2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Tax control is a special type of activity of specialized bodies. Employees of this service are authorized to conduct tax audits, as well as to supervise the financial activities of entities of all forms of ownership.

How are tax controls and tax audits carried out? What are their goals and what types of these actions are there? Let's consider these points in more detail in the article.

What is tax control?

Control in the field of taxation is the activity carried out by specially authorized bodies. It is a set of certain measures regarding control over the proper implementation of tax legislation, as well as the identification of violations in this area that can be committed by both legal entities and individuals.

In the process of conducting tax control, the authorities pursue certain goals and apply various methods of influencing the subjects of legal relations. The forms of control are also varied. Which ones - we will consider below.

Control targets

Bodies that carry out control in the field of taxation always set themselves certain tasks. So, the main task is to detect violations of the implementation of legislation in the field of paying taxes, keeping records, etc. In addition, their activity also consists in providing individuals and enterprises with all the conditions that are required for the normal fulfillment of obligations in the field of taxation.

In the event that in the process of conducting an audit, tax control officers detect violations of any degree, they are obliged to suppress them.

In addition to all of the above, controls should be aimed at directly facilitating proper and lawful accounting and reporting in a correct and valid manner.

Object and subjects of control

Bodies that are engaged in tax control conduct their professional activities in relation to certain objects. The main object in legal relations of this type are certain illegal actions, and in some cases, inaction, which are carried out by the taxpayers themselves. In addition, the group of persons whose actions are considered to be the object of control includes tax agents, as well as persons who are directly involved in the collection of taxes and contributions.

Who does the controlling activity? to the bodies responsible fortax control, the legislator refers a certain number of services and organizations. On their behalf, activities are carried out by certain authorized officials. The group of structures exercising control in Russia includes financial authorities, tax and customs services, collectors of taxes and fees, as well as various non-budgetary organizations that operate within the limits of their competence.

About forms of control

If we talk about the forms of tax control, it should be understood that this activity can be represented in various forms. All options for conducting control are prescribed in legislative acts, as well as in the official job regulations of certain employees of the structures that are authorized to engage in this type of activity.

Among the forms of tax control, there are such activities as conducting inspections at enterprises or at another place where a person carries out his activities. These forms also include cases of requesting certain documents to establish specific information necessary for the tax authorities. Data checks, inventories and accounting are also certain forms of control that are now widely used in practice by specialized bodies.

Recently, a new type of tax control - monitoring has become widely used in the system.

We will consider each form of activity mentioned earlier in more detail.

Checks

Inspections are the most common form and method of tax control that canbe carried out in any enterprise. The procedure for conducting inspections is prescribed in a separate regulation, which is mandatory for study by all employees of regulatory agencies involved in the conduct of this type of activity.

Modern legislation provides for two options for implementing this form of control: cameral and on-site inspections. What is their essence?

If we talk about desk audits, they are carried out by authorized tax inspectors by examining documents that contain reports on financial transactions at a separate enterprise or institution. The duration of this form of control should not exceed three months. Its peculiarity lies in the fact that, through a desk audit, information can be established only regarding the collection or type of tax in respect of which the authority received reports.

If we talk about on-site inspections, then unlike cameral inspections, they should be carried out exclusively at the location of the controlled object. As for the object of verification, they can be absolutely all types of payments.

Separately, the verification of the data that was provided to the services within the framework of accounting and tax accounting can be carried out. Any taxpayer must provide them within 10 calendar days in the proper form to the authorized body. Authorized employees of specialized services must declare the requirement to provide data of this type in accordance with the procedure established by law. As part of such an audit, service employees are required to establish how correctly accounting is maintained at the enterprise, as well as whether the financial report is correctly compiled by its employees.

Practice shows that inspections are most often carried out if the bodies that control conscientious taxpayers have some reason to believe that an enterprise, organization or institution is hiding certain objects of taxation from the service. Also, very often this is done as a result of discovering the fact of an increase in this object, especially if this factor was not reflected in declarations, reports or other documents.

In addition to these situations, an audit can be carried out if a person who is a taxpayer provides information in the declaration and reports that is not comparable with the data on his expenses and actual income. In the event that the document, which provides information on the income and expenses of a person, was provided to the tax authorities out of time or is not available at all, then this is also considered a weighty reason for an audit.

The legislator provides for a mandatory on-site inspection in the event that a legal entity is being liquidated or reorganized.

Based on the results of each inspection, the bodies that carried it out are required to draw up a document that fully reflects the course of their actions, as well as the violations identified. Todocuments must be attached to this act, the content of which confirms the existence of an offense. Having considered the results obtained during the control measures, all members of the commission sent by the authorized body must express their opinion on the degree of existing violations, as well as the possibilities for their elimination. At this stage, it is also necessary to stipulate a realistic time frame in which the shortcomings will be eliminated. All such decisions may be made by the authority within a 10-day period and communicated to the other party.

Getting an explanation

Another variant of the form of control is the request for explanations by authorized bodies of services regarding certain issues related to the payment of taxes and contributions, record keeping, as well as other aspects of financial activities that are carried out at enterprises and in organizations of various forms of ownership.

The legislator determines that within the framework of this form of control, the authorities can receive both written and oral explanations, which the taxpayer is obliged to provide. With regard to the time limit for providing clarifications, it should be a maximum of 10 days.

Inventory and Inspection

Quite often, specialists of the system of control bodies use in practice such forms of control as inventory and inspection. Practice shows that the main purpose of this type of tax control is to establish the fact that a taxpayer has certain property. This form of supervision can only be applied whenan on-site inspection is being carried out, since its implementation requires the actual presence of an inspector at the location of the facility.

As for the inspection, it is carried out in relation to things, structures, documents, as well as territories related to the subject of the inspection.

After the inspection, an inventory act must be drawn up, which requires an indication of a clear reflection of the state of affairs.

Monitoring

As for monitoring, this is a type of additional tax control measures that has been used relatively recently in the Russian Federation, since 2015. It has been established that such a form can be applied exclusively to large taxpayers and only upon their personal application, in which a corresponding desire will be expressed. In parallel with the receipt of the application, it is necessary to have permission from the body conducting financial control.

In the process of carrying out actions, employees of the special service get full access to the databases, which contain all the information regarding a particular taxpayer. As for the duration of the control, it is carried out on an ongoing basis, continuously.

Methods

Tax control and tax audits, which are carried out for its purpose, are carried out using certain methods. What does this concept imply?

Methods of control in the field of taxation is a combination of all possible methods and techniques, usingwhich the tax control authorities are able to carry out their work.

In the process of their activities, representatives of structures have the right to apply general scientific methods, which include visual inspection, economic analysis, dialectical approach. In the process of carrying out the work, representatives of the bodies that carry out control can use such methods of analysis as logical and systemic. Practice shows that in fact, specialists very often use such a type of control as selective verification of documents.

Practice shows that the concepts of form and method are very closely related. In fact, it is very difficult to separate them from each other.

All the main methods of tax control, which are used in their practice by employees of the relevant authorities, are divided into two large groups: basic and additional. And those, in turn, into separate subgroups, depending on how this method is implemented in practice. So, let's look at each of these groups in more detail.

Main methods

The main methods of tax control include documentary and factual. Practice shows that both of them are widely used by specialists.

The essence of documentary methods lies in the fact that they provide for all kinds of checks regarding the correctness of the preparation and filling of reports, documents, as well as for their reliability. In addition, during these operationscontrols must determine whether the expenditures were targeted and whether the transactions were justified.

In practice, documentary verification is also expressed in the form of performing certain arithmetic calculations, as well as monitoring whether all financial transactions comply with the current legal norms.

One of the main methods of documentary verification is the demand for registers, documents, and reports on financial transactions, the movement of funds within a particular taxpayer entity. In the manner prescribed by the regulations, these documents may also be seized.

