2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

The Swiss franc is conventionally abbreviated as CHF. Let's try to figure out what kind of currency we are talking about. CHF (Swiss franc) is the officially recognized monetary unit of Switzerland, the popularity of which is due to the powerful banking system of the state. The franc is actively used in international banking, belongs to the category of assets in the international currency markets and belongs to the category of the leading monetary units of the world. The importance of the currency grows significantly during periods of economic crises. Minimal exchange rate fluctuations make the currency an excellent alternative to the main world currency, the dollar.

General information

The Swiss franc, or CHF, what kind of currency is known to almost everyone, as it belongs to the category of freely convertible monetary units of the world. In international settlements, the share of the franc slightly exceeds 10%. The volume of foreign exchange reserves in CHF corresponds to only 0.1%. The monetary unit is actively used in deposit transactions, and Switzerland itself is the owner of one of the highest credit ratings in the world. Control over the issue of currency is carried out by the state bankcountries. He is in state power, and one of his dominant tasks is to ensure a stable exchange rate. Considering the question of CHF - what kind of currency, we can say that the most common banknotes have a denomination of 10, 20, 50, 100 and 1000 francs. Coins of 1, 2 and 5 francs, as well as 5, 10, 20 and 50 centimes are common in circulation. One franc corresponds to 100 centimes.

Characteristic features of the currency

The national currency of Switzerland has low interest rates. The volatility of the currency increases in the event of important monetary and political events in Europe. In the last decade, one can observe a significant weakening of the currency. The price of the Swiss franc with the change of the exchange rate with the euro has a downward trend. If in the period up to 2006 the average cost of a franc corresponded to 1.5 euros, then in 2011 one could observe a price of 1.1 euros. A significant blow to the reputation of the currency was inflicted in 2010, when it was decided to refuse to provide the monetary unit with 40% gold and foreign exchange reserves.

Frank in the foreign exchange market

The currency (Swiss francs) is actively used as a trading instrument in the international Forex market. It is perfect for implementing a low-risk strategy known among traders as Carry Trade. The monetary unit is effective both for hedging risks and for insuring them. Maximum impact on the movement of quotes with currenciesprovides the policy of the state bank and important economic events in the EU. CHF/JPY, EUR/CHF and USD/CHF are the most common currency pairs in the foreign exchange market. They account for about 5% of all Forex operations.

History of the Swiss currency

The Swiss franc was introduced in 1850. On the territory of the country at that time there was no such enterprise as a mint. The minting of coins was carried out by banks and private enterprises. Own funds were issued not only by financial institutions, but also by small towns, abbeys.

Starting from 1920, a law came into effect that the entire currency of the state would be backed by a gold reserve (40%). During the existence of the Swiss franc, CHF (which country's currency, we have already discussed above), the devaluation took place only once, in 1936. The depreciation was insignificant and did not exceed 30%. The prerequisite for the phenomenon was the economic crisis in the United States. The strengthening of the monetary unit fell on the period of the Second World War, since the monetary enterprises of the state did not suffer from military operations. Banks played the role of depositories for the gold and foreign exchange reserves of the conflicting countries. Despite the pan-European crisis, at the moment the franc remains the world's bargaining currency.

Link between the franc and the US dollar

When trying to figure out which currency is CHF and what affects its movement, it is worth taking into account its relationship with the USdollar. To analyze the situation, it is worth paying attention to the behavior of the American currency and its movement in tandem with other currencies of the world. At times when a large investor wants to reduce risks, he directs the flow of capital to Switzerland, which automatically strengthens the exchange rate. Thus, the strengthening of the national currency occurs separately from the development of the economy of the country itself. Switzerland is considered one of the richest countries in the world, and its currency is the most reliable. The national banks of the category UBS and Credit Suisse have the title of the world's leading financial institutions. Despite the fact that the state of the country's economy is not advertised, each report of the National Bank and any changes in the aspect of the state's monetary policy always attract the attention of almost all participants in the international currency market.

Features of the country's economy and its impact on the popularity of the currency in the global foreign exchange market

Paying attention to the peculiarities of the Swiss economy is very important when studying the topic of the Swiss currency, also known by the abbreviation CHF. What kind of currency is it, we considered above, and now we can dwell on the banking system. It is characterized by complete confidentiality, which makes it very effective to evade taxes. According to preliminary estimates of world economists, it is possible to weaken the financial mechanism of the state only in one case - when severe sanctions are imposed on the state by the EU.

Reliability of the banking system of the state directly affects the reliabilityher currency. Features of the country's economy and the factor of influence on the currency of the American economy and the EU economy determines the mirror movement of the USD/CHF and EUR/USD pairs. When one of them jumps, the second one starts a similar movement, but with a small time delay. The effectiveness of forecasting the movement of currency pairs is due to the stability of the franc on the one hand and the intensive movement of the dollar on the other.

Recommended:

Swiss currency Swiss franc: exchange rate

Due to frequent changes on the geopolitical map of the world, many people are already confused about which country belongs to which union. Moreover, not everyone knows what currency people use in a particular country. For example, some people still doubt what currency is in circulation in Switzerland today. Since this country is a member of the European Union, the currency there must be the euro. But is it really so? It turns out no

The most stable currency: an overview of world currencies

The most stable currency in the world is a topic requiring special discussion and study. For many years, the Swiss franc has been such a currency, but it has other national monetary units among its rivals, which are also worth talking about in more detail

CFA franc is the currency of the Congo

The Republic of the Congo is a former West African French colony, and therefore the history of its currency dates back to the colonial period. The CFA franc circulating in the country as a currency is formally fifteen years older than the country. Congo gained independence in 1960, and the first colonial franc appeared in 1945

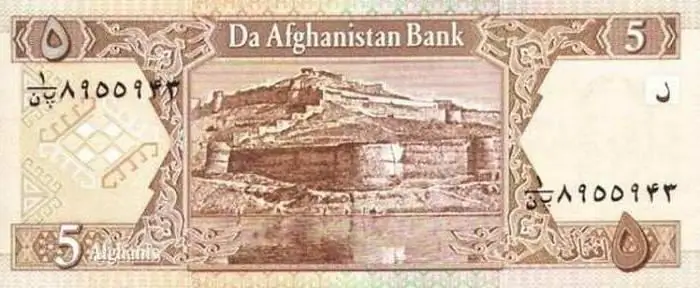

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article