2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

In this article we will get acquainted with one of the basic concepts of financial law, the importance of which cannot be overestimated either in theory or in practice. Let's analyze its types, methods, forms. Financial control as a concept will also be considered in the material.

Term Definition

Let's start with a keyword. Financial control - the activities of various objects (economic, state, public, municipal, etc.) according to:

- Checking the timeliness and accuracy of economic planning;

- completeness and validity of income streams to certain funds;

- efficiency and correct use of funds.

This kind of control should always be regulated by law.

This is an important tool that can ensure the legitimacy of financial and business activities. It is financial control that prevents wastefulness, mismanagement, reveals the facts of abuse of authority, theft of money and material property. Its effectiveness depends onthe degree of interaction between subjects: government agencies, municipal government systems, law enforcement agencies, audit companies.

Gradation control

As for the subject composition, financial control is divided into:

- public;

- civil;

- government;

- departmental;

- legal;

- intraeconomic (intracompany);

- banking;

- auditor (independent).

The following gradation is observed in the areas of financial activity:

- tax;

- customs;

- budget;

- credit;

- currency;

- insurance.

Let's analyze these varieties in more detail.

Types of control by subject composition

We turn to the analysis of the types and forms of financial control. Depending on the subjects (who implements it), it is divided into several types.

State. Control here is the business of state structures. Their task is to ensure state and public interests both in terms of revenues to the treasury and in spending budget funds.

Internally, the form of state financial control is divided into three types:

- Parliamentary - from the legislature.

- Presidential - by the head of state.

- Governmental - from the executive side.

Departmental. Control is carried out by the audit departments of the ministries. They check the financialeconomic activities of their subordinate institutions.

On-farm (corporate, intracompany). Subjects: financial services of organizations and enterprises. The object will be the financial and economic activity of the institution.

The goals of control are:

- Securing the interests of the entire facility.

- Reducing wasteful losses.

- Identification of reserves to increase profits.

- Improving the efficiency of using resources - cash, labor, material.

Banking. Control over the activities of clients: organizations, enterprises. It is produced by commercial banks that serve these facilities. The goal is to ensure that customers comply with the rules of cash settlements, checking their creditworthiness.

Public. The subjects are non-governmental institutions: the media, trade unions, and so on. The object depends on the tasks of these institutions. For example, trade unions control the timeliness of salary accrual, payment of social benefits by the enterprise.

Independent. Subject - audit firms, auditors-IP. The purpose of their activity is to check financial statements, to establish the reliability of accounting.

Legal. Control is exercised by law enforcement agencies. These are forensic accounting expertise, revisions.

Civil. Carried out by individuals when receiving salaries, benefits, taxes on income, property, etc.

Types of control by area of activity

Financial control depending on the field of activity is dividedinto six categories.

Budget. This is the most important species on the list. Produced during the preparation, review and approval of the budget. The task is to check the completeness of the use of funds from the revenue share of the treasury.

The expediency of financing various kinds of expenses, the timeliness of the allocation of funds from the budget, their effective and targeted use are also controlled.

Tax. The purpose of this type of control is to mobilize tax revenues at all levels of the Russian budget system.

Customs. The main task is to ensure the timeliness and completeness of payment of customs duties to the budget.

Credit. This kind of control is carried out when issuing and collecting loans, checking their security.

Currency. The main goal is to ensure the timely and complete receipt of foreign exchange export earnings in the Russian Federation. As well as confirmation of the reasonableness of the foreign currency import fee.

Insurance. This is the oversight of the correct conduct of insurance procedures. The goal is to ensure the stable development of the market for these services.

Forms of financial control

Now let's move on to the next topic. Forms of financial control are specific ways of organizing and expressing actions. They are divided depending on the time of the operation or control procedure.

There are three in total:

- Preliminary.

- Current.

- Follow-up.

Let's dwell on each in more detail.

Preview

A preliminary form of financial control is carried out before an important event, event. An example would be checking the correctness and legality of the documentation that serves as the basis for receiving funds from the budget.

This type of control is usually carried out by higher bodies of economic institutions, the management of the financial and credit structure. They consider cash, credit estimates and plans, regulatory calculations, documents on opening loans and transferring funds.

Current control

The next form of financial control is operational (current). It is carried out directly at the time of spending or receiving monetary resources.

The current control is based on operational and accounting data. Visual observation, periodic inventories help prevent economic offenses, as well as adjust financial risks in time.

