2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

At the moment when a person has free money, he wants not only to keep it, but also to increase it. Now we will talk about what a Sberbank certificate is and how it differs from deposits.

What is a savings certificate?

So, this is a security that is a reliable tool for saving money. The certificate certifies the amount that an individual has deposited into an account with Sberbank. The owner of the paper after a certain period can withdraw his money with interest accrued on them.

How does a savings certificate from Sberbank differ from a simple deposit?

The most important difference between a certificate and a deposit is that in the first case it is not required to open an account for a specific person, since this security is issued to the bearer. Thus, the owner who has received a savings certificate, Sberbank gives the opportunity to donate, sell, buy or inherit it without any problems. It can also be used as a payment document.

Benefits of purchasing a certificate

Among the benefits that a Sberbank certificate has are:

1. A higher interest rate than on a deposit - 9.75% per annum. In this case, the owner of this paper will receive high incomes.

2. Money in a savings certificate can be kept for a long time, as well as presented for payment at any convenient time before the end of the contract.

3. Mobile use. The certificate can be given or sold at any time, while receiving the full amount.

4. A Sberbank certificate can be cashed out by any person who has securities and an identity document in his hands, so you do not need to issue a power of attorney or contact the bank yourself. But you should be careful, as scammers can also cash out the certificate. Paper should only be given to someone you really trust.

5. The Sberbank certificate has protection, which is more like the protection of banknotes, so you can save your own savings in this form without fear.6. The maximum amount here has practically no restrictions. A Sberbank certificate can have a face value of up to 8 million. You can also save funds from 3 months to 3 years.

Disadvantages of purchasing a Certificate

Certificates still have a few significant drawbacks:

1. The minimum amount to purchase a certificate is 10 thousand rubles. Papers can berepurchased but not cashed out. If required, the money can be returned in full before the end of the term, but the interest rate will be 0.01 percent, as for the “On Demand” deposit. As for certificates, the rate will be floating.

2. The certificate cannot be renewed like deposits. Therefore, you can use the conditions for such securities only in the event of a complete withdrawal of funds from them and the acquisition of the security again.

3. Another disadvantage is that certificates are not subject to insurance. Therefore, if the company goes bankrupt, then damages can only be made on a first-come, first-served basis.4. Interest is charged only at the very end of the term, while deposits have capitalization and placement of their funds at a higher rate, that is, by transferring from one deposit to another.

Before you buy a savings certificate, you should decide for yourself how much the advantages outweigh the disadvantages.

Recommended:

Rules for filling out a certificate 2 personal income tax: step by step instructions, required forms, deadlines and delivery procedure

Individuals are required to transfer taxes accrued on their income to state budget funds. To do this, a certificate of 2 personal income tax is filled out. This document displays data on income and tax deductions of individuals. The employer is obliged to submit this documentation annually to the relevant regulatory authorities at the place of its registration. Instructions and rules for filling out certificate 2 of personal income tax will be discussed in the article

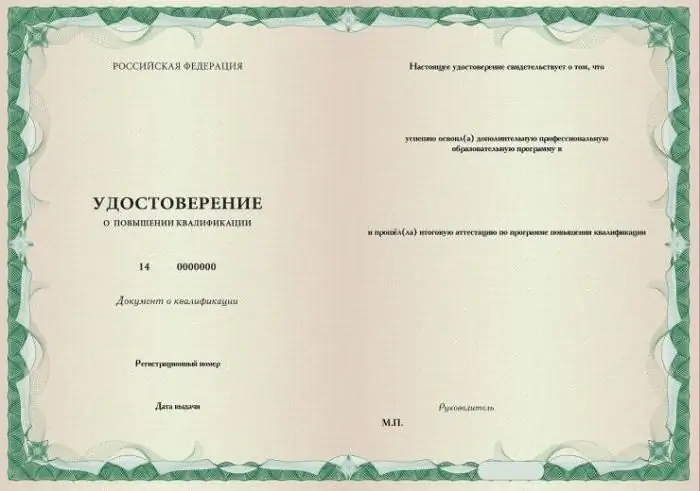

Profession of a nurse: a certificate as proof of qualification

Nursing certificate is issued when the employee receives a sufficient amount of knowledge in the field of theory and practice. It is a document confirming that a specialist has the right to work in the field of medicine

How valid is the 2-personal income tax certificate for a loan: validity period, procedure for obtaining

How valid is the 2-personal income tax certificate for a loan, why else do people need it, and also, how can citizens get it? Such questions often arise from people. In short, this document is provided upon request to various organizations, it discloses information about the income of an individual

Certificate of advanced training: sample, form and filling rules

In the process of professional activity, it is necessary to periodically improve the level of training. Time passes - technologies, standards and requirements for the work of specialists are constantly changing. A certificate of professional development is a guarantee of high professionalism of an employee. Here you can find a sample and form of a certificate of advanced training, as well as familiarize yourself with the rules for filling it out

Sberbank savings certificate: interest. Sberbank bearer certificates

One of the areas where you can invest free money is a savings certificate. This is a security that certifies the obligation of the bank to pay an individual a certain amount. Issue it in any credit institution. Savings certificates of Sberbank of Russia, the interest on which is higher than on all other deposits of the organization, are in demand in the market