2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Any citizen of the Russian Federation who regularly contributes income tax to the country's budget has the right to count on the fact that the state will take care of him in a difficult situation. One of the manifestations of such care is the receipt of partial compensation of funds spent on treatment, one's own or family members, as well as on the purchase of medicines. The amount of such compensation directly depends on the amount of personal income tax paid to the state. So what is a tax deduction, and what kind of documents for a social deduction for treatment will you have to prepare?

Terminology

A tax deduction is understood as a certain part of the income of each citizen that is not subject to taxation. The right to receive such a “discount” is regulated by the Tax Code of the Russian Federation, Article No. 219, which says: any officially employed citizen can return a certain amount spent on treatment, provided that he regularly paid personal income tax. At the same time, it is worth noting that you can receive such a benefit any number of times, the main thing is that its total amount does not exceed 13% of the total deduction made during the year.

Toeligible for a medical tax refund

Before talking about what documents you need to prepare for a social deduction for treatment, let's figure out who exactly can receive such a benefit, and who is not en titled to it. Deductions cannot be granted to those who do not pay personal income tax, these include:

- unemployed citizens, even if they receive social assistance;

- individual entrepreneurs who operate under a special tax regime and do not receive income that is subject to taxation at a rate of 13%.

Citizens who are officially employed and paid on their own (not at the expense of the employer) medical drugs, services or insurance premiums under a voluntary medical insurance contract can count on receiving a personal income tax deduction. You can use this right not only for yourself, but also receive a social deduction for the treatment of your spouse, minor child or elderly parents. You can also compensate for the purchase of voluntary he alth insurance for your family members or the purchase of necessary medicines prescribed by a doctor.

Attention! The law does not provide for a social deduction for the treatment of a child over 18 years of age, even if the son or daughter is a full-time student and is dependent on their parents.

There are several conditions for obtaining such a tax benefit, we will dwell on them in more detail.

Condition one

Unfortunately, not all treatments canbe compensated, for this there is a certain list of medical services, enshrined in Decree No. 201 of the Government of Russia dated 19.03.2001. These include:

- prevention, rehabilitation, diagnosis and treatment in outpatient clinics, clinics and hospitals;

- carrying out various medical examinations;

- emergency diagnosis/treatment;

- rehabilitation, prevention and treatment in a sanatorium (only that part of the voucher that relates to medical services can be compensated);

- he alth education services.

Expenses for types of treatment and prevention not named in the list of the above decision cannot be deducted. It does not do without some incidents: for example, the cost of purchasing restorative products for postoperative patients is not included in this list, but the cost of rhinoplasty or breast augmentation can be easily compensated.

Second condition

What else do you need to know in order to correctly issue a social deduction for treatment? Documents will be accepted from you only if the treatment was carried out by the appropriate subject. This means that a medical organization or an individual entrepreneur providing you with a service must have a valid (not expired) license to conduct medical activities in the territory of the Russian Federation. If there is no such document or the treatment took place abroad, it will not be possible to receive a personal income tax deduction.

And the third condition

There is also anotherrule: all expenses for treatment must be paid by the taxpayer at his own expense. If the treatment or medical insurance was financed by the employer or the funds of any charitable foundation were raised, then such amounts cannot be used for deduction. The same applies to cases where the employer, although not paying for the treatment of an employee, provides him with material assistance intended for these needs, that is, sets the condition that the money can only be spent on treatment.

In addition to direct therapy, you can also compensate for the cost of medicines, a list of them is also defined by the Decree, however, the prescription of medicines must be confirmed by a doctor's prescription.

But the inclusion of the cost of medical devices in the costs is rather controversial. If you are not sure whether certain expenses can be deducted, then, in order to avoid misunderstandings, it is best to contact the Russian Ministry of He alth for clarification. You can do this on his official website in the "Public Reception" section - you should be given an answer within 30 days from the date of registration.

