2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:49

Economic crises are the least affected by areas with a high degree of integration and joint financial resources. In a market without internal borders, where goods, resources, capital, labor force move freely, there is a favorable investment climate and more conditions for the development of powerful producers. Under such conditions, the need for another financial structure increases - a regional bank.

Purpose

Regional development banks are created with the participation of the state. They have clear lines of work, complement the integration of the government into the economic and social spheres, support foreign trade relations by providing loans to small and medium-sized businesses. For example, assistance provided by the European Investment Bank in 2010 to Hungary, Iceland, Greece, Latvia helped to stabilize the economic and financial situation of the countries. Regional development banks make a significant contributionfor the mutual growth of member countries, help to overcome the negative consequences of financial crises. Under such conditions, the role of interstate financial institutions is increasing. Let's take a closer look at the stages of their cooperation.

Development history

The starting point can be called the period of economic recovery after the Second World War. In 1949, in Moscow, the leaders of Hungary, Albania, Romania, Bulgaria, Poland, the USSR and Czechoslovakia decided to create a Council for Mutual Economic Assistance (CMEA). The goal is to provide financial, scientific and technical cooperation, to assist in the implementation of joint activities. In subsequent years, the GDR, Mongolia, Yugoslavia and Cuba joined it. By the mid-1970s, CMEA maintained relations with more than thirty international institutions.

Achievements

Even at the stage of formation of relations, the organization managed to satisfy the needs of the allies for fuel, raw materials and machines, by joint efforts to build the largest oil pipeline "Druzhba", which was used to transport raw materials to Hungary, Poland and Czechoslovakia. In the second half of the 1960s, Intermetall and Freight Car Park were created. Through the CMEA, clearing trade between countries was coordinated, economic plans were linked, and a mechanism for cooperation functioned.

Hungary supplied the allies with buses, the GDR - clothes, Poland - cosmetics, pharmacology, Czechoslovakia - electric locomotives, Cuba - sugar, Romania - furniture. These goods were exchanged for cheapoil, gas, metal, machine-building, instrument-making and defense industry products. After the collapse of the USSR, this structure also ceased to exist. But other similar institutions are functioning today.

Asian Regional Development Bank

AsDB was established in 1966 by the Economic and Social Commission for Asia and the Pacific. Organization Goals:

- promoting economic growth in the Asia and Far East region;

- improving the position of women in society;

- provide labor resources for member countries.

Asian Regional Development and Reconstruction Bank provides:

- loans for economic and social projects;

- technical assistance in program preparation;

- loans to public and private enterprises for development purposes;

- helps coordinate plans and goals.

Today the union has 56 member countries. The structure of the organization is represented by three levels of authority:

- president;

- board of directors;

- leaders.

Financial resources include authorized capital, reserve funds, loans received from special funds created for concessional lending. The Regional Development Bank is actively working in all spheres of the economy. But more attention is paid to agriculture, the capital market, energy, transport and communications.

Inter-American Development Bank

For the purpose of providingdevelopment assistance to Latin American countries in 1959, the IDB was created. Directions of the organization:

- promoting investment in Latin America;

- directing all available resources to finance important economic projects;

- Promotion of investment;

- assistance in expanding the foreign trade policy of participants;

- Providing technical assistance to implement plans.

IADB has over 48 members. The organization structure looks like this:

- leadership committee;

- board of directors;

- administration;

- presidents;

- departments.

Financial resources include subscription capital, reserve capital, concessional lending trust funds. Most of the assets on paper exist in the form of funds that can be called upon, or guarantees of interaction in the market. The bank's operations cover all sectors of the economy, but more attention is paid to agriculture and fisheries, industry, social services, planning, reforms and investments.

In addition to the IADB, the Inter-American Investment Corporation, Caribank, and the Central American Credit Institution for Economic Integration also operate in Latin America.

Domestic market

The Central Bank assures that there is no direct connection between "he alth" and the size of the bank. Regional development banks also play an important role in the development of the state's economy. They are more efficient and better aware of the characteristics of small and medium-sized businesses. The activities of the latterdepends on local availability of loans. According to statistics, firms that operate in a region with a developed financial system increase turnover 67% faster than enterprises in the country as a whole.

In Russia, such institutions are not very popular with clients. Entrepreneurs in the Urals, Siberia and the Far East cannot get borrowed capital at all. They have to apply to large credit organizations. Regional development banks should be partners for such entrepreneurs. Large credit institutions are not very interested in such clients. In a state institution, the process of making a decision on the issuance of borrowed funds can drag on for several months. It is better to contact the regional regional development bank. The management of the institution is better acquainted with the specifics of the business. The probability of making a positive decision is higher.

