2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:35

To know the actual quantity of goods and other valuables managed by the enterprise is one of the prerequisites for effective work. That is why the inventory has become an obligation prescribed in the Accounting Law. In this way, the reliability of accounting data is ensured, and the actual existence of property and liabilities is verified.

Ideally, the data on paper and in reality should match. But for various reasons (theft, damage, natural decline, natural disasters, etc.), discrepancies can be identified. In such cases, a reconciliation statement is drawn up. The standard form INV-18 is a document that indicates data on possible discrepancies in the availability of fixed assets, and INV-19 reflects the accounting for the results of an inventory of inventory items.

Such documentsare compiled by an accountant, who reflects in them data from the relevant inventory records, comparing them with the data of accounting accounts. As a result, there may be shortages or surpluses. At the same time, their amounts in these documents should be indicated in accordance with the assessment in accounting. The responsible employee of the accounting department is obliged to carefully check whether everything is calculated correctly. And only after that do the appropriate entries.

The collation sheet also contains mandatory fields that indicate information about the structural unit in which the inventory was carried out, the number and date of the order, the start and end date of the inventory, as well as the full name of financially responsible persons. Each such document has its own serial number, which is indicated in a specific column.

The procedure for filling out the second and third pages of INV-19 is as follows. Column 1 indicates the serial numbers of goods and materials subjected to inventory. Columns 2 and 3 are intended to indicate the name, purpose of materials, their brief characteristics and item numbers.

The following columns reflect information about the unit of measure and its code according to OKEI, inventory numbers, and, if available, passport data. Next comes the basic information, for the clarification of which, in fact, a collation statement is compiled - this is the number and amount of excess (or missing) inventory items reflected in the column “Inventory results”.

Columns 12, 13, 14 indicate clarificationrecords that are associated with surplus. Columns 15-17 specify the data related to the shortage.

At the end of the second sheet, the collation sheet contains data on the total quantity and amount of surplus (or shortage) of goods and materials. The chief accountant must put his signature here!

On the third page in columns 18-23 the results of offsets for sorting, permitted by a special commission, are reflected. In columns 24-26, the number and amount of surpluses are entered, as well as the numbers of the accounts on which they are credited. Columns 27-32 contain the same information, but in the context of shortage of goods and materials.

A collation statement is compiled in two copies. This is done manually or with a computer. One document remains in the accounting department, the second is transferred to the person responsible for the safety of the values of the corresponding type. His signature, full name and position must also be present in such a document.

Recommended:

How to clean your credit history in Russia? Where and for how long is the credit history kept?

It is not easy to get a loan for customers with delinquency. To increase your chances of getting a loan, you need to look for options to improve your credit history. You can clear your credit history within 1-3 months. This can be done in several ways

From the field to the table: how do they clean seeds in production?

Vegetable oil is prepared from seeds. They can also be sprinkled on baked goods. Pumpkin seeds are ground into a powder, added to desserts and salads, or consumed just like that. So that every housewife can use them in her kitchen, it is necessary to prepare raw materials on a large scale. Next, we will learn about the benefits and how seeds are cleaned in production

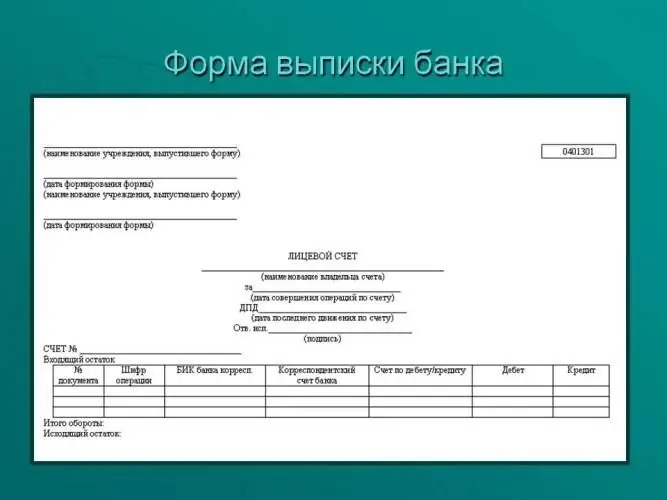

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Osmosis reverse - a guarantee of clean water

Reverse osmosis, as the process of separating the components of a solution from each other, has a rather long history. Even the ancient Greeks, in particular, Aristotle, noticed that when sea water passes through the walls of a vessel made of wax, it is desalinated

Oil-free compressor as a solution for clean compressed air

Oil-free compressor, their variety and principle of operation is the topic of this article. This device does not use compressor oil during operation. Such a compressor has both a number of advantages and disadvantages