2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:30

Proper documentation is important for any organization, because it allows you to competently engage in core business and not be afraid of tax and other audits. Reporting documents are prepared in various types and forms. The types of documentation differ depending on the type of company, its line of business, and many other factors.

General concept

The reporting document reflects a set of indicators with the results of the company's work for the selected period. Reporting may contain tables with accounting, statistical and other data. The report is the result of the work on accounting for information.

Reports are compiled according to the forms recommended by the Ministry of Finance and the State Statistics Service. They can be summaries for specific industries, as well as for territorial areas - districts, regions, throughout the entirety of the economy.

Reporting documents can be classified by type, period, amount of data, degree of generalization.

Varieties

By type, reporting is divided into:

- accounting;

- statistical;

- operational.

Accounting is systematized property dataorganization, its finances, results of work. Reporting accounting documents are prepared according to accounting information.

Statistical data is prepared according to statistical, accounting and operational records.

Operational reporting is prepared based on operational materials for certain time intervals - a week, a month, a decade, and so on. This information helps you maintain operational control over the workflows in your organization.

The frequency of preparation of reporting documents can be:

- intra-annual - per day, five days, ten days, month, quarter, half a year.

- annual is a summary of the year.

Intra-annual statistical reporting is current, and accounting is intermediate.

The degree of generalization of information in reporting may be different. Depending on this indicator, reports are:

- primary - they are compiled directly by the organization;

- consolidated - prepared by higher institutions.

Any reporting must provide reliable data on the activities of the organization, its financial position, results of work, any changes in this information.

Appearance and content

Forms of reporting documents are approved by state regulations.

Each company maintains internal reporting, which provides information on the implementation of plans, instructions from the management. These reports are prepared by specialists from various departments of the company and submitted to management. Such documentation maybe called a report or help.

Reports within institutions are made in free form. They are submitted on paper sheets or on letterhead of the organization.

The following data is required in the report:

- organization name;

- name of the structural unit or department of the company;

- document name;

- its date and number;

- title;

- direct text with the results of the work;

- signature;

- approval or resolution.

The text of the report contains complete information about the work done, the analysis of the results of the activity. Conclusions are drawn, if necessary, proposals are made. Explanatory notes are often attached to the reports. The date of the report must be consistent with the manager's approval.

Business trips

A separate type of reporting are reporting documents for hotel accommodation in cases of business trips of specialists.

Travel expenses include the cost of renting a hotel room. The company is required by law to reimburse the employee for all hotel room expenses.

An employee who has returned from a business trip provides one of these documents:

- account;

- check;

- receipt.

Which of these documents will be the most correct and will not raise questions from the tax authorities?

If the hotel does not use cash register equipment, then the hotel employeemust fill out a special form. You can call it in different ways: receipt, check, voucher.

Form requirements

Each hotel has its own form, but issued according to approved requirements. Reporting documents for accommodation meet the following requirements:

- the report contains details (name of the organization, its number, series, address, TIN, seal);

- the form itself is made in a printing house or using automated systems that are protected from unauthorized access and store information for five years;

- document number and series are assigned.

If an employee presented a document that does not meet the approved requirements, and the company accepted and carried it out, in the event of claims from tax employees, the organization will be able to defend its costs in court.

If the hotel has a ticket office

Usually hotels have cash registers. Then the reporting documents for accommodation are not filled out, and the employee is issued a cash receipt. It is he who speaks about the fact of registration and payment for a hotel room.

The check may be accompanied by an invoice or other document that provides information about the registration of a certain employee.

If an employee was issued a cash receipt instead of a check, in such a situation, there may be problems on the part of tax specialists when compiling reports. Of course, the company can defend its interests in court, but this procedure is not too simple.

Receipts for PKO are also provided as reporting documents for hotel accommodation. They are also accepted and usually do not cause unnecessary questions. Receipts are considered official documents that certify the acceptance of money by the hotel management.

In case of missing documents

There are also situations when an employee does not provide a single document. Then the accountant requests from the hotel a certificate of residence of a particular person. And the company itself should have information about the travel period of this employee.

Such nuances can lead to disputes with tax officials, which are usually resolved in court in favor of the organization.

Situations of non-provision of documents may be explained by the fact that the employee did not live in a hotel, but in a rented apartment. In this case, the company pays the costs of renting housing, the employee does not bear any expenses, which means that they are not compensated to him.

