2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Chart of accounts is an integral part of the work of an accountant, both with experience and a beginner. In fact, all accounts used to reflect the operations of the organization are systematized in a common document. They called it the Chart of Accounts. This is a kind of table that contains all the digital designations necessary for work used in postings. It is also worth remembering that an enterprise can create its own working Chart of Accounts. However, the Instructions for Use of this document should be followed. It allows the accountant to find answers to many questions related to accounts.

What is a Chart of Accounts?

It's no secret that so-called postings are used in the accounting of any organization. They help to reflect both the arrival and departure of various elements. Accounts take an active part in posting. In fact, they are the basis of operations.

In fact, the Chart of Accounts is a table that contains a list of all accounts used by the accounting department. This is a scheme that helps to correctly register the conduct of business and financialoperations of any organization. It is worth noting that any enterprise maintains this kind of accounting. Even "Accounting for Dummies" suggests that you first of all familiarize yourself with the Chart of Accounts, as well as with its sections.

Legislative regulation

The Chart of Accounts is not just a piece of paper used by individual accountants. It has not changed for any kind of organizations. So, the introduction of the current chart of accounts into circulation was fixed by the Federal Law in 2000, and later there was a new edition of 2010, that is, ten years later. That is, these regulatory documents stipulate which accounts are used by the enterprise and for what purpose.

If the organization needs to use additional accounts, then the "Instructions for Using the Chart of Accounts" can help here. In it you can find the structure of a particular account. Probably, one or another action can be displayed on it. If such an option was not found, then it is allowed to use accounts that were not affected in the main chart of accounts. However, these innovations should be fixed in the accounting policy of the organization.

Working chart of accounts of the organization

As mentioned above, a business can structure its own chart of accounts. In this case, you must adhere to a number of rules. So, based on the Instructions to the Chart of Accounts, an enterprise can select those accounts that are necessary to work with specific operations.

By the way, in agreement with the Ministry of Finance, the organizationmay use additional accounting systems. This is possible in cases where the specifics of the organization require it. The finished chart of accounts of a particular organization is fixed in the accounting policy. It becomes a tool for the organization to conduct quality business, and also simplifies business operations.

Chart of working chart of accounts

Existing manuals, such as "Accounting for Dummies", give not only the approximate content of the work plan for an enterprise of various profiles, but also the theoretical basis.

For example, a work plan is a branched structure. In the first place are synthetic accounts. They take into account capital, its movement, other liabilities and property, as well as business processes.

On analytical accounts, you can reflect more specific actions. The presence of such accounts allows for the verification of transactions. However, this type of account is optional.

There are also sub-accounts that help detail transactions. So, at enterprises related to production, separate sub-accounts can be distinguished by type of product or product. The chart of accounts with explanations helps the accountant to draw up a work plan "for himself".

Composition of the Chart of Accounts

Currently, the Chart of Accounts consists of eight sections. In total, sixty accounts are described in them. An interesting fact is that in the plan itself there are numbers from one to ninety-nine. This means that a number of digits remainfree from a specific account. This is just in case if the specifics of the organization's activities allow the use of additional synthetic accounts, that is, the enterprise can use free numbers. The accounting chart of accounts with sub-accounts also has off-balance accounts, which reflect, for example, leased property or material assets that were accepted by the organization for storage.

Total The Chart of Accounts has eight large sections, in which all accounts are distributed, except for off-balance ones. There are also instructions as to which sub-accounts can be opened for each of the synthetic accounts and under which number.

Off-balance sheet in brief

Off-balance accounts are those accounts that do not belong to any of the sections of the Chart of Accounts. They indicate transactions related to funds that do not belong to the organization, but, for example, are in its temporary storage.

Off-balance accounts are also called subsidiary accounts. It is noteworthy that operations on them are not reflected in the balance sheet in the end, they also do not in any way affect the financial result of the organization. In the chart of accounts, they are presented as three-digit numbers, starting from zero. That is, the first account of such a plan is number 001, and so on. This kind of section ends with the account number 007.

Which sections are included in the Chart of Accounts?

As already mentioned, the Chart of Accounts consistsof eight sections with their accounts. They are structured so you can quickly find the information you need.

- Non-current assets of the enterprise. This includes fixed assets on the balance sheet of the organization, their depreciation, as well as intangible assets;

- Inventory. In this section, you can find accounting synthetic and analytical accounts for accounting for the movement of materials, company reserves, or, for example, the acquisition of any material assets;

- Production costs. As the name implies, this includes accounts that are directly related to all kinds of industries.

- Finished products. Accordingly, on the accounts located in this section, you can take into account finished products, calculate their cost.

- Cash. This includes accounts such as "cashier", "settlement account", "money transfers".

- Calculations. This extensive group includes many payment options, ranging from repayment of debts to creditors and ending with the payment or calculation of wages to employees of the organization.

- Capital. This section helps to structure accounts related to the authorized, reserve or additional capital of the organization.

- Financial accounts. This final section includes accounts that help identify the result of the sale, as well as the final financial result for the enterprise at the end of the year.

Synthetic and analytical accounts: what's the difference?

