2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:37

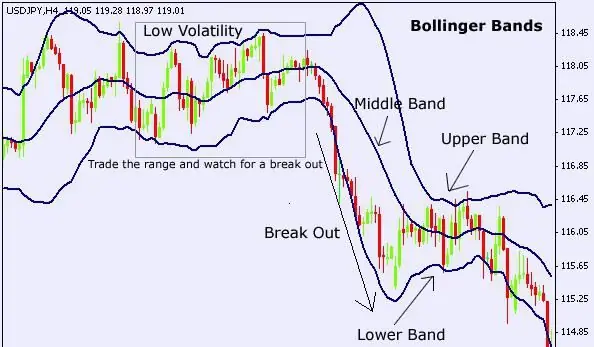

Bollinger Bands is one of the indicators of the Forex currency market, which appeared in the 80s. The tool has become a real discovery that has taken technical analysis to a higher level. The indicator was created by John Bollinger. The algorithm of the instrument is to determine the moment of undervaluation or overvaluation of an asset. Since the indicator belongs to trend instruments, it helps to determine the direction of price movement. Thanks to the precise definition of undervalued and overvalued zones, it is possible to find the reversal point of the movement.

A bit of history

John Bolinger is a well-known trader in the modern world and is also the founder of Bollinger Capital Management, which specializes in money management. Bollinger Bands, which is the name of the indicator in English, can be considered a real find for every trader. With the help of the situation analysis tool, you can clearly set goals, as it analyzes the volatility in the market. The channel that forms aroundmoving average, flexible and constantly follows the price. All brokers, including Forexstart, offer Bollinger bands in the public domain. This tool is already built into the trading terminal and no additional payment is required for its use.

Tool description

Bollinger Bands are, in fact, three moving averages that are superimposed on the price chart, the indicator is not built in a separate window. The middle lines cover the movement of quotes from both sides, thereby creating a volatility corridor. It was the appearance of the instrument that led to the appearance of its second name - “envelope”. Moving averages are simple, with a standard deviation of +2 at the upper boundary and -2 at the lower boundary. The settings are basic, and, depending on the TS, each trader can upgrade them. In addition to the level of deviations, you can change the period and shift in the indicator settings. There is an option to specify which price the indicator applies to. The standard deviation value indicates the volatility of the trading instrument at a given time. As volatility grows, the Bollinger bands expand, the range between the extreme edges of the corridor increases. With a decrease in market activity, the corridor will narrow.

How does changing the period affect the behavior of the indicator?

Period is a time interval corresponding to a certain number of candles, which is taken into account by the indicator when building a channel. The standard settings provide a value of 20. When itdecreasing, the channel lines become more broken. The price begins to actively break through the boundaries, which leads to the appearance of a large number of false signals. The reaction of the lines themselves to the price movement is activated. An increase in the period leads to a smoothing of the channel, to an increase in the distance between the upper and lower lines. The indicator begins to slowly respond to price changes. Due to the fact that the channels will break much less frequently, the number of trading signals will decrease. In this case, the strength of the signals themselves will become much stronger.

What do changes in deviation rates lead to?

Deviation is an indicator that determines the distance of the upper and lower borders from the central moving average. As the standard deviation increases, the distance from the upper boundary to the center increases. The number of incoming signals is decreasing. Reducing the deviation brings the channel borders closer to the center, which leads to an increase in false trading signals. By experimenting with the standard deviation, you can choose the optimal parameters for the highs and lows that the price must reach for a breakout.

Primary orientation and important points

Initially, the indicator was not created for the Forex market. Its main purpose was to analyze the situation on the stock market. Later, the tool began to be actively used in the foreign exchange market and implemented in binary options trading strategies. The author of the indicator himself used it on the daily chart. Hence the conclusion that the use of the indicator on othertimeframes requires setting other parameters. The use of lines with volatile pairs with a decrease in the period will cause a huge number of false signals to appear. Most professional traders do not recommend increasing the standard deviation. As practice has shown, in 90% of situations the price remains within the corridor. Of the settings, the period of the moving average most often changes. Everything else is left with default values.

Indicator features

Binary options trading strategies, in fact, like most strategies adapted to the foreign exchange market, are developed based on the features of this analysis tool. It is especially necessary to carefully monitor the periods when the price goes beyond the extreme edges of the corridor. There is a high probability of two scenarios. Both the continuation of the movement and its reversal are allowed. This signal must be supported by other instruments of the trading system. In a number of situations (about 75%), if an active price movement began at one of the channel edges, it will certainly continue to the opposite edge of the same channel. Another feature of the indicator is related to the situation when the lows and highs are formed outside the channel. If the next candle takes place in the range of movement, we can consider the formation of the opposite signal. If the Bollinger Bands narrow sharply and remain in this state for a certain time, it is worth talking about the beginning of a new trend with a strong primary impulse. Subsequently, it will be possible to observe a strong jump in volatility. A dubious feature is the prevention of the formation of more than 4 candles outside the corridor. After reaching the peak, the price starts a correction. This feature is not taken into account if there are important economic news.

Practical application

Bollinger Bands belong to the category of trend indicators. Their main goal is to determine the current direction of movement in the market. In theory, this tool is not designed to determine exact entry and exit points. At the same time, many traders have found a very effective use of the indicator in the process of monitoring its work. The simplest signal format is formed when the middle line is broken in any of the directions. When breaking through in the direction from the bottom-up, you can consider buying. The opposite situation indicates preparation for sales. In addition to the priority entry point, Bollinger Bands for binary options, for other types of markets, help set goals. As soon as price quotes reach the upper or lower border of the channel, depending on the direction of the trend, you should worry about closing trading positions.

