2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Strategic alliances are an agreement between two or more parties to achieve a set of agreed goals while maintaining the independence of the organizations. They tend to fall short of legal and corporate partnerships. Companies form an alliance when each of them owns one or more business assets and can share business experience with each other.

Definition for joint ventures

Strategic alliances are agreements between two or more parties to share resources or knowledge for the benefit of all parties involved. This is a way to complement internal assets, the ability to access the necessary resources or processes from external players: suppliers, customers, competitors, brand owners, universities, institutions and government departments.

Definition excluding joint ventures

The arrangement between two companies that decide to share resources to carry out specific mutually beneficial projects is a strategic alliance. They are less involved and constant. Each company maintains its autonomy while gaining new opportunities. A strategic alliance can help an enterprise develop a more efficient process, enter a new market, and increase competitive advantage.

Historical Development

Some analysts might say that strategic alliances are a recent phenomenon, but in fact, collaboration between enterprises is as old as the existence of organizations themselves. Examples are early lending institutions or trade associations such as the Dutch guilds. Strategic alliances have always existed, but in the last two decades they have developed very rapidly, moving to the international level.

In the 1970s, the focus of alliances was product performance. The partners sought to achieve the best quality of raw materials at the lowest possible price, improved technologies, faster market penetration. But the focus was on the product.

In the 1980s, strategic alliances focused on the economy. The enterprises involved tried to strengthen their positions in their respective fields. During this time, the number of alliances has grown dramatically. Some of these alliances have led to great product success, such as Canon's copiers sold under the Kodak brand. OrMotorola/Toshiba's international partnership, combining resources and technologies, has led to great success with microprocessors.

In the 1990s, geographic boundaries between markets collapsed. Higher demands on companies have led to the need for constant innovation. The focus of strategic alliances has moved to the development of abilities and competencies.

Vertical alliances

This is a collaboration between a company and its upstream and downstream partners in the supply chain. Such alliances are aimed at intensifying and improving these relations, as well as expanding the network of companies and the ability to offer lower prices. At the same time, suppliers are involved in decisions on the design and distribution of products. An example of this type of strategic alliance is the close relationship between car manufacturers and their suppliers.

Horizontal alliances

Formed by firms operating in the same business area. This means that alliance partners used to be competitors. They began to work together to improve market power compared to other competitors. Research and development cooperation between enterprises in high-tech markets are horizontal alliances. An example would be an alliance between logistics service providers. Such companies get a double benefit:

- access to material resources that can be directly used (expansion of common transport networks, storage infrastructure, provision of a more complex packageservices);

- access to intangible resources that cannot be directly used (innovation and know-how).

Cross-sector alliances

These are partnerships in which the participating firms are not linked in a vertical chain. They do not operate in the same area of business, do not come into contact with each other, have completely different markets and know-how.

Joint ventures

In this case, a partnership agreement is entered into by two or more companies to create a new enterprise. It is a separate legal entity. Forming companies invest capital and resources. New firms may be formed for a limited time for a specific project or for long-term business relationships. Control, income and risks are distributed depending on the contributions.

Equal Alliances

It is a form of strategic alliances in which one company acquires a stake in another company, and vice versa. This makes the companies stakeholders and shareholders of each other. The acquired share of the shares is insignificant, so the decision-making power remains with the selling company. This situation is also called cross-shareholding and leads to complex network structures. Companies that are connected in this way share the profits and have common goals. This reduces the desire for competition. It also makes it difficult for other companies to accept orders.

Unequalalliances

They cover a wide field of possible cooperation between companies. This may be close cooperation between the customer and the supplier, outsourcing of certain corporate tasks or licensing. Such an alliance may be informal, which is not indicated by a contract.

Target typology

Michael Porter and Mark Fuller, founders of the Monitor Group of strategic alliance split alliances according to their goals:

- Operational and logistics alliances. Partners either share the costs of introducing new production facilities or use existing infrastructure owned by a local company in foreign countries.

- Marketing, sales and service alliances. Companies use the existing marketing and distribution infrastructure of another enterprise in a foreign market to distribute their own products.

- Technology development alliances. These are consolidated research and development departments, simultaneous development agreements, technology commercialization agreements, and license agreements. As a rule, these are international strategic alliances.

Additional views

These types of strategic alliances include:

- Cartels. Large companies can cooperate informally, controlling production and prices within a certain market segment or business area and curbing their competition.

- Franchising. He gives the right to use his partnerbrand name and corporate concept. The other party pays a fixed amount for this. The franchisor retains control over pricing, marketing and corporate decisions in general.

- Licensing. One company pays for the right to use another company's technology or production processes.

- Industry standard groups. These are groups of large enterprises that are trying to enforce technical standards in accordance with their own production interests.

- Outsourcing. One party pays the other to perform production steps that are not part of the firm's core competencies.

- Affiliate marketing. This is a web-based distribution method in which one partner provides the opportunity to sell products through their channels in exchange for predetermined terms.

Using their enterprises build their activities.

Meaning

Main goals of strategic alliances:

- making common decisions;

- flexibility;

- acquisition of new customers;

- strengthening strengths and eliminating weaknesses;

- access to new markets and technologies;

- common resources and risks.

You need to take them into account when working.

Examples of international alliances

International strategic alliances include the DuPont/Sony partnership. It consists in the development of optical memory. The Motorola/Toshiba connection is engaged in the joint production of microprocessors. General Motors/Hitachi ispartnership to develop electronic components for automobiles. Fujitsu/Siemens manufacture and sell computer products. Apple/IBM is a partnership that brings analytics and enterprise computing together with a sleek iPhone and iPad user interface. Google/Luxottica is a brilliant collaboration resulting in Google smart glasses. Leica/Moncler - The alliance is described as the perfect marriage of aesthetics and technology. It was created to produce branded cameras.

Innovation Alliance

Marks Spencer/Microsoft - This partnership will allow both organizations to jointly explore how retail can use technologies such as artificial intelligence to improve the customer experience and streamline operations. Microsoft's world-class engineering team will work with M&S' retail lab team. The partnership is based on a new technological approach. Steve Rowe, CEO of Marks Spencer, called the venture the first digital retail. The signing of the strategic agreement took place on June 21, 2018 in London.

Success Factors

The success of any alliance largely depends on how effective the capabilities of the enterprises involved are and whether the full commitment of each partner to the alliance is achieved. There is no partnership without compromise, but the benefits must outweigh the cons. Poor alignment of goals, metrics, and corporate culture clashes can weaken and limit the effectiveness of any alliance. Some keyfactors to consider in order to be able to manage a successful merger include:

- Understanding. Collaborating companies need a clear understanding of the resources and interests of potential partners, and this understanding should be the basis of the goals of the alliance.

- No time pressure. Managers need time to establish working relationships with each other, develop a time plan, set milestones, and develop communication channels. The hasty signing of a cooperation agreement may harm the members of the alliance.

- Limitation of alliances. Some incompatibility between enterprises may not be avoided, so the number of alliances should be limited to the necessary number, which will allow companies to achieve their goals.

- Good connection. Managers of large firms must be very well connected in order to be able to integrate different departments and business lines across internal boundaries. They need legitimation and support from senior leadership.

- Building trust and goodwill. This is the best basis for mutually beneficial cooperation between enterprises, as it increases tolerance, intensity and openness of communication and facilitates joint work. In the future, this leads to equal and satisfied partners.

- Intense relationship. The intensification of partnership leads to the fact that partners get to know each other better. This builds trust.

Risks

Use and operationstrategic alliances brings not only chances and benefits. There are also risks and limitations that need to be considered. Some of the risks are listed below:

- partner experiencing financial difficulties;

- hidden costs;

- poor management;

- activities outside of the original agreement;

- information leak;

- loss of competence;

- partner product or service failure;

- loss of operational control;

- partner is unable or unwilling to provide key resources.

Failures are often attributed to unrealistic expectations, lack of commitment, cultural differences, differences in strategic goals and lack of trust. To avoid them, it is necessary to carefully consider all aspects of cooperation.

Recommended:

Strategic planning and strategic management. Strategic planning tools

A novelty of strategic planning and management management of closed forms of company development is the emphasis on situational behavior. This concept opens up more opportunities to prevent external threats and develop mechanisms for protecting against risks in a market environment

The difference between a commercial organization and a non-profit organization: legal forms, characteristics, main goals of activity

The main difference between commercial organizations and non-profit organizations is the following: the former work for profit, while the latter set themselves certain social goals. In a non-profit organization, profits must go in the direction of the purpose for which the organization was created

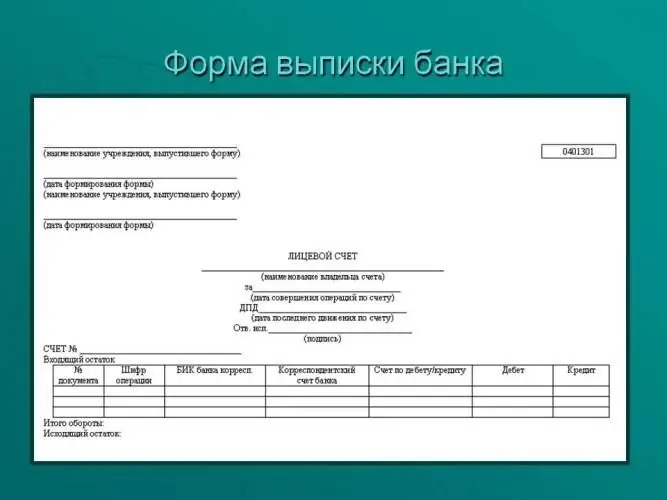

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Commitments - who is this? Postings, report and agreement between the commission agent and the committent

According to the financial dictionary, a committent is a party to a commission agreement that instructs the other party (commission agent) to make a transaction with goods for a monetary reward (commission)