2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Loan capital is the property transferred to the borrower by the owner. In this case, not the capital itself is transferred, but only the right to its temporary use.

Capital is a kind of commodity, the value of which is determined by the possibility of using it by the borrower and providing profit, part of which can be used to pay loan interest.

The form of alienation of loan capital is specific, since its transfer to the borrower is extended in time, in contrast to the usual transaction: the sold goods are paid for instantly, credit resources are returned after a certain period. Unlike commercial and industrial capital, credit exists only in the form of money.

Definition

According to K. Marx, loan capital is capital-property, not capital-functions. The difference between the first and the second is a complete circulation in the organizations of the borrower and profit. The formation of credit capital is accompanied by its bifurcation: for the money capitalist, it is property that returns to him at the end of the loan term.with interest, and a function for the commercial and industrial capitalist, who invest it in their own enterprises. In the financial market, loan capital acts as a commodity, the value of which is reflected in its ability to function and make a profit. Interest - part of the profit received - pays for the ability of capital to satisfy the need for use value.

Features of capital

As one of the historical forms of capital, loan capital is a reflection of capitalist production relations, expressed as a separate part of industrial capital. The funds released in the process of reproduction are the main sources of credit capital.

Its characteristics:

- Loan or credit capital, being a certain property, is transferred to the borrower by the owner for a specific fee for a limited time.

- The profit brought to the borrower as a result of the use of capital determines its use value.

- The process of alienation of capital is characterized by a payment mechanism broken in time.

- The movement of capital is carried out only in cash and is reflected in the formula "D-D", since it is lent and returned in a similar form, but with interest.

Formation of loan capital

Sources of loan capital are financial resources attracted by state credit institutions, individuals or legal entities. Given the evolving systemnon-cash payments, in which credit institutions act as intermediaries, the funds released as a result of the turnover of commercial and industrial capital can become a source of capital. These funds are:

- Depreciation of funds.

- Share of working capital released from the sale of a product and costs incurred.

- Profits spent on the main activities of organizations and enterprises.

Money is accumulated in the accounts of credit institutions and other institutions. The economic role of the loan capital market lies in the accumulation in certain segments of the economy of monetary amounts free for a specific period of time.

The difference between the loan type of capital from commercial and industrial is that the owners of enterprises do not invest it in the activities of companies, but transfer it to business entities for temporary use to receive loan interest.

Demand and supply

Factors that determine the supply and demand for credit capital:

- Growth scale of the manufacturing economic sector.

- Amount of savings and savings owned by organizations, businesses and households.

- Amount of public debt.

- Cycles of economic development.

- Seasonal production conditions.

- Changes in the exchange rate.

- Intensity of inflation processes.

- The state of the global loan capital market.

- State of the balance of payments.

- Public policyeconomy and financial policy of the issuing bank.

Sources of Capital

The main source of loan capital are funds that accumulate money capital and are released in the process of reproduction:

- Depreciation aimed at restoring fixed capital.

- Profit intended for renewal and expansion of production.

- Capital released from circulation due to a mismatch in the timing of receipt of revenue and payment of costs.

The second source is the capital of rentiers, capitalists whose activities are aimed at making a profit from issuing loans to the state or other capitalists and receiving loan interest, provided that the initial capital is returned.

The third source that forms loan capital and loan interest is associations of creditors who invest their own savings in credit institutions. These include the pension fund, insurance companies, income of various institutions and classes, temporarily free finances of the state budget.

Sources of capital can be free cash generated as a result of the turnover of commercial and industrial capital, the accumulation of the state or the private sector.

Structure and market participants

The loan capital market is a specific sphere of relations in which the object of the transaction is the money capital provided on loan. From a functional point of view, the credit capital market is understood as a systemmarket relations that accumulate and redistribute capital in order to provide credit to the economic system. From an institutional point of view, the capital market is a set of financial institutions and other institutions through which the movement of loan capital is carried out.

The subjects of the capital market are intermediaries, primary investors and borrowers. Free financial resources belong mainly to primary investors. The role of specialized intermediaries is played by credit and banking organizations that attract funds and invest them as loan capital. Borrowers are individuals and legal entities, as well as government agencies. The modern market of credit capital is characterized by two features: temporary and institutional.

Market signs and targets

Based on the time feature, the capital market - long-term and medium-term resources - and the short-term credit market are distinguished. On an institutional basis, the market is classified into the securities market or capital and debt capital.

The action of the securities market is aimed at providing a mechanism to attract investment by establishing contacts between investors and those in need of funds.

The securities market creates conditions for two types of attraction of resources:

- In the form of loans with the expectation that they will be repaid in the future by borrowers. Such conditions imply that the borrower will pay interest onthe right to use money for a certain period of time. The commission is represented by regular payments, calculated as a percentage of borrowed funds.

- The borrower can use as collateral the ownership of an enterprise or company. The loan is not expected to be repaid as the borrower provides the new owners of the company with an opportunity to share in the profits.

