2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:49

At the end of January of this year, the well-known Moscow bank Interkommerts (reviews of its work can be found later in the article) stopped operations on all accounts and, without explanation, began to send its clients to the Deposit Insurance Agency. Many clients of this financial institution learned about this from the ads neatly pasted on the doors of the bank's branches. But this happened long before the regulator revoked his license. What is it connected with? What's the catch? And did the bank representatives know about the revocation of their license in advance? Let's figure it out.

Silence and lots of questions

According to the opinions of many users, they learned that Intercommerce Bank is closing from the text of the announcement on the doors of branches in Krasnodar, Yekaterinburg, Voronezh and the Moscow region. At the same time, his text did not contain a word about the complete liquidation of the organization, but only reported on the cessation of all operations on the accounts. Moreover, all clients - to a greater extent this concerned depositors - were invited to seek help from the DIA. But it should be understood that the Deposit Insurance Agency issues compensationonly in the event of an insured event. And they are the revocation of a license, the announcement of the complete liquidation or bankruptcy of a credit institution. And all this is based on the conclusion of the Central Bank.

The lack of an official statement from the regulator and baffled confused investors. There was no confirmation anywhere that the license had been revoked. Interkommerz, in turn, instead of explaining, simply hid and froze in anticipation.

Knock on a closed door and wait for an answer

At the time the bank branches were closed, no one explained anything to anyone. According to an eyewitness, all the phones of the bank's customer support center were silent. Accounts and, accordingly, the money on them were frozen. Therefore, withdrawing cash or transferring funds to another account was simply unrealistic. Even the press service of the bank turned on the air silence.

Moreover, the DIA also did not dare to comment on the bank's actions. According to the employees of the organization, they cannot be held responsible for the actions of still existing organizations. Whether business, when at them the license is revoked. That's when you can get compensation for frozen deposits. Intercommerce Bank was not included in the list of sanctioned companies in this case. The impression was that the depositors were simply knocking on a closed door and did not receive any clear answer.

First signs of bank problems

Not so long ago, Intercommerce Bank was one of the top 100 financial institutions in the Russian Federation.organizations, despite his high ratings, began to emerge gradually.

At first it was interruptions in payments on deposits. According to customer reviews, for the first time they began to talk about this at the end of January. The same data was published on January 27 on the Internet and in the printed edition of Kommersant. And already on January 28, the bank's offices began to issue deposits, but by prior arrangement.

It was necessary to sign up for such queues three days before the end date. However, later the money was no longer issued even according to such a strange schedule. “Everything is frozen,” users shared their impressions.

Then, the clients of the credit institution began to complain about the blocking of accounts and problems with transferring funds from one account to another. And then, on January 29, the Bank of Russia announced the introduction of temporary administration in the bank "Interkommerz". The interim administration had to work for at least six months.

The regulator explained its decision by a sharp decline in the banking capital of this organization. According to preliminary information, at that time it decreased by almost 30%. On the same evening, representatives of Intercommerce announced the suspension of all current operations on open customer accounts. At the same time, in their statement, they stressed that this measure is temporary and everything will be fine soon.

Why is the bank silent?

Despite the absence of any explanations from representatives of Intercommerce Bank, some experts still believe that the appearance of the announcement onat the door of bank branches - this is ordinary ignorance and misunderstanding of the whole situation as a whole by the employees of the financial institution.

Recall that there are two scenarios involving the introduction of an interim administration. The first of them occurs after the official revocation of the license from the bank, which will be an insured event and a reason for contacting the DIA.

The second option is performed without license revocation. At the same time, the organization itself reserves the right to carry out all the same payment transactions that it carried out before the introduction of the temporary administration of the regulator. However, the last resort may well control and restrict certain operations in order to prevent a significant outflow of capital from Interkommerts Bank. Contributions in this case play an important role.

Therefore, the interim administration urgently needs to stop the start of a massive outflow of capital. Otherwise, this will lead to the zeroing of all bank values and the complete bankruptcy of the credit institution. It will be impossible to save such a bank.

The important role of the interim administration

The introduction of a temporary administration into Interkommerts (reviews about this organization can be heard not only in a positive, but also in a very negative way) helps to assess the real financial situation of the bank. Based on the results of this audit, as a rule, the issue is resolved in favor of saving the credit institution or its bankruptcy.

If the administration of the regulator decides in favor of saving the bank, then soontime, investors will be able to withdraw their funds themselves. It remains only to wait a little. When the license is revoked, contributors will also receive their compensation, but already from the representatives of the DIA.

