2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Trading uses a variety of tools. The most popular among traders are technical indicators that help them in trading in the financial market and during the analysis of market movements.

Professionals, developers and experts, such as Bill Williams and other founders of trading, have specially created many tools for traders and investors to facilitate their trading on the stock exchange. In the conditions of the modern market, which periodically changes, various classic indicators are periodically refined, and their settings are selected taking into account new parameters.

Description of the MFI indicator

Bill Williams created several tools for traders: the Alligator indicator, Fractals, MFI and others. All these tools are widely used in trading not only by traders, but also by investors. The MFI indicator (Market Facilitation Index) translates as "market facilitation index", allows you to assess the state of the market, the mood of its participants and the direction of quotes. It can be used to analyze the movement of impulses, as it is a trend tool.

MFI indicator formula presentedbelow.

The index itself is able to fix any change in the market price at minimum values. Each point and tick is controlled by an indicator and allows you to effectively calculate the values taking into account the time interval, which is determined by the timeframe.

Any market mood, increase in demand, interest or offers from sellers and buyers, as well as their decrease, is immediately displayed in the instrument's reporting. Traders and experts, based on the obtained indicators, carry out an analytical forecast of the market movement and make decisions on opening positions or, conversely, closing them.

The MFI indicator is installed in a separate window under the market price chart and looks like a multi-colored histogram.

Instrument column values:

- Green color - increase in the volume market and MFI.

- Blue - decrease in volumes with the growth of MFI.

- Brown color - decline in the volume market and MFI.

- Pink - increasing volumes with decreasing MFI.

It is not necessary to use standard colors, you can choose the color scheme that the trader likes. For example, in the settings you can set black, white, magenta, blue and others, the main thing is to know what they will mean. Let's say a trader chose blue to decrease volumes and increase MFI, and yellow to increase these indicators at the same time.

Terms of use

It is believed that this indexspecially designed for the stock market. However, many traders use it in Forex trading as well. The most complete information can be obtained on the MFI indicator on the footprint chart, since volumes are immediately displayed on it. The main condition for trading is the presence of a trend in the market, which he himself shows. This is a fairly effective tool that allows you to fix any movement of quotes.

In addition, the market relief index is great during analytics to predict possible changes in market movements. With its help, experts learn about the situation on the stock exchange, make calculations and suggest further price movements. For beginners, the main thing in working with the index is to understand how to use the MFI indicator and apply it correctly in trading. Consider this further.

Using the indicator in trading

To make a profit on transactions, you need to carefully study the features and parameters of the instrument. If it is used incorrectly in trading or its indicators are incorrectly deciphered, then losses simply cannot be avoided.

First of all, you need to understand the meaning of the index columns and use them to correctly analyze the market condition. And then it will be possible to make a decision to open a position or close it, if the order is already in progress, and make the necessary calculations of lot volumes, a protective stop-loss order and a take-profit fixing order.

Green indicator bar

Colored histogram is very often confusingbeginners and they don't know how to use the MFI indicator. It's actually quite simple, but you need to know how each column is colored.

The green line of the index informs the trader that there is a fairly strong movement in the market. At the same time, the growth of the development of the impulse occurs very rapidly. If we consider the market situation, it can be noted that it is at this time that new players come to the exchange, as a result of which the volume of open positions increases.

They all open orders in the direction of the trend movement. When the indicator forms three green bars in a row, you need to be very careful, as the market is already saturated and a decline will surely follow in the future. This is especially true for short positions on lower timeframes.

Column brown

When the indicator line is colored in this color, the current situation on the market is completely opposite to the green bar. That is, at this time there is a decline in the market movement. Bill Williams called this column "fading", which is fully consistent with its meaning.

Market momentum or trend begins to weaken, players lose interest in the current situation and the movement on the stock exchange gradually "fades out". Most players prefer to close their positions, but there are also speculators who wait out the resulting drawdown.