Classification of loan markets

The securities market is divided into primary, secondary, over-the-counter and exchange markets. Under the primary understand the market for primary securities, in which investors place them initially. Securities previously issued on the primary market are traded on the secondary market, and securities already in circulation are issued. Primary and secondary markets can be exchange and over-the-counter.

The exchange market is an institutionally organized market, represented by a set of stock exchanges, where high-quality securities are traded, and all transactions are carried out by professional market participants. Stock exchanges are the professional, trading and technological core of the securities market.

Off-exchange securities transactions are covered by OTC markets. Most of the new securities are placed through the over-the-counter market. It also trades securities that are not admitted to stock quotes. Computer-based securities trading systems can be created onbasis of over-the-counter turnover. The criteria by which participants in such trading systems are selected and securities are admitted to the market vary.

Market Functions

The following functions are typical for the securities market:

- Raising funds into the turnover of subjects.

- Combining finances to cover debts and budget deficits at different levels.

- Consolidation of capital to create various market structures - companies, stock exchanges, investment funds.

The functionality of the debt capital market is different:

- Servicing the turnover of goods with the help of credit funds.

- Accumulation of financial resources from economic entities.

- Transforming accumulated savings into loan capital.

- Increase the range of capital investment opportunities to service the production process.

- Ensuring the receipt of temporarily free finances at the disposal of the owners.

- Concentration and centralization of money to form corporate structures.

There are a number of factors affecting the level of development of the loan capital market:

- The level of economic development.

- Traditions and signs of the functioning of the state financial market.

- Degree of development of other market sectors.

- Savings rate.

- The level of accumulation of production.

International Debt Market

The international market is an international type of credit system, the essence of whichis to provide repayable loans from banking institutions, governments and companies. Creditors can be international banking organizations that issue loans to governments, enterprises and banking institutions of other states.

Global loan capital is a powerful mechanism that allows you to effectively distribute free capital between borrowers and lenders with the possibility of attracting intermediaries. Such relationships are built on the supply and demand of capital.

Types of international markets

On the global capital market, major credit-type transactions are made between countries. It is divided into two types:

- A foreign loan market where transactions are made with non-residents of the country.

- Euromarket where deposit and loan transactions are made outside the issuing country and in foreign currency.

Structure of international markets

The components of the global market are as follows:

- Money market, in which it is represented by short-term transactions for the provision of loans that serve working capital.

- Stock market where securities servicing transactions take place.

- The capital market. It is formed from short-term and long-term loans aimed at servicing fixed assets.

- Mortgage market. It is formed on the basis of aggregate loan transactions concluded in the real estate market.

Market Functioning

International marketoperates on the basis of the following principles:

- Urgency. Loan repayment terms are always negotiated at the conclusion of agreements.

- Returnability. The borrower receives funds for a certain period of time.

- Paid. Loan processing is possible only at interest.

The main function of the international market is the movement of loan capital and its transformation into borrowed funds, that is, an intermediary role between the borrower and the lender.

Recommended:

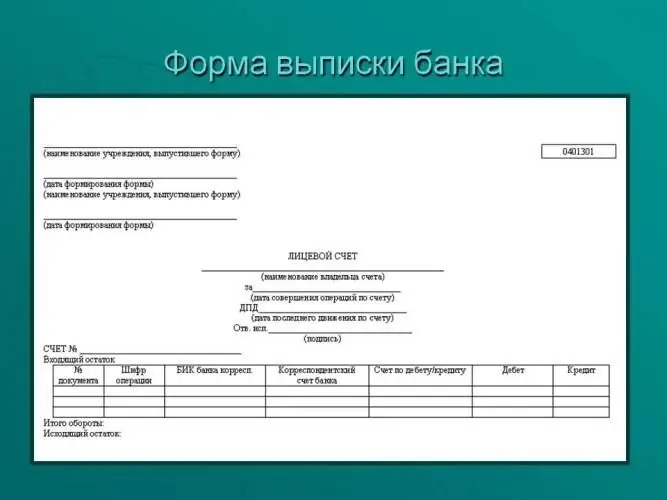

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Entrepreneurship, its types and forms. Concept, essence and signs of entrepreneurship

This article discusses in detail the concept of "entrepreneurship", given its concepts, essence, features, forms and types, and analyzed the personality of the entrepreneur. The main features of small, medium and large types of entrepreneurship are highlighted

What is FEA and what are its main types and forms?

The development of any modern economy is hard to imagine without the activation of its ties with other countries. Since 1991, Russia has abandoned the state monopoly on foreign trade, which means that all firms now know what foreign economic activity is. Today, every enterprise has the right to enter the world market for goods and services, and the state no longer acts as an intermediary between it and foreign partners

Organizational structure of Russian Railways. Scheme of the management structure of Russian Railways. Structure of Russian Railways and its divisions

The structure of Russian Railways, in addition to the management apparatus, includes various dependent divisions, representative offices in other countries, as well as branches and subsidiaries. The head office of the company is located at: Moscow, st. New Basmannaya d 2

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options