2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Commercial enterprises are created with the aim of obtaining the maximum amount of profit. For this, various types of economic activity are used, for example, wholesale and retail trade in purchased goods, the provision of services, and own production. Depending on the chosen field of activity, a system for maintaining all types of accounting is selected.

Production

An enterprise engaged in production activities, in the chosen direction, applies the classical system of tax and accounting. Management references, diagrams and reports are generated in parallel according to a generalizing principle in accordance with the requirements of the organization's owners. When carrying out production activities, each company forms the cost of manufactured products. Account 20 is used to summarize costs. The presence of auxiliary industries or an extensive system of production workshops and the administrative building requires the use of accounts 23, 26, 29, 25 in accounting, on which all costs are collected,relating to the cost of the main product.

Accounting

Account 20 "Main production" in accounting is designed to reflect all production, general business costs. It is active, synthetic, balance, account closing occurs as the production cycle ends. As a rule, 20 accounts have no balance. The balance sheet may reflect the amount of work in progress on a specific date. If an enterprise simultaneously produces several different types of products, then account 20 is kept for each analytical position separately. The credit of the account is used to write off the full (production) cost of production. The debit reflects the sum of all expenses for its issue.

Types of production costs

During each reporting period, costs are formed in monetary terms. Account 20 reflects in this case the cost of production. They can be divided into several groups:

- basic and overhead;

- complex and one-component;

- indirect and direct;

- one-time and ongoing;

- constant, variable, conditional variables.

The final cost is calculated by summing the cost estimates posted to account 20 "Main production". These include:

- Current assets (materials, purchased semi-finished products, raw materials).

- Third party services used for main business purposes.

- Wages for workers.

- Deductions to pension, off-budget funds.

- Utilities (electricity, water supply, heat supply).

- General production expenses.

- General expenses.

- Marriage.

- Depreciation of non-current assets.

- Expenses for modernization and introduction of new technologies.

- Other expenses.

- Selling costs (commercial).

Selling costs are not included in the production cost of products, as they are sales costs. 20 account may not contain this article, according to the provisions of the accounting policy of the enterprise, it can increase account 44 (this is typical for trading companies).

Indirect costs

On accounts 25, 23 and 26 of accounting during any reporting period, costs are collected for auxiliary, economic and administrative productions, which are an integral part of the production of a certain type of product. For the effective functioning of all departments of the enterprise, it is necessary to make timely accrual of wages to their employees with appropriate deductions, update and repair non-current assets, and ensure the uninterrupted supply of materials and raw materials.

The maintenance of the administrative and managerial staff of an enterprise is associated with large amounts of costs that must be covered by the organization's own and borrowed funds or (which happens much more often)included in the cost of the finished product. All listed costs are summarized on the debit of synthetic active accounts 23, 29, 25, 26. After the closing of the reporting period, the monetary value of the turnover is debited to account 20. In this case, the costs can be distributed in proportion to a certain indicator (the amount of materials used, salary, the number of types of manufactured products) or transferred to the cost of one of the manufactured products in full. At the beginning of the next reporting period, these accounts should not have a balance, the amount of work in progress is reflected as a balance at the end of the period in the debit of account 20.

Document flow for account 20

Production is an internal process of the enterprise, therefore, the workflow is based on accounting calculations and certificates, internal regulations of the organization. The release of tangible assets to any unit is accompanied by an appropriate invoice, the end of the production cycle is documented by a report, and a payroll sheet is used to include it in the cost of wages. With the help of an accounting calculation (reference), the following indicators are included in the cost price: distributed indirect costs, depreciation (depreciation amount) of fixed assets and intangible assets, auxiliary production costs, deferred expenses, losses from marriage, returnable waste (subtracted from the cost of production).

Debit 20 account

The following transactions are reflected in the debit of synthetic account 20.

| Dt account | CT account | Content of operation |

| 20 | 10, 15, 11 | Decommissioned into main production materials |

| 20 | 02, 05 | Depreciation accrued on fixed assets and intangible assets used for main production |

| 20 | 23, 26, 25, 29 | Auxiliary production costs, ODA, OHS, irreparable marriage are written off for OP |

| 20 | 70, 69 | Salary accrued to employees, deductions made from the amount to the relevant funds |

| 20 | 96 | Created a reserve for OS upgrades |

| 20 | 97 | Written off part of the (estimated) expenses of future periods |

Turnover for the reporting period is summarized and transferred to the cost of manufactured products. After that, account 20 is closed.

