a report on any asset or type of settlement, exclusion of data leakage and distortion.

Applied forms and accounting systems

The set of documents, registers, accounting reports, the sequence and order of their completion, appearance are decisive for the form of accounting. It is customary to distinguish several of their types:

- Memorial order accounting system.

- Journal-order accounting system.

- Simplified system.

The most widely used accounting system in an enterprise is considered to be a journal-order form. In modern conditions of process automation, many software options have been created.software that is focused on getting the best results. When using accounting programs, there are no clear boundaries between forms and accounting systems, since the formation of a report of any kind takes a minimum amount of time and effort.

General characteristics of the journal-order accounting system

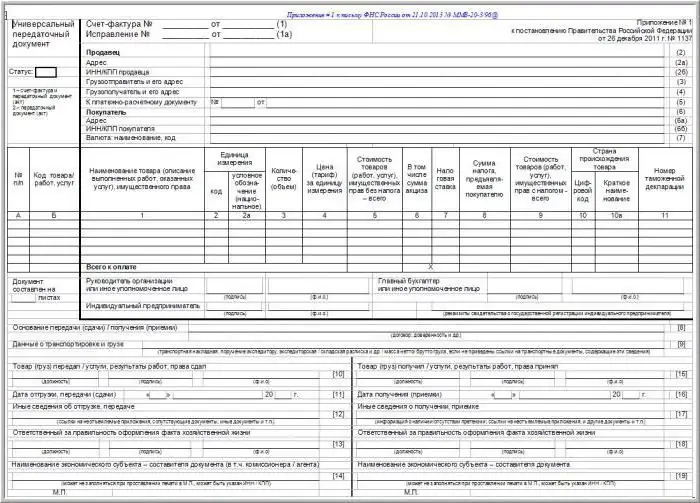

This system is based on the principle of systematization and accumulation of data reflected in primary documents. Recording information in the registers occurs simultaneously, taking into account the chronological sequence. The main documents of the system are: journal-order, accumulative (auxiliary) statement, general ledger and balance sheet. For a more detailed disclosure of information on analytical accounting, a card and a turnover sheet of the account can be used. Their data is transferred to the corresponding journal-order and statement. To account for fixed production and non-production assets, intangible assets, inventory cards of each object are maintained, production costs are recorded using costing sheets. Various kinds of settlement tables and transcripts are maintained as necessary separately for each type of assets, calculations.

The order of filling registers

Filling of journal-orders occurs on the credit basis of the operation, i.e. the data reflected in the primary documents are summarized by the credit of a particular account and recorded in the corresponding register. In this case, the debit-corresponding register is reflected in it, which makes it possible to apply the methoddouble entry in one document. Each journal-order is a statement built according to the chess principle, formed on the credit of one or several similar (similar in content) accounts.

The total value of a business transaction is placed at the intersection of the line and column of the register. For example, you can take journal-order 2, designed to reflect information on the credit of account No. 51 "Settlement account", in the debit of accounts 50, 55, 52, 57, 58, 18, 60, 62, 68, 66, 76, 71, 70, 73, 75 etc.

Journal Order 2

| record number | Date | 50 | 71 | 60 | 75 | 55 | 70 | 66 | 68 | Total Loan |

| 1 | May 11, 2010 | 2, 0 | 2, 0 | |||||||

| 2 | May 12, 2010 | 57, 0 | 57, 0 | |||||||

| 3 | May 13, 2010 | 15, 0 | 15, 0 | |||||||

| 4 | May 16, 2010 | 20, 0 | 15, 0 | 35, 0 | ||||||

| 5 | May 19, 2010 | 13, 0 | 13, 0 | |||||||

| 6 | May 25, 2010 | 10, 0 | 35, 2 | 3, 5 | 7, 3 | 56, 0 | ||||

| Total | 35, 0 | 2, 0 | 70, 0, 0 | 10, 0 | 15, 0 | 35, 2 | 3, 5 | 7, 3 | 178, 0 |

The following operations are reflected here:

- 10.05.2010 2.0 units were issued from the current account to the sub-report.

- 12.05.2010 funds were transferred to suppliers of raw materials and supplies, 57.0 units.

- 13.05.2010 - cash withdrawal to the cash desk of the enterprise, 15.0 units.

- 16.05.2010 funds were transferred to a special account (letter of credit) in the amount of 15.0 units

- 16.05.2010 - cash withdrawal to the cash desk (20.0 units) for household needs.