Often, accountants ask the question - how then to take into account the costs for taxation? A company may report, when taxing its profits, the expenses incurred in renting a dwelling, but only for the period when its employee actually lived in it. Expenses in all other periods will be considered unreasonable expenses and will not be accepted by the tax authorities.

Preparation of reporting documents is an important and crucial moment in the activities of any organization. As a rule, this is done by accounting staff or heads of structural departments.firms. In case of difficulty, you can use the services of third-party companies.

Recommended:

Courier documents: individual order, invoice, order form, document delivery rules and courier working conditions

Working in the delivery service is very popular today, especially among ambitious young people. A courier is not just a person delivering parcels, but a trained specialist who has certain skills and can bring a parcel or correspondence to the specified address with high quality and promptly

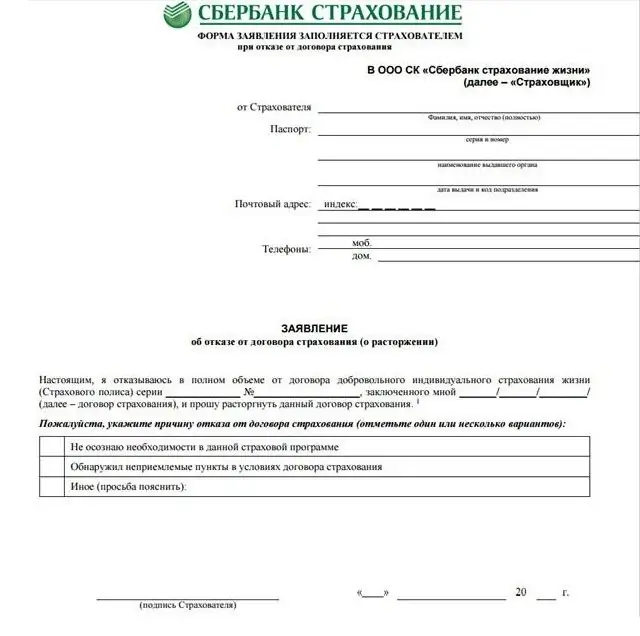

How to return insurance at Sberbank: types, procedures and a sample of filling out the form

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is

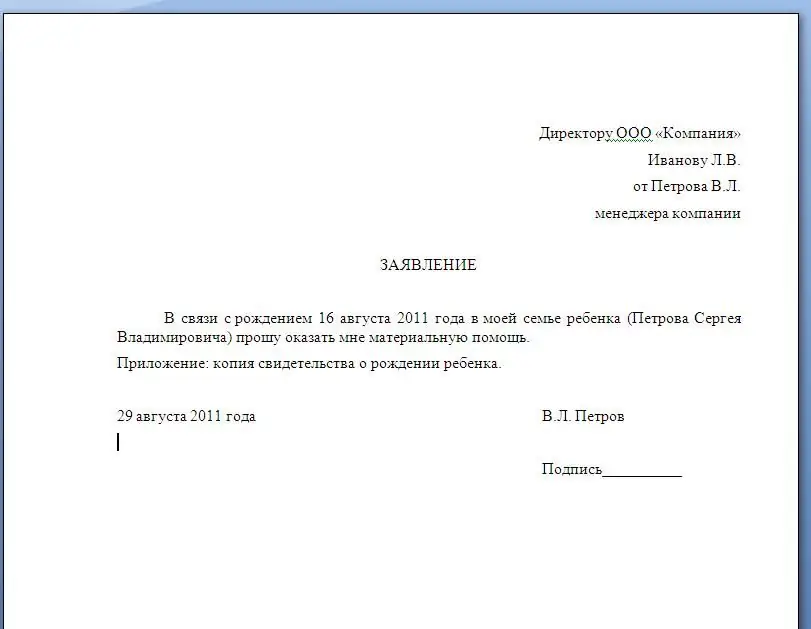

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

FSS reporting: form, deadlines and delivery procedure. Reporting to the Social Insurance Funds: registration rules

Regardless of the taxation regime, all entrepreneurs are required to submit a quarterly report to the Social Insurance Fund in the prescribed form (4-FSS). The report is submitted even if the activity was not carried out and the employees were not paid wages. Such reporting is called zero and is mandatory

Technical proposal: design rules, features and a sample document

A technical proposal is a set of design documentation containing updated justifications (including feasibility studies) of the feasibility of developing documents for a product. It is developed if the corresponding condition is provided for in the terms of reference