2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

In the modern market, there are many algorithms for assessing the market situation, which differ in complexity and power. Recently, more and more often traders have resorted to using the Market Way indicator (in Russian, which means “market path”).

What is this

Using the Way Market display indicator, traders can quite accurately predict the dynamics and trends of price changes in the market, and determine the best places to place positions. The undoubted advantage of this indicator is more accurate signals in comparison with the classic "Stochastic" and MACD. In addition, its basic principles are somewhat different in a positive way.

Way Market display indicator: how it works

The window of the algorithm is located below the price level. In it you can see a set of multi-colored lines and a histogram. The orange curve is responsible for the trend line (the main curve of the algorithm). An uptrend is displayed with light green and green curved lines, and a downtrend is displayed with lilac and pink. You can check the validity of the algorithm signals using the histogram.

Installation and optimal settings of Market Way

The process of installing the indicator is quite simple and will not raise any questions even for novice users. To start working with the algorithm, you need to activate it. Only after this operation, you can go to the parameters window.

The Way Market display indicator has the following main parameters:

- IdMain - draws a trend curve in the indicator window.

- IdBear - setting the parameters of the downward trend curves.

- IdBull - setting the parameters of uptrend curves.

- IdArray - smoothing curves in the window. By smoothing, you can get rid of market noise and reduce the risk of false signals.

The success of the algorithm depends on its correct optimization, so certain recommendations should be followed. The Way Market display indicator may initially seem too confusing. It is worth noting that it is quite difficult to correctly configure the indicator, so it is recommended to start working on the default settings.

Features of application in work

The Way Market display indicator can be used in three ways. In the first option, you need to track the position of the blue dots. So, when placing dots above the orange curve, you need to create buy positions, and if the blue dots are under the orange curve, you need to create sell positions.

The second way is to evaluate the market situation according to the position of the histogramrelative to zero. If the bars are below zero, provided that the orange trend curve is increasing, this is a signal to create buy positions. When the bars are below zero and the orange curve tends to fall, you need to create sell positions.

The essence of the third (safest) way to use the Market Way is to focus on three signals. The essence of this method is as follows:

• Uptrend orange curve.

• Intersections of green and orange curves.

• The blue tint of the histogram and its location below the zero mark.

For novice users of the algorithm, it is recommended to use a demo account for a detailed acquaintance with all the intricacies of setting up and using the algorithm.

Main advantage: Way Market display indicator and good forecasts

In accordance with its nature, the Market Way indicator is a very complex oscillator algorithm for deep technical analysis. The undoubted advantage of this algorithm is the ability to display both the strength of bulls and bears, as well as the ability to track the moment of weakening sellers and buyers.

Also, the Way Market display indicator allows you to follow the current trend (moving averages). Therefore, in addition to simply measuring strength, it can be used to determine the flow trend quite accurately.

Thanks to all the above features, the Market Way indicator is a complex, powerful system indicator that can easilycan be used to determine trading tactics.

Market Way Strategies

The algorithm allows you to apply the strategy on an arbitrary part of the time frame. But, due to the low level of market noise, the Way Market display indicator has disadvantages: senior bidders have advantages. Consider the main strategies in the algorithm:

Signal to buy:

1) The red line in the center signals an uptrend in the market above zero.

2) The light green bull line should be positioned so that it crosses the moving average line (dark green) from below or above it.

3) The bearish line (dark pink) crosses the moving average line (blue) from below or is located above it.

No minimum value of the signal candle should be placed with a stop order. It will also be correct to set it on the values of local minima and maxima. But the more advantageous is the installation of "stop" when the signal candle reaches the minimum value after its close. Profit is equal to the stop signal.

Sell signal:

1) Downtrend of the market - the red line in the center passes under zero.

2) The bullish line crosses the moving average line from above or is below it.

3) The bearish line is placed below the moving average line or crosses it from top to bottom.

Performance

As practical experience shows, the indicatorThe Way Market display has been tested for performance by monitoring nine currency pairs. No more than 3-4 deals were open at a time. As a result, the trader will be able to make 20 successful transactions. At the same time, all open deals will be closed during the day due to low profits (20-30 points).

Recommended:

Pallet display: detailed description

Pallet display is a tool that sellers can use to maximize the attention of potential customers and more effective sales. Bright images, unusual shapes in harmony with branded elements will help to achieve the goals of trade marketing. What remains to be seen is the reason for such a high rating

Market "Dubrovka". "Dubrovka" (market) - opening hours. "Dubrovka" (market) - address

In every city there are places where a good half of the population prefers to dress. In Moscow, especially after the closure of Cherkizovsky, the Dubrovka market can be called such. It bears the proud name of a shopping center, although in reality it is an ordinary clothing market

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

Market "Gorbushka". Gorbushka, Moscow (market). Electronics Market

Of course, for a huge number of residents of the metropolitan metropolis, the phrase "Gorbushka market" has become something of a native, because once it was the only place where you could buy a copy, albeit a "pirate", of a rare movie or an audio cassette with recordings of your favorite rock band

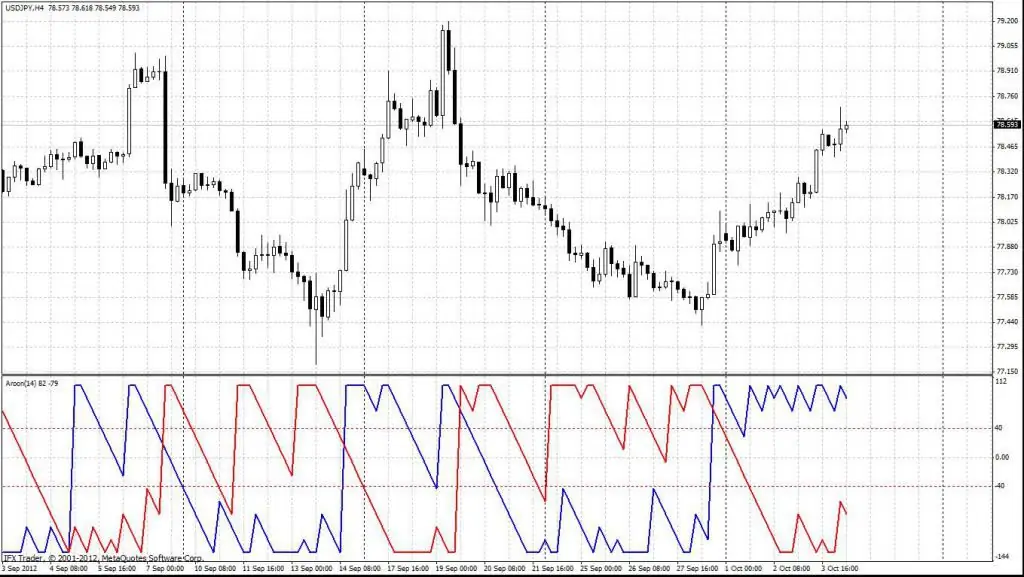

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement