2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Letter of credit - what is it? This is the bank's obligation to make, on behalf of the client and at his expense, payments to individuals and legal entities within the specified amounts and on the conditions specified in the order. The main feature in the framework of the settlement of letters of credit is that banks deal only with documents, and not at all with the goods that these papers represent.

What are the main benefits of a letter of credit?

The advantages of a letter of credit are, as a rule, as follows:

- Guaranteed receipt of the amount to the supplier from the buyer.

- Monitoring of compliance by the bank with the terms of delivery and letter of credit.

- Not diverting funds from economic turnover.

- Providing a full and guaranteed refund to the buyer when the transaction is cancelled.

- The presence of legal liability of credit institutions for the legality of the transaction in which the letter of credit is used.

What aredisadvantages of the letter of credit settlement scheme?

Flaws

The list of shortcomings is small, and it is difficult to call them significant. They are as follows:

- The presence of some difficulties associated with a large number of documents at various stages of issuing a letter of credit.

- Some additional costs that go to bank charges.

Features

The application of the letter of credit settlement scheme must be specified in the agreement between the seller and the buyer. The calculation scheme is established in the main contract, which reflects:

- Name of the issuing bank and the structure serving the recipient of funds.

- Indicate the name of the recipient of funds and the amount, as well as the type of letter of credit.

- Option to notify the recipient about the opening of a letter of credit.

- Message to the payer of the account number for depositing funds, which is opened by the executing bank.

- The complete list along with the exact characteristics of the documents provided by the recipient.

- Letter of credit validity periods and paperwork requirements.

- Payment terms along with liability for default.

In addition, the contract may reflect the conditions that relate to the procedure for settlements.

Types of letters of credit opened by banks:

- covered, or deposited, upon opening of which the amount of the letter of credit is transferred to the executing bank;

- uncovered, or guaranteed, while the amount of the letter of credit can be written off by the executing bank from the main correspondent term;

- revocable, which can be canceled or changed based on the order of the payer; Cancellation of the letter of credit or pre-approval of changes with the recipient of funds will not be required. When a letter of credit is canceled, the issuing bank does not bear any obligations to the recipient;

- Irrevocable letters of credit can only be changed or canceled after agreement with the nominated bank and the recipient of funds.

Calculations under a letter of credit: scheme

The settlement procedure for letters of credit is usually as follows:

- Conclusion of a contract for the supply of goods.

- Instructing the buyer to open a letter of credit to the issuer and the procedure for its launch.

- Notice of opening from issuer to advising bank.

- Conduct shipment of goods.

- The process of handing over shipping documents to the advising agency from the seller.

- Sending documentation and requirements from the advising financial institution to the issuer.

- Debiting funds from the buyer's account.

- Transfer of finance from the issuer to the nominated bank.

- Transfer of securities to the buyer.

- Crediting funds to the seller's account.

Letter of credit from Sberbank when buying real estate

You can never be completely sure of an outsider, especially when it comes to transactions for a large amount. Sberbank offers its customers to take onresponsible for the outcome of important transactions and guaranteed security for each party. Buyers are confident that they will receive the goods, and sellers have no doubts about payment. A letter of credit from Sberbank when buying real estate is considered a unique opportunity to avoid numerous risks and not be a victim of unscrupulous clients.

This is one of the frequent services that this financial institution provides. Its essence is to provide additional guarantees to citizens involved in the transaction. This type of calculation is expedient and very beneficial in a number of the following cases:

- As part of the sale and purchase of real estate, including mortgage lending.

- Amid real estate exchange.

- When conducting a sale or purchase of valuable property, whether it be a vehicle, jewelry, securities, a share in a business, and more.

- To pay for expensive services.

The principles of interaction of each of the parties to the transaction, which prefer a bank letter of credit as a method of payment, is as follows:

- They draw up an agreement in which they stipulate the rights with the obligations of the parties, the subject of the agreement, the timing of the fulfillment of obligations, as well as the price of the issue.

- The written agreement is signed by both parties (or their official representatives).

- Further, the buyer transfers money to a special open savings account for these purposes in Sberbank in the amounts referred to incontract.

- After the seller fulfills his obligations under the signed agreement, and the buyer transfers the required amount to the account, Sberbank will transfer the funds to the seller.

Citizens who are directly involved in transactions with this or that real estate often use a letter of credit. Acquiring this type of property is a fairly large purchase, and there is usually a considerable amount of money at stake. In order for the transaction to be successful and all obligations to be fulfilled, the parties apply to Sberbank within the terms established by the agreement in order to issue a letter of credit.

What is the essence of letters of credit for individuals?

They can be used for the following operations:

- Conducting real estate transactions.

- Purchase and sell goods.

- Performing all kinds of work and services.

Distinguish between covered letters of credit, under which a financial institution transfers the amount to the disposal of the nominated bank. In addition, there is also an uncovered type, in which the issuer does not transfer funds, but makes it possible to write off money from the correspondent account within the established amount.

Contract of sale: basic concepts

A sale and purchase agreement with a letter of credit formalizes a transaction using a fairly safe and convenient in terms of additional guarantees for the parties in terms of fulfilling their obligations of the scheme.