However, it should be borne in mind that in the case of the second decision-making option, it is necessary to have a sufficient amount of the deposit available, since the minus on the transaction may bebig. And it is categorically not recommended to open new orders. After the formation of several brown columns of the MFI indicator, in most cases, the market movement reverses.

Blue indicator line

This column is formed when there are trend movements in the market with small volumes. That is, although there is an active impulse on the stock exchange, for some reason it does not arouse interest among speculators. As a result, the index is rising, but volumes are falling.

Usually the blue bar appears when there are large market participants and market makers in the market. They are trying to attract medium and small players to the exchange, contrary to the real market trend.

Professionals advise not to open orders at this time, as the trend movement is artificially created by large market participants. In the near future, it will turn in the opposite direction from the positions of traders and, accordingly, they will receive losses. Bill Williams called this column "fake", which corresponds to the current market situation.

Pink indicator bar

Bill Williams gave him the name "squat". It appears in the instrument as a harbinger of the imminent end of the current market trend. At this time, the movement of quotes on the stock exchange begins to slow down and a consolidation zone with a narrow range is formed. Traders, sellers and buyers are fighting among themselves, defending their positions. At the same time, their activity is quite large, and as a result, a reversal of movement occurs or anew momentum.

Professionals consider this moment the most favorable for opening new positions. However, to be completely sure, you need to check the accuracy of the signal using additional tools. The "crouching" column informs the trader that he will have the opportunity to start quickly in the near future.

Setting the BW MFI indicator

This trading tool is available on all popular trading platforms. How it works and how signals are formed on it, as well as the description of the BW MFI indicator was discussed in our article above.

On the MetaTrader 4 and 5 versions, it is located in the "Indicators" section, and then you need to go to the Bill Williams tab and select it ("Insert" - "Indicators" - "Bill Williams" - Market Facilitation Index). The beginning of the BW name is the initials of the author and creator of this tool, since there is another type of index - MFI (Money Flow Index). Therefore, in order not to confuse them, this prefix was added.

You can choose the color of the columns yourself or use the standard settings. The remaining indicators should be left as recommended by the developer, of course, if this does not contradict the trader's trading strategy.

Application in trading in the financial market BW MFI

Professionals have developed many trading strategies based on this indicator. They differ somewhat in the values of the indicators, but have common characteristics, the main ones on the signalscolumns. Therefore, to understand how to use the BW MFI indicator, it is enough to understand their meanings. In most methods, indicator signals are filtered out by additional tools. For example, you can add "Parabolic", "Moving Averages", "Alligator" and other indicators to the chart.

Entry into the market to open a deal occurs on a pink column, and other instruments confirm or refute this signal. The general market situation can be tracked throughout the histogram. It can also be used to analyze changes in market quotes.

Many traders use it in short-term trading, but it gives the most profitable signals on the D-chart of the BW MFI indicator. There is a simple explanation for this: the smaller the timeframe (M 1, M 5, M 15), the more various interferences and noises occur in the market that create false impulses. The older the timeframe (H 4, D 1), the smoother the quotes chart, and almost no false signals are displayed on it.

Besides, the BW MFI Vertex Fx indicator allows, as the name suggests (Vertex Fx is the top of the "Forex"), that it will be possible to get the maximum profit, since all changes occur in ticks. This approach to quote analysis creates greater accuracy of values.

Triple Trading Tool - MFI, CCI, OBV

For trading in the financial market, experts have developed a "3 in one" indicator: CCI MFI OBV, which works at the intersection of the values of these threeinstruments, if taken separately. By and large, this is a real automated robot adviser that gives a signal to open positions after all indicator values - OBV (volume), CCI (market oscillator) and MFI reach the maximum suitable indicators.

A trader who uses this Expert Advisor in trading does not have to independently perform calculations, analyze statistical data and examine indicators in each individual case. Everything happens automatically, and the speculator is provided with a ready-made result - a signal to open / close a position.

MFI based trading strategy

To use this technique, you need to trade on the daily chart, that is, the timeframe D 1 must be set. The reversal of the market movement always occurs on the pink columns of the MFI indicator. Therefore, a trader should carefully monitor all changes in market quotes, and as soon as such a column appears, he must be ready to make a decision.

Trading by strategy:

- As soon as a pink line appears in the indicator values, you need to open two positions with pending orders - for sale and purchase.

- Pending orders should be placed near the extreme points of the pink column. Most often, the market reaches the minimum or maximum values near this line, touches the pending order and continues its movement.

- The pending order that didn't work needs to be deleted.

Usually, after opening a position, a green column appears in the indicator values, which indicatestrader about the right direction. As a result, the speculator has time to enter the market at the very beginning of the momentum, when other participants are still swinging, and his big players have not started to move the trend.

Gradually, volumes begin to increase on the market, the interest of other bidders increases. Initially, quotes will move in a narrow range, and then there will be a sharp jump, and prices will gain momentum at a high speed, that is, a strong impulse will begin.

Conclusion

The MFI indicator is a great assistant for a trader. It allows you to receive the most accurate signals for entering the market and in the analytical forecast of quotes. However, as its creator Bill Williams advises, it should be used in trading with other tools that will help improve trading efficiency.

Recommended:

Momentum indicator: description, configuration and use, methods of application

The probability of trend continuation can be predicted by assessing the intensity of trading. The strength of a market movement is often referred to as momentum and there are a number of indicators designed to measure it. The Momentum indicator helps identify when players have bought or sold too much

WACC - what is this indicator? Concept, formula, example, use and criticism of the concept

Today, all companies use borrowed resources to some extent. Thus, they function not only at the expense of their own funds, but also credit. For the use of the latter, the company is forced to pay a percentage. This means that the cost of equity is not equal to the discount rate. Therefore, another method is needed. WACC is one of the most popular ways to evaluate investment projects. It allows you to take into account not only the interests of shareholders and creditors, but also taxes

How to use the MACD indicator in the Forex market

MACD indicator is without a doubt one of the most popular trading tools in the Forex market. Proper use of this indicator allows you to determine the direction of the trend and timely show a possible entry point to the market

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

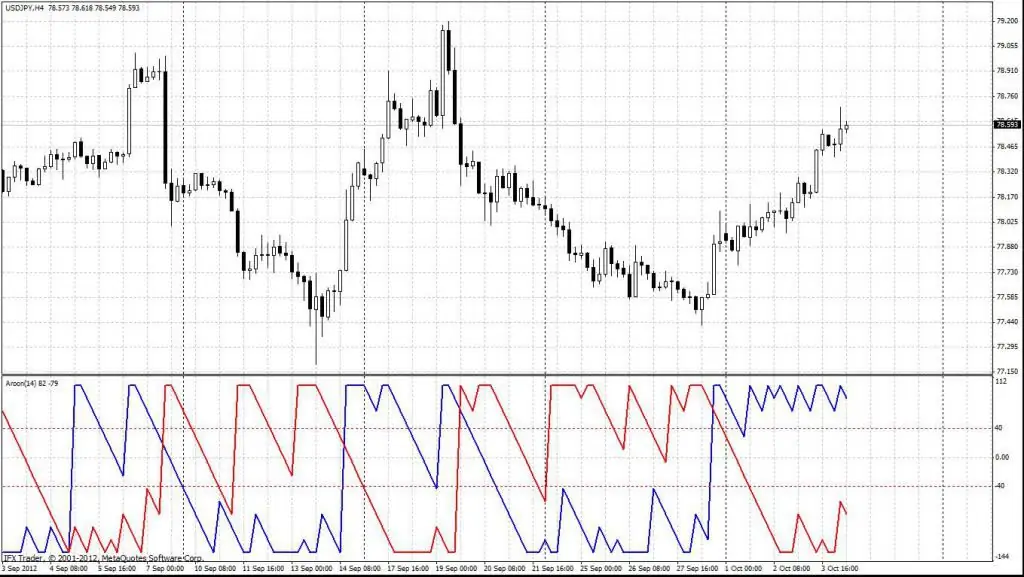

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement