2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

A senior accountant is a specialist who takes care of accounting for the financial and economic activities of an enterprise. He controls how economically the organization uses material, labor and other types of resources, while maintaining the property of the company. Accounting experience is required for this position.

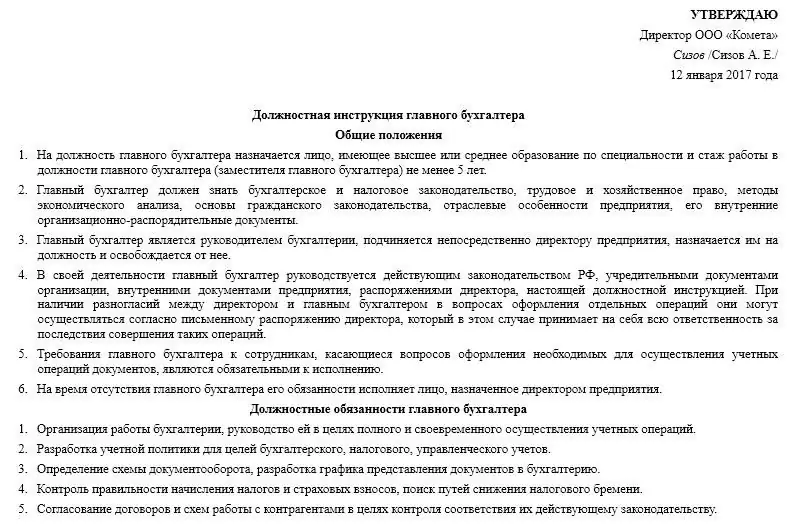

This position is not the final rung of the career ladder. Upon gaining experience and additional education, a specialist can count on the position of financial director. More detailed information is contained in the job description of a senior accountant. You can find all the information you need in this sample document.

Regulations

The specialist is appointed by the director of the company on the recommendation of the chief accountant, to whom he must subsequently report. This employee belongs to the professional category. To get this job, the applicant must have a higher economic orprofessional education. In addition, he must have worked in a relevant position in the accounting field for at least two years.

As stated in the job description of a senior accountant, he is obliged to take into account, while performing his work, accounting rules, regulations and legal acts, as well as instructions and recommendations directly related to reporting work and accounting. He must also take into account organizational, administrative and other documents of the organization, local acts and rules of the institution where he is employed.

Responsible for what?

This employee is responsible for ensuring that all work assigned to him by higher management must be completed on time and at the proper level of quality. He must monitor the observance of labor and executive discipline. In addition, the job description of a senior accountant assumes that this employee is responsible for the preservation of company information and documents that contain information subject to trade secrets or other confidential data.

This also includes the personal data of all subordinate employees provided to him for the implementation of his duties. He maintains and ensures that the norms of labor discipline, order and compliance with the rules of the company are observed.

Knowledge

The job description of a senior accountant assumes that an employee, starting tohis duties, he is familiar with the current legislation of the country regarding accounting, the basics of civil law, as well as with financial, economic and tax legislation. He must study the methodological and regulatory documentation that affects his activities.

Employee is required to know the organization of accounting, the rules for its implementation, codes of ethics, corporate governance methods, all types of accounting, including statistical, tax and managerial. In addition, according to the job description of a senior accountant, he must familiarize himself with the profile, specialization and structure of the company where he is employed, study the prospects and strategies for its development.

Other knowledge

The specialist must know how accounting operations are correctly executed, and the organization of the circulation of documentation for accounting areas, how shortages, receivables and other losses are written off from accounts. He must understand how to process the acceptance, posting, storage and spending of the company's financial savings, inventory and everything else that is necessary for auditing and tax inspections. He is obliged to study how financial calculations are made correctly, what taxation conditions exist, how to properly conduct inventories, settle accounts with creditors and debtors, conduct checks and revision of documentation.

The job descriptions of the chief accountant of an LLC are based on the fact that he knows the methods of analyzing the economic and financial activities of an organization, how individual entrepreneurs, OJSC and LLC are registered, how to properly store accounting documentation and protect information. The specialist must constantly monitor the advanced foreign and domestic experience in organizing accounting. It is also assumed that he knows the organization of production, economics, management, legislation at the proper level, has theoretical and practical skills in using computer technology.

Functions

The job description of a senior accountant according to the professional standard assumes that the following functions are assigned to him, namely, the performance of work related to the organization and record keeping in the area of the company entrusted to him. Also, his labor functions include the management of subordinate employees of this department, the organization of their activities. He must ensure that data on business transactions, asset flows, income and expenses, fulfilled obligations in accounting accounts are entered, and do this accurately and on time.

Responsibilities

The main job responsibilities of the chief accountant include preparing information on the company's activities so that they can be used to draw up reports, monitor the safety of documentation, carry out its execution in accordance with norms and standards, for further transfer to the archive.

Heis obliged to accept and control primary documentation, as well as prepare it for accounting. This employee is engaged in the production and maintenance of accounting, meaning tax operations, fees to budgets, payments to financial institutions, payroll, and so on. He reconciles data with external organizations that relate to financial transactions, carries out work on checks that are carried out by government agencies in order to control accounting.

Other functions

An employee may be assigned the responsibility for developing work plans of accounts, forms of primary documentation that is used to formalize the company's business activities. It is this employee who is engaged in determining the basic methods and techniques of accounting and technological processing of documents of the organization. The duties of the chief accountant of an enterprise include the formation, maintenance and storage of a database, its use and reporting.

He should be involved in developing activities that help educate lower-level employees on how to properly maintain financial discipline and exploit company resources. He takes part in the formation of an information system for reporting and accounting, in accordance with the norms and standards. And also participates in financial analysis and creation of tax policy based on the collected data, through internal audit in the company. He is developingplans on how to improve the efficiency of the organization, minimize losses and non-production costs in the company.

Other duties

The job descriptions of the chief accountant of a budgetary institution usually include such an item as the obligation to provide the company's management, its auditors, investors, creditors and other interested parties with information and reporting regarding the company's accounting activities.

This employee should take part in the economic analysis of the organization's activities in order to discover reserves within the company, control savings, and develop a better workflow. In addition, his responsibilities include the introduction of modern methods and forms of accounting, taking into account modern technological and theoretical developments and best practices in this area. It occupies itself with the formulation of the economic delivery of tasks or their specific stages, which are solved using ready-made projects, computers, application programs, algorithms and other tools that allow you to create systems for processing the necessary information.

Tasks

A sample job description for a chief accountant may contain a clause stating that the employee undertakes to provide methodological assistance to company employees regarding accounting issues. The employee must ensure the timely preparation of reporting documentation that relates to the execution of the budget, cost estimates, all types of reporting. He must also ensure that all information and documents are sent to the controlling state bodies on time. If necessary, an employee may be left at the workplace for overtime if circumstances so require, but only if this is in accordance with applicable law.

Rights

The official rights of the chief accountant include the receipt by the employee of all the documents and information that he needs to perform the tasks assigned to him. An employee has the right to interact both with employees of other departments of the organization where he is employed, and with representatives of third-party organizations, if necessary to resolve operational issues, but his actions should not go beyond his competence. Also, the employee has the right to represent the interests of the company in third-party institutions on issues that directly relate to his activities.

Responsibility

The job description of the chief accountant of an institution assumes that an employee may bear administrative, material, disciplinary and criminal liability for his actions. He may be called for failure to fulfill his duties, including for ignoring the governing and methodological documentation of the institution. If he ignores the orders of his superiors, misuses his powers, or exploits company resources for personal purposes. He is responsible for providing false data about the work performed, for violating labor discipline. He is responsible for the fact that his subordinates violate the labordiscipline and company rules.

Conclusion

All the information necessary for an employee to start performing their duties is contained in the job description of a senior accountant. This sample document provides general information only, which may vary depending on the activities of the company where the person is employed, its size and location. In addition, everything also depends on the state, the needs of management for a specialist in one direction or another, and many other factors. It is important that this legal document must be drawn up in strict accordance with the current legislation of the country, and not go beyond the law in any way.

The employee has the right to start his duties only after the agreement of this document with the higher management. In other words, only after a clear definition of exactly what requirements are provided for the applicant for this position, what skills and knowledge he must have, and also after assurance that he is familiar with his duties, rights and responsibilities, he can start work. It is recommended to coordinate this issue very carefully so that in the future there will be no problems and misunderstandings with higher management. The employee must clearly understand what his role in the company is and what is required of him. And also clearly understand the degree of responsibility for the work performed.

Recommended:

Job description of the deputy chief accountant: duties, rights, requirements and functions

In most cases, employers impose certain requirements on applicants for this position. Among them, the main one is the presence of a diploma of graduation from a higher educational institution in the field of accounting and accounting. In addition, the employee must have at least five years of experience in this field

Job description of the head of the logistics department: rights, duties, competence and responsibility

Every person with a certain set of ambitions wants to build a successful career in their chosen field. Logistics is no exception. Even a novice dispatcher wants to become a boss someday. After all, this means not only the presence of a prestigious position, but also a significant increase in income. However, you should find out in advance what items the job description of the head of the logistics department contains. After all, this is almost the main document that will have to be guided in the forthcoming work

Job description of an electrician: functional duties, rights, responsibility

The main task of an electrician is the repair and maintenance of electrical equipment, electrical machines, electric starting equipment, voltage electrical networks, electric lighting equipment

Job description, rights, responsibilities and functional duties of a database administrator

The employee hired for this position is a specialist who can be hired or fired only by the head of the company. Usually, the applicant is required to have a higher education in the profession, namely, that it relates to the mathematical, engineering or technical direction

Job description. Excavator driver: functional duties, rights and responsibilities

Without such a wonderful machine as an excavator, today you can not do almost anywhere. Wherever it is necessary to perform any earthmoving work, the work of an excavator driver is necessary. Just about this person and will be discussed in this article