2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

Inventory is the verification of a firm's inventory on a given date by comparing actual data with balance sheet information. This is the main way to control property values. For more information on how inventory is carried out and processed in a pharmacy, read on.

Legislation

The following regulatory documents regulate the inventory procedure in a pharmacy:

- Order of the Ministry of Finance No. 49 "Instructions for inventory";

- ch. 25 of the Tax Code of the Russian Federation;

- FZ No. 129 "On Accounting";

- normative documents of the state authority exercising internal control;

- orders of the leadership of the organization.

Timing

Inventory helps track the movement of funds and determine the value of the property. The legislation does not clearly spell out the conditions and frequency of reconciliation. These data should be recorded in the accounting policy of the enterprise. The number of inspections per year, their dates, the list of property is also determined by managementfirms.

FZ No. 129 spells out situations in which an inventory must be carried out in a pharmacy:

- when transferring assets for rent, buyback or sale;

- annually before reporting;

- when changing persons liable;

- when facts of theft of property are revealed;

- in the event of a natural disaster or emergency;

- when an organization is reorganized or liquidated, etc.

Preparation

Before the start of the test, you need to form a commission. It usually includes an accounting officer, a representative of the administration and a specialist who is well acquainted with the conduct of business. A financially responsible person is also involved in finding the property “in fact”. The composition of the commission, the timing of the audit is approved by the head of the enterprise by special order.

After it is signed, the commission starts preparatory activities. First of all, the pharmacy warehouse is checked for the presence of a fire alarm, the storage conditions of the MPZ (presence of safes, special containers). MZP storage areas must be equipped with measuring instruments. The export of goods from the territory of the organization must be controlled. Entrances and exits to the room in which the MZP are stored are sealed. The commission also checks whether a labor and liability agreement has been concluded with the storekeeper.

Inventory at the pharmacy

Before calculating the actual balances, all cash receipts are fixed,invoices from suppliers. After that, the commission is issued an inventory list form. This is a list of available values, presented in alphabetical order. It lists all the minimum wages available to the organization, their quantity and quality. According to these data, the presence of the MZP is checked. Property that is not listed is surplus. The procedure for their identification and accounting will be described in more detail below.

Inventory in a pharmacy can be carried out in one of the following ways: by balance, using equipment, manually filling out the list.

In the first case, the actually available goods are checked with the values listed in the act. All identified discrepancies are recorded and corrected in the inventory. This reconciliation method takes a very long time. In the course of daily work, especially if the pharmacy has high traffic, the likelihood of putting the drug in the wrong box or leaving it next to the checkout increases. When taking the goods, part of the drugs can be forced to use more popular drugs. It is very difficult to recalculate the entire game in search of a missing position. Therefore, during such checks, a shortage is often revealed, which in fact does not exist. We have to re-collect the commission and re-verify.

The easiest way to inventory in a pharmacy is by using equipment that scans goods in their storage areas, transfers data from the terminal to a computer and automatically generates inventory sheets. The information received is compared with accounting data. All discrepancies are recorded in the inventory.

Similar methoddata processing provides a third method. The difference lies in the fact that employees themselves need to bring all the goods to the scanner and process them. This process takes a long time. But there is a way to organize time rationally.

The commission should be divided into groups of two. It is necessary to carry out verification from different ends of the pharmacy, moving towards each other. One person will be the “server” (“counting”) and the other person will be the “scanning” (“writing”). The first one opens the box and passes all the preparations to the partner, who scans them and transfers them to a separate box. After the inventory of one box or shelf is completed, you need to put a box of medicines on it and move to the next shelf. Upon completion of the test, you should simply arrange the drugs in the right order. With this method of inventory, all goods that are not in their place will be taken into account. The computer will calculate their number and give the final result.

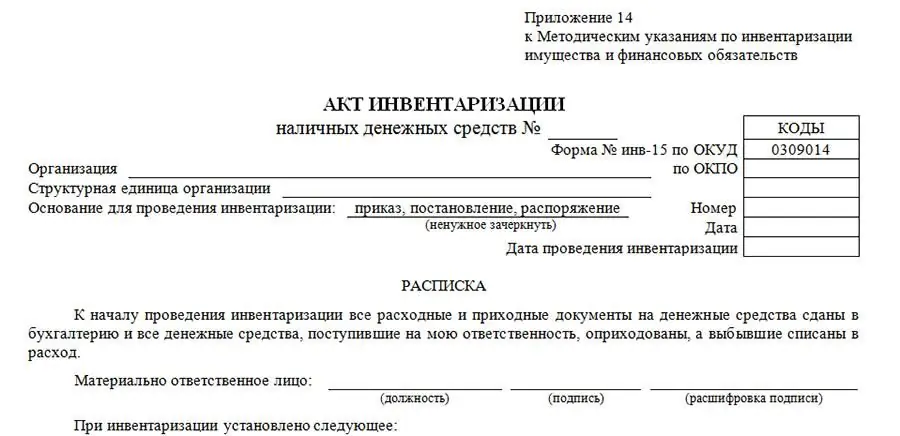

Filing results

After the check is completed, an inventory act is generated. It presents the identified shortage and re-sorting. An interim commodity report is generated separately. It is signed by the chairman of the inventory commission and all participants in the audit.

Surplus Accounting

Sometimes the results of the audit reveal property that is not reflected in the balance sheet. In such a situation, the commission needs to establish the causes of its occurrence. In the balance sheet, the surplus is accounted for at the market price on the date of the verification by posting DT10 KT91. With furtheruse, these surpluses are recognized as expenses from ordinary activities. In NU, their cost is classified as non-operating income. In case of further use, it is written off as expenses when calculating income tax.

If the management decided to sell the identified minimum wages, then the accounting of expenses for such operations will take place in a different order. Income from the sale of identified surpluses must be reduced by the price of their acquisition. There is no such information on surpluses. The methods of its calculation are not prescribed by law. Therefore, the income from the sale of such products is not subject to adjustment, since the costs of their manufacture were not taken into account during the inventory.

Inventory rules

Reconciliation of balances in a pharmacy is different from the usual inventory. The commission can only conduct an audit in its entirety. The absence of even one of its members may serve as a basis for protesting the results. During the inventory, you need to pay special attention to the following points:

- Drugs that are subject to quantitative accounting are accounted for by types, packaging, names, forms and dosages. They are entered into the inventory act in groups.

- Responsibility for the theft of funds lies with the warehouse manager, if the commission can prove his guilt. The employee must pay a fine equal to one hundred times the damage caused to the legal entity.

- When reconciling poisonous agents, a separate inventory form is drawn up. In case of detection of deviations above the approvednorms, the manager must notify the higher organization about this within three days.

Accounting for shortages in accounting records

Shortages cannot be covered by surpluses. They are written off within the established norms by order of the head. Write-off rates do not apply to factory-made drugs.

Drug loss cannot be attributed to natural wastage:

- during storage, transportation, due to violation of the conditions and rules of technical operation;

- when repairing or transporting equipment;

- during warehouse operations, accidents, emergencies;

- technological losses.

In accounting records, the shortage refers to distribution costs and is reflected in postings:

DT94 KT10 - the entry is made on the basis of the inventory act;

DT20(44) KT94 - the entry is made on the basis of the calculation certificate.

In NU, losses within the norms of loss are related to material costs. The norms themselves are indicated in such Orders of the Ministry of He alth: No. 1689 (2007), No. 375 (1996), No. 284 (2001), No. 2 (2007).

If the GORZDRAV pharmacy reveals shortages in excess of the norms, then the costs are written off to the guilty persons with the following postings:

- DT94 KT10 - based on the account statement.

- DT73.2 KT94 - based on the order of the head.

The Labor Code provides for the obligation of the employee to compensate the actual damage to the employer. The latter is understood as a real decrease in property or deterioration of its condition, as well as the need for the employer to bear the cost of restoring property. Financially responsible persons must compensate the damage in full. If an employee voluntarily refuses to compensate for the damage, the amount of which exceeds his average monthly earnings, then the recovery is carried out through the court.

If the perpetrators are not identified or the court refused to recover, then the losses are written off to the financial results: DT91 KT94.

Accounting for shortages at NU

In NU, such losses are included in non-operating expenses. The fact of the absence of perpetrators must be documented by the authorized authority. Cases of theft of valuables in a pharmacy should be considered by state authorities. If the perpetrators are not found, the preliminary investigation stops. The commission shall issue a resolution on this fact, a copy of which shall be sent to the prosecutor. A copy of this document just confirms the absence of the perpetrators.

