2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

In order to tighten currency control, legislative acts have been amended. In particular, they concern the definition of the term "currency resident". The taxation of citizens' income largely depends on its correct interpretation.

Concept

The term "resident" is introduced in the legislation not only in relation to tax, but also to currency control. The new law "On currency residents" (2012 edition) provides that persons who left the country more than a year ago and no longer appear in Russia are not citizens of the Russian Federation. It does not matter what specific visa a person has: student, tourist or giving the right to visit relatives. The regulations refer to "permanent" or "temporary" residence in another country, but none of them refer to "continuity". That is, citizens of the Russian Federation living in another country, who at least one day a year will come to their homeland, will lose the status of a non-resident. But some lawyers believe that it is necessary to pay attention to the fact of registration at the place of residence. When a person migrates to another country, he is discharged from housing in the Russian Federation. track it downshort-term visits to the homeland is difficult.

The concept of "currency resident" was introduced in the legislation before. Then it was no less confusing. In particular, this category of citizens could include all persons with open long-term visas in their passports, even if they never used them.

Who is a currency resident of the Russian Federation:

- persons who have a residence permit in Russia;

- legal entities registered in the Russian Federation;

- municipal subjects of the Russian Federation.

The turmoil around the interpretation of this term is not accidental. The number of duties for citizens of the Russian Federation is increasing every year.

Responsibilities of a resident

- Notify about the opening and closing of an account in foreign banks. For violation of the requirement, a fine of five thousand rubles is provided.

- Do not allow funds from illegal transactions, in particular, income from the sale of property, to be credited to the account. For violation of the requirement, a currency resident is obliged to pay a fine in the amount of 75% of the transaction volume.

- Since 2015, individuals are required to submit annual (until June 1) reports on the movement of funds. For the primary violation of the established procedure, a fine of 3,000 rubles is provided, and for a second violation - 20,000 rubles.

How to report

The report can be compiled in paper form and submitted directly to the Federal Tax Service or sent through your personal account on the taxpayer's website. The first page contains information about the applicant,and on the second - about the currency account. A separate copy of the second sheet is provided for each account. The Federal Tax Service, within its powers, may request additional documents confirming the operation. They have a week to prepare. In particular, they may request:

Report on the movement of funds on the account (it is better to ask the bank in advance) is also accepted in electronic form

- Notarized copies of documents from the bank and their certified translation into Russian.

- Declarations, passports of transactions and agreements, according to which the tax authorities may request information.

After submitting a report on any income, a currency resident is required to pay personal income tax. Legislation provides for the taxation of dividends (13% and 15%, respectively, for residents and non-residents), income from operations with the Central Bank:

- 13% for individuals resident persons (30% - for non-residents);

- 20% for legal entities persons - (non) residents.

In order to avoid double legislation, Russia has concluded agreements with 80 countries of the world. For some types of income, a resident can pay taxes only in the host country. For example, if a taxpayer has paid a tax on rental income at a rate of more than 13% in the host country, nothing needs to be paid in the Russian Federation. But so that the Federal Tax Service does not have any questions, it is better to provide a copy of the foreign tax return and payment documents. If a trustee is engaged in real estate management, then a certificate must be obtained from him, since in this situation he istax agent.

Confession

To avoid claims for payment of fees for previous years, you can use the capital amnesty - submit a special declaration before July 1, in which you indicate the balance of the account and attach a notice of its opening.

The capital amnesty also applies to illegal transactions. You can transfer salaries, travel allowances, social benefits to a foreign account. In the OECD and FATF countries, it is also allowed to credit loans in foreign currency, income from renting out property, and coupon income. However, it is forbidden to transfer grants and income from the sale of property. Violation of this requirement is subject to a fine of 75% of the transaction amount. In practice, it looks like this. If a foreign account received an income of $100 from the sale of the Central Bank, then $75 will be used to pay off the fine. But if you have time to submit a special decoation before June 1, then liability can be avoided.

Administrative responsibility

A currency resident (non-resident) is liable only for those offenses in respect of which his guilt is established (Article 1.5 of the Code of Administrative Offenses). In this case, a decision on an offense can be issued after 2-3 months from the date of its commission. As part of the case pending in court, the terms of liability have been increased to two years.

If the Federal Tax Service independently finds out about the existence of a foreign currency account, then the resident will be fined in the amount of 5 thousand rubles. If he reports immediately after the deadline, that is, on June 1, then the amount will be reduced exactly 5 times.

If the currency resident did not have time to submit a report after receiving the request, the fine will be 300 rubles (if there is a delay of ten days) and 2.5 thousand rubles. (when delayed for a longer period). For a repeated violation, a fine of 20 thousand rubles is provided.

If a foreign currency resident has not announced the opening of an account, but will constantly receive income from it, then this is regarded as tax evasion. The Federal Tax Service will still oblige to pay fees and impose a fine in the amount of 100-300 thousand rubles.

Check

How does the Federal Tax Service know that a foreign currency resident (individual) has a foreign account? So far, only from the taxpayer. Since 2018, the Russian Federation has been joining the automatic information exchange system on tax issues. Therefore, the Federal Tax Service will find out information in a timely manner.

There are situations when a currency resident himself is interested in informing the Federal Tax Service about opening an account. For example, in order to transfer funds from your account in the Russian Federation to a foreign bank, you need to provide a notification to the Federal Tax Service about opening one with a note that the document has been accepted. This is a mandatory requirement for all clients. Wanting to bypass it, citizens transfer funds to the accounts of third parties. But the legislation of some countries only allows the receipt of funds to your account with confirmation of the origin of the money.

Citizens who previously notified about foreign accounts also fell into the risk zone, until 2015 they were not closed and did not provide information on time. Such persons may be prosecuted foran administrative offense with a fine of 10 thousand rubles. and a ban on leaving the territory of the Russian Federation.

Salary in a foreign company

You can also get paid abroad. At the same time, it is desirable to be absent from the homeland for more than 183 days a year. In this case, the person is removed from registration in the Russian Federation. There is no need to talk about currency residence. Short visits are not binding. Registration at customs can be required only for trips for a period of 90 days or more. In other cases, reporting on foreign accounts is not required.

CB trading

Only in OECD and FATF countries, coupon, interest income on transactions with the Central Bank, payments on bonds, income from trust management can be credited to the account. All these transactions are taxed at a rate of 13%. Tax is also levied on exchange rate differences. Therefore, the tax rate is calculated based on the converted amount.

From 2018, changes regarding the transfer of income from the sale of securities to the account should come into force. To date, such transactions are prohibited on accounts opened in any country in the world. It is also worth noting that the redemption of bonds is not a sale of the Central Bank. Such operations are not subject to currency restrictions.

Useful Resources

Firstly, residents must create a personal account on the website of the Federal Tax Service without fail. Then all issues with the fiscal authorities can be resolved without coming to Russia.

You can track the debt on administrative fines on the website of the Federal Judicial Servicebailiffs.”

Sometimes it is better to cancel the status of a currency resident and deregister than to argue with the Federal Tax Service.

Conclusion

Currency legislation is designed in such a way that people do not have any desire to export capital abroad. Standard currency transactions between residents can be carried out without additional red tape, and transferring funds to your own account in another country can cause a lot of difficulties. It is better to violate the reporting deadline than to ignore this requirement altogether. The Federal Tax Service sooner or later will find out about the existence of the account anyway. And then additional taxes will be assessed and a huge fine will be imposed.

Recommended:

How to pay less for utilities in accordance with the legislation of the Russian Federation

In search of methods to save the family budget, citizens often resort to a variety of tricks, while ignoring affordable and simple ways to save money. A vivid example of this is the receipt of benefits and other concessions in terms of payment for housing and communal services. Only certain categories of citizens can receive them, for example, families with disabled people, parents with many children, low-income people

Is a seal mandatory for an individual entrepreneur: features of the legislation of the Russian Federation, cases where an individual entrepreneur must have a seal, a confirmation l

The need to use printing is determined by the type of activity the entrepreneur carries out. In most cases, when working with large clients, the presence of a stamp will be a necessary condition for cooperation, although not mandatory from the standpoint of the law. But when working with government orders, printing is necessary

Tax residents of the Russian Federation are What does "tax resident of the Russian Federation" mean?

International law widely uses the concept of "tax resident" in its work. The Tax Code of the Russian Federation contains fairly complete explanations of this term. The provisions also set out the rights and obligations for this category. Further in the article we will analyze in more detail what a tax resident of the Russian Federation is

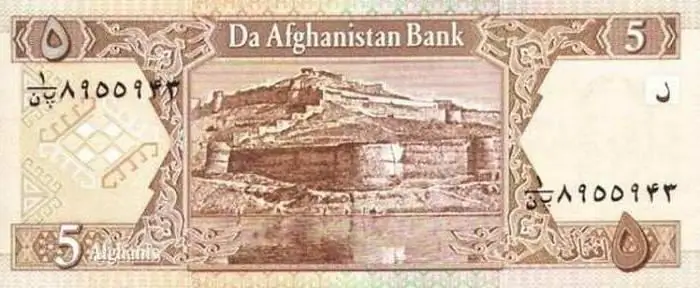

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article