2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:31

Law No. 343-FZ of December 8, 2010 prescribes the calculation of payment for temporary disability certificates, in connection with pregnancy and childbirth, benefits from the Social Security Fund for child care, based on the average daily earnings for 2 years, which preceded the start year of the insured event.

If an employee works at the enterprise for a long time (more than two years), then the information for calculating sick leave is stored in the accounting department, and he should not worry: the calculation of the average daily earnings for payment will be correct.

If an employee leaves, he will need information about earnings to calculate the payment of insured events at a new place of work. Help form 182n contains this data.

How to get help 182н

On the day of dismissal, the employer, together with the work book, must issue to the employee:

- Certificate of 2NDFL (on accrued and withheld income tax).

- Certificate of SZV-STAGE (issued since 2017, contains information about the length of service in the year of dismissal).

- Form 182n (the certificate contains data for calculating the payment of insured events).

On the day of dismissal, the employer is obliged to pay the employee the final payrollpayment and compensation for unused vacation.

All certificates must reflect all final accruals, including compensation.

If for any reason the document was not received upon dismissal, the employer is obliged to issue it to the resigned employee at any time. Apply for help.

The application form is shown below.

Why do you need help 182n

Help on form 182н is intended for transfer to a new employer when applying for another job.

This document confirms the amount of payments received for the two years that preceded the year of dismissal and for the current year before the date of dismissal from this employer.

The certificate indicates only those accruals for which insurance premiums were accrued in the FSS.

182н (reference) contains information on the number of days of disability due to illness or motherhood and periods of maintaining average earnings if contributions were not accrued on it.

According to this certificate, in the event of an insured event, an allowance will be accrued (it is used to calculate the average daily earnings for calculating benefits).

Rules for issuing certificate 182н

Wage certificate 182n provides the following information:

- Information about the employer (insured).

- Data on the employee (insured person).

- The amounts of wages and other accruals included in the base for paying contributions to the Social Insurance Fund for periods of work with this employer.

- Numbercalendar days of illness, parental leave up to 1.5 years, maternity leave. The periods of release of the employee from work are indicated while maintaining the average earnings, if contributions were not accrued on him.

Data on the insured (employer) must contain:

- Full name of the enterprise, organization, individual entrepreneur. Abbreviations are not allowed even in the indication of the form of ownership.

- Full name and branch number of the FSS (territorial authority where the employer is registered).

- Employer's registration number in the FSS, TIN, KPP.

- Employer's actual address, phone number.

Information about the insured person (employee):

- Last name, first name, middle name.

- Passport details.

- Residence (address).

- SNILS.

- Work period for this employer.

The certificate is signed by the head of the enterprise and the chief accountant. Signatures are deciphered and sealed.

Composition of earnings in the form of 182n

The salary statement 182n contains the total income for each year (calendar) of work at this enterprise in chronological order.

The document indicates only the accruals included in the base for paying contributions to the FSS.

Based on this rule, the certificate does not indicate:

- sick leave accruals: at the expense of the FSS and three days at the expense of the employer;

- paid maternity leave;

- child care allowance up to 1, 5 and 3 years old;

- one-time childbirth allowance;

- allowance for early pregnancy registered;

- burial allowance;

- severance pay, if its amount does not exceed three times (for workers in the Far North - six times) average monthly earnings;

- material assistance up to four thousand rubles per calendar year;

- material assistance for burial;

- material assistance for the birth of a child;

- payment for services under GPC agreements and copyright agreements;

- Some other payments.

Attention: all accruals for which contributions to the Social Insurance Fund are accrued are taken into account, even if they are not spelled out in the Regulations on remuneration at the enterprise.

Earnings in the form of 182n: restrictions

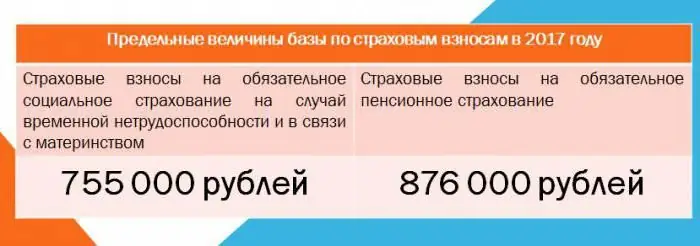

For each year there is a limit on the amount of earnings from which fear is paid. FSS contributions.

The limit amount is indicated in the certificate 182n, if the amount of annual earnings exceeds the established limit.

For example:

- In 2015, the earnings limit is - 670,000 rubles.

- In 2016, the limit is 718,000 rubles.

- In 2017 - 755,000 rubles.

Example:

Employee Ivanov P. P.:

In 2015, he earned 680,000 rubles, with which contributions to the Social Insurance Fund were paid.

For 2016 - 720,000 rubles.

In the certificate 182n will be reflected:

2015 RUB 670,000 00 kop. (Six hundred seventy thousand rubles 00 kopecks)

2016 RUB 718,000 00 kop. (Seven hundred eighteen rubles 00 kopecks).

Employee Melnikov N. P. earned in 2015 488155 rubles 16 kopecks, for 2016 - 528,000 rubles 25 kopecks.

In the certificate 182n is reflected as follows:

2015 RUB 488155 16 kop. (Four hundred eighty eight thousand one hundred fifty five rubles 16 kopecks)

2016 RUB 528,000 25 kop. (Five hundred twenty-eight thousand rubles 25 kopecks).

Form 182н: sample design of the first and second sections

Example: certificate 182n issued upon dismissal of Ivanova Elena Vladimirovna. She worked in the Alpha organization from 2015-01-01 to 2017-28-08.

The first section contains information about the Alpha organization.

The second section provides information about Elena Vladimirovna Ivanova.

Reference 182n (form) is drawn up as shown below.

Form 182n: sample design of the third and fourth sections

During the period of work in the organization Ivanova E. V. the following remuneration for work, subject to insurance contributions to the Social Insurance Fund, was accrued:

- 2015 - 200,000.00 rubles

- 2016 - 300,000.00 rubles

- 2017 - 80,000.00 rubles

In 2015, from March 15 to March 31, Ivanova E. V. sick, she was issued a sick leave.

Filling out certificate 182n (third and fourth sections) is done asshown below.

Help 182 n: is it possible to replace the form 2NDFL

The organization accepted an employee who did not receive a 182n certificate from the previous employer on the amount of wages for two years before the year of dismissal. However, he has certificates in the form of 2NDFL for these years.

Can income information from this certificate be used to calculate sick leave?

No, you can't. In this case, the sick leave will be calculated from the minimum wage.

The employee has the right to write an application with a request to send a request to the Pension Fund.

An employer paying benefits for insured events must submit a request to the territorial body of the Pension Fund of the Russian Federation to obtain information on earnings and other payments of the employee of interest on the basis of personalized accounting. After receiving the answer, the sick leave calculation must be adjusted.

Form 182н: employer doubts

Income statement (182n) can be verified. The employer has the right to apply to the territorial body of the FSS for confirmation of the information specified in the provided document. To do this, a request must be sent to the FSS department at the location of the employer that issued the certificate. It can be submitted in person, by mail or via communication links using an electronic signature.

If the employer who issued the certificate indicated false information, then he is obliged to reimburse the amount excessivelybenefits paid.

If an employee has provided a false certificate, then he is withheld the paid amounts on disability certificates.

Reference 182n: "maternity leave"

An employee, while on maternity leave, worked a shortened working day. Then the certificate 182n in section 3 indicates the amount of monetary compensation, which was included in the base taxed by insurance premiums. Section 4 indicates the number of days (calendar) during which she was on maternity leave, childcare (despite the fact that she worked at that time on a shortened working day).

To pay for sick leave for pregnancy and childbirth and to calculate benefits for caring for a child up to 1.5 years old, a woman has the right to replace the two years preceding the onset of these insured events with other years where earnings were higher. Help 182n must be issued in the form currently used. In this case, the maximum amount should not exceed the current base.

Attention: if the organization is liquidated, then employees on maternity leave must issue a certificate of earnings twelve calendar months before the month of dismissal during the decree period (the month of parental leave). The allowance in this case is calculated from the average daily earnings, calculated as follows: earnings for twelve months are divided by 29, 3 and 12 (as for ordinary vacation pay).

There is no approved form for such a certificate. The accountant must compile it in any form. The statement must show incomemonths that are included in the base for calculating vacation pay, not benefits.

Help 182n: nuances

If an organization pays contributions to the Social Security Fund at a zero rate, then the certificate still indicates the amounts included in the base for paying contributions (even if they are zero).

If an employee submitted instead of the original a copy of certificate 182n from another employer, then such a certificate of income cannot be used to calculate insurance claims. A copy of the document must be certified in the prescribed manner.

Certificate for sick leave 182n is not issued to employees working under civil service contracts. Insurance premiums in Social Insurance are not charged for payments under the GPC agreement. "Contractor" is not an insured person, he is not en titled to paid sick leave.

Section 4 of certificate 182n is filled out only if the employee had paid sick leave, maternity leave, parental leave up to one and a half years, release from work with pay (if insurance was not accrued on it contributions to the FSS).

Conclusion

Wage certificate 182n is an important document. The employer must take full responsibility for filling it out. The organization is responsible for false data in the certificate. And also the timely payment of sick leave to a former employee depends on the correctness of filling out and the timeliness of issuing a certificate.

Recommended:

Salary in the police in Moscow: salary level depending on the region and position

Many are interested in the salary of a policeman in Moscow. This amount depends on many factors. Let's take a closer look at what benefits police officers can count on and what are the average salaries of servants of the law, depending on the region and length of service

What is the salary of military personnel? The average salary of the military

The legendary and invincible Russian army, which has known the joys of victories, nourishes the fighting spirit of more than half of Russian citizens who are confident that the patriotic mood will strengthen the country's position at the world level. Recently, capital investments have been made in defense, the salaries of the military have increased, and the attractiveness of the service has grown significantly

US doctor salary: average and minimum salary, comparison

Good pay is America's greatest asset. It is because of her that thousands of emigrants come to the country every year. Prestigious and highly paid is the salary of a doctor in the United States. According to statistics, every fifth doctor in the country is a foreigner

Information and reference system: types and examples. What is an information and reference system?

Dissemination of information, its further collection and processing within modern society is due to special resources: human, financial, technical and others. At some point, this data is collected in one place, structured according to predetermined criteria, combined into special databases convenient for use

Reference on the general taxation system: sample, features of obtaining and recommendations

In our country, at the legislative level, merchants are given the opportunity to choose a taxation system suitable for doing business. In some cases, when making transactions, it is required to know which of the existing types of it is used by the counterparty. Let's try to figure out what a certificate of the general taxation system is. We give an example of it in the article