2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Today, no one is immune from the reduction (which for some reason is more often called the optimization of personnel): neither a civil servant nor an employee.

Even if you receive a regular income, but it is not confirmed by the corresponding entry in the work book, you are an unemployed citizen. But it may happen that a civil servant, an employee, and an unemployed person will need a large amount of money that can only be borrowed from a bank. And from that moment on, people begin to delve into such a thing as a loan to the unemployed.

What is the main difficulty? The thing is that one of the main criteria for assessing the possibility of issuing a loan is an assessment of the client's solvency. And if he cannot confirm his income in any way, then you can forget about loan money: the bank will not take risks.

And yet you can take a loan to the unemployed. There are a number of ways to get it:

• without proof of income received;

• through brokerageoffices;

• by contacting a private investor;

• taking out a business loan.

In the first case, a loan to the unemployed is issued as part of one of the express lending programs. Their main disadvantage is cannibalistic interest rates. In this way, the lender is trying to protect itself from the risk of default by unscrupulous borrowers.

In the second case, you will have to cooperate with an organization that is supposedly interested in helping people. In fact, its profit is a commission paid by the applicant. Most often, loans with the participation of brokers are concluded at a high interest rate. In addition, you will also have to provide real estate or a car as security. My advice to you: don't get involved.

Also, a private investor can provide a loan to the unemployed. But here you can’t do without security. You should also be aware that the activities of such benefactors are not controlled by anyone. It is difficult to predict the consequences of such "partnership" relations. It is good when everything is good. And if not?

The last option is completely legal. Here, the government issues loans to the unemployed. That is, a citizen receives all the unemployment benefit due to him in one amount, but only if his business plan is successfully defended and his business has been fully registered.

There is another answer to the question of where to get a loan for the unemployed. We are talking about illegal aid. Surely many have seen ads, the meaning of which is that some intermediaries promise their help in obtaining a loan. At the same time, special emphasis is placed on the fact thatincome level and credit history does not matter.

The essence of cooperation with such dealers is as follows. An unemployed citizen receives a fake stamp in his work book and goes to the bank. If, when checking the place of work, a bank manager calls the “enterprise” where the borrower allegedly works, then a special person (dummy) will confirm this fact. However, you need to understand that such schemes only work if the financial institution is young, that is, in the sense that its customer base is limited. If, as they say, it is not possible to hide the awl in the bag, then the entire responsibility lies with the unemployed who succumbed to weakness. Intermediaries, obviously, will not work. So think a hundred times, is it worth the risk?

Recommended:

What does early loan repayment mean? Is it possible to recalculate interest and return insurance in case of early repayment of the loan

Each borrower should understand what early repayment of a loan means, as well as how this procedure is performed. The article provides varieties of this process, and also lists the rules for recalculating and receiving compensation from an insurance company

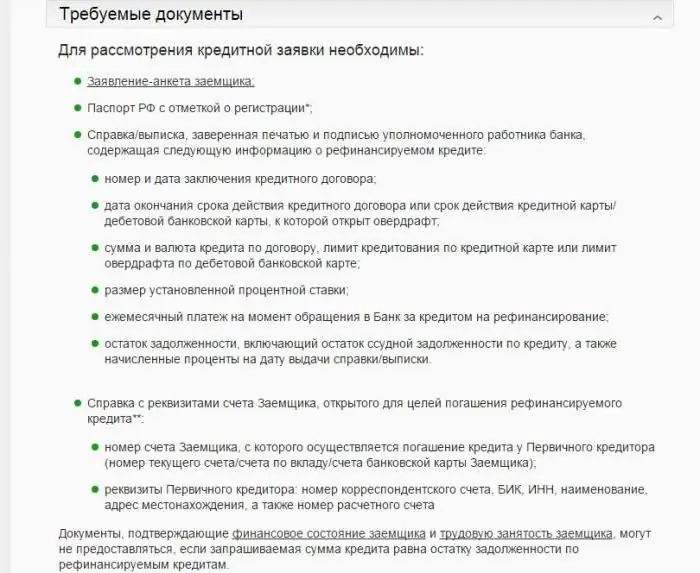

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

Which bank to get a loan? What documents are required for a bank loan? Conditions for granting and repaying a loan

Big plans require solid funds. They are not always available. Asking relatives for a loan is unreliable. People who know how to handle money always find successful solutions. In addition, they know how to implement these solutions. Let's talk about loans

Places where you can get a loan for the unemployed

The number of places where you can get a loan for the unemployed is very limited. Yes, and there are usually very tough conditions. The article describes the main existing opportunities for obtaining a loan for the unemployed

How to repay a loan with a loan? Take a loan from a bank. Is it possible to pay off the loan early

This article helps to deal with the refinancing agreement, which is one of the most successful loan repayment options