2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

A diploma of completed higher education opens up wide career opportunities for young people. Since the Soviet times, the majority of Russians believe that higher education is a guarantee of well-being and prosperity. However, in modern Russia, not everyone can enter a higher educational institution. There are not enough budget places for everyone, and tuition fees are beyond the power of most people. In this situation, financial institutions are ready to help applicants or already enrolled students by providing a loan for education. Sberbank, the program of which will be discussed, also works in this service sector.

What is an education loan?

In the West, the practice of student support has been open for a long time and enjoys constant success among young people. For more than half a century, there have been various loan programs for students, including foreigners, some of which may include, in addition to tuition fees, small scholarships for the entire period of study. Most lending programs abroad are supported by the state in cases of need. In this way,more than a quarter of all students of foreign universities study on credit.

In general terms, an education loan is a targeted consumer loan with a special repayment schedule. The loan term depends on the period of study and exceeds it by 5 years. At the time of training, a deferral of payment of the body of the loan, and sometimes interest on it, is provided. The interest rate on such loans is usually lower than the average consumer loan rate. You can become a borrower of such a loan from the age of 14, which is a feature of the service. The bank will require additional guarantees, such as collateral or third party guarantees, as well as written permission from the parents. The loan can be obtained for the entire period of study in accordance with the agreement with the educational institution, or it can be differentiated according to the payment schedule, that is, the bank transfers funds to the account of the educational institution in installments for each year or semester of education. The second option is preferable, since interest is not charged on the entire amount at once, in the event of a premature termination of training, the borrower will not have to pay the full original cost of the loan, but only a part, according to the recalculation at the original rate. This must be reflected in the contract. The bank may require additional justification for successful study - certificates of successful completion of the semester and the absence of debts. Often, the agreement with the bank prescribes the possibility of obtaining an academic leave for students and the corresponding postponement of loan terms and the recalculation of interest onloan.

Peculiarities of educational lending of PJSC "Sberbank of Russia"

On the Russian financial services market, among educational lending, the programs of one of the leaders in the banking sector PJSC Sberbank of Russia stand out favorably. Taking into account state programs to support student lending in certain speci alties, among banks that provide loans for education, Sberbank provides the best conditions. The lending rate is from 13.9%, which is one of the lowest in comparison with other consumer lending programs. The loan is issued only in rubles for a period exceeding the period of study by 10 years. Sberbank is ready to pay the full cost of training or the remaining part to pay, regardless of the client's income. There is a "mitigation" for interest payments for the first and second years of using the loan, while the main debt is required to be paid after 3 months from the date of graduation, regardless of the successful completion of the diploma. That is, even having failed and completed the training ahead of schedule, the client has time to look for an additional source of income to repay the amount issued on an education loan. Sberbank thus divides loan payments into 2 periods: the first period is valid for the entire period of deferral of payments (training period and 3 months) and provides for the payment of only interest on the loan, and in the first and second years, payments are 40 and 60%, respectively; the second period provides for the payment of the body of the loantogether with accrued interest in equal (annuity) payments.

A loan can be provided as a one-time transfer of funds to the account of an educational institution, as well as parts of a credit line, according to the agreement. In the second case, it may be necessary to provide documents confirming the successful completion of the training stages, and additional signing of annexes to the agreement with Sberbank. A loan for education, the terms of which do not provide for any commission or insurance, is secured by a pledge or guarantee from third parties only in the case of a large loan amount. If the payment terms are not met, the remaining loan debt is subject to a pen alty rate of 20% per annum.

Educational program clients

Any interested student of an educational institution can act as a borrower of an educational loan from Sberbank of Russia, that is, the bank needs confirmation of the applicant's enrollment in an educational institution on a paid basis, on the basis of which a targeted education loan is issued for students. Sberbank lends not only to students of higher educational institutions, a loan can be taken for any paid education in educational institutions that have the appropriate accreditation for educational activities. Students of evening and correspondence courses also have the opportunity to use credit services, along with students of day departments. The age of the borrower must be at least 14 years old, additional written consents will be required for minor clientsfrom legal representatives, as well as permission from the guardianship and guardianship authorities for the right to use an education loan. Sberbank excludes servicing persons under guardianship, in accordance with the federal law "On guardianship and guardianship."

State support program for students of higher educational institutions

The Ministry of Education and Science has been experimenting with student support programs for several years. State-supported loans can be obtained for education in more than a hundred universities, a wide variety of speci alties. Agreements have been signed with several banks, including Sberbank, where education loans are discussed in the article. An attractive feature of the state-supported loan is the reduced interest rate according to the refinancing rate of the Central Bank of Russia and an additional 5 points. For example, under the student loan program of Sberbank of Russia, the state will assume the obligation to pay half (7.5%) of the rate for using the loan. The borrower will be required to pay only the remaining 7.5% of the rate to Sberbank. A loan for education under such conditions corresponds to foreign counterparts.

Sberbank of Russia is a guarantee of stability for most Russians

In general, the attitude towards Sberbank of Russia PJSC for more than a hundred and fifty years has been quite positive among clients. No exception is the program that provides student loans foreducation for students. Sberbank, reviews of which emphasize one of the lowest lending rates in Russia, provides an opportunity to receive education for low-income segments of the population, as well as the opportunity, regardless of the help of relatives, to get the necessary education for adult working borrowers on their own. Payments at the beginning of use are not too high, while they discipline the borrower and prepare to fulfill the main obligations of the loan in the second repayment period, when the loan amount must be paid along with interest.

Service not up to the mark

Of the negative reviews, complaints about the quality of work in individual divisions of the bank prevail, mainly due to the lack of professionalism of the staff providing loans for education at Sberbank. Reviews often say that student lending and state support for such programs is a fairly new area of services not only for consumers, but also for the banks themselves, this is natural, so there are some problems with bank specialists who find it easier to get a standard consumer loan than to go into the details of specialized programs. Several reviews highlight the lack of compliance with the deadlines for reviewing documents, indeed, in some regional branches of the bank, which again confirms the lack of staff awareness or deliberate reluctance to work with the new service, providing education loans for students. Sberbank, reviews of which we were interested in, to solve problems withto avoid delays in the loan process and pen alties from the institution for late payment, strongly advises you to contact your senior management or the customer support hotline, as the difference between a regular personal loan and a targeted education loan is quite noticeable.

Impact of the crisis

Interesting reviews were left by users who have already received a loan from Sberbank for education with state subsidies during the economic crisis. For several months, such students studied under the fear of immediate expulsion from an educational institution, because the banks did not have the funds to secure loan obligations. Universities themselves could temporarily afford to take on part of the banks' obligations. As a result, the situation with the education of students who found themselves in this difficult situation was resolved positively, educational institutions fully fulfilled the educational services stated in the contract, despite interruptions in payment.

Perspective

Still quite young student lending programs in Russia can be well developed, based on the experience of foreign student support systems. Analysts see a good future for such types of lending, which, coupled with a stable economy and state support, can give the country a lot of trained and independent specialists. Given the demographic rise, caused, among other things, by the state policy to support the birth rate of the latterdecades, the future of educational lending is not far off. Sberbank, as a participant in the state student support program and as an independent lender on standard lending terms, is currently the most profitable partner for most people who want to get a higher or professional education on credit.

Recommended:

Loan repayment methods: types, definition, loan repayment methods and loan payment calculations

Making a loan in a bank is documented - drawing up an agreement. It indicates the amount of the loan, the period during which the debt must be repaid, as well as the schedule for making payments. The methods of repayment of the loan are not specified in the agreement. Therefore, the client can choose the most convenient option for himself, but without violating the terms of the agreement with the bank. In addition, a financial institution can offer its customers various ways to issue and repay a loan

Car loan or consumer loan: what is more profitable? Which loan to choose: reviews

According to statistics, the average cost of a car in Russia reaches 800,000 rubles. It is worth emphasizing that this figure may vary depending on the region. At first glance, it is clear that it is impossible for a simple layman to earn such money even in a year. As always, credit organizations come to the rescue. Often the population asks the question: "Car loan or consumer loan, which is more profitable?"

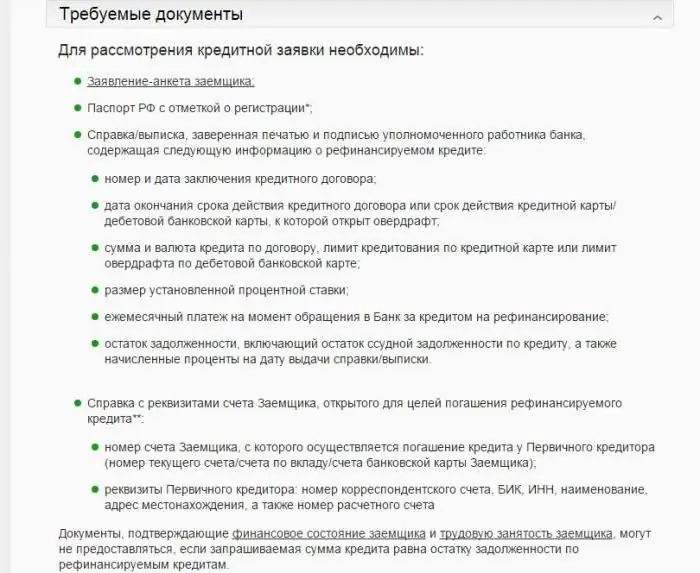

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

Which bank to get a loan? What documents are required for a bank loan? Conditions for granting and repaying a loan

Big plans require solid funds. They are not always available. Asking relatives for a loan is unreliable. People who know how to handle money always find successful solutions. In addition, they know how to implement these solutions. Let's talk about loans

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options