2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

There are many ways to transfer money from VTB to a Sberbank card. You can use an ATM, the Telebank service, a mobile application, as well as in other ways. How much money goes from VTB to Sberbank? This is described in the article.

Money between banks takes longer to transfer than within the same institution. In almost all organizations, the transfer takes 1-5 business days, but there are also quick transfers. Details can be obtained from a bank specialist.

Pros and cons of VTB Bank

The main advantages of the bank are reliability and stability. The institution offers clients a wide range of services. They can transfer funds to accounts in other banks. But in order to apply for a loan, you will need a certificate of income.

In large cities, it is easy to find a bank branch. ATMs are also everywhere. Through them, you can perform various financial procedures. And for transfers to other institutions, a minimum commission is charged.

What do you need to translate?

To transfer funds, you need to know the details and account number of the card. You can find out this information by visiting a bank branch, as well as by calling the hotline. It will not be possible to perform the procedure only by number, as it can be done in other banks.

If you transfer funds from Sberbank to VTB, you only need the recipient's card number. According to these data, the transfer can be sent via the Internet, terminal, ATM. Terms of enrollment and fees for transfers are minimal.

Duration of interbank transfer

How much money goes from VTB to Sberbank? Usually funds are transferred within a few minutes, but everything can take several hours. There are also delays, but you should not worry about this, since the transfer time is 1-3 days. There may be delays before the holidays when the system is overloaded, so you need to take care of sending funds in advance.

How much money goes from VTB to Sberbank depends on the method of sending:

- App - 5 minutes - 3 business days.

- Office - 1 day.

- ATM - 1-3 days.

In practice, the transfer is rarely delayed for the maximum time. Through the Internet, funds are received very quickly, as well as through the office, ATM. The main thing is to type the correct data.

Types of transfers

How much money goes from VTB to Sberbank also depends on the method of transferring funds. Here are the options:

- Necessaryvisit the Telebank website, open a personal account. There is a section "Transferring money to a card of another bank." You need to specify the details and the amount. The operation is confirmed by entering the password received via SMS.

- Visit the VTB office. The operator needs to provide documents, details. How much money goes to VTB through Sberbank? Funds will arrive within 1 day.

- If you need to regularly make payments, then at the bank office you should fill out a payment order indicating the amount and frequency. After that, transfers will be performed automatically with online notification. Treatment fee is 1.5%.

ATMs of this bank do not allow transferring funds to the current account of another organization. How long does it take to transfer from VTB to Sberbank? In all cases, money can be credited from a couple of minutes to 3 business days. Please note that funds will be transferred longer if they are sent on weekends or holidays. Tracing can be done using the bank hotline. If an SMS notification is enabled, the recipient will be notified automatically about the receipt of funds.

Commission

It is known that funds between accounts in the same bank are transferred free of charge and in a few minutes. But if the cards are issued by different institutions, then there may be difficulties with making interbank transfers. Usually funds are credited faster. Therefore, a transfer from VTB to Sberbank, depending on the sending method, can be expensive. Pay attention to this.

How long can a transfer from VTB to Sberbank take as long as possible? The term is 5 days. The commission also depends on the method of sending:

- Office - 1, 5%.

- ATM - 1.25%.

- Internet - 0.6%.

Internet banking

It is convenient to transfer money using Internet banking:

- You need to connect a service that allows you to use services remotely. Services are provided free of charge.

- To make a transfer, you need to log in by entering your login and password.

- From the card you need to send funds to the current account in the system.

- Then you need to click on the "Transfers" tab, enter the details and the amount.

Using this method, money is transferred within a maximum of 3 days, but usually they arrive faster. Commission is 0.6%.

Mobile application

Now many banks are practicing applications. With it, you can transfer funds at any time of the day. All you need is internet and a smartphone. The application will always let you know about the balance of the account.

To transfer, you need to download the application, register. Details are entered in the personal account. If everything is correct, then the transfer is carried out in 3 days. The commission is 0.6%, the minimum is set at 20 rubles, and the maximum amount is 1000.

Terminal

This method also allows you to simply transfer money. There are terminalspractically everywhere. To make a transfer, you need:

- Find a terminal.

- Insert card, dial pin.

- Perform balance check, find transfer section.