Property, the shortage of which was revealed during the inventory, was not used for VAT transactions. If the perpetrators of the theft are not found, then the tax amount is subject to recovery.

Inventory in a pharmacy: documents

The law does not establish clear forms of forms for processing the results of the check. Therefore, the city he alth department, the pharmacy can develop their own form of the act, indicating in it all the necessary details. You can take as a basis the ready-made forms of the State Statistics Committee (for example, INV-3) and supplement them with the necessary fields.

This inventory list indicates all members of the commission, the place of the inspection, information on units of measurement,actual availability of facilities and balance sheet data.

Inventory results (shortages and surpluses in quantitative and monetary terms) are reflected in the act by comparing the actual availability of drugs with accounting data. Expired medicines should be included in a separate inventory. This will make it easier to write them off. These drugs should not be reflected in the general inventory act.

Write-off of expired drugs

The procedure for establishing the shelf life of drugs is mandatory for all pharmaceutical companies. The expiration date is understood as the time for which the drug must fully meet all the pharmacopoeial requirements and technical conditions under which it was released. Expired drugs should be withdrawn from sale and written off. For these purposes, you can develop your own document form or use the established one: TORG-15, TORG-16.

There is no regulatory document that would prescribe the rules for the destruction of drugs. As part of this operation, you can refer to the order of the Ministry of He alth N 382. It spells out the obligation of the owner of low-quality, counterfeit and falsified products to destroy them. The procedure itself is regulated by government decree No. 674. Such drugs are transferred under the contract to a specialized organization that has a license for the disposal of waste of classes I-IV.

Income tax

The procedure for writing off expired drugs usually does not raise questions. Most of all, accounting staff are interested in the method of writing off expenses incurred.

The Ministry of Finance in Letter N 03-03-06/1/24154 clarified that the cost of the expired goods and the costs of its disposal can be attributed to expenses (Article 264 of the Tax Code), provided that the latter are documented. Pay special attention to this point.

When a pharmacy warehouse is inventoried, the TORG-15 waybill is often used. However, it does not display information about the nature of the defects. Therefore, to confirm the expenses for the disposal of medicines, you must submit the following documents:

- inventory inventory act;

- the decision of the owner of drugs to withdraw and destroy them;

- agreement with a waste disposal company, a copy of its license;

- document confirming the transfer of drugs;

- disposal certificate.

The following information should be disclosed in these documents:

- destruction site;

- name of drugs, their form, dosage, series, unit of measure;

- number of drugs transferred;

- tare and packaging information;

- manufacturer's name.

All of these data are needed to identify discarded drugs.

Conclusion

At least once a year, before submitting annual reports, an inventory should be carried out in a pharmacy. The process of comparing the amount of actual property with the number must be recorded in the approved documents inin the prescribed manner. If possible, it is better to use a computer method of data collection. All drugs with an expired shelf life are recorded in a separate act indicating all the data necessary for their further write-off. Only if these requirements are met, the cost of expired goods and the cost of their disposal can be expensed.

Recommended:

Drawing up the results of the inventory: a list of documents, the procedure for compiling

Filing out the results of the inventory is a significant step in a full-fledged and high-quality audit. To do this, the members of the inventory commission must draw up a set of documents containing the information obtained during the verification process. Based on this documentation, a decision is made by the head of the company regarding the prosecution of violators

Commission trading. Rules for commission trade in non-food products

The legislation of the Russian Federation regulating commercial relations provides for the possibility for stores to sell goods through commission trade. What are its features?

Inventory is Inventory accounting. Enterprise stocks

Stock is a form of material flow existence. On the way from the source of occurrence to the final consumer, it can accumulate in any area. That is why it is customary to distinguish between stocks of materials, raw materials, finished products and other things. It turns out that inventories are materials, raw materials, components, finished products, as well as other valuables that await personal or industrial consumption

Act of inventory of emission sources. Order on the inventory and the composition of the inventory commission

Inventory of waste emissions into the atmosphere is a set of activities that are carried out by nature users, including systematization of data on pollutant emissions, identification of their location, determination of emission indicators. Read more about how this process goes and how the act of inventory of emission sources is filled out, read on

Inventory - what is it? Goals, methods and types of inventory

Inventory is an inventory of property designed to identify discrepancies between the actual number of valuables and the information contained in the company's internal documentation. The article lists the main varieties of such a check. The procedure for conducting an inventory is given