Object of operational control - documents related to the receipt and transfer of funds. Auditors regularly compare actual spending with current budget spending rates, which allows timely identification of deviations.

Follow-up control

The last form of organization of financial control is the next one. It is carried out after the cash transaction. The goal is to additionally check the validity and legality of the actions.

One way to do this is to analyze balance sheets and reports. Audits are also carried outdirectly on the ground - enterprises, organizations, institutions.

Control methods

We are finishing considering the types, forms and methods of financial control. The latter include checks, audits, supervision, surveys, observations, analysis of activities. Let's take a closer look at them.

Checks. They relate to primary documentation, financial statements, accounting registers. Inspections make it possible to carry out statistical observations, identify individual issues of financial and economic activity, and outline ways to eliminate shortcomings.

Divided into:

- Exit (documentary) - directly in organizations with officials.

- Office - at the location of the control body based on the documents provided, available information.

Examination. This is a personal acquaintance of controllers on the spot with certain aspects of the organization's activities. Includes the following tools:

- questionnaire;

- control measurements;

- on-site inspection;

- polls.

Supervision. Produced by the controlling structure for the activities of entities that have received a license for a certain type of work, services. The goal is to control compliance with regulations and rules. Their violation leads to license revocation.

Economic analysis. This is a detailed study of financial and accounting statements. Conducted to assess economic activity, financial condition.

Observation (or monitoring). These are systematiccontrol actions. The goal is to determine the current changes in the activity of the object.

Revision. This is the most important, comprehensive and deep method of financial control. It helps to ensure the effectiveness, validity and expediency of the use of funds, financial discipline, and the correctness of reporting. The goal is to detect and prevent violations.

Internal revisions are divided into several groups:

- Combined, solid and selective.

- Factual and documentary.

- Partial and complete.

- Sudden and planned.

- Thematic and complex.

Types and forms of financial control, as we have seen, are quite diverse. Also, this activity is carried out with the help of a whole range of methods.

Recommended:

Forecasting and planning finances. Financial planning methods. Financial planning in the enterprise

Finance planning combined with forecasting is the most important aspect of enterprise development. What are the specifics of the relevant areas of activity in Russian organizations?

Forms of loan security: types, requirements of banks and methods of verification

Modern realities are such that rarely people can do without loans. It often happens that one person has several loans. Such a frivolous attitude leads to the fact that not everyone returns the money. In this situation, banks suffer. They try to protect themselves from such cases and introduce collateral for the loan. Let's talk about him

Tax control: bodies, goals, forms and methods

Tax control is a special type of activity of specialized bodies. Employees of this service are authorized to conduct tax audits, as well as to supervise the financial activities of entities of all forms of ownership. How are tax controls and tax audits carried out? What are their goals and what types of these actions are there? Let's consider these points in more detail in the article

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties

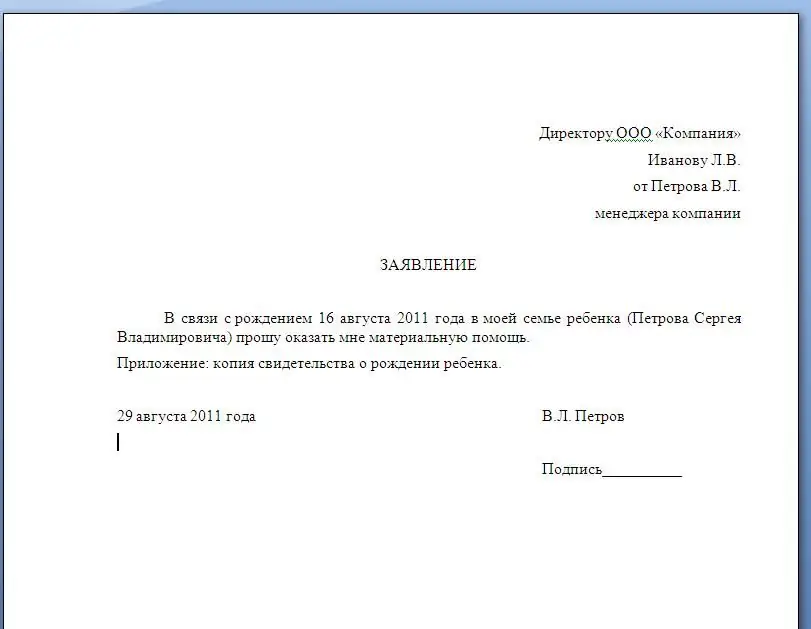

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer