2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Among securities, a significant segment of the market received such an instrument as GKO. What it is? What does this abbreviation - GKO hide? The decoding of this word means "government short-term bonds." Why are they needed?

By the way, there is another interpretation of this abbreviation - "GKO USSR", the decoding of which has nothing to do with the world of finance and means "State Defense Committee of the Union of Soviet Socialist Republics." It will not be about this, but about bonds.

Initial release

What is GKO? The decoding of this term implies that these papers were the prototype of bills that exist in the United States of America. Government short-term bonds were issued on the territory of the Russian Federation in May 1993. Their role was to cover the state budget deficit. Since these securities are classified as short-term in the financial system, it is logical that they cannot be used for long-term investments. The first issue of state short-term bonds (GKO) was ten thousandrubles, but rather quickly the face value was raised to one million rubles.

Bond income

What are GKOs and what is their income? The investor makes a profit by selling government short-term bonds at various auctions at a price that is below the nominal value (with a discount). These securities can be redeemed at face value by transferring money to the owner's account in a non-cash form. Income in this case is the difference between the purchase price of GKOs and their nominal value at an auction on the secondary market or at their initial placement.

Who can buy short-term government bonds?

Individuals and legal entities can be owners of T-bills. However, the participation of individuals in the market for the circulation of these bonds is hindered by some purely technical reasons. The first issue of government short-term bonds GKO authorized to carry out all transactions with them only through dealers, which are large financial companies and banks. In most cases, they are not interested in cooperation with the capital of private individuals. Many banks and financial institutions set certain limits on the amount of funds that investors need to conduct bond transactions through a dealer. At the beginning of the ninety-seventh year, this amount was in the range from three hundred to five hundred million Russian rubles.

Issue history

What does the term T-bills mean? The decoding of the name of this financial instrument, as we have already mentioned, is “government short-term bonds”. Therefore, they were released for short periods of twelve, six and three months. In 1997, the issuer (the Ministry of Finance of the Russian Federation) changed the structure of issues of such an instrument as short-term bonds, leaving only six-month and twelve-month ones in use. Since GKOs, whose decoding focuses on short terms of validity, are issued in alternating series, the issuer has the opportunity to systematically redeem previously issued series by issuing new ones. These bonds are zero-coupon, so an investor can purchase them at a price below par. When placing a series, the volumes of issues at face value should be higher by the discount value, which was set during the auction sale of these securities.

MoF action on short-term bonds

The Ministry of Finance of the Russian Federation conducts frequent and regular issues (issues) of GKOs. The decoding of this abbreviation includes the word "state", since it is the budget that receives the proceeds from the sale of these assets. Thanks to the policy of frequent issuance, short-term bonds are converted into long-term bonds by such simple methods, since the state always has a certain amount of borrowing. For example, already in the ninety-fifth year from the implementation of GKOs, net revenues to the budget amounted to almost thirty trillion rubles. This made it possible to covermore than fifty percent of the federal state budget deficit. In 1996, the proceeds from short-term bond issue cycles amounted to more than fifty trillion rubles.

Who are the participants in the short-term bond market?

GKO abbreviation, the decoding of which we discussed above, has a wide range of market participants. The main subjects are:

- The Ministry of Finance of the Russian Federation (Russian Federation), which is the issuer and determines the price of the initial placement of bonds at auctions, forms the weighted average price, and also influences the issue volumes.

- The Central Bank of the Russian Federation (Russian Federation), which is an authorized agent of the Ministry of Finance on issues of GKO placement. Also, the Central Bank of the Russian Federation conducts and organizes auctions for the primary placement of bonds, participates in secondary auctions, and operates with securities on open markets.

- Dealer, that is, a professional trading participant who has concluded an agreement with the Central Bank of the Russian Federation and services transactions with GKOs. The dealer can either enter into transactions at his own expense or be a broker, executing transactions on behalf of his clients.

- Investor, that is, a natural and / or legal person who is not a dealer and purchases government short-term bonds on the basis of an agreement concluded with a certain dealer.

- Depositories. GKO, the decryption of which implies a non-cash form of issue, have a two-level system, which consists of a sub-depository (actually, it is a dealer)and the head depository (an organization that has entered into an agreement with the Central Bank of the Russian Federation to conduct the necessary depository activities for accounting for short-term bonds).

Recommended:

What does the BTI do: functions, powers, decoding of the abbreviation

It is necessary to note the benefits of the work of the BTI structure, no matter how it is corrected, innovations are introduced. This department controls the legality of buildings and projects. Citizens must be sure that their floor will not collapse from the fact that someone needed to move the supporting structure at their own discretion

"JSC": abbreviation decoding

What to choose for business - OJSC, CJSC or LLC? What are the advantages and disadvantages of each of these organizational and legal forms?

OOS - what is it? Abbreviation decoding

OOS is… Four meanings. What is environmental protection? CAB activities and projects in the organization. All-Russian official website: what are public procurements, what can they be, what are the criteria for bidding?

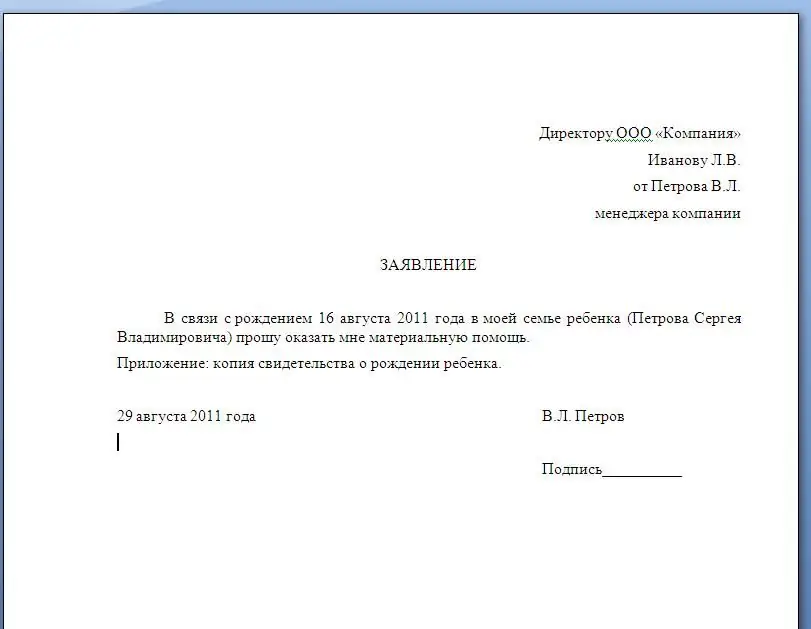

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

NDFL: abbreviation decoding

Tax issues themselves are extremely important. Especially if you don't know what specific tax you're dealing with. Maybe you don't need to pay it at all? It is enough to know how to correctly decipher personal income tax in order to understand this issue