2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:30

A cash check is a type of security. It is a kind of "instruction", allowing the payment of a certain amount to the person who provided this document to the bank.

Checkbook: application, pros and cons

The main purpose of a money check is to provide money in a bank for various needs. This type of payment has become very common, as you can get cash using checks quickly and without any problems. Now Russian banks accept samples of completed new-style cash receipts, which do not need to be stamped. Benefits of using check receipts include:

- Clear control of the cash flow of the current account: a strictly defined amount specified in the receipt is paid.

- High level of reliability. The paying bank will refuse to provide funds if the basic required details are not included in the receipt in the manner prescribed by law.

Disadvantages of maintaining the finances of an organization (or individual) using cash checksare as follows:

- The slightest blots and corrections in the check are strictly prohibited. If the document is incorrectly drawn up, it is already canceled.

- When withdrawing cash on receipt, the bank may charge a fee.

- To receive money by a cash check, you must definitely come to the bank. It will take time to travel and wait at the bank, plus travel costs.

Cash check - sample filling: regulation

With regard to regulatory regulation, the laws of the Russian Federation do not provide approved forms or samples for filling out cash checks. Since 2017, the maintenance of checks has been regulated by the Regulations of the Central Bank of Russia dated February 27, 2017 approved by the Ministry of Justice.

In order for the document to become legally valid, you must fill in the basic details. The receipt consists of two parts - this is the check stub and the receipt itself. The receipt is provided to the bank, and the spine remains with the company.

In an organization, this type of security must be held by the chief accountant and accounted for as an off-balance sheet account. In Russia, unlike the United States, for example, checkbooks are used by organizations and not by individuals.

How to get a checkbook

So, all checks of an organization or individual are stored in a checkbook. To get such a book, you need to apply to the bank. It contains a limited number of pages - usually up to 50 receipts. In addition, toThis book requires a checking account with the paying bank. The shelf life of the document after full operation is 3 years.

Sberbank Cash Checks: Filling Requirements

Sberbank, known as a reliable and trustworthy institution, is the most common among businesses that open checkbooks. It should be noted that not all branches can accept this type of securities. So this question needs to be clarified first. You can call, go and pre-register. Let's list the main requirements for filling out a money check at Sberbank:

- Gel or ballpoint pens can be used to fill in checks. The ink color allowed is black, blue and even purple.

- The amount to be issued is written both in words and in numbers.

- The location of the amount should be on the left side, the inscription ends with the currency.

- When filling in the date, the month is written in cursive.

- There should be no blots or corrections in a cash receipt.

- If a mistake is nevertheless made, you need to sign "Spoiled" / "Cancelled".

- The check must be stamped, unless otherwise specified in the contract with the banking institution.

- The recipient of funds must sign on the back of the money check. Samples of filling in the spines and the check itself can be obtained from the bank upon request.

- Recipient's name is a required element. Another person cannot receive the money, and a check without a name is already considered invalid.

- The drawer keeps the roots. They must be archived for a period of 3 years.

- The right to sign a checkOnly certain employees have organizations. These are, as a rule, leaders and their deputies.

- If the bank account is closed, the checkbook must be returned to the bank. The application indicates the numbers of the remaining pages.

These rules also apply when filling out checks from any bank. Consider, using the example of a certain Sidorova O. V., how a completed sample of a cash check in a Savings Bank should look like:

This is what a money check looks like on the back.

How do I get money from a bank check?

To do this, you need to go to the bank and cash a check. An application form is provided by the bank. You will also need a document proving the identity of the recipient. It is necessary to tell the operator-cashier the amount that is written on the receipt. The operator checks the information specified in the citizen's passport, and also checks the information on the application and on the check. Then he sticks a sticker on a special area in the receipt and dispenses cash. The issued amount should be checked immediately.

What should I consider when filling out money checks? First, the sample signature on all sides of the check must be the same. Secondly, the same date must be entered both when receiving money and when filling out the cash book of the organization.

Recommended:

TTN - what's this? How to fill out TTN correctly? Sample filling TTN

TTN is a consignment note. Filling out this document is distinguished by a lot of features and subtleties that are useful for everyone working in the field of transportation of goods to know

Symbols in the time sheet. How to fill out a time sheet (sample)

Working time and its accounting are important components of any organization, allowing you to control the activities of the company and discipline employees. In order to simplify this procedure, a special form was developed - a time sheet

How to fill out the journal of the cashier-operator correctly: sample and basic rules

Roles and tasks of the cash journal. Basic rules for filling and registration of KM-4. The main requirements for the title page of the book of the cashier-operator. Journal replacement rules. Columns of the KM-4 form, instructions for filling them out. Journal entry template. Features when returning goods, acquiring

How to fill out the calculation of insurance premiums: sample

Article about the features of filling in the main applications of the reporting calculation for insurance premiums. Useful tips and tricks considered

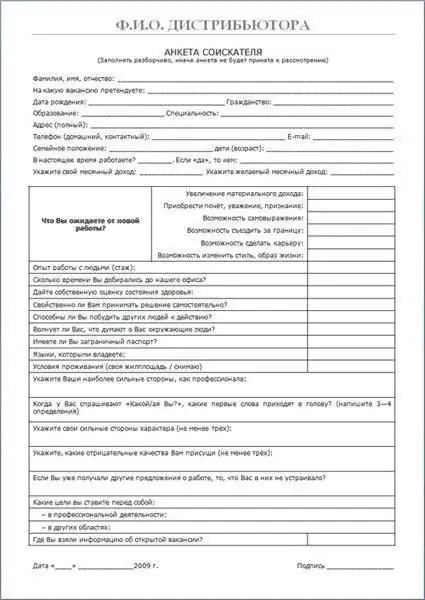

Sample questionnaires for employment: how to fill them out correctly

Let's look at sample job application forms. What blocks does the document consist of, how to fill it out correctly? What information can be requested in the questionnaire? We will talk about all this in the article