When calculating the issueron behalf of the payer and in accordance with his instructions, assumes a unilateral obligation to transfer money to the recipient, provided that the latter submits to the financial institution the appropriate documentation that meets the requirements.

A contract for the sale, in which the letter of credit is indicated as a form of payment, is drawn up in accordance with the existing requirements. This strategy of payment under a letter of credit can be applied in the implementation of any trade transaction. For example, it is very common to use a letter of credit for real estate transactions and delivery of goods.

How to open this account?

In order to apply the forms of settlement under a letter of credit between the parties to the transaction, it is required to draw up an appropriate agreement. It is compiled on a documentary basis, and the form of payment is indicated without fail. The agreement usually includes the following items:

- Name of each party to the transaction (supplier and buyer).

- Types of settlements and their variety (for example, an uncovered irrevocable letter of credit).

- The amount of funds that will be transferred to the supplier as part of the fulfillment of the terms of the agreement.

- The terms for which the contract is concluded and the indication of the amount of the commission.

- The procedure for making payments (immediately the entire amount or advance transfers).

- The actions of the parties in case of non-fulfillment of the conditions for which the payment letter of credit was applied.

- Rights of members along with their responsibilities.

Statement

How to open a letter of credit, it is important to find out in advance. In order for the signed contract to come into force, the buyer must contact the bank and draw up an application indicating the letter of credit settlement form. Also in the application indicate:

- A link to an agreement according to which a letter of credit will be used between the parties.

- Name of the supplier's institution, as well as its data from the Unified State Register of Legal Entities.

- Indicating the type of transaction and the amount due to the seller.

- The terms of the agreement and the method of implementing the cash letter of credit (whether it be an advance payment or all the money, and also under what conditions they can rely).

- Name and number of goods whose delivery is indicated in the contract (or maybe we are talking about services or some kind of work).

- Name of the banking institution that will fulfill the obligations.

- List of documentation that will be accepted by the bank as part of the confirmation of compliance with the terms of the agreement.

From the moment of registration and signing of the application, the letter of credit comes into force. The executed type can be extended for new terms by mutual agreement of each of the parties.

What is the difference between letters of credit and a safe deposit box?

Many customers often ask this question. Please note the following:

- A safe deposit box is the best option to guarantee the security of the transaction as part of the settlement between the parties to the agreement using cashfunds.

- A letter of credit acts as an additional guarantee for the participants in the transaction, subject to a non-cash transaction that takes place between them. When the parties fulfill the obligations specified in the agreement, the funds are stored in a non-cash form on a savings account, which is opened by the client specifically for these purposes. After the seller successfully fulfills all the terms of the transaction, the bank transfers the buyer's funds in favor of the seller.

So the difference is that the latter involves non-cash payments, not cash.

We reviewed the letter of credit settlement scheme.

Recommended:

Calculations under a letter of credit are The procedure for settlements, types of letters of credit and methods for their execution

When expanding business, many companies enter into agreements with new partners. At the same time, there is a risk of failure: non-payment of funds, non-compliance with the terms of the contract, refusal to supply goods, etc. are possible. To secure the transaction, they resort to settlements with letters of credit at the bank. This method of making payments fully ensures compliance with all agreements and satisfies the requirements and expectations from the transaction of both parties

Payments by letters of credit: scheme, advantages and disadvantages

In the framework of this article, we will consider the main characteristics of a popular means of payment - a letter of credit. A settlement scheme is presented for both the importer and exporter side. The main points of the interaction are characterized

"Direct Credit": reviews, conditions, features, advantages and disadvantages

Review of the modern system "Direct Credit". The main direction of the company. How did the system of formation and issuance of loans online. What are the terms of the partnership? Used technologies for partners and clients of the company

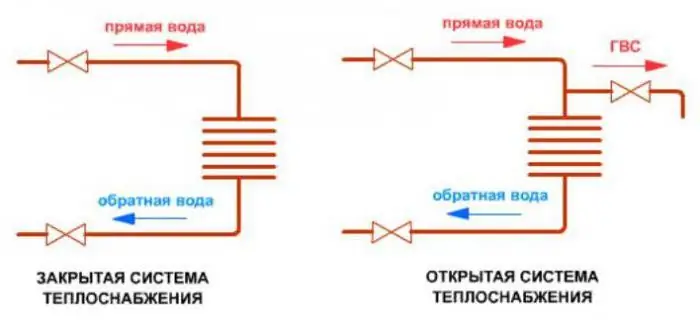

Closed and open heating system: features, disadvantages and advantages

At present, it is promising to introduce the technology of a closed heat supply system for consumers. Hot water supply allows you to improve the quality of the water supplied to the level of drinking water. Although new technologies are resource-saving and reduce air emissions, they require significant investment. Ways of implementation are at the expense of commercial and budgetary financing, competitions for investment projects and other events

Letter of credit when buying real estate. Letter of credit agreement

Purchasing real estate is a high-risk transaction, so the seller may only require a transaction to be made using a letter of credit. This is understandable, since settlements using such a system are the most reliable option for both parties. That is why it is required to consider in detail not only what it is, but also how it works in reality