2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Today you can use one of the legal grounds and not pay taxes on cars. How do you avoid paying the annual toll on your four-wheeled iron horse?

There is a certain sense in calculating the transport tax: by contributing considerable amounts to the budget, motorists allegedly compensate for the wear and tear of the road surface. At first glance, the calculation may seem fair, but the quality of roads in the country, despite the annual revenues to the treasury, is not improving. Highways, highways and city roads are still in a deplorable state. In addition, the Russian government has introduced fuel excises, which already include transport charges. From here, the question of whether it is necessary to pay car tax twice is quite logical.

What the Russian Tax Code says

Every citizen who has purchased a new or used car is required to pay a fee to the local budget every year. The periods of taxation are counted from the moment of registration of the vehiclefunds in the traffic police. To understand whether you need to pay car tax, you should read Chapter 28 of the Tax Code of the Russian Federation (Articles 356-363). It follows from the Tax Code that every owner of a vehicle is required to pay annual fees, regardless of whether his car is in good working order, whether it exists in reality, whether it is dismantled for spare parts, is constantly operated by the owner or is in a garage.

How to calculate the annual payment

The size of the duty in Russia depends on several criteria:

- car motor power;

- market value of the car;

- of the region in which the vehicle is registered;

- the presence or absence of benefits from the taxpayer.

The amount of payment is set by the municipalities, so even in neighboring regions the amount of tax on the same car may differ. To find out how much car tax is paid, you need:

- determine the taxable base based on the number of horsepower or engine size (this information is indicated on the vehicle certificate);

- apply the appropriate rate to calculate the payment (it can be found on the website of the Federal Tax Service of the Russian Federation, indicating the region where the car was registered);

- determine the tax period (if the vehicle is owned by the taxpayer not from the beginning of the reporting year, then the fee is calculated by the number of months of direct ownership);

- apply an exemption that reduces the amount of the tax or increase the coefficient if the car is classified as luxury and costs more than three million rubles.

To get the exact amount of the tax fee, you need to multiply the tax rate in force in the region by the engine horsepower. Then the result is multiplied by the multiplying factor and the period of car ownership.

Every citizen of the Russian Federation must pay a car tax. This fee is mandatory for all Russians, and in case of delay or non-payment, the taxpayer will be charged fines and pen alties.

Grounds for non-payment

There are several legal ways to avoid paying car taxes. As a rule, this applies to citizens who, for various reasons, could not register a vehicle in the MREO or deregister. A citizen has the right not to pay an annual fee even if his car is stolen or stolen, while the very fact of theft is recorded by law enforcement agencies. After reporting the theft, the tax ceases to accrue.

You should also think about how not to pay taxes on a car if the vehicle passport contains incorrect information. In this situation, the owner of the car should report the discrepancy to the tax office at the place of residence or file a corresponding claim with the court.

Russians who are engaged in private business activities, the state has provided a number of preferences, including in the field of taxation. For example, individual entrepreneurs who use personal cars in their work are exempted from paying transport tax.

Preferential categorytaxpayers

In our country, socially unprotected segments of the population are taken care of. For example, large families, veterans of the Great Patriotic War, Heroes of the USSR and the Russian Federation, disabled people do not pay car tax, and other categories of citizens are given a significant discount on the annual payment. These include:

- parents or legal guardians of a disabled child;

- family members of servicemen who died in the line of military duty;

- persons of non-working age;

- citizens affected by the Chernobyl accident.

In the regions, the list of beneficiaries may be supplemented by other categories. At the same time, local authorities usually set a number of conditions for those who may not pay taxes on cars, as, for example, in the Kemerovo region. Here, pensioners and disabled people of the third group are exempted from this duty, but on condition that the car is the only one owned and its engine power does not exceed 250 hp. s.

Which vehicles are tax-exempt

Article 358 of the Tax Code of the Russian Federation presents varieties of equipment for which you do not need to pay an annual fee. Among them are rowing boats, sea and river fishing boats. There is also no need to pay an annual fee to persons with disabilities. Do people with disabilities pay car taxes? An affirmative answer can only be given if we are talking about small cars with a capacity of not more than 100 hp. With. Car owners who transport people with disabilities are also exempt from paying the duty.

One way to save on annual taxes is to constructively change the engine, reducing power and modifying the electronic control of the car. To carry out such a technical manipulation, permission from the traffic police will be required. As soon as it is received, you can contact the service station. However, keep in mind that the cost of such an operation is several tens of thousands of rubles, so changing the engine power is not always an appropriate solution.

If the engine power of the car does not exceed 70 horsepower, you do not need to pay tax on it. The information specified in the TCP is taken into account. The owner of a car, which is registered to the company under a leasing agreement, is also exempt from paying the annual fee. However, in this case, transport tax is often included in lease payments along with interest.

No tax is paid on agricultural vehicles, including milk trucks, tractors, livestock trucks, and equipment involved in road repair work. Since 2015, heavy vehicles have joined this list, regardless of who owns them - a legal entity or an individual. We are talking about machines weighing 12 tons or more. These cars are listed as road damaging vehicles, so their owners pay fixed amounts in excess of the standard vehicle tax.

Where to pay and how to save money

As noted, the size of the transport fee depends on the region of residence of the owner. For todayday the highest taxes are paid by Muscovites - the average rate is 35 rubles. In the Yaroslavl region, the same figure is 28 rubles, in Voronezh - 20 rubles, in Kemerovo - 14 rubles, and in Chukotka - 7 rubles.

Due to the difference in tax rates, some car owners go to the trick and register the car with the traffic police not in the region where they permanently reside, but in the one where the tax rate is lower. However, this way to save is not always effective.

The current legislation does not prohibit citizens from registering vehicles in any region of Russia, without reference to their place of residence. Moreover, data on the new owner is still sent to the Federal Tax Service at the place of permanent residence of the latter. Based on this, the tax is calculated at the rate established in the region of residence of the owner, and not the registration of the car.

Luxury car: how to avoid taxes

An attempt to reduce the amount of payment to the state treasury can also be made by owners of expensive cars. The luxury car tax is calculated using a different formula, using a multiplier. This category includes vehicles whose value exceeds 3 million rubles.

When calculating the fee, the tax authorities take into account the make and year of manufacture of the car. Since 2015, the Ministry of Industry and Trade of the Russian Federation has been publishing a list of expensive cars for which higher tax rates apply. There are hundreds of models on this list. For example, one of them is Ford Explorer Sport (2016) withengine power of 345 liters. With. The annual tax for such a car will be about 55-60 thousand rubles, but this is not the limit. For some models like the BMW M6, Rolls-Royce Dawn or Bentley Flying Spur, the maximum coefficient is applied, so the duty on such cars can reach 200-300 thousand rubles.

When calculating the duty, the technical serviceability of the car and its price under the sale and purchase agreement between individuals are not taken into account. If the car was sold for less or was involved in a serious accident, but is on the list, the tax on it is still calculated with an increased coefficient. Sometimes officials include in this list models that have not been produced for a long time.

Given the stability of inflation, experts predict an inevitable increase in the cost of luxury vehicles, and with them the current coefficients. To reduce the amount of tax on expensive cars, buyers are advised to use the following methods:

- Choose a model that is not on the list published by the ministry. Despite the absence of this car in the ministerial list, this does not mean that the specified model will not appear there by the time of the next publication.

- Purchase a car older than the model you like, or in a different configuration, with a less powerful engine.

- When registering a car with the traffic police, the owner must indicate a relative who belongs to the preferential category of taxpayers. At the same time, we must not forget that the preference applies to machines with a power ofengine no more than 100-150 liters. With. - this is the average threshold for beneficiaries in the Russian regions. The duty will be calculated for each horsepower over the limit.

Before buying a luxury car, it is advisable to calculate the amount of tax in advance and include it in the family's annual budget.

Accrual of annual duty in case of car sale

When the owner of the vehicle changes, the vehicle is re-registered. As long as the previous owner is listed in the traffic police databases as the owner of the sold car, transport tax will be charged in his name. If the new owner of the car is in no hurry to go through the registration procedure, the previous owner can protect himself from unnecessary expenses. In order not to receive payments from the tax office in the future, you yourself need to come to the traffic police with a sales contract and write an application in the form that the inspector will give. Information about the change of owner of the traffic police will be transferred to the Federal Tax Service. After that, the car will no longer be registered as a citizen.

Car sales tax: is it mandatory to pay?

Contributions must be made not only for the objects of the sale and purchase agreement, but also for property received as a gift, by inheritance or as a lottery prize. Do I need to pay car sales tax? Yes, but not in all cases.

Regardless of the grounds on which the car became property, the owner must have documents confirming the legality of the acquisition, and an act of appraised value of the car. By the way, the choice of rate depends on the last paper.taxation.

Before calculating the amount of the fee, you should make sure for sure whether you need to pay tax on the sale of a car in a particular case. If, nevertheless, the car falls under taxation requirements, it is advisable for the seller to take care of filling out the 3-NDFL declaration in advance. The question of whether to pay tax on a sold car should not arise if the car has been owned by the seller for less than three years. At the same time, even the car that was bought at the expense of credit funds is taxed.

As a rule, a transaction between two citizens (seller and buyer) is carried out on a private level. Despite the absence of a fiscal receipt, the seller is obliged to draw up a declaration and pay income tax in the amount of 13% of the value of movable property in excess of 250 thousand rubles. At the same time, there are several conditions under which a citizen is exempted from paying the fee. You need to find out about them in advance so as not to break the law and competently sell the car.

What taxes to pay if, for example, the car has been owned by the seller for more than three years? None. The previous owner of the car may not pay tax when buying and selling the car in 2018 if he has owned it since 2014. Exempt from taxation is a car that is sold at a price lower than the original cost, that is, in the absence of profit from the transaction. When selling a car, you need to pay tax only when its value exceeds 250 thousand rubles. The presence of at least one of the above conditions is sufficient for the formerthe owner received a tax break.

How to calculate correctly

The duty is paid if the cost of the car exceeds 250 thousand rubles. If the price of the car is lower, a zero rate is applied. To date, two methods are used to calculate tax when selling a car:

- The first one is costly. It is supposed to take into account the price and expenses when buying. The asking price is deducted from the original cost of the car, at which its current owner bought it. The resulting difference is subject to income tax in the amount of 13%.

- The second one is the subtraction method. If the primary contract of sale is lost, 250 thousand are subtracted from the price set by the seller and the difference is multiplied by 13%. The amount received is the amount of income tax from the sale of cars.

Let's give an example of duty calculation for both schemes. The car was bought from a private person in 2016 for 500 thousand rubles. A year and a half later, the owner put it up for sale for 570 thousand rubles. The difference in cost is 70 thousand rubles. Multiplying it by 0.13, you get 9100 rubles. This amount must be paid after the transaction as an income tax.

Using the subtraction method to calculate the tax, you get the amount of 41,600 rubles. ((570 thousand - 250 thousand) x 13%). The cost method is more profitable, but it is not universal. It can only be used once per calendar year, so this option is not suitable for car dealers.

Taxationvehicle rental income

The rate for calculating the duty on car rental (what taxes to pay, every owner who plans to earn money by providing his vehicle for use by other persons should know) depends on the terms of the lease agreement. For individual entrepreneurs, the amount of tax is determined by the current taxation system. For example, for individual entrepreneurs who apply the simplified tax regime, the rate is 6%. For individuals who receive income from renting property for temporary use to other persons, the duty is calculated at the standard rate of 13%.

Vehicle rental can be with or without a crew. In the first case, the obligation to maintain the car falls solely on the lessor, in the second - on the lessee. The amount of tax does not depend on the type of lease and is paid according to the scheme described above.

Annual tax payment schedule

When do I need to pay car tax? This question worries most taxpayers. In order not to violate tax discipline, payment of the transport duty must be made before December 1 in the year following the reporting one. Thus, before December 1, 2018, payment for 2017 must be made. The region of residence of the car owner does not matter.

For legal entities there is no clear rule until what date to pay car tax. All organizations pay the fee according to an individual schedule, in different periods. This is explained by the fact that deadlines are set for companiesmunicipalities, depending on the field of activity. At the same time, no organization has the right to pay taxes for cars later than February 1 of the year following the reporting year.

Recommended:

What happens if you don't pay taxes? Liability for non-payment of taxes

This article will tell you all about the consequences of not paying taxes. What will happen in this case? What is the punishment for such an act? And does it exist at all?

What taxes do sole proprietors pay? What taxes are subject to I?

The question of what taxes are paid by individual entrepreneurs, of course, worries all people who want to do business. Indeed, information must be collected in advance, even before the start of direct business, because the size of payments will significantly affect financial success. The article describes in detail what taxes are subject to individual entrepreneurs, how to calculate them and how often to pay

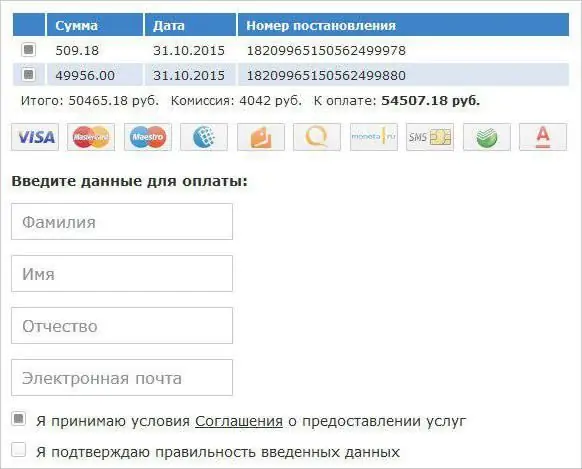

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way

What taxes do citizens of the Russian Federation pay. How much taxes do citizens pay

How many taxes are available to citizens of the Russian Federation? How much do the most popular taxes take?