2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Currently, a huge number of accidents involving vehicles occur on the roads of our country. In order to somehow protect themselves in an accident, the driver needs to take out an insurance policy.

Every year more and more motorists are wondering how to restore the discount on OSAGO. This is due to the fact that when extending a motor vehicle citizen, the cost of the policy is calculated without taking into account the discount. This is a rather unpleasant situation, especially if the driver has a long continuous accident-free record and the discount reaches 50 percent.

Burning up accumulated bonuses may seem like a hopeless situation, however, there are several ways in which you can restore the BMF (bonus-malus ratio). This article will tell about this and much more.

Why might the BMF be calculated incorrectly?

Before we talk about how to restore the OSAGO discount (Rosgosstrakh offers it to its clients), you first need to understand the main reasons why the insurance coefficient cancalculated incorrectly. This will greatly simplify the process of restoring the discount and save a lot of time.

All information about the insurance period and previous policies is stored in a single electronic database AIS, which is under the jurisdiction of the PCA. When making changes to the database and updating data about a particular driver, various errors can be made that will cause an incorrectly calculated car insurance discount.

Besides this, there are a number of other reasons for a decrease in MBM, among which the most common are:

- Replacing driver's license or personal data.

- The insurer did not submit driver information to PCA.

- Mistakes made by the insurance agent when filling out the policy.

- Changing the insurance program.

- Interruption of accident-free service.

- Permission to drive the car for several drivers.

Regardless of the reason for the loss of insurance points, each driver can return the overpayment for OSAGO and restore the discount in one of several ways, which will be discussed a little later, but for now, each reason should be considered in more detail.

Change driver's license or personal data

One of the frequently asked questions for many drivers is: “How to restore the OSAGO discount after changing the rights?” And this is not surprising, because every motorist changed his driver's license at least once in his life. Each document is assigned an individual number, which must be entered into a single electronic database. If this is notdo, then the insurance history is reset to zero, and you will not receive any discount when applying for a policy. The same applies to the change of surname.

The insurer did not submit the necessary information about the client to the PCA

Employees of insurance companies are the same people as you and I, therefore, due to their negligence, inattention or other human factors, they may not transfer data about the insured to the AIS. A similar situation may arise in the liquidation of an insurance company. How to restore the OSAGO discount (Rosgosstrakh offers its customers such an opportunity) will be discussed a little later.

Incorrectly completed insurance policy

Even the slightest mistake made when filling out the insurance contract can lead to the return of the CBM to the base value. This is due to the fact that if incorrect data is entered into the policy, then they will also fall into the AIS, as a result of which the driver will be perceived as a completely different person.

Multiple driving license

This situation mainly concerns corporate transport, which is used by several employees of the company. In this case, when applying for an OSAGO policy, the smallest amount of KBM will be taken into account.

Changing the insurance program or interrupting the accident-free period

If the driver has not been involved in a traffic accident for one full year, then he is awarded insurance points that provide a discount when renewing the policy. If the insurance program has been changedor the driver has not driven a car for more than one year, then all accumulated points are burned out and the KBM is reset to zero. How to restore discounts on OSAGO insurance in this case? Unfortunately not.

Is it worth it to restore insurance points?

The size of the discount depends on many factors, among which the main ones are the accident-free period of driving and the number of accidents involving the driver. If a car owner regularly gets into an accident, then when taking out an insurance policy, he is charged a coefficient of 2.45. It follows that he will have to pay almost 2.5 times more for insurance of his vehicle than the average driver.

If a car enthusiast observes the speed limit and traffic rules, and also does not get into an accident, then over time he can accumulate insurance points that will allow him to receive almost a 50 percent discount on insurance services.

Thus, the question of how to restore the OSAGO discount in Rosgosstrakh is very relevant today, since KBM allows you to significantly save on motor insurance. In addition, if the insurer incorrectly calculated the coefficient for previous policies, then the driver will receive compensation when the points are restored.

Basic KBM Recovery Methods

So, you contacted the insurance company to renew the policy and found that it has risen in price. What to do in this case, and how to restore the OSAGO discount? VSK offers assistance to its clients, other insurance companies -too. The first step is to calm down, because there is nothing to worry about.

You can return the previous discount by:

- applying to the UK;

- appeals to the Central Bank of the Russian Federation;

- drawing up a complaint to the PCA.

Each of the methods has certain nuances, so it is necessary to dwell on each of them in more detail.

Solving the problem through the insurer

Many drivers are interested in the question: "How to restore the OSAGO discount after replacing the rights?" The easiest and fastest way is to contact your insurer. The current legislation obliges insurance companies to consider all complaints and appeals of customers related to OSAGO.

In this regard, most UK websites even have a special section where you can file a complaint online. You will need to attach scanned copies of the previous policy or a certificate certifying that the client has no insured events, issued by the insurer, to the form. If there is no access to the Internet, then you can write a statement in writing and send it by registered mail to the physical address of the company. The application must be submitted in two copies, and photocopies of the above documents are attached to it.

The secretary will have to register the appeal in a special journal, and on one of the applications put down the registration number and seal, and then send it by mail to the client. According to the legislation of the Russian Federation, the insurance company has 10 days during which it mustestablish the problem of combustion of CBM and solve this problem. And how to restore the OSAGO discount if a year has passed, you ask? Unfortunately, this case does not provide for the possibility of restoring the KBM.

What if the insurance company was liquidated?

If the insurer with whom you issued the insurance policy no longer operates, then you can restore the KBM through the Central Bank of the Russian Federation or the PCA. You will learn more about the procedure for applying and submitting documents to these authorities.

Applying to the Central Bank

How to restore the discount on OSAGO through the Central Bank of the Russian Federation? It is very simple, but it is necessary to take into account the fact that this instance considers only those appeals of citizens that are filed under OSAGO, which ended no more than one year ago.

To restore the CBM, you need to go to the Internet reception of the Central Bank and fill out an online form, entering all the necessary information and indicating “Incorrect calculation of the CBM” as the reason. It will also be necessary to attach a scanned copy of the previous policy or a certificate confirming the absence of insurance payments to the form. This method is very convenient, because the driver will receive notifications about the status of his application by e-mail. The time for the Central Bank to make a decision may take up to 30 days, during which representatives of the instance will check the relevance of the information provided by the driver, establish the cause of the problem and make a final decision.

Now you know how to restore the OSAGO discount. Alfa insurance and the Central Bank of the Russian Federationhelp to solve this problem on the same principle. If suddenly, for some reason, contacting these authorities does not bring any results, then you should file a complaint with the PCA, which is the most powerful tool in solving this problem.

Appeal to RSA

PCA is one of the most influential organizations in the world of auto insurance. It can not only exert significant pressure on the insurance companies, but also deprive them of their licenses, which is something every insurer is afraid of. Therefore, when mentioning only the name of this instance, any insurer will strive by all means to solve the client's problem. It should be noted that the PCA does not have the right to make any changes to a single electronic database, since this is the responsibility of insurance companies.

So, how to restore discounts on OSAGO in PCA? On the official Internet resource of this instance, detailed instructions are provided on the procedure for restoring the discount on the OSAGO policy. There you can also find the corresponding application form and contacts for consultation.

Restoration of KBM through an insurance broker

This method of restoring insurance points is not the most successful, but it cannot be completely ruled out. Motorists prefer to avoid these companies as they charge a commission for their services. Nevertheless, they work very quickly and will be able to help you restore the OSAGO discount in 1 day. The only exception will be the case if you have previously been in a traffic accident.an accident that you yourself caused.

Contacting insurance brokers will be justified if you do not have time to deal with the restoration of KBM on auto-citizenship yourself, and the accumulated points provide a really big discount. Otherwise, you will pay for the services of the company much more than you save on insurance.