Documents when applying for benefits

To receive compensation, expenses will have to be officially confirmed. You will need the following documents for the social deduction for treatment:

- passport of a citizen of the Russian Federation;

- tax form 3-personal income tax - declaration;

- help in the form 2-personal income tax - to receive at the place of work;

- application for personal income tax refund, which contains account details for creditingfunds;

- copy of the license of a medical institution for the right to engage in medical activities on the territory of the Russian Federation;

- copy of the contract for the provision of medical services (if any);

- certificate of full payment for medical services provided, indicating the type and cost of treatment, certified by the seal of the medical institution;

- checks, receipts, bank statements confirming the expenditure of funds (indicating the service and the name of the medical institution);

- prescription form with a list of prescribed drugs (of those included in the relevant resolution);

- Sanatorium voucher stub, supplemented by a certificate of the immediate cost of treatment (excluding food and accommodation).

If you are going to apply for a social deduction for the treatment of a child, spouse or parents, the list will have to be slightly expanded.

Other documents

In addition to the above, you will also have to provide papers confirming the fact of kinship. If you are making a deduction for the treatment of a child, the documents must be supplemented with a birth certificate of a son / daughter, and in order to receive compensation for a spouse, a marriage certificate must be added. You can return the tax deduction for children under guardianship, for this you need to provide documents confirming the fact of appointment of guardianship. If you are going to receive a social deduction for the treatment of your parents, then you need to add a copy of your own birth certificate to the main list of documents.

When contacting the tax office, it is very important to have with you not only copies, but also the originals of alldocuments - this will greatly facilitate the registration procedure.

If treatment was expensive

When applying for a tax refund, it is worth distinguishing between a social deduction for treatment and expensive treatment - this is not the same thing at all. Due to the fact that each of us has our own concept of expensive and cheap, Decree No. 201 of the Government of the Russian Federation approved a special list of types of treatment that are expensive. There are twenty-seven such names in total. However, in addition to the treatment itself, it often becomes necessary to purchase special equipment and expensive materials. Such expenses can also be attributed to a tax deduction, but certain conditions must be met:

- materials and equipment were purchased for the treatment of a disease included in the list of Decree No. 201;

- the medical institution was not able to purchase these materials or equipment on its own;

- there is a certificate from a medical institution that without the use of this equipment/drugs, it would be impossible to carry out expensive treatment;

- the organization that conducted the therapy issued the citizen a certificate of the provision of medical services (paid) under the code "2": this is how expensive treatment is indicated in the Federal Tax Service.

Tax social deduction for dental treatment

According to the list of medical services, it is also possible to solve the problem with teeth and save on taxes. However, it is worth noting here that resorting to the services of an aestheticmedicine will not work in this case. That is, if you decide to simply whiten your teeth, get silver plating, get expensive implants, or use any other procedure aimed at improving the appearance of your teeth, then you will not be able to receive a social deduction for dental treatment. But if you had to treat flux, caries and other dental "joys", then you are welcome. You can also get a tax refund for prosthetics - this type of service is on the list.

Documents for a social deduction for dental treatment are no different from the above, the same rules and laws apply here. One of the main ones is that the dental clinic/private doctor must be licensed.

How much will they give

You need to understand that although the tax deduction compensates for part of the amount spent on treatment, it still does not always cover it completely. This is especially true for expensive treatments. It all depends on what kind of income you had for the past reporting period, and how much personal income tax amounted.

In general, the tax deduction is accrued in an amount equal to 13% of the cost of treatment, but cannot exceed 120 thousand rubles a year, and in case of need for expensive treatment, the amount is not limited by anything (except for the actual amount of tax paid by you in the past period). Let's look at some examples.

