2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Amortization funds are a certain amount of funds accumulated by an enterprise aimed at renewing the value of fixed capital. Funds are accumulated with the help of depreciation deductions, which in turn are part of the cost of production. Thus, depreciation funds ensure the most complete existence of the enterprise. They eliminate the process of depreciation of expensive equipment, transport, buildings and structures, representing the amount of funds focused on their restoration.

Depreciation of fixed assets

However, although this concept is still used in modern accounting, it is a rather abstract way of forming a special fund that is not provided for in the legislative form. Amortization funds have not existed in practice since 1992, representing only derivative accumulations of deductions formed from the cost of production. Changes in legislation took place in connection with the full-scale privatization of state property by private entrepreneurs.

After that, the legislative bodies of the country decided that in a democratic environment they have no right to control the technology of entrepreneurial activity, according to which the depreciation of the main fund will be restored. Although many modern economists today may not agree with the formulation of this internal economic issue of enterprises and organizations by Russian legislators, since the constituent capital of business entities in the modern economic system, like the funds of Soviet enterprises, in most cases is not formed by the founders of the organization, but is attracted from the external investment environment. In this regard, the managers of the economic entity are equally responsible to the investors, as well as the management of the plant to the Soviet authorities in their time. Amortization funds, in turn, do not allow the manager's fantasy to run wild, thus mastering excessive capital to the detriment of dividends, as simple deductions from the cost allow. However, since this process is not stipulated in the legislative form, investors can only analyze the investment attractiveness of the enterprise more carefully, hoping for the integrity of its management.

Enterprise sinking fund

But it often happens that an enterprise consistently maintains a positive dividend policy for the investor. In such cases, management uses the classic method of calculating the sinking fund. It reflects the total cost of fixed assets, transferred to the manufacturedproduct for their service life. That is, on that

the amount that could fully compensate for fixed assets when they wear out. The volume of the depreciation fund from a mathematical point of view is:

AF=MF+CR+M+L, where:

- PV - value of fixed assets;

- KR - cost of depreciation repairs during this period;

- M - cost of modernization;

- L - salvage value.

Recommended:

What is better - own funds or borrowed funds?

Some founders of enterprises invest exclusively their own funds in the development of their business and use only them, while others, on the contrary, use only borrowed funds. What are these types of capital and what are the advantages of each of them?

Sberbank mutual funds. Reviews of mutual funds of Sberbank

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

Gazprombank, mutual funds (mutual investment funds): deposit features, exchange rate and quotes

UIF is designed for investors who want to minimize their risks. The goal is to provide income above bank deposits and inflation. Managers invest shareholders' funds in bonds with a high trust rating, including federal loan bonds (OFZ)

Hedge funds in Russia and in the world: rating, structure, reviews. Hedge funds are

The structure of hedge funds, still unrestricted in the financial sector and inaccessible to the general public, remains the subject of ongoing disputes, discussions and litigation

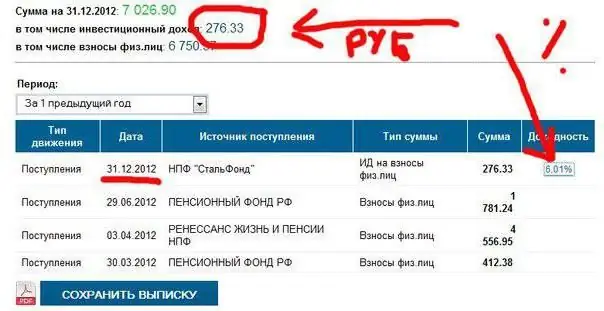

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?