Credit account 20

20 credit account contains information on the full (production) cost of manufactured products, semi-finished products, the cost of services rendered. In the process of closing the period, it is transferred in accordance with the accounting policy of the enterprise to accounts 43, 40, 90. Correspondence on credit 20 of the account is presented below.

| Dt account | CT account | Content of operation |

| 10, 15 | 20 | Return of materials from production |

| 40, 43, 45, 90 | 20 | Released finished products credited |

| 94 | 20 | Discoveredshortages based on inventory of work in progress |

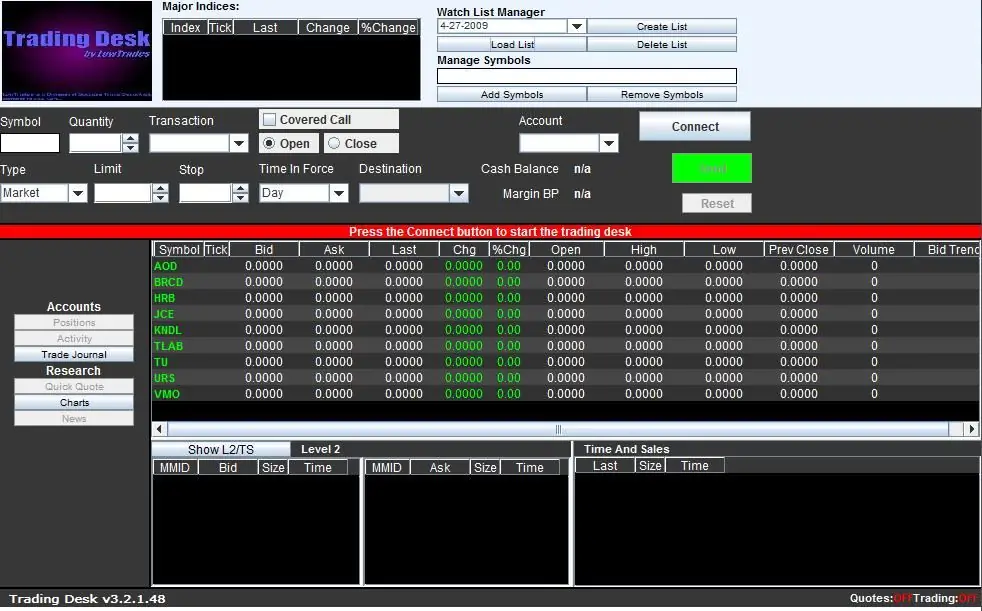

Automated accounting

Organizations that maintain accounting and tax records in a specialized program greatly simplify the process of reporting, interim analysis of activities and can evaluate the movement of assets at any stage. Most often, various versions of the 1C program are used, which are equipped with unified documents and are configured for effective use under the current legislation of the Russian Federation. Also, some versions of the program allow you to conduct parallel accounting and tax management accounting, generate a number of non-standard reports for full disclosure of information.

Account 20 in "1C" is formed on the basis of conducted standard documents. At the stage of preparation for accounting, it is necessary to configure the program in accordance with the requirements of the accounting policy of the enterprise and the applicable taxation systems. Separately, analytical accounting and the algorithm for closing accounts are configured. Calculation accounts must be closed in strict sequence, complex expenses are distributed in proportion to the indicator specified in the program. First of all, when closing the period, depreciation of the fixed assets employed in all production and administrative divisions is charged, then the costs are transferred to the cost of accounts 23, 26, 25. Account 20 is closed only if all preliminary registers are filled in correctly and the program is optimally configured.

Recommended:

Bank accounts: current and current account. What is the difference between a checking account and a current account

There are different types of accounts. Some are designed for companies and are not suitable for personal use. Others, on the contrary, are suitable only for shopping. With some knowledge, the type of account can be easily determined by its number. This article will discuss this and other properties of bank accounts

Just2Trade: reviews, account opening procedure, personal account

Choosing a broker is a very responsible step. Every beginner who has made the decision to become a trader faces it. To understand the degree of reliability of any brokerage company, you need to study the information and find out reviews about it

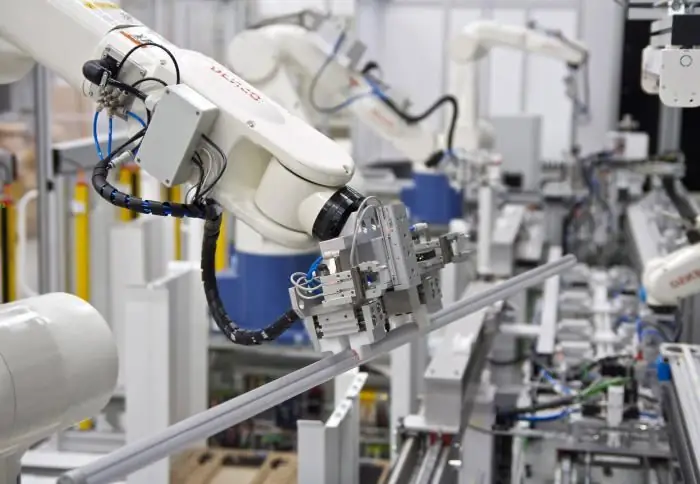

Modern production. The structure of modern production. Problems of modern production

Developed industry and a high level of the country's economy are key factors influencing the we alth and well-being of its population. Such a state has great economic opportunities and potential. A significant component of the economy of many countries is the production

Gas production. Gas production methods. Gas production in Russia

Natural gas is formed by mixing various gases in the earth's crust. In most cases, the depth of occurrence ranges from several hundred meters to a couple of kilometers. It is worth noting that gas can form at high temperatures and pressures. In this case, there is no access of oxygen to the place. To date, gas production has been implemented in several ways, each of which we will consider in this article. But let's talk about everything in order

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?