2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Forex 2018 is pretty consistent. There were no major incidents in the global economy and this was reflected in the major currency pairs in the market. Last year's trend continued this year as the US dollar rose slightly against other currencies.

However, the profit of traders was not very significant. The euro ended the previous year on the rise, but in 2018 it is not very strong. The yen was fairly flat and fluctuated slightly around its current market value. But some currencies have recorded higher volatility relative to each other than others. The relationship between them is expressed by the ratio of their prices. The article provides a table of the most volatile Forex currency pairs and an overview of currencies in mid-2018.

What is volatility?

First of all, you need to have a basic understanding of the Forex market. Volatility is a term thatdescribes the price movement over a certain period of time. The more volatile the market, the greater it is. If the market is less volatile, the price changes less.

In addition, the movement of value can be either proportional or absolute. Both cases take place when trading currencies under the terms of a margin contract. Proportional measurements are more useful for comparing prices. But in order to evaluate a certain currency pair, reviews recommend doing this in absolute terms. For example, traders might want to know what a typical price move is over a period of time.

How volatility is measured

One of the most common indicators used by traders is the moving average. This indicator displays the normal movement of the market over a certain period. Its duration can be whatever the trader wishes to choose. There are other, more complex types of moving averages.

To determine which currency pairs are the most volatile, reviews also recommend using the average true range. It measures the average spread of market prices over a given period. The indicator may vary depending on the length of the observed period.

When trading Forex, there are times when very little change occurs and the price stays within a set range. This describes a low volatility market. However, the announcement of economic data could lead to a sharp and strong rise in prices. Suchthe situation is a burst of volatility.

Most volatile currency pairs

The market has established certain trends, due to the data of previous years. Most currency pairs in the market tend to have a level of volatility based on their status. For major currency combinations such as USD/GBP, volatility never gets too high or too low. This is due to the stability of the currencies involved and the demand for them in the global economy. On the other hand, exotic pairs such as USD/SEK tend to be very volatile. This is due to the different attitude towards them and the level of demand. No wonder GBP/NZD and USD/SEK are extremely volatile.

Of the major currencies, USD/JPY and GBP/USD were the most volatile on average for the year. The level of their volatility is still marginal and not as sharp as fluctuations in the rate of exotic pairs. They tend to take many traders by surprise.

The goal of every Forex trader is to decide how best to deal with volatility by choosing the best trading strategy. This is usually determined when a trader has to choose an account type before trading. Different accounts allow traders to define different risks and rewards in trading.

Below is a table of the most volatile currency pairs in mid-2018.

The safest options

According to traders, the most calm and predictable currency pairs are almost always the main monetary units. And nothing has changed in 2018. The two pairs with the least average volatility are EUR/USD and USD/CHF.

The exchange rate between the euro and the dollar is quite consistent even at times when the economies of the respective countries are experiencing difficulties. This currency pair is quite stable due to its popularity in the market. The daily trading volumes of EUR/USD are always among the highest and the demand provides more stability as a result. The two key economies that support these currencies also have the most economic power. The EUR/USD pair is thus the largest and most liquid in the world. According to reviews, for beginners who want to get into trading, this currency pair offers the best opportunities to get a trading experience.

What you need to know about volatility

While major currency pairs tend to be less volatile than others, this is not always the case. There have been many instances where volatility was driven by current events. For example, the Brexit vote in 2016 caused a lot of turmoil in the market, and all pairs involving the British pound became very volatile. Speculators also play a role in destabilizing the exchange rate. Therefore, it is important to note that the most volatile currency pairs on Forex appear for the reason:

- speculation in the market;

- announcements of major economic data;

- changes in currency liquidity in the pair.

These factors, among other things, may lead to changes in volatility levels. Exotic pairs with obscure currencies with volatile liquidity are almost always volatile when paired with a major currency.

Euro/dollar

This is the most active, though not the most volatile Forex currency pair of 2018. The benefits of EUR/USD trading are widely known. One of them is the high level of dollar and euro liquidity, which contributes to profitable transactions. There is a large amount of liquid financial instruments available for this currency pair, allowing traders to trade both the spot market and futures, options and CFDs. The high transparency of the EU and US economies also provides a high level of predictability for the currencies of these countries.

Dynamics of prices can usually be calculated by means of technical analysis. The euro has had a good 2017, bypassing all the political traps. In 2017, the United States markets rose significantly on reports of tax cuts. The monetary policy of the US Federal Reserve and the ECB in the first months of 2018 determined the difference in the key interest rates of the two countries.

If Trump's tax plan along with aggressive tax stimulus goes into effect, the dollar will continue to rise. On the other hand, any delay from the ECB in cutting interest rates, the expectation of lower inflation and the sensitivity of European markets to this outlook for the euro will be bearish.

Dollar and Japanese yen

According to traders, the USD/JPY pair is one of the best traded in Asian markets. It accounts for 17% of all transactions in the global foreign exchange market. The pair is associated with lower spreads and is sensitive to political relations between the US and the Far East. JPY in the spring of 2018 strengthened against the backdrop of a weakening dollar. This is surprising since a stronger United States economy was predicted earlier in the year. However, by the middle of the year, the dollar regained its positions.

The Bank of Japan announced a reduction in purchases of ultra-long-term bonds, which led to lower yields and lower prices. Moreover, it was confirmed that the country will maintain its ultra-liberal monetary policy. Ideally, this should weaken the JPY, but for now, the yen against the US dollar remains at the level of the beginning of the year.

USD/JPY is one of the three most volatile currency pairs on the international market. While this provides a good opportunity for experienced traders, due to the large range of fluctuations, reviews advise beginners to exercise caution.

British pound and US dollar

This pair makes up 12% of the total trading volume on the foreign exchange market and is extremely volatile. It is mainly used by professional traders who practice short-term aggressive strategies. One of the most volatile currency pairs allows you to quickly make a profit. However, reviews warn that this is high risk.

Early 2018GBP/USD traded in the face of a weakening dollar. The news that senior EU officials are adopting a more UK-friendly stance in the second phase of the Brexit negotiations in 2018 helped the currency pair rise. However, since mid-April, there has been a constant fall in the pound, which has already reached a year-old low.

Recommended:

Correlation of currency pairs with each other

Assets that are used in trading in the financial market have a fundamental relationship. This is best seen by traders in Forex and other financial markets. Assets that are placed in the trading window follow each other's movements

"Baths and spa" in Voronezh - review, features and reviews

Everyone needs to relax sometimes. "Baths and spa" in Voronezh provide such an opportunity. In our article, we will tell you where this institution is located, what services you can get there, and most importantly, what impressions the visitors left with the service provided

The official currency of Morocco. Country currency. Its origin and appearance

The official currency of Morocco. Country currency. Its origin and appearance. Where and how to change currency. Moroccan dirham to US dollar exchange rate

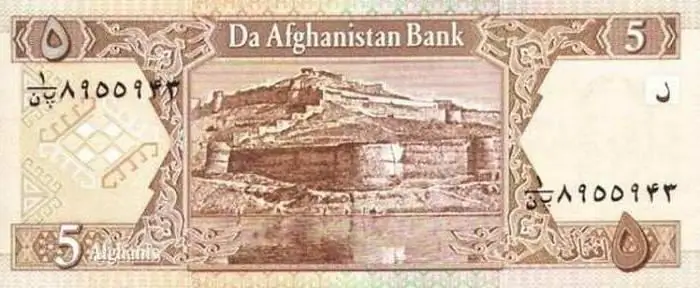

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article