Example 1:

Last year, citizen X. earned 35 thousand rubles per month. His annual income was:

35,000 x 12 months=420 thousand rubles

The amount of personal income tax paid inlast year was:

420 thousand x 13%=54,600 rubles

Also, over the past year, he paid for his daughter's treatment in a private clinic in the amount of 70,000 rubles. By law, he has the right to count on a tax refund in the amount of:

70,000 x 13%=$9,100

Since this amount does not exceed 54,600 rubles paid by citizen X last year, the deduction will be returned to him in full.

Example 2:

Citizen U. earned 300,000 rubles in 2014, from which personal income tax was paid in the amount of:

300,000 x 13%=39,000 rubles

In the same 2014, she underwent an operation costing 105,000 rubles, and she also needed to purchase medicines in the amount of 35,000 rubles. The total amount spent on treatment was:

105,000 + 35,000=140,000 rubles

The tax on this amount is: 140 thousand x 13%=18,200 rubles. But since a tax deduction cannot be made from an amount greater than 120,000 rubles, the maximum tax refund that Mr. U. can receive will be 120,000 x 13%=15,600 rubles.

Example 3:

Citizen S. earned 380,000 rubles in 2013, from which tax was paid:

380,000 x 13%=$49,400

Then she underwent expensive treatment with the use of special equipment. The cost of treatment was 510,000 rubles. It is easy to calculate that the amount of overpaid tax amounted to:

510,000 x 13%=66,300 rubles

But since the amount of tax paid in 2013 was 49,400 rubles,then the return on personal income tax can be made only for such an amount. If her income in 2013 was 10 thousand rubles more, then she could make a tax deduction for the entire amount spent on treatment:

520,000 x 13%=67,600 rubles (which is more than 66,300 rubles of tax deduction).

Timing

There is no definite deadline for submitting documents for calculating a tax deduction, this can be done at any convenient time. In this matter, there is only one rule: you can return the tax for 3 years. This means that if a citizen has the right to a social deduction, for example, in 2014, then it will be possible to return personal income tax in 2015-2017. But in 2018, the deadline for a tax refund will already be passed. Of course, you should not wait for three whole years, because with each subsequent day it will become more and more difficult to collect the necessary documents.

Recommended:

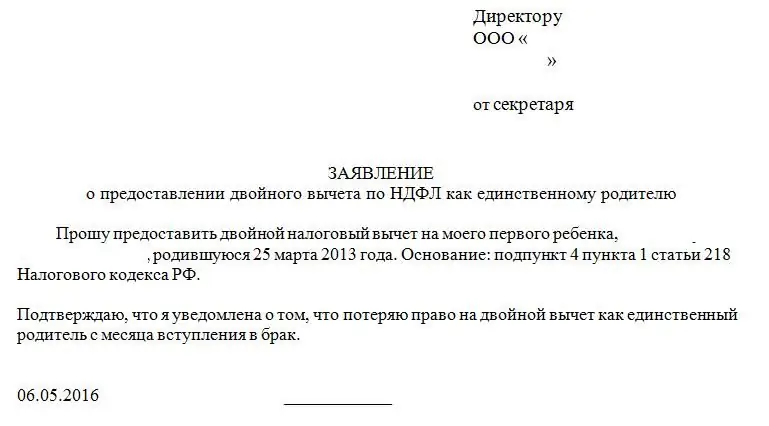

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Job description of a social work specialist. Social protection and social assistance

What are the requirements for a social worker, what are his functions, rights and obligations as a professional in social protection and social assistance to citizens - a complete description of a representative of one of the most humane professions

Social deductions for treatment, education: documents. Social tax deductions are provided

The legislation of the Russian Federation provides for a very wide range of tax deductions for citizens. Among the most popular - social. What are their features?

Escorting a child to and from school. How to choose a nanny to accompany a child?

Human life is always priceless. Especially the life of a child. When the child is near, parents are calm. But the little man grows, becomes more independent. Along with his independence, anxiety about him increases. Mom and dad do not have enough time to accompany the child to and from school, they work. In such a situation, it is worth considering a nanny

How child support is calculated. Formula and example for calculating child support for one and two children

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated