2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Material assistance to an employee can be provided by the employer in the form of cash payments or in kind. Sometimes it is issued to both former employees and non-employees.

Term Definition

No legislative act contains such a concept as “material assistance to an employee”. The definition of this term can be found in the economic dictionary. It is he who explains that material assistance to an employee is nothing more than cash payments or the transfer of material goods in material form to needy employees.

Grounds for payment

Paying social assistance to employees is not an obligation. The components of the salary are indicated in the first part of Art. 129 of the Civil Code of the Russian Federation. Financial assistance to the employee is not included in the list. Other legislative acts do not contain obligations to pay it.

As a rule, each organization stipulates the procedure and developed conditions for the provision of any material assistance to employees in itslocal act. It can be a collective agreement, etc. The payment of material assistance is often covered in an agreement signed by both the employee and the employer. Such a document is an employment contract. It provides guarantees to the employee, allowing to prevent the deterioration of his position in comparison with the norms contained in the labor legislation. That is why material assistance to an employee can be regarded as an additional condition of the agreement. At the same time, it is designed to improve the social situation of a person.

In what case are accruals made

Material assistance is provided to an employee if he needs financial support in connection with the events that have occurred, which must be confirmed by the provision of documents. We can talk about a wedding and the birth of a child, the death of a family member and emergency circumstances (theft, fire, etc.). Financial assistance can be provided for vacation, for the New Year or for any other date. The list of all events must be fixed in the regulatory local acts of the organization, collective or labor agreement.

Reason for granting

Material assistance is classified as non-productive payments. In this regard, its source is the profit of the organization. Since no legal documents provide for the provision of material assistance, its payment is made only at the discretion of the employer.

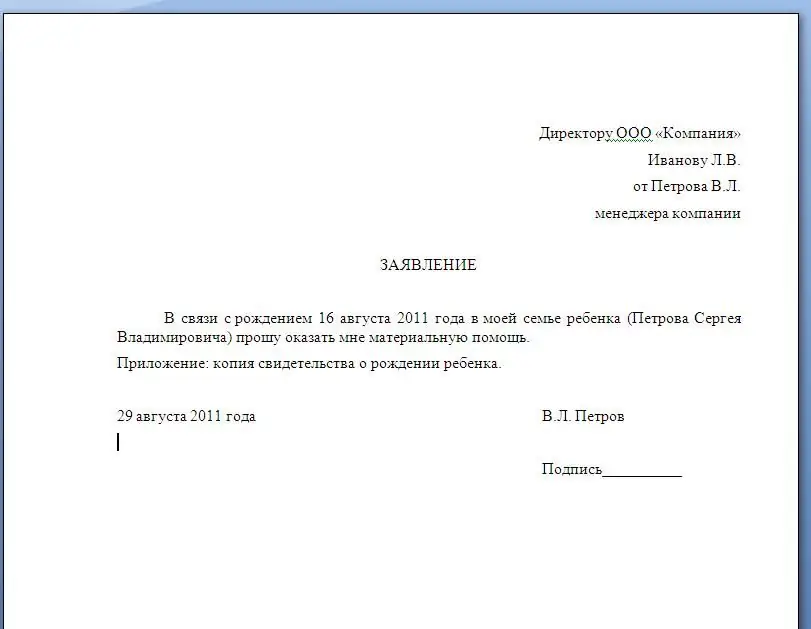

The basis for providing financial or material support to an employee are variousregulations. So, an employee can write an application for financial assistance. In the event that, after its consideration, the head gives a positive answer, an order is issued. This document specifies the following:

- link to a normative act that stipulates the possibility of providing material assistance;

- Full name the person to whom this payment is intended;

- reason for decision to provide assistance;

- payment amount;

- accrual term.

There may be cases when the procedure and conditions for the payment of assistance to employees are not established in the regulatory local acts. Despite this, social support to the employee is not prohibited. How this issue will be resolved completely depends on the opinion of the head of the enterprise.

Material assistance to an employee can also be provided at the initiative of the employer. As a rule, these are payments on the occasion of any celebration or anniversary of the employee. As in the previous case, the basis for accruing such material assistance will be an order signed by the head of the enterprise.

Payouts

The amount of material assistance that the employer provides to its employees is also not specified in the current legislation. All amounts are reflected in the regulatory local acts of the organization and can be set by the head of the enterprise in absolute terms or multiples of the official salary. The amount of financial support for employees is directly dependent on individual situations, as well as on the opportunitiesspecific enterprise.

Types of financial support

Material assistance to an employee can be paid in various cases. In this case, the reason for making a decision to provide financial support may be the following:

- The difficult financial situation of the employee.

- Emergency circumstances or natural disasters. In this case, the employee who wrote a statement to the manager with a request for financial assistance must present certificates from the police or other authorities that would confirm the amount of damage.

- The presence of family circumstances. Employees claiming to receive material payments from the enterprise on these grounds must submit supporting documents to the accounting department of the enterprise. This may be a marriage or birth certificate and other documents.

- Severe illness of the worker himself or his relatives. Such an ailment implies a loss of working capacity for more than two months or an employee receiving a disability. The basis for the payment of this type of material assistance will be a certificate of the VKK of the established form.

- Anniversary date.

- The need for recovery. Such material assistance can be received by an employee in the form of full or partial payment of the cost of the tour.

- The need for better living conditions. An employer can provide such material assistance for the purchase of housing, as well as for its construction or reconstruction. In this case, the employee must provide certificates of registration with local executive organizations asin need of better living conditions and a receipt for payment of expenses incurred.

An employer can also provide material assistance to an employee for burial. The basis for its payment is the death of any close relative of the employee or himself. The supporting document for such payments will be a copy of the issued death certificate, as well as those papers that reflect the payment for funeral services.

Accounting

Whether or not material assistance is prescribed in local regulatory acts also affects accounting entries. In the event that an organization considers an employee’s financial incentives to be part of his remuneration for work, these amounts are reflected in the credit of the seventieth account, which includes settlements with personnel for remuneration for participation in production processes.

In the event that the accrual and payment of assistance are made according to the application written by the employee, everything is reflected in the credit of the seventy-third account, which takes into account the settlements made with the staff for other operations.

Financial support can be provided to former employees. In this case, all calculations should be reflected in the seventy-sixth account, which takes into account transactions with different creditors and debtors.

Debit account, which reflects all amounts paid, and is a financial source. It must be mandatory indicated in the order for assistance. When using the profits of previous years, the eighty-fourth account is debited, and the current profit is reduced by the debit of ninetythe first, which reflects other expenses.

If support for an employee is one of the parts of the salary, then which accountant should put the entries? Financial assistance in this case is reflected at 20, 26 or 44 hours. by debit (in Ct 70).

Accounting in budget organizations

Code of material assistance, which is paid by state organizations at the expense of the salary fund, - 211. Such accounting is regulated by the instructions of the Ministry of Finance of the Russian Federation of December 10, 2004, number 114n. The order of application of the budget classification also indicates the code to which material assistance is attributed to former employees.

Such amounts are paid out of other expenses or social security. These are, respectively, codes 290 and 260. But, be that as it may, the provision of any material assistance will certainly be reflected in the relevant regulatory legal acts.

Income tax base

So, the employer issued an order according to which material assistance should be provided to the employee. Taxation is characterized by some nuances. Financial assistance has nothing to do with remuneration for labor activity. That is why it is not included in the costs incurred by the organization in the manufacture of its products. These payments are mentioned in Art. 270 (p. 23) of the Tax Code of the Russian Federation. This legislative act establishes that the amounts of assistance provided are not included in the base for calculating income tax.

Tax-Free Financial Assistance

There are some types of financialsupport for employees, paying which there is no obligation to accrue insurance premiums, as well as withhold personal income tax, if the employer has provided targeted material assistance to the employee. Taxation in this case does not provide for the calculation of either insurance premiums or personal income tax. This applies to lump sum payments in connection with various emergencies, as well as in connection with the adoption or birth of a child, in the event of the death of close relatives or the employee himself. The legislation also provides for a number of other benefits related to taxation of material assistance.

Target payments

Financial assistance provided in case of emergency, death or birth is not subject to insurance premiums and personal income tax. However, such a benefit can only be applied if the employee attaches supporting documents to the application. They can be certificates from the Ministry of Emergency Situations, as well as copies of a birth or death certificate, etc. If the documents necessary to confirm the benefits are not available, then the inspectors may impose a fine in the amount of twenty percent of the unwithheld tax amounts, the contributions themselves are assessed and the calculation is made pen alties.

Targeted aid is not taxed in cases where it was provided in kind. For example, the company made repairs on its own or organized a funeral.

Peculiarities of application of benefits

Taxation of targeted material assistance has its own nuances. If financial support was provided in connection with an emergency, then the recipient must be the victim himself. It is permitted to pay such assistance to any memberfamily of a worker who died as a result of an emergency. The main purpose of support is to compensate for material damage or harm to he alth. At the same time, the legislation does not establish restrictions on the size of non-taxable amounts.

In the event of the death of an employee, who should be considered members of his family? The Ministry of Finance of the Russian Federation notes that these are parents, spouse (wife) and children.

The organization may provide material assistance to an employee on the occasion of the death of one of his family members. This type of financial support also falls under the list of benefits and is not subject to personal income tax and insurance premiums. This exemption may also apply to former employees of the organization who have retired.

When paying employees money or giving them valuable gifts at the birth of a child, some nuances should be taken into account. Such material assistance will not be subject to insurance premiums and personal income tax. However, this benefit can only be applied during the first year after the child is born. In addition, the state has set a limit for non-taxable payments. Its value is the amount of fifty thousand rubles that can be received per newborn.

Taxation of the presented gift can be made only if this fact is provided for in the collective agreement or other regulatory local act. When drawing up a donation agreement, contributions are not calculated.

Inappropriate aid

In addition to the above types of payments, there is another type of financial support thatalso belongs to the category of non-taxable. This is non-targeted assistance paid to an employee for any needs. However, it should be borne in mind that the non-taxable amount is equal to four thousand rubles for one year. If the organization has decided to pay a larger amount of assistance, then it should be issued in the form of a gift. In this case, the amount of eight thousand rubles a year will not be subject to taxation. In this case, you will need to conclude a donation agreement.

Read more at Fin-az.ru.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Payment for fuel and lubricants: contract execution, calculation procedure, rules and features of registration, accrual and payment

Situations often arise when, due to production needs, an employee is forced to use personal property. Most often we are talking about the use of personal vehicles for official purposes. Moreover, the employer is obliged to compensate for the related costs: fuel and lubricants (POL), depreciation and other costs

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

Accounting and tax accounting at a manufacturing enterprise: definition, maintenance procedure. Normative accounting documents

In accordance with PBU 18/02, since 2003, the accounting should reflect the amounts arising from the discrepancy between accounting and tax accounting. At manufacturing enterprises, this requirement is quite difficult to fulfill. The problems are related to the difference in the rules for valuation of finished goods and WIP (work in progress)