2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:35

A certain circle of specialists knows that long before the Bretton Woods system arose, there was a time of the gold standard on our planet, when the pound sterling could be freely exchanged for gold. Britain in those days was a strong world power, so it could afford such operations. However, everything changed in 1914, when during the 1st World War, the US currency entered the financial arena, which spread to North and Latin America.

In 1922, an attempt was made to create a reserve currency and a gold standard based on the pre-war model. In 1925, England introduces the gold standard for the pound, backed by gold and the reserve currency (US dollars). However, in 1929 there was a stock market crash in America, and in 1931 a panic began on the London financial market, which finally assigned the pound a secondary role after the dollar. In 1931 and 1933, the gold standards were abolished in Great Britain and the USA, respectively. exchange rates became floating, which served as the basis for future forex systems. Attempts to createthe gold convertibility of currencies by European countries collapsed (1936, the collapse of the "Golden Bloc", which included a number of countries, including France, Holland, etc.).

By the end of the 1940s, due to the financial crises of the 1930s and World War II, there was a need for a radical renewal of the financial system in the world. And in this regard, in 1944, the Bretton Woods Conference was convened, at which it was decided to peg the currencies of 44 countries to the dollar, and the dollar to gold at the rate of $35 per troy ounce (31.1034 grams). After World War II, the predominant share of the world's gold reserves was concentrated in the United States, which gave this country grounds for world leadership. In December 1944, the Bretton Woods system went into effect.

At the 1944 conference, a provision was adopted on the creation of two organizations that will exercise control functions and provide the countries participating in the agreement with funds to stabilize the national currency. These were the International Monetary Fund and the International Bank for Reconstruction and Development. The Bretton Woods system assumed that gold remained the final medium in international settlements, that national currencies were freely circulating, that national currencies had fixed rates against the dollar, and that central banks supported this rate (+-1 percent).

However, by the mid-70s, gold reserves were redistributed to other financial centers (European, Asian), and thus the theorem was violatedTriffin that the issue of currency should be compared with the gold reserves of the country that produced this issue. The Bretton Woods system began to lose its relevance, which was intensified by speculative transactions, the instability of the foreign exchange balances of the participating countries, and the currency crisis of 1967. This creates the prerequisites for changing the existing world monetary system, which the United States has been supporting by force of arms for many years, because. they have not had a gold reserve equivalent to the issuance of dollars for many years.

Recommended:

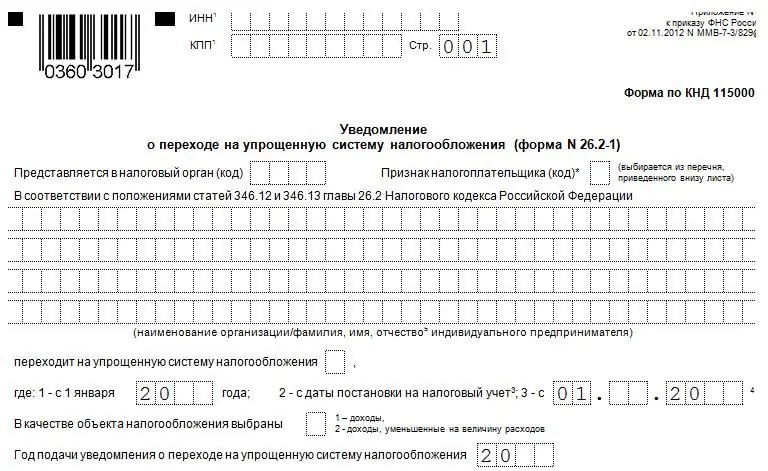

Using the simplified tax system: system features, application procedure

This article explores the characteristics of the most popular taxation system - simplified. The advantages and disadvantages of the system, conditions of application, transition and cancellation are presented. Different rates are considered for different objects of taxation

Staffing of the personnel management system. Information, technical and legal support of the personnel management system

Since each company determines the number of employees independently, deciding what requirements for personnel it needs and what qualifications it should have, there is no exact and clear calculation

Is the consolidated budget a set of budgets of all levels or a way of state influence on the system of market relations?

This article describes in an accessible way the concept of the consolidated budget, its sources and purpose of activity

Anti-aircraft missile system. Anti-aircraft missile system "Igla". Anti-aircraft missile system "Osa"

The need to create specialized anti-aircraft missile systems was ripe during the Second World War, but scientists and gunsmiths from different countries began to approach the issue in detail only in the 50s. The fact is that until then there simply were no means of controlling interceptor missiles

All professions are needed, all professions are important, or the Commandant is

Commandant is a profession that originates from distant and romantic France, but has already settled down so firmly with us that it is hard to imagine that it has come. If we define the word "commandant", then, as it turns out, despite its roots, it has nothing to do with romance, it is nothing more than command