- 17.05.2010 transferred to suppliers 13.0 units per item delivered.

- 25.05.2010 payments made to the founders in the amount of 10.0 units.

- 25.05.2010 the salary of employees of the organization was transferred in the amount of 35.2 units.

- 25.05.2010 transferred to reduce the amount of debt on the loan 3.5 units

- 25.05.2010 funds were transferred to the budget (VAT, advance payment) 7.3 units.

Each business transaction is confirmed by a primary document, on the basis of which the journal-order is filled. When withdrawing cash to the cash desk of an enterprise, a cash receipt order (account 50) is used, to transfer cash assets from the company's current account to various counterparties or budgets of various levels - a payment order.

Vedomosti

The journal-order is filled from primary documents, but some accounts have a fairly large amount of analytical information that is processed in the auxiliary statement, and its daily total is included in the corresponding cell of the register. For example, when making settlements with suppliers and contractors, it is possible to make several dozen transfers in one day to pay off (reduce) the amount of debt or pay advance payments. To conduct analytics, an auxiliary statement is compiled for account 60. In this example, on May 12, 2010, 57.0 units of funds were transferred from the company's current account, which are sent to various counterparties under the relevant agreements or delivery documents. To decipher this amount, a special document can be drawn up.

Bill decryption 60

| Date | Amount | Name of counterparty | Foundation |

| 12.05.2010 | 15, 0 | Polet LLC | Delivery Agreement No. 34 dated 2010-10-01 |

| 37, 0 | JSC "NPK" | Debt on invoice No. 102 dated May 2, 2010 paid off | |

| 5, 0 | Lira LLC | Advance payment based on invoice No. 33 dated May 10, 2010 | |

| Total | 57, 0 |

The result of this statement is reflected in the order journal No. 2, documents confirming the operation (payment orders with a bank mark) are attached to the analytical transcript.

Register numbers

Numbering is subject to each journal-order. The form is a sheet of large format, which reflects a set of columns for recording account numbers corresponding to the credit of the selected account (or group). Records of transactions are kept daily or as primary accounting documents, auxiliary statements are formed. A journal-order is opened for a specific synthetic account (a group of accounts with similar content) on a monthly basis, each is assigned a permanent number.

- Form No. Zh-1 is maintained on credit 50 of the account.

- Form No. Zh-2 is maintained on the credit of account 51.

- Form No. Zh-3 - credit of accounts 56, 57, 55.

- Form No. G-4 - credit of accounts 92, 95, 93, 94, 90.

- Form No. Zh-6 - credit 60accounts.

- Form No. Zh-7 - credit 71 accounts.

- Form No. Zh-8 - credit of accounts 06, 97, 09, 61, 67, 64, 63, 76, 75, 58, 73.

- Form No. Zh-10 - credit of accounts 70, 02, 10, 84, 20, 69, 23, 65, 29, 28, 26, 31, 44, 05.

- Form No. Zh-11 - credit of accounts 43, 41, 40, 46, 45, 62.

- Form No. Zh-12 - credit of accounts 82, 89, 96, 86, 87, 88, 85.

- Form No. Zh-13 - credit of accounts 01, 48, 03, 04, 47.

- Form No. Zh-14 - account credit 14.

- Form No. Zh-15 - credit of accounts 83, 81, 80.

- Form No. Zh-16 credit accounts 11, 07, 08.

Closing registers

Journals-orders for accounts are filled out throughout the month, when each register is closed, the turnover on the loan is summed up in the debit of the specified accounts. Synthetic accounting data is checked for compliance with the values of the auxiliary statement, which reflects analytical transcripts. The values obtained after reconciliation are transferred to the General Ledger. It is opened for each calendar year, contains balances at the beginning of the period, is filled monthly with account turnover and serves to compile an interim balance sheet (quarterly, monthly, semi-annual).

At the end of the year (reporting period), on the basis of the data entered in the General Ledger, a balance sheet is formed. To do this, the turnovers of all order journals for the period are summed up, the opening balance is taken into account, and, depending on the type of account (passive or active), the balance at the end of the year is calculated. The journal-order accounting system is designed for manual data processing. Its main negative characteristic isthe bulkiness of journals and registers, so the best option for its use is accounting automation.

Recommended:

Payment order: filling order, purpose

The payment order is mentioned in the Regulation of the Central Bank No. 383-P of 2012. This settlement document is created in a banking institution to make a partial transfer of funds

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?