- Click on the section "Crediting funds to cards of other banks".

- Dial details.

- Check everything.

- Confirm the operation, collect the receipt.

The fee will be equal to 1.25%, but not less than 50 rubles. Funds are transferred in 1-3 days.

Bank branch

It is possible to transfer money in the bank office. To do this, you need to take your passport. Details are collected by the operator. After verification, you need to pay for the transfer with a commission. This completes the transfer procedure.

A commission fee of 1.5% is taken for services. The minimum is 200 rubles, and the largest fee is 3000. The enrollment time does not exceed 3 days.

What should I do if funds are not received?

First, you need to make sure that the problem appeared due to the fault of the bank, and not due to an error in sending. Often this is due to the fact that inaccuracies were made in the filling. Receipt of funds is impossible if the card limit is exceeded, therefore, before making a transfer, you need to familiarize yourself with the conditions indicated in the agreement.

If the details were filled in correctly, then you should contact the VTB contact center. It works around the clock, calls are free. If the money was sent, but not received, then you can contact Sberbank.

Transfer money from Sberbank to VTB

How much money goes from Sberbank to VTB is determined by the sending option. It is more convenient to use an ATM or Sberbank Online Internet banking. If the first method is chosen, then it is necessary:

- Insert card, dial pin code.

- Select the "Payments and transfers" button, and then select "Funds transfer".

- On the page that appears, you must enter the card number and amount.

- After verifying the data, click on "Submit".

How much is the transfer from Sberbank to VTB? The maximum period is one day. Commission - 1.5%, but minimum - 30 rubles. If you choose Internet banking, then you need:

- Visit your personal account, enter your login and password.

- Find the section "Payments and transfers", then "Transfers and currency exchange", "Transfers to a private person".

- On the page that appears, enter the details of the recipient's card, the amount.

- It is necessary to conduct data, confirm the operation. The fee is 1.5%, the minimum amount is 30 rubles.

Thus, transfers are made not only within the bank, but also between institutions. The terms for transferring funds are approximately the same for all organizations, but the exact information can be obtained from their specialists.

Recommended:

How to transfer money from Russia to Germany: payment systems, rating, transfer conditions, exchange rates and interest rates

The Russian market, as well as the system of international money transfers, has changed markedly over the past decade. Most banks provide a range of services related to sending foreign currency abroad. Domestic systems of fast money transfers are significantly expanding the geography of their presence. This is only beneficial. Money transfer to Germany is also available

Is it possible to transfer money from a credit card: transfer features, all available methods

Along with debit cards, on which it is convenient to place your own funds so as not to carry large amounts of cash with you, and with salary cards, thanks to which you do not have to wait for the withdrawal of earned money through the cashier, credit cards are especially popular. But is it always convenient to use them on your own? Can I transfer money from a credit card?

How to send money to a Sberbank card. How to transfer money from a Sberbank card to another card

Sberbank is truly the people's bank of the Russian Federation, which has been placing, saving and increasing funds of both ordinary citizens and entrepreneurs and organizations for several decades

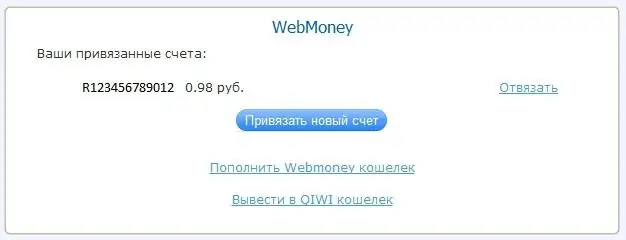

How to transfer money from Webmoney to Qiwi? Now it's much easier to do it

There are many ways to turn virtual money into real money. One of them is to withdraw through the Qiwi system. We will talk about how to transfer money from Webmoney to Qiwi in this article

How much money can I withdraw from a Sberbank ATM? How to transfer money through a Sberbank ATM?

If you own Visa Electron or Maestro cards, then ATMs will give you no more than fifty thousand rubles per day. By the way, it is not always possible to pay with these cards abroad and on the Internet. And how much money can I withdraw from a Sberbank ATM with Visa Classic and MasterCard Standard cards? You can get only eighty thousand per day and 2.5 million per month