As for the second subgroup, which is one of the main methods of tax control by the authorized bodies, it consists in establishing the actual correspondence of the availability of certain funds and objects to what is written in the statements. As part of the actual inspections, expert examinations, as well as inventories, can be carried out. This category also includes test purchases and various analyzes of raw materials and materials that are used in the manufacturing process.

Additional methods

The methods of additional tax control include settlement-analytical and informative operations.

As for the informative methods of control, they consist in various claims, the implementation of requests, as well as the requirement to provideany oral or written explanations regarding a particular issue related to the conduct of economic activities of an enterprise or institution.

If we talk about the calculation and analytical methods of control, then their range is wider. In particular, this subgroup of measures includes carrying out technical calculations, providing logical estimates, maintaining control over pricing issues, as well as performing economic analyzes of the data provided. Often, to carry out such control methods, services involve specialists in specific industries who are professionally versed in the narrow issues of the activities of enterprises of a certain direction.

Types of control

As well as the concept of tax control, the types of this activity are also provided for in the legislative sources of the Russian Federation. Modern regulations provide for a rather large-scale classification of the types of control in the field of taxation. Their subdivision takes place depending on which entities carry out activities, with what frequency, plannedness, what volume of papers is provided for verification, etc. Let us consider in more detail what types of tax control in the Russian Federation are divided into.

Depending on the territory in which the check is carried out, it can be divided into cameral and field. The difference between these two concepts is that in the first case, all control activities are carried out on the territory of the tax authority itself, and in the second - within the enterprise,in respect of which the verification procedure has been initiated.

Depending on the sources from which information is taken to perform actions, checks can be divided into factual and documentary. Their difference lies in the fact that in the first case, the employees of the control service draw all the necessary information from documentary sources: reports, acts, estimates, etc. As for the second type, it provides for the conduct of control actions based on the information provided as a result of the actual inspection of objects of interest, from testimonies, inventory results, revisions, etc.

If we talk about such a concept as priority, then it provides for the division of types of control into primary and secondary. In the notes to the second definition, the legislator indicates that re-control is considered as such in the case when all procedures are carried out for the second time in a year on the same tax issue.

Depending on whether the check was carried out in accordance with the established plan or it is spontaneous on a sudden issue, it may belong to the group of planned or unscheduled. In the first case, the taxpayer must be notified of the forthcoming control functions.

Control activities can also be divided depending on how much documents and information is submitted to the authorities for verification. So, if absolutely all registers and documents classified as primary, left over the last year, are subject to verification, then such verification will behave a solid appearance. In some cases, it becomes necessary to check only a certain part of the documentation, selected according to specific parameters - this type of verification is selective in nature.

In addition to all of the above, there are preliminary, current and subsequent checks. In the first case, all those control measures that precede the performance of business transactions subject to verification are implied. This form of control is very important in the event that an assessment is made of a number of consequences of bills in the field of tax law or the introduction of new legal norms is expected. Among them, special attention is paid to legal, economic, as well as political phenomena that may occur. As a rule, the results of such audits can be formalized in the form of expert opinions on one or another important issue, for example, on the provision of tax benefits for specific categories of the population, on the possibility of deferring loan payments, installment plans, etc.

In the event that actions are performed during the reporting period, then such a check is called the current one. Its form is operational. Practice shows that the peculiarity of this type of control is that it is provided for directly in the course of the execution of economic or financial transactions that take place in an enterprise or organization. Observations here are based not only on primary documents, but also on inventory acts, documents that reflect information regarding tax or accounting, as well as the procedureconducting cash transactions.

If the control follows after the implementation of the audited activity by the enterprise, then its nature is subsequent. It is based on existing results. The bodies conducting it are faced with the immediate task of assessing not only the completeness, but also the timeliness of the fulfilled tax obligation. As for the forms of control that are appropriate for such audits, they are usually presented in the form of an analysis or revision of documentation that is directly related to the accounting department of the enterprise.

The legislator provides for a special case when financial tax control must be carried out - this is the liquidation of a legal entity. This type of control is considered special, since in the case of its implementation, absolutely all reporting documentation is considered and evaluated. This type of control belongs to the mandatory group. Along with it, there is another type of control - initiative. If it is carried out, the head of the organization or an authorized person must independently declare the conduct of control measures at the place of their business activities.

Sanctions for violations of tax laws

The organization of tax control provides for the immediate detection of minor and major violations in this area of legislation, as well as the punishment of those responsible for their commission. So, according to the results of control actions, certain sanctions may be imposed on the guilty persons, which are provided for by the legislative acts of the Russian Federation. The legislator alsodetermines the statute of limitations during which the taxpayer can be held liable - it is three years from the date of discovery of violations.

In what cases does the taxpayer become liable before the law? First of all, for this, the fact of the existence of an offense in the field of tax legislation must be determined. In addition, the state tax control authorities are required to prove that it is a particular person who is guilty of committing a certain violation, as well as that as a result of his actions, significant damage was caused to the budget or funds that belong to the group of non-budgetary funds.

As for the sanctions applied to unscrupulous taxpayers, they consist in the imposition of fines. The amount of financial costs directly depends on how significant violations were revealed in the course of tax control measures. In some cases, the legislator is not limited to the recovery of material resources from the violator. So, if we are talking about acts of a criminal scale, then they are subject to criminal liability.

How can a taxpayer protect his rights?

Practice shows that sometimes the authorities in the course of tax control measures make certain mistakes, which violate the rights of conscientious payers. In this case, the party whose rights and interests have been infringed has the right to file a claim with the court. When it comes to protecting the rights of an individual who is a privateentrepreneur, then he should submit his application to the court of first instance, and in the event that the party to legal relations is a legal entity, then to arbitration. However, according to the results of recent innovations in the legislation, persons who are registered as private entrepreneurs can protect their interests in court only if they pass the administrative stage, which involves filing a complaint addressed to a higher official of the highest tax authority.

As recent legal practice shows, judicial protection of the rights of taxpayers is recognized as more effective. This is due to the fact that a panel of independent judges is engaged in the consideration of the case in this order. In addition, the process of considering the issue has a clear legislative regulation, and if it is necessary to suspend the consideration of the issue, the parties can file a corresponding petition.

Recommended:

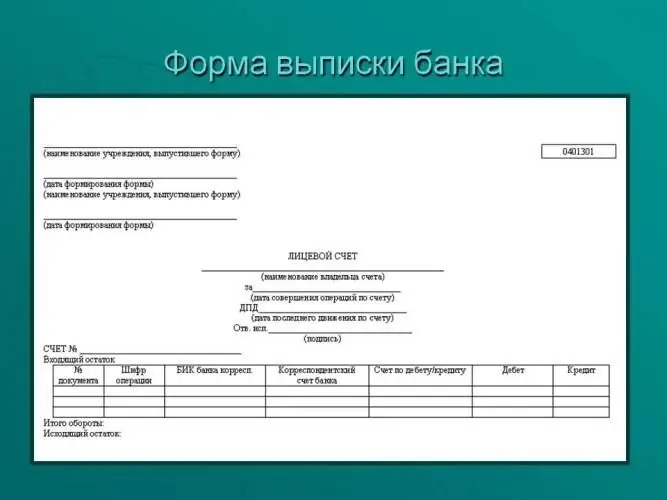

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Forms of tax control: classification and their definition

Forms of tax control are ways of a certain expression in the organization of certain control actions. These may include: taking explanations from taxpayers, checking credentials, as well as inspecting territories and premises that can be used to generate income

Types, methods and forms of financial control

What is financial control? How many main classifications of its species? Gradation of financial control by subject composition and by field of activity. Forms of financial control: preliminary, current, subsequent. What are his methods?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?