A branch is not a bank

Large credit institutions, of course, have branches in remote regions of the country. But they are usually deprived of independence and perform only the technical work of collecting documents. And the decision is made by the leadership in Moscow, which may not be aware of the specifics of the region and business. Big banks prefer to avoid difficult clients. And almost all small businesses require an individual approach. Regional points are ready to delve into the specifics of business and can become an alternative in banking services for small and medium-sized enterprises.

Abbreviation

As of June 01, 2014, there were 888 banks operating in Russia. This is significantly less than in Germany (1.8 thousand) and the USA (more than 5.8 thousand). The level of provision with credit services in Russia is 0.6. That is, there is less than one credit point per person in the country. In the US, this figure is 2, and in the EU countries - 1.8. Another problem, or, more precisely, a feature of the time, is that all large organizations are state structures. Sberbank, VTB (24), Gazprom and Rosselkhoz serve more than 53.8% of the population. Over the past 5 years, the number of credit points in Moscow has increased dramatically: from 15.4% to 22%. As a result, enterprises that are serviced by metropolitan organizations are in a more convenient position compared to organizations in Siberia or the Far East.

Funding

The development of the bank's regional network contributes to the economic growth of the region. This is confirmed by the situation in Russia. In Siberia, there are 258 banks with branches, and in the East even fewer - 118. And this despite the fact that over the past 10 years the same number have ceased to exist. No other county can boast of such figures. The existing regional development banks are classified as small. They cannot provide organizations with the necessary resources. As a result, the level of GDP in these regions is two times less than in Moscow. Yes, and individuals can provide only a small range of services. Reviews testify to this.

The Regional Development Bank is also evaluated bythe ratio of capital to the maximum amount of credit. Thus, in Russia there are 140 organizations that can issue a loan to a client in the amount of 1 billion rubles. Of these, 37 pieces are located in Moscow, 6 - in Siberia (Tyumen, Novosibirsk) and 3 - in the Far East. As a result, entrepreneurs in remote districts are forced to apply for loans to large metropolitan structures or the Regional Development Bank OJSC.

Out of the situation

Regional lending institutions must develop. The Central Bank can greatly contribute to this by capitalizing small organizations. You can also create forms of supervision that will assess the situation according to an algorithm different from that used for large structures. Now there are no special measures to support small banks either at the federal level or in the Central Bank. But if local authorities pay attention to this issue, then the number of banks deprived of licenses in the region is much less. But even if there are such, they are not accompanied by loud scandals, discussion of problems in the media and subsequent panic. A similar situation occurred in 2013, when the Regional Development Bank lost its license. Not all deposits have been returned to clients so far. In total, over the past two years, the Central Bank has revoked licenses from 62 credit institutions. Such statistics are alarming. If the situation does not change, then in 5 years the banking sector will be managed by large state-owned financial institutions.

Conclusion

Economic and social development of the region largely depends onthe entrepreneur's ability to raise funds in a local bank. There are 888 credit institutions in Russia. And they are scattered across the country unevenly. As a result, entrepreneurs in Siberia and the Far East cannot use all possible types of services provided by credit institutions. For help, they have to turn to a large metropolitan or regional development bank. The rating conducted in 2014 showed that the largest of the specialized institutions in terms of equity capital (Russia, MDM, AK Bars) are concentrated in St. Petersburg, Novosibirsk and Kazan.

Recommended:

Real estate development and its role in economic development. The concept, types, principles and foundations of development

In the framework of this article, we will consider the organization of the real estate development system and its role in economic development. The basic concepts, types and principles of organization of the development system are considered. The characteristic features of the system in Russian conditions are considered

Systemically important banks: list. Systemically important banks in Russia

The Central Bank of the Russian Federation has formed a list of systemically important banks in Russia. What are the criteria for classifying financial institutions as such institutions? Which banks are included in the respective list?

International consulting company PERFORMIA International ("PERFORMIA"): reviews. How to pass the tests of the company "PERFORMIA"?

Working on the Internet is what attracts many users. Now even consulting companies are starting to operate here. One of such firms is "Performia". What do users think of it? How to pass the tests that are issued before the interview? What to prepare for?

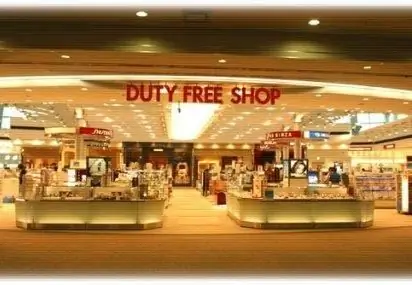

Duty free shops are the main factor in the development of international trade

Describes the benefits, possible locations, rules and restrictions in force in duty free shops

International rating of banks in Kazakhstan

Positions of the main banks of Kazakhstan in the ratings of international financial agencies. Analysts' forecasts and general trends in the country's banking sector. Reliability ratings of banks in Kazakhstan