2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

Sooner or later, a person begins to wonder how to save a million in a year. In addition to the fact that such an amount will help solve existing problems, it will also become a good safety cushion in the future. But you also need to approach such financial issues wisely.

How realistic is saving up

How to save a million in a year? In principle, nothing is impossible, it is only important to correctly prioritize. For example, if you are determined to save money, then you don’t need to spend money in vain.

But all this is good if there is start-up capital, that is, there is money available with which to start saving.

If there is no initial money, then you will have to study investments and other financial instruments.

Goal setting

How to save a million in a year? You can do this if you set the right goal.

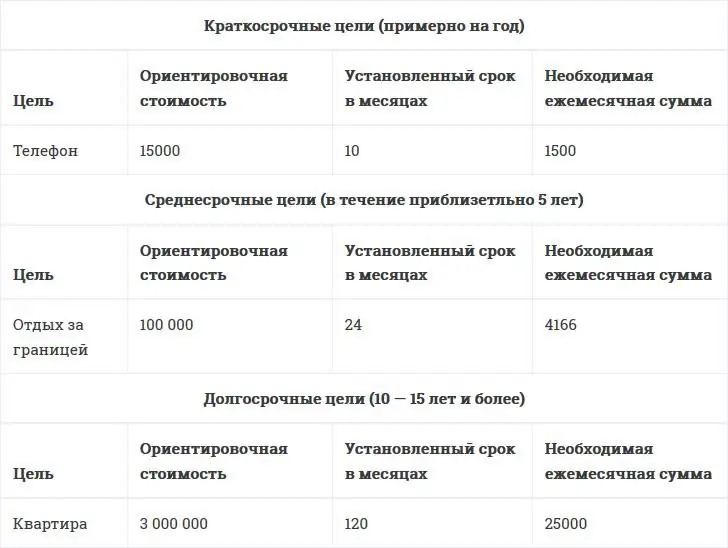

First you need to decide what amount is required. Next, you should set the time frame that can be spent on savings. The amount that canlet a person procrastinate is also important.

When calculating income, do not set unrealistic deadlines. It is better to choose an option that will not hit the wallet hard, but will not postpone savings indefinitely.

When calculating the options for how to save a million in a year, do not forget about bank deposits. It is thanks to them that possible inflation will not greatly affect savings.

An indisputable plus is that banks offer deposits for a certain period. This means that under the influence of a minute you will not be able to spend money, and they will continue to lie on the account.

Determine the monthly amount to save

If a person first figures out how to save a million rubles a year, and then limits himself in everything, then the fuse will not last long. This means that you need to calculate a comfortable amount that can be painlessly set aside.

According to research, for stable accumulation you need to allocate no more than thirty percent of income, but no less than twenty-five. It is worth remembering that these figures are relevant for people who do not have debts and loans.

How not to break loose

It is not uncommon for people, under the influence of a minute, to spend all the money they have accumulated on random purchases. For this reason, many undertakings in financial savings remained at the initial stage.

To prevent this from happening to you, it is important to stick to the plan. A great option would be to set up auto payment. Money will be debited to the account immediately afterreceipts, and there will be no chance to spend them. But for such a service, it is necessary that the salary card and the deposit are in the same bank.

An equally effective way to accumulate a million per year will be the distribution of priority. What does it mean? It's simple - first, the money is deposited in a savings account, and then the rest is spent on other needs.

Another convenient option would be to open a long-term deposit without the right to withdraw money from it. So the savings will definitely remain intact and will only multiply.

How to optimize costs

To understand how to save 1 million rubles a year, you need to correctly calculate your own expenses. To do this, you need to take into account all income and compare them with expenses.

It is with this approach that holes in the budget and those items that can be dispensed with will be visible. For example, on one trip to a cafe or restaurant, you can save up to five thousand a month. In this case, nutrition will only become he althier.

By giving up bad habits like alcohol or smoking, you can also save a lot a month.

But don't go to extremes. If you forbid yourself everything, then the desire to save will disappear. After all, no one wants to live in anticipation and austerity.

Correct financial behavior

When you start saving, don't give up on your household budget. This is a good way to learn financial literacy and manage money wisely.

If earlier home accounting assistants were a notebook with a pen, now there are a lot of applicationsfor smartphone. You can choose exactly what you like.

In addition, there are other ways to return the money. You can not discount the return of cashback or various tax deductions. It will be no less effective to track all kinds of discounts and sales.

Budget Tips

Try not to buy anything under the influence of advertising. It's no secret that advertising has a very strong influence on buyers these days. But it's not just that. Often a person goes to the store not because he needs something, but to kill time. Just at such moments, unnecessary purchases occur. The reasons for such purchases may be different: for some, shopping is a way to get rid of stress, while for others it is a desire to please yourself. Both lead to wasted money.

It will be great if you weigh the pros and cons of buying before you buy something. And only when necessary will you buy a thing.

It's not for nothing that all psychologists recommend going to the store full. The fact is that a hungry state encourages a person to rash purchases. In addition, if a person goes to the store hungry, then he will pick up much more than planned, simply because he wants to eat. With this behavior, all thoughts of how to save a million in a year can be abandoned.

Experts recommend having cash. This is because when buying with a card, a person does not see money, so it is easier to part with them. But if there is cash in the wallet, then before paying, he has timeconsider whether this purchase is necessary. In addition, spending money in front of your eyes is much more difficult than spending money on the map.

Bad advice

So that the thought of how to save a million in a year without a bank does not become intrusive, you need to be periodically distracted. We offer you harmful advice that will show how even the most noble impulse can be brought to the point of absurdity. So let's get started:

- Free sachets of s alt and sugar can be picked up at catering establishments. Also, do not ignore the toilet paper and paper napkins on the tables.

- Down with electric dryers! Gimme cat litter! Every economical person knows these slogans. It is enough to fill the filler at night - and in the morning the shoes will be dry.

- Burned matches are a great substitute for air freshener. Cheap and natural!

- Only homemade food. The author of this phrase is right if he means saving on lunches. But going to a restaurant in the evening a couple of times a month will not punch a hole in the budget, but will brighten up life.

- Collect banknotes that have an eight in the serial number, and the money will not be spent. After all, it is the figure eight that will save you from spending if, for example, winter boots are torn.

- Money on the roads is also money. Feel free to pick up a coin of any denomination, because there is an example of an English married couple who have accumulated millions in this way. What if you get lucky too?

- You need to charge mobile phones at work. And you can also bring a tablet, laptop and iron. And rightly so, a freebie is a freebie.

- Forget about lying inbath and introduce ourselves as a cadet. Only they need to get dressed while the match is burning, and you need to wash in two minutes. But this is a trifling matter for someone who has decided to save seriously.

- Soap also needs to be saved. All remnants are perfectly collected in one pretty soap. And this same soap can serve indefinitely.

- Beautiful clothes are sold in second-hand shops. The quality is excellent, and things can be bought in kilograms. Even the stars do it.

All of this would be a lot of fun if it weren't so sad. Instead of improving their financial literacy, people go to extremes and then fail.

Conclusion

How to save a million rubles in a year? Of course, for the average Russian with a salary of thirty thousand, this is unattainable. But if you set a more realistic time frame, then everything will work out. There are a few things to remember before you start saving:

- The amount set aside for savings should be comfortable. You can’t start saving a lot, because soon you will get tired of it and the accumulation will stop.

- Saving should be economical. No need to bring to the point of absurdity. If you go out to a cafe or cinema several times a month, you will not cause significant damage to the budget.

- In order not to spend the already accumulated money on all sorts of nonsense, you need to open a deposit. It is desirable that it be for a long time and without the right to withdraw money.

- Cost optimization also helps to save a lot. Don't give up on spending controlincome in the future.

- If everything is completely deplorable, then it would be useful to sign up for financial courses. Such a pastime will certainly be useful. You should not spare money for your own education, because then all this knowledge will come in handy.

If you follow all the rules, then you can save for a long time and fruitfully, without infringing on yourself.

Recommended:

How to make money on deposits? Bank deposit with monthly interest payments. The most profitable deposits

In the modern world, in conditions of absolute lack of time, people are trying to secure some additional, passive income. Almost everyone is now a client of banks or other financial institutions. In this regard, many quite legitimate questions arise. How to make money on bank deposits? Which investments are profitable and which are not? How risky is this event?

How to save money with a small salary? How to save correctly?

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

Which bank has the maximum interest on deposits? The maximum percentage of the deposit in the bank

How to save and increase your savings without risking your wallet? This question is of increasing concern to all people. Everyone wants to earn income without doing anything on their own

Deposits of banks in Kazakhstan. Interest and terms of deposits

The economy of Kazakhstan is currently in a state of growth. Experts predict further growth in the standard of living in Kazakhstan. Therefore, such a way of additional income as a deposit can be very relevant and interesting

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available