2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

In 2000, the Regulations on Accounting, approved by the order of the Ministry of Finance dated 06.05.1999, - PBU 10/99 "Expenses of the organization", came into force. It was developed in pursuance of the state program for reforming the Russian accounting system in accordance with IFRS. In this article, we will deal with the features of the application of PBU 10/1999 "Organization's expenses".

General information

Why do we need PBU 10/99? In the accounting of the organization, expenses occupy a special place. The Regulation under consideration establishes the rules for reflecting information about costs in commercial enterprises that have the status of legal entities. At the same time, PBU "Expenses" does not apply to insurance and credit organizations.

The cost of an enterprise is considered to be a decrease in economic benefits due to the disposal of an asset (monetary or non-monetary) or the incurrence of a liability, leading to a decrease in the capital of the company (except for casesreduction of deposits by decision of property owners).

Exceptions

According to PBU, an organization’s expenses are not recognized in accounting:

- The cost of buying or creating any non-current assets. Among them are fixed assets, intangible assets, construction in progress, etc.

- Contributions to the share/authorized capital of other enterprises, the acquisition of JSC securities not for sale/resale.

- Transfer of funds for charitable purposes, expenses for sports events, entertainment, recreation, etc.

- Transfer of amounts under agency agreements, commission agreements, etc. in favor of the principal, committent, agent, commission agent.

- Advance payment for services, works, inventories and other valuables.

- Repayment of a loan, credit.

- Payment of an advance or deposit against payment for works, services or inventories.

Cost classification

According to PBU 10/99, the expenses of the organization are divided depending on the conditions for conducting activities, its nature and directions. The Regulation provides for the following classification:

- Costs for ordinary (core) activities.

- Other expenses.

The second group, in turn, includes operating, non-operating and extraordinary expenses.

The first group includes costs associated with:

- production and sales;

- purchase and sale of goods;

- provision of services, production of works;

- provision forpayment of the enterprise's own assets for temporary use (possession) under a lease agreement, if this is the usual activity of the company;

- participation in the capital of other organizations, if this is the normal activity of the company;

- depreciation of fixed assets, intangible assets and other depreciable items.

If a particular type of activity is not usual for an enterprise, then the costs associated with the transfer for a fee for temporary use of its own assets, products of intellectual labor, participation in the capital of other business entities, must be recognized as operating expenses.

Accounting

PBU 10/99 establishes the following rules for recording costs for ordinary activities. These costs are taken into account in an amount calculated in monetary terms and equal to the amount of payment or accounts payable (if the costs have been calculated but not yet paid).

If the actual receipts cover only a part of the recognized costs, then when taking into account the payment made and the accounts payable in the uncovered part are summed up. Their sizes are determined in accordance with the price and conditions established in the contract between the supplier and the enterprise (contractor) or other counterparty.

Features of determining the amount of debt or payment

In paragraphs 1-6 of RAS 10, when accounting for the expenses of an organization, the price at which, under comparable conditions, the company determines the costs of other services, works, material and production values, provision of temporary possession / use of similar objects can be used. Suchthe procedure applies when the value of the asset is not fixed in the contract and cannot be established under its terms.

If inventories, works, services are purchased under a commercial loan provided in the form of an installment/deferred payment, the costs should be taken in the amount of all accounts payable.

In accordance with PBU, in accounting for the organization's expenses under contracts that establish obligations, the fulfillment of which is carried out in non-monetary form, the amount of debt or payment is determined based on the cost of objects transferred or to be transferred under the terms of the contracts. It is determined by taking into account the price at which, in similar circumstances, the company evaluates comparable goods.

If it is impossible to determine the value of the values to be transferred or transferred, then the amount of accounts payable or payment is set at the cost of the products received by the enterprise. It, in turn, is determined based on the prices at which the company purchases goods under comparable conditions.

This principle of calculating the price of exchanged objects corresponds to the provisions of Art. 524 GK. According to the norm, the current price is the amount that, under comparable conditions, is charged for similar products in the place where the goods are supposed to be transferred. If the current price is not fixed in that place, the price applied in another territory can be used if it can be a reasonable substitute. At the same time, it is necessary to take into account the difference in the costs oftransportation of objects.

Difficulties in applying regulations

Many experts note certain contradictions between PBU 5/98 "Fundamental Property Accounting" and PBU 6/97 "Inventory Accounting", on the one hand, and the new Regulations adopted in 1999 (PBU 9 "Income of the Enterprise" and PBU 10 "Expenses of the organization").

It must be said that the approach provided by earlier documents is considered justified in terms of recording material objects at their actual cost as acquired. At present, when using methods for assessing income and expenses according to PBU-99, i.e., published in 1999, the enterprise actually charges only "turnover" taxes and can reduce or increase the book value of valuables. The "revolving" include, for example, fees for the use of roads, for the maintenance of housing and communal services, social and cultural institutions.

Problem Solving

Many accountants do not understand how they need to be guided by PBU when accounting for the organization's expenses.

Experts recommend using this approach: if the prescriptions of regulations approved by the same institution of power and identical in status have contradictions, you need to be guided by the provisions of a document published later.

Nuances

When contract obligations change, the original payment or payable should be adjusted to reflect the value of the asset to be written off on disposal. It is determined based on the price at whichsimilar assets are valued on disposal under similar conditions.

The amount of accounts payable or payment is set taking into account all discounts provided to the company in accordance with the contract.

Amount differences

Due to them, the amount of payment decreases or increases. Such differences arise when paying in rubles in the amount corresponding to the amount in foreign currency. They are the difference between the ruble valuation of payment, expressed in foreign currency and made after the fact, calculated in accordance with the official or agreed exchange rate on the day the corresponding debt was taken into account, and the ruble valuation, calculated at the exchange rate on the date of reflection in the accounting of expenses.

Cost Items

Costs of ordinary activities should be grouped by:

- Material costs.

- Payroll expenses.

- Social spending.

- Depreciation payments.

- Other expenses.

According to PBU 10, expenses are reflected in documents by cost items. Their list is established by the enterprise independently.

For the formation and analysis of the financial result from the implementation of ordinary activities, the cost of services, works and products sold is determined. At the same time, as established in RAS "Expenses" from 1999, the costs of operations recognized in the current year and previous periods, as well as carry-over costs associated with the receipt of income in the coming periods, are taken into account. In the latter case, take into accountproduction-specific adjustments are accepted.

Features of the formation of a group of operating costs

In accordance with PBU, the expenses of an organization in this category include interest deducted by the enterprise for the use of borrowed funds.

Companies can now take into account interest on amounts received not in banks, which before 01.01.2000 were reflected, for example, on the account. 88 at the expense of sources of own funds. These interest (i.e. losses) will not be taken into account for tax purposes. Some experts consider this innovation as an attempt to stop the practice of reflecting data on the account. 88.

Non-operating and extraordinary expenses

To deal with these cost groups, you need to refer to Government Decree No. 696 of 1999-26-09. According to this act, non-operating costs include interest deducted by the issuer on certain types of bonds. In particular, we are talking about securities that are put into circulation through trade organizers that have a license issued by the Federal Commission. The costs of deducting this interest for tax purposes should be accepted within the refinancing rate of the Central Bank, increased by 3 points.

The group of extraordinary expenses under PBU includes expenses arising from unforeseen situations (natural disasters, nationalization of property, accidents, etc.). The list of non-operating costs includes uncompensated losses resulting from natural disasters. It's about destruction and destruction.inventories, finished products and other valuables, losses during production shutdowns, etc. The costs include, among other things, the costs associated with the prevention or elimination of the consequences of accidents or natural disasters. Non-operating expenses also include non-compensated losses incurred in connection with fires and other emergencies caused by extreme conditions of production activities.

Amount of other expenses

The amount of costs associated with the sale, disposal, write-off for other reasons of fixed assets and other assets expressed in non-monetary form (except for foreign currency), products, goods, are determined according to the rules of clause 6 PBU 10 "Expenses". Accounting in this order is carried out in relation to the costs associated with:

- Participation in the capital of other business entities.

- Granting temporary possession/use of the company's own assets, rights obtained under patents for industrial designs, inventions and other products of intellectual labor, when their creation is not a normal activity.

- Paying interest on borrowed funds.

- Paying for the services of credit institutions.

Extra

According to the provisions of RAS 10, accounting for the organization's expenses related to the payment of pen alties, pen alties, fines for non-fulfillment of contractual terms, compensation for losses caused by the enterprise, is carried out in amounts awarded by a court decision or recognized by an economic entity.

Expired accounts receivable, other uncollectible debts are expensed to the extent they are reflected in the financial statements.

The amount of markdown of objects (except for non-current assets) is set according to the rules provided for revaluation.

Other costs are transferred to the profit and loss account, unless otherwise stipulated in legislation or accounting rules.

Conditions for cost recognition

In accordance with PBU 10/99, expenses can be reflected in the accounting if:

- Carried out under the terms of a specific agreement, in accordance with the requirements of the law, other regulatory act or business practices.

- Their size can be accurately and reliably determined.

- It is certain that a particular business transaction will reduce the economic benefit when the entity has transferred the asset or there is no uncertainty about the forthcoming transfer of the asset.

If at least one condition is not met, accounts receivable are reflected in accounting.

As established by PBU, accounting for depreciation costs is carried out based on the amount of deductions determined on the basis of the cost of depreciable property, its useful life and methods of accrual established by the financial policy of the organization.

Features of cost reporting

In accordance with PBU, expenses are recognized in accounting regardless of:

- intentions of the enterprise to receive revenue, operating or other income;

- forms of costs (in kind, cash).

Expenses are recognized in the period in which they were incurred. The time of actual payment (in cash or other property) does not matter.

If an enterprise, in cases prescribed by law, adopts the procedure for recognizing profits from the sale of goods not as the transfer of the right to use possession and disposal of the delivered objects, but after payment is received, then the costs are reflected after the debt is repaid.

The specified procedure until 2000-01-01 was valid only for small businesses. The basis was the Model Recommendations approved by the Order of the Ministry of Finance No. 64n dated 1998-21-12. In accordance with paragraph 20 of this document, the costs associated with the release and sale of products, services, works should be reflected in the account. 20 only in the amount of paid-in valuables, paid earnings, accrued depreciation and other repaid debts. This reflection method is referred to as "cash".

For other economic entities using the "on payment" method, the cost of work, products, services decreased in proportion to the amount of actually received profit by calculation. Explanations on these issues were given by the Supreme Court. In the decision of 09.12.1998 No. GKPI 98-655, the court stated the following: “The method of determining the proceeds from the sale “by shipment” or by payment” affects the rules for determining the cost of goods sold. Usingof the "on payment" principle, it includes the costs of the period to which they relate, in accordance with the terms of the execution of the contract and the actual calculations made."

Profit and Loss Statement

According to PBU, expenses are recognized in the report:

- Taking into account the causal relationship between costs and receipts. It is especially important to keep records of expenses and income for all activities that are material. We are talking about cases where the profit exceeds 5% of the total revenue of the company. The report reflects not only the gross revenue and the cost of goods corresponding to it, but also the amounts received by types of activity and the cost of the goods corresponding to them. Such a distribution of indicators will allow interested parties (users of reporting) to form an idea of the profitability of the areas of the enterprise.

- Through their reasonable distribution between periods, when the costs cause the receipt of funds at different time intervals, and the relationship between costs and income is either not clearly defined, or is determined indirectly.

Distribution of costs by periods can be made in accordance with regulations. If there are no such legal documents, then the calculation procedure is established by the enterprise independently.

Selling and management costs

In accordance with PBU, accounting for expenses for commercial and administrative needs can be carried out as part of the cost of sales of works, goods, services inthe full amount in the reporting year as a cost of the company's ordinary activities. However, this does not mean that the enterprise can reflect these types of costs that are not related to the sold products. The moment of recognition of these costs is the moment of recognition of income, i.e. sale.

In accordance with PBU, the costs of the organization for the packaging of products and their transportation, classified as a group of commercial costs, are directly charged to the cost of the corresponding goods. If this is not possible, they can be distributed on a monthly basis between certain types of products sold based on their volume, weight, production cost, or other indicators fixed by industry instructions. All other selling expenses are charged to cost of goods sold each month.

Regulatory documents may establish the recognition of expenses in the event that the corresponding receipts are not received. For this provision to apply, it must be established that the non-receipt of income has become certain.

The PBU includes the costs of canceled orders, as well as the costs of production that did not release goods (except for losses compensated by customers), minus the cost of used material assets.

The period of order cancellation is taken as the reporting period in which the fact of non-receipt of income becomes certain.

Donated Objects

In accordance with the Chart of Accounts, such property is reflected in the credit account. 87 subaccounts 87.3 incorrespondence with accounts 01, 04, etc.

Based on PBU 10/99, objects transferred to an enterprise free of charge, including under a donation agreement, are included in non-operating income. Accordingly, information about them in accounting is reflected in postings:

Dt sch. 01 (04 etc.) 80 subaccounts "Extracurricular income".

Non-Asset Recognition Liabilities

These include legal costs, arbitration fees deducted by the company in the event that the proceedings ended not in favor of the payer. Clearly, the company's assets have not increased, although there have been costs.

Disclosure

In the reporting, the accountant must reflect the following information:

- Costs of ordinary activities in the context of cost elements. It takes hard work to meet this requirement. In particular, the accountant will have to draw up a detailed list of expenses for ordinary activities and attribute them to the cost elements provided for by PBU 10.

- Change in the amount of costs that are not related to the calculation of the cost of sales of works, goods, services in the reporting year. Here it is necessary to reflect the order of distribution of commercial and administrative costs, as well as distribution costs for tax purposes. In accounting, these expenses are fully written off.

- Costs equal to the amounts of deductions for the formation of reserves (estimated reserves, future costs, etc.).

Note non-salesand operating costs may not be shown on a gross basis in relation to related income if:

- Accounting rules do not require or prohibit such reflection of costs.

- The costs and revenues associated with them, arising from the same business transaction, do not have a significant impact on the characteristics of the financial condition of the enterprise.

All other expenses of the enterprise for the reporting year, not credited to the account of losses and profits, must be disclosed separately in the reporting.

The article provided information on the features of the application of PBU 10 of 1999, the rules for maintaining and recording various expenses depending on the status of the organization and the classification of costs.

Recommended:

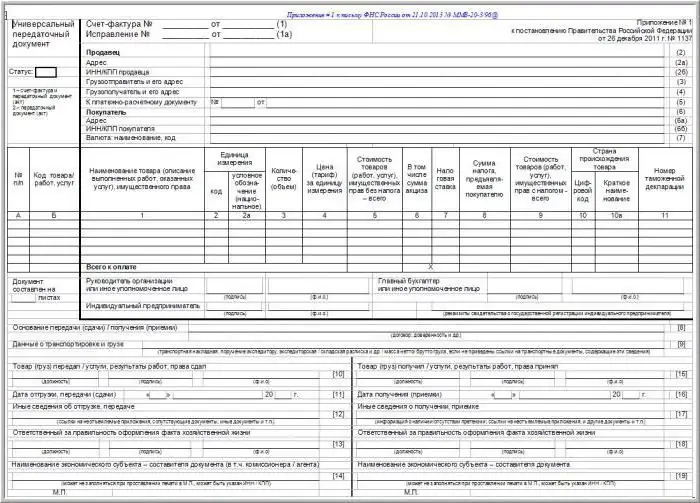

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below