Still withdrawn

Despite all attempts to rehabilitate Interkommerz (user reviews confirm this fact), it still failed to return it to service. This event took place on February 8 this year. Reasons for revoking the license included high-risk credit policies, repeated violations of laws and regulations, large debts to creditors, and financial fraud.

According to preliminary data, even with unsatisfactory asset indicators, the bank continued to operate as before and did not take into account the existing risks. As a result, he completely lost his own funds, and he could not be rehabilitated. And this is with all the efforts of the regulator.

What do customers think about Interkommerz Bank: reviews

Before the license was revoked, many users spoke positively about the work of the financial institution. They were completely satisfied with his credit and deposit policy, the quality of customer service and much more.

According to the stories of other clients of the organization, this bank was not too convenient, but not too bad either. Recall that the bank itself has been operating since 1991. He had not only a high financial, but also a popular rating. And this means that the level of people's trust in him was very high. By the way, among the visitors of the organization were not only individuals andentrepreneurs, but also fairly large corporate clients. For example, among them were the following companies:

- Transneft.

- Federal Customs Service.

- Oboronstroy.

- SME Bank and others.

The largest insured event in Russia

Revocation of the Intercommerce license has become one of the largest insured events in the history of the Deposit Insurance Agency. According to the latest data, the amount of deposits attracted from the population at the time of the introduction of the provisional administration was 68.4 billion rubles. Moreover, the Agency itself estimated compensation to depositors at 45 billion rubles.

Recommended:

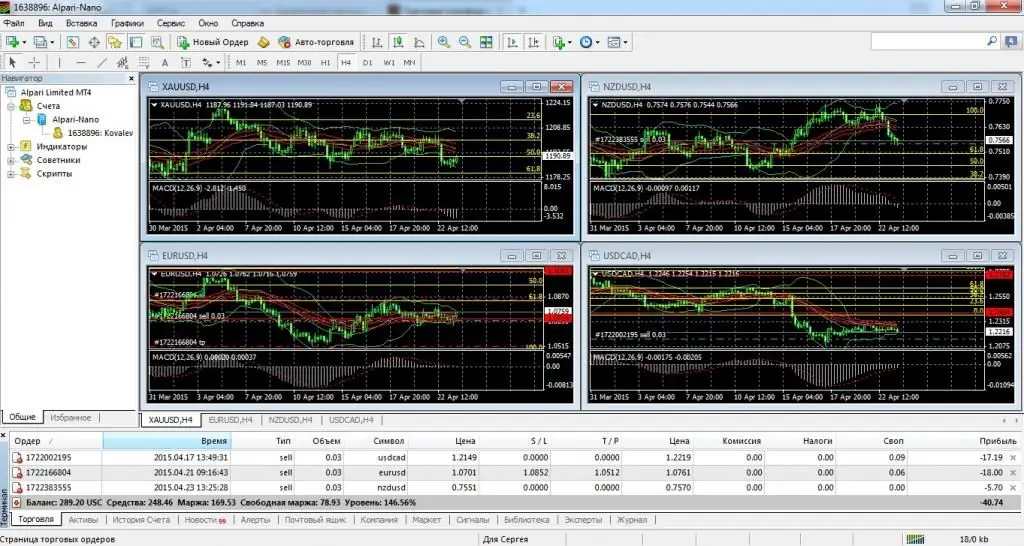

Alpari Broker: reviews, reviews, license and recommendations from experts

Reviews about the broker "Alpari" are very different. Some clients praise the company, which makes it possible to make real money in this difficult time. Others consider them almost scammers who are only engaged in extorting money from people. In this article, we will present a complete overview of the work of the broker, dwell on the advice and recommendations of specialists

Bank "Legion": license revocation. The Central Bank deprived Legion of a license

Complication struck in the summer of 2017 on various clients of Legion Bank. The revocation of the license hit the well-being of depositors in ten cities across the country. The register of creditors' claims was closed on November 29. The external administration takes measures to liquidate a financial market participant

Bank deposits. Bank deposits of individuals

There really are a great variety of banking services. This article will talk about deposits, their types and how not to miscalculate and choose the right bank that will be your reliable financial partner

"Mast-Bank": license revoked? "Mast-Bank": deposits, loans, reviews

Mast-Bank, according to the rating agency, belongs to the category of stable banks. Despite the ban on accepting and replenishing deposits by the Central Bank of the Russian Federation, the financial institution has no problems with liquidity

Frozen deposits of Sberbank. Can deposits be frozen? How secure are deposits in Russian banks?

The frozen deposits of Sberbank in 1991 are systematically paid out by a financial institution. The bank does not refuse from its obligations, and guarantees the complete safety of their funds to new depositors