2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Government loans are represented by a structure of interrelated elements and types. So, depending on the status of borrowers, the following types of loans can be distinguished: centralized and decentralized.

The first variety is represented by government securities issued by the government through the Ministry of Finance. State loans of the second type are based on the issue of securities by local authorities and are the main structural element in the financial system of regional self-government. With the help of these funds, it becomes possible for local governments to carry out activities for the development of a particular region. That is why the decentralized state loan of 2013 has all the prerequisites for using it as the main financial instrument through which the development of the national economy can be carried out.

It is the responsibility of the issuer of local loan bonds to announce all necessary financial and economic information. The use of this information enables potential investors to make a decision to purchase such securities. The value of public credit is explained by the efficiency of its use. At the same time, the level of qualification of the personnel responsible for organizing the placement of these bonds is considered to be the main subjective factor.

Depending on the accommodation facility, such public loans are distinguished: internal and external loans. The first type of borrowed funds include those placed on the territory of the state in the national currency. The definition of external loans involves placing them in foreign currency abroad. At the same time, it should be noted that non-residents also have the opportunity to purchase domestic government loans.

The state has the right to issue loans in credit institutions of international level, as well as foreign banks.

Depending on the maturity of debt obligations, the state can provide short-term, medium-term and long-term loans. Thus, a short-term loan involves its execution for up to one year, medium-term - up to five years, and long-term - from five years.

There is another classification of government loans based on the types of their profitability:

- interest, suggesting that their owners receive income in the form of certain dividends;

- discount - the sale of government-importance securities is carried out at prices below their face value;

- winning -the sale of these securities is carried out without fixing interest, and their holders will receive income only if a specific bond number is included in the redemption draw, which implies a win.

A special place in the system of lending and financing is given to state lotteries (drawing money or property using tickets purchased for a fee).

Recommended:

Real estate development and its role in economic development. The concept, types, principles and foundations of development

In the framework of this article, we will consider the organization of the real estate development system and its role in economic development. The basic concepts, types and principles of organization of the development system are considered. The characteristic features of the system in Russian conditions are considered

Sectors of the economy: types, classification, management and economics. The main branches of the national economy

Each country has its own economy. It is thanks to industry that the budget is replenished, the necessary goods, products, and raw materials are produced. The degree of development of the state largely depends on the efficiency of the national economy. The higher it is developed, the greater the economic potential of the country and, accordingly, the standard of living of its citizens

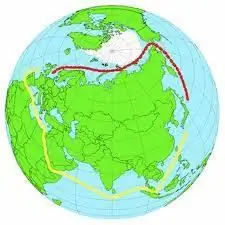

Northern Sea Route. Ports of the Northern Sea Route. Development, significance and development of the Northern Sea Route

In recent years, the Arctic is one of the key regions in terms of Russia's national interests. One of the most important aspects of Russia's presence here is the development of the Northern Sea Route

Foreign currency deposits and their significance for the Russian economy

From a strategic point of view, it is much more profitable for Russians to deal with the domestic currency and keep capital in it. However, the domestic monetary system for the newest period of its existence has brought many surprises to the holders of ruble deposits. How to be?

Economy - what is it? Development of the country's economy

Science economics allows you to correctly analyze the processes of interaction between subjects of market relations, wisely spend and produce material resources, and also shows the ways of proper development and improvement of well-being