As you know, there are three groups of accounting accounts, namely,synthetic, sub-accounts and analytical. All three groups are interconnected, however, there is a possibility that they can be misunderstood, especially by novice accountants.

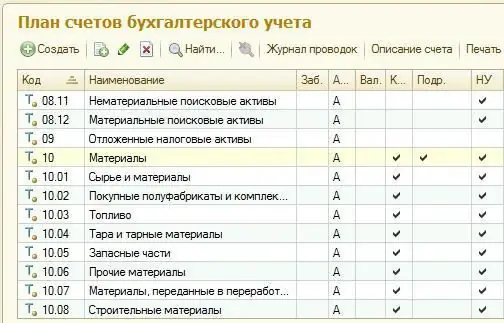

So, synthetic accounts are just located in the chart of accounts. That is, account 10 with the name "materials" is in the "production costs" section. This includes all means that are present in production activities, with the exception of the main ones.

In turn, this account has sub-accounts. This is a more specific version. That is, to the synthetic account "materials" you can open a subaccount at number one and the name "raw materials and materials". That is, neither animals nor spare parts are included here - only what is described in the name of a particular sub-account.

Analytical account allows you to further specify the account. That is, oil, for example, it will be a separate analytical account that is opened for a sub-account. Thus, the analytical account helps to structure the accounting of business activities, and also allows you to check which cost items you can save on.

Instructions for using the prepared Chart of Accounts

Instruction is a document that helps the accountant to correctly use the existing Chart of Accounts. It contains the following information:

- Account number.

- Full name.

- The purpose of the account, namely its content and general structure.

- Methods of application, that is, the order in which it is filled.

Thatthere is an instruction that helps the accounting department to correctly use each of the accounts. After reading this document, the organization can begin to draw up a work plan for a specific enterprise.

Practical Tips for Compiling a Working Chart of Accounts of an Enterprise

After reading the instructions for using this document, you can proceed to the specific preparation of the Chart of Accounts of the enterprise.

It must be taken into account that in the future there may be changes that involve the introduction of new, additional accounts in the structure of the enterprise. Therefore, you need to make sure that there are reserve sub-accounts.

It is also better to minimize the number of accounts used for accounting. This helps to facilitate ways of recording business activities. That is, if it is possible to refuse the use of any account, it is better to do it.

It is also worth remembering that it is not so easy to make global changes to an organization's already existing Chart of Accounts. Therefore, it is better to think about how the future of the enterprise is seen in a couple of years. There is probably the prospect of a new type of product.

Do not forget that accounting is now automated, but this does not prevent many specialists from carrying out checks manually. So, the popular turnover sheet of accounts, which allows you to identify errors on a specific account, is also perfectly created using the 1C program.

Recommended:

Chart of accounts of budgetary organizations: main sections, accounting features

Budget accounting in accounting is a system for registering and summarizing information about the state of assets and liabilities of the Russian Federation and its subjects, as well as municipalities. Also, the definition of budget accounting includes all operations that lead to a change in the assets and liabilities of the constituent entities of the Russian Federation and municipalities. The chart of accounts of budgetary entities is a list of accounts on which budgetary institutions perform operations

Synthetic accounts. Synthetic and analytical accounts, the relationship between accounts and balance

The basis for monitoring and analyzing the financial, economic, investment activities of an organization are accounting data. Their reliability and timeliness determine the relationship of the enterprise with regulatory authorities, partners and contractors, owners and founders

Gantt chart is your planning assistant. What is a Gantt chart and how to make one?

Gantt Chart is one of the most popular tools for visually illustrating the schedule in project management

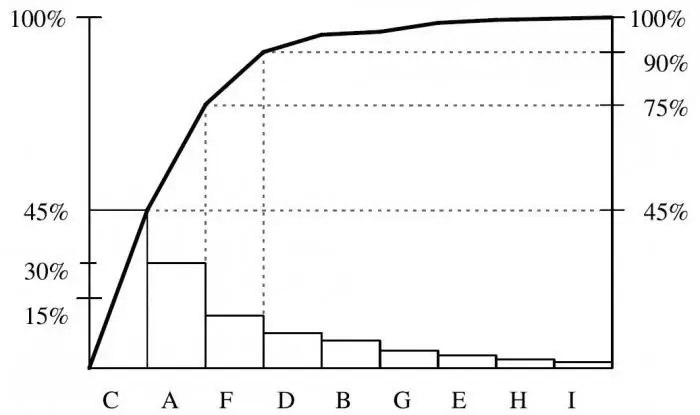

Building a Pareto chart. Pareto Chart in Practice

No one wants to waste energy. We are striving with all our might to improve efficiency: ours, subordinates, enterprises, equipment, after all. And it doesn't matter at what cost we achieve it. One of the simplest and most understandable methods for evaluating efficiency is the construction of a Pareto chart

Accounts receivable and accounts payable is The ratio of accounts receivable to accounts payable. Inventory of receivables and payables

In the modern world, various accounting items occupy a special place in the management of any enterprise. The material presented below discusses in detail the debt obligations under the name "receivables and payables"