MBM recovery via the Internet

Today, various issues can be resolved via the Internet, so many motorists are interested in the question of how to restore the OSAGO discount without leaving your own home.

On the World Wide Web, you can find many online services, among which there are both paid and free ones, which allow you to quickly and easily restore KBM. All that is required of you is to fill out a special form and attach scanned copies of the necessary documents to it. However, you should be very careful in choosing, as a lot of cybercriminals have divorced in recent years.

What documents may be needed to restore the KBM?

In order to regain your rightful discount on insurance, earned for many years of accident-free driving, you must submit certain documents. The most important of them are last year's insurance policies. If for some reason you cannot find them, then in this case you will need to contact the insurer and ask him to provide a certificate certifying the absence of insured events.

In some cases, the insurer may requestyou a certificate from the traffic police about the absence of offenses, so that the recovery process goes as quickly as possible, you should get it in advance. However, there is one small nuance here. The thing is that the traffic police is not obliged to provide such certificates, so everything depends on the loy alty of the defender of law and order.

It would not be superfluous to make screenshots from the PCA website, as well as photocopies of the technical passport for the vehicle, driver's license and certificate of inspection. Having copies of all of these documents can greatly speed up and simplify the application process.

Conclusion

So, now you know how to restore the OSAGO discount. In this article, all the methods for solving car insurance problems that exist today have been considered. As practice shows, in most cases everything ends with contacting the insurance company. Indeed, despite the fact that insurers are very reluctant to accept applications from their clients, nevertheless, no one wants to pay a large fine or lose a license. However, if suddenly, for some reason, the UK was unable to solve the problem of incorrect calculation of the coefficient, then you can always contact higher authorities.

Recommended:

Quik: setup, installation, step-by-step instructions, features of work

The trading platform plays a very important role in trading. All transactions are made on it. In trading on financial markets, there are different terminals that have their own characteristics and characteristics. This article will talk in detail about the Quick trading platform. The reader will receive information about the correct Quik settings for different trading assets and its installation

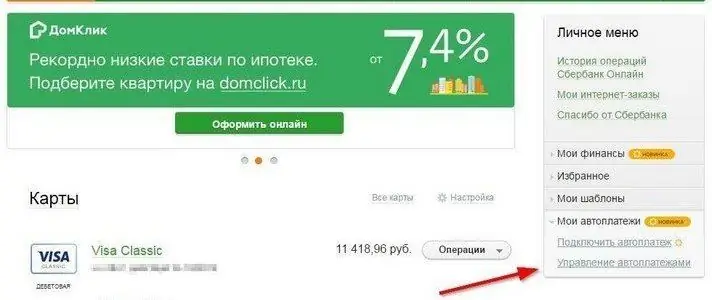

How to remove auto payment from a Sberbank card: step by step instructions

Sberbank has a wide variety of services that make life much easier. Some of them are provided free of charge, while others require payment. The "Auto Pay" option can be very useful, but it needs to be turned off from time to time. But how to do that? Look for the answer in this article

How to open a taxi depot: step-by-step instructions, recommendations, documents

Currently, the transportation of passengers on urban and suburban routes by taxi services is a very profitable area. However, for this to be truly profitable and not to bring the owner into debt, it is necessary to carefully plan everything in advance. For this reason, many are wondering how to open their own taxi fleet

Check the OSAGO policy for PCA - step by step instructions and recommendations

The article describes how to check the authenticity of OSAGO on the official website of the PCA. The main types of false policies are also considered

How to return KBM under OSAGO: step by step instructions

Today, a huge number of vehicles drive on the roads of our country. When buying a car, the driver should immediately worry about the registration of OSAGO. After the cost of insurance services doubled, more and more drivers began to think about how to save money on insurance policies. There are several main ways to do this, one of which is a discount on the insurance coefficient set by the state