One of the most aggressive strategies

Some aggressive traders also cannot do without such a tool as Bollinger Bands. The strategy is based on opening deals at those moments when the candles go beyond the channel. The danger of such decisions is related to the fact that several falling or rising candles can form simultaneously outside the channel. Thus, before the moment of the trend reversal, it will be necessary tospend some time at a loss. It is much more practical to build dynamic support and resistance levels based on the indicator values. The accuracy of the boundaries remains at a fairly high level. The use of the tool is effective during a sharp narrowing of the corridor. It is worth acting by analogy with the use of the Alligator by Bill Williams. The longer the corridor is in a compressed state, the stronger the movement will eventually be.

Independent and additional tool for trading

Bollinger Bands can be used in trading both independently and as an additional tool in technical analysis. Combining the latter with candlestick patterns (Price Action) is effective. It is relevant to consider formations near the upper and lower boundaries of the channel. The simplest double signals can be pin bars or inverted candles, hammers, which will clearly indicate a trend reversal. Bollinger bands trading can be effective when combined with the signals of the MACD indicator. A decrease or increase in the histogram with a parallel increase in the curved lines of the channel is already a powerful signal. The presence of divergences or convergences may indicate an upcoming trend reversal. Opening a trade at the most opportune moment will allow a confirming signal from Bollinger Bands.

Benefits of a technical analysis tool

Like any other technical analysis tool, John Bollinger Bandshas its positive and negative sides. Stop is on the strengths of the tool. The main advantage of the latter is the ability to determine the trend as accurately as possible, which is one of the main criteria for successful trading in the market. This opens up opportunities for using the instrument in any market situation. With the help of the tool, in addition to determining the trend, there is a chance to predict areas and even reversal points of movement. To say more, focusing on the position of quotes in relation to the channel, you can objectively set goals. The versatility that the Bollinger Bands indicator has allows it to be used in all types of markets: currency markets, binary options market, stock market and stock market. The main thing is to adapt the settings to a specific time period and take into account the activity of each trading instrument separately.

Disadvantages of the technical analysis tool

There are certain drawbacks to such a technical analysis tool as Bollinger Bands. "Forex" should be analyzed very carefully, which determines the relevance of acquaintance with the errors of the "envelope". Due to the subjectivity of the bands, they can be interpreted in completely different ways by different traders. Please note that there are no universal settings that could provide trading signals on different assets. Adaptation of the system is necessary for each of the trading formats. Most of the signals from the indicator turn out to be false. It is extremely important to filter them with the help of additional technical analysis tools. According tothe creator of the channel himself, he does not work well in weak and inactive markets.

Options trading bands

Lines or "envelope" are often used by traders when trading options. An oscillating and at the same time trending indicator reflects the actual deviation in the value of assets. The tool allows the trader to accurately determine whether the price of a trading instrument is high or low compared to the average price. This allows you to make a forecast regarding further growth or decline. A feature that a trader trading binary options should pay attention to is the constant tendency of the price to the average level.

Main signals for a binary options trader

The main indicator signal that a binary options trader should look at is the maximum narrowing of the channel. This is a clear sign that a strong movement can be observed in the near future. If, after a long stagnation in the market, a bullish candle is formed that breaks through the channel, purchases can be considered as soon as possible. There is a 90% chance that traffic will head north. If the situation is reversed, and a bearish candle has formed on the chart, which has broken through the lower border of the channel, it is better to give the advantage to sales. Any indicator signals should not be considered as the only true ones. Any formed pattern must be confirmed either by another indicator, or by the results of a fundamental or technicalanalyses.

Recommended:

Shelf life of water meters: period of service and operation, verification periods, operating rules and time of use of hot and cold water meters

The shelf life of water meters varies. It depends on its quality, the condition of the pipes, the connection to cold or hot water, the manufacturer. On average, manufacturers claim about 8-10 years of operation of devices. In this case, the owner is obliged to carry out their verification within the time limits established by law. We will tell you more about this and some other points in the article

How profitable is it to use a credit card? Overview of credit cards and terms of use

The decision to issue a credit card comes to the client within a few minutes after sending the application for receipt. If approved, issuing a card can take up to three days, some financial institutions issue them to customers immediately upon application. A borrower over the age of 18, in order to issue a credit card to him, must provide a banking organization with his passport data, documents confirming income (certificate 2 personal income tax)

How to make a business page on Instagram: procedure, setup, design and promotion

"Instagram" has recently become increasingly popular, and many use accounts in this social network to conduct their business, as it is a dynamically developing trading platform. The first thing to do in order to start actively selling is to register and follow certain recommendations developed by promotion specialists

Installation of the 1C server and setup at the enterprise

In the article we will consider the instructions for installing the 1C: Enterprise server in the office. The 1C installation option in the client-server version is the most suitable. But first you need to understand what a client-server architecture is. After that, we will tell you in which cases it makes sense to implement this architecture, and most importantly, how to do it correctly. If you are faced with the installation for the first time, then our material will be very useful to you

Rational use of land: the concept and functions of land, the principle of use

Exploitation of the land fund involves the creation of favorable conditions for the production of agricultural products. However, it is impossible to achieve high economic efficiency in this area without a careful calculation of the costs of energy, power and natural resources. The concept of rational use of land is of key importance in maintaining sufficient production indicators in this area without harming nature