2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Form 6-NDFL was introduced by the tax service of Russia on October 14, 2015 by order of the MMV 7/11/450. According to this order, all tax agents (companies, enterprises, institutions, etc.) that pay individuals monetary remuneration for work and make other payments from which income tax is withheld, are required to submit a declaration in the form of 6-NDFL from 2016.

Calculation of 6-personal income tax - quarterly, consists of only two sections, its structure has not changed since the adoption of the Law.

However, to date, the report is the most difficult for accountants, filling it raises a lot of questions, and the answers of the tax authorities are not always unambiguous.

Often an accountant (especially a beginner) is baffled by the question of how to reflect vacation pay in 6-personal income tax.

Some typical situations for the payment of vacation pay, which cause difficulties when filling out the lines of the report, will be considered below.

Content 6-personal income tax

Declaration 6-personal income tax consists of two information sections.

The first one reflects the summary information:

- the amount of income (for the whole enterprise), accruedemployees;

- calculated personal income tax for the whole enterprise;

- withheld personal income tax.

All amounts are indicated for the tax period from the beginning of the year for each tax rate.

The second section contains detailed information on each transaction with which it is necessary to withhold tax (personal income tax).

Its main indicators are:

- day of receipt of actual income (reflected on line 100),

- day withholding income tax (shown on line 110),

- day, no later than which, according to the law, the withheld tax must be transferred to the tax authority (line 120),

- pre-tax income (line 130),

- withheld income tax (shown on line 140).

6-personal income tax: the rule for reflecting vacation pay

From the payment of wages, bonuses and some other payments subject to personal income tax, vacation pay differs by the deadline for paying tax (personal income tax) to the budget.

So, how to reflect vacation pay in 6-personal income tax? When reflecting vacation pay in the 2nd section of the declaration, it is important to remember the basic rule: payment of income tax on paid vacation pay should be made no later than the last day of the month in which vacation pay was paid.

So, if vacation pay was paid, for example, on June 20, 2017, then the deadline for paying income tax on them is 06/30/17 (working day). Therefore, regardless of what date the tax was actually transferred, the date is entered in 6-NDFL on page 12006/30/17.

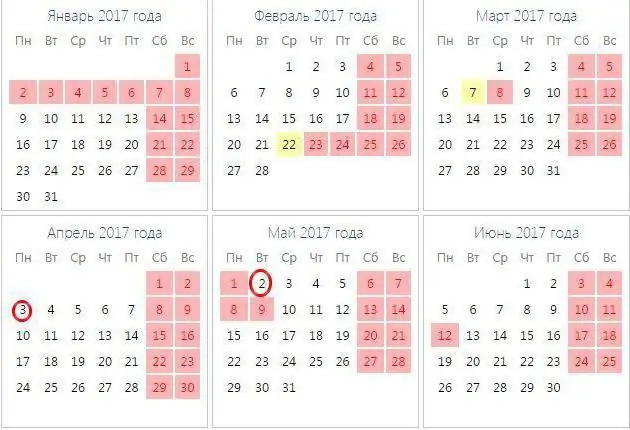

If the deadline for transferring tax to the budget falls on a "red" day of the calendar (holiday or weekend), then the last day of payment is the next business day of the next month.

For example, vacation pay was paid to an employee on April 28th. The last day of April (April 30) fell on a day off (Sunday), the working day (nearest) - May 3. Line 120 records the date 2017-03-05.

You should fill out the report even more carefully if the end day of the month turned out to be not only a weekend, but also the last day of the quarter. In this case, the income tax payment deadline falls on the next business day of the next quarter (this situation occurred in December 2016), vacation pay paid is indicated in the next reporting period.

Example: holiday pay in December 2016

How to reflect the rollover vacation pay in 6-personal income tax is indicated in the examples below.

In December 2016, OJSC "Privet" accrued vacation pay to the following employees:

- Sergeev L. Yu. - 12/15/16 - 28,000 rubles;

- To Kozlov P. I. - 30.12.16 - 14000 rubles.

When paying out of vacation pay, tax was withheld at a rate of 13 percent:

- 28000 x 13%=3640 rubles;

- 14000 x 13%=1820 rubles.

Vacation pay was made:

- Sergeev L. Yu. - 12/15/16;

- To Kozlov P. I. - 30.12.16.

Tax (3640 + 1820=5460 rubles) was paid to the budget on 12/30/16.

31.12.16falls on a weekend, so the last day for transferring personal income tax is 01/09/17, which is the 1st working day in 2017.

How to reflect December vacation in 6-personal income tax? Vacation pay paid in December should be reflected in the report for the 4th quarter of 2016 and in the 6-NDFL declaration for the 1st quarter of 2017.

4th Quarter Report:

- accrued vacation pay (28000+14000=42000 rubles) are reflected in the first section of the 6-personal income tax form in line 020,

- accrued tax (3640+1820=5460 rubles) is reflected in the first section on line 040,

- tax withheld (5460 rubles) is reflected in line 070.

- transactions are not displayed in the second section, since the deadline for paying personal income tax to the budget for vacation pay falls on the 1st working day 01/09/17.

Report for the 1st quarter of 2017:

- in the first section, the amounts for these operations are not shown,

- in the second section are displayed as follows:

100 12/15/16 130 28000

110 12/15/16 140 3640

120 01/09/17

100 12/30/16 130 14000

110 12/30/16 140 1820

120 09.01.17.

Example: holiday pay in June 2017

How to correctly reflect vacation pay in 6-personal income tax in the last month of the quarter, if the last day of the month is a working day, consider the example of June 2017.

The date on which vacation pay is received is always the day their employee is paid.

The tax withholding date must coincide with the day the income is paid, since income (in this case vacation pay) is paid minus income tax.

Vacation paid in June. The last day for transferring personal income tax to the budget is June 30, which is a working day. Vacation pay paid in June does not roll over to July (the next reporting period), but is reflected only in the half-year report.

Let's consider 6-personal income tax (an example of filling for half a year) in terms of vacation pay.

In June 2017, Privet LLC paid vacation pay to the following employees:

- To Ivanov K. Yu. - 16/06/17 - 28000 rubles;

- V. V. Petrov - 30/06/17 - 14000 rubles.

When paying from vacation pay, income tax was withheld at a rate of 13%:

- 28000 x 13%=3640 rubles;

- 14000 x 13%=1820 rubles.

Income tax was transferred to the budget on 2017-06-30.

In the 6-personal income tax form, an example of filling which is being considered, for half a year these operations should be reflected in the first and second sections:

- in section 1, vacation pay is included in lines 020, 040 and 070;

- in section 2, lines 100-140 are filled in as follows:

100 06/16/17 130 28000

110 06/16/17 140 3640

120 06/30/17

100 06/30/17 130 14000

110 06/30/17 140 1820

120 06/30/17

How to reflect the recalculation of vacation pay

There are situations when vacation is issued in the first days of the month. Vacation pay is paid before the start of the vacation, that is, at the end of the month that precedes the month the vacation starts.

How to reflect the payment of vacation pay in 6-personal income tax? A sample is shown below.

Suppose an employee took a vacation for the period from 2017-03-07 to 2017-17-07. Accountants were accrued and paid vacation pay on June 30, when paying them, the tax transferred to the budget on June 30 was withheld.

Vacation pay (10,000 rubles) was accrued without taking into account earnings for the last month (in this case, earnings in June are not taken into account. When calculating wages for June 2017, the amount of vacation pay will be recalculated. It will amount to 12,000 rubles. Additional accruals for vacation - 2000 RUB Tax withheld from the additional accrued amount - RUB 260 Payments will be made along with wages - 06/07/17.

6-personal income tax for six months (half a year) is formed as follows:

- In section 1, the recalculated (correct) amount of vacation pay is recorded in line 020.

- In section 2 lines 100-140 are filled in:

100 06/30/17 130 10 000;

110 06/30/17 140 1 300;

120 06/30/17

In the nine-month report (third quarter):

- In section 1, the amounts additionally accrued for vacation are not reflected.

- The following lines are filled in section 2:

100 07/06/17; 130 2000;

110 07/06/17; 140 260;

120 31.07.17.

How the tax authorities check

After receiving the report, the tax authorities enter the deadlines for paying tax on lines 120 and withheld personal income tax on lines 140 in accordance with 6-personal income tax in the company's settlement card with the budget. Then, the dates and amounts of actual payments to the budget by the bank are compared.

If the check reveals that the income tax indicated on lines 140 was paid in a smaller amount or later than the day,specified in lines 120, then the arrears are reflected in the company's card on settlements with the budget.

The company is fined: 20 percent of the amount of unwithheld or overdue tax.

Conclusion

The process of generating the 6-NDFL reporting form raises many questions for accountants. It is small, but contains many nuances. Not always the accountant correctly reflects certain transactions. Sick leave, bonuses, vacation pay … How to reflect in 6-personal income tax? The above are just some of the aspects of filling.

It must be remembered that if you made a mistake with the dates when filling out, but the tax was paid on time and in full, then you should explain this with your mistake and submit the updated calculation to the tax office. This way you will avoid unpleasant sanctions from the tax authorities.

Good luck with your reporting!

Recommended:

How to create a reserve for vacation pay. Formation of a reserve for vacation pay

In art. 324.1, clause 1 of the Tax Code contains a provision requiring taxpayers who plan to calculate the reserve for vacation pay to reflect in the documentation the method of calculation they have adopted, as well as the maximum amount and monthly percentage of income under this article

Advances on income tax. Income tax: advance payments

Large Russian enterprises, as a rule, are payers of income tax, as well as advance payments on it. How are their amounts calculated?

Tax return for land tax: sample filling, deadlines

A land tax return must only be filed by companies that own plots of land. The article tells what sections this document consists of, as well as what information is entered into it. The terms during which the documentation is submitted are given. Describes pen alties for companies violating legal requirements

Deadline for filing income tax return. What is required for income tax refund

Income tax refund is very important for many citizens. Everyone has the right to return a certain percentage of the funds spent. But what documents are needed for this? And how long will they make the so-called deduction?

Income tax on wages with one child. Income Tax Benefits

Today we will learn how income tax is calculated from a salary with one child. This process is already familiar to many citizens. After all, families often enjoy a variety of benefits. Why not, if the state gives such an opportunity?