2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Today, many young managers do not have sufficient experience in personnel management. Even if the workflow can be established independently, non-executive or inexperienced staff will cause many problems. A simple worker can be quickly trained, but this will not work with the employees of the administrative apparatus, because the quality of their work can be assessed only by the results of the reporting period. So it turns out that after a year of so-called "successful work" it is necessary to restore accounting and adjust reporting documents. Faced with such a situation, business people turn to outsourcing organizations for help, for which the restoration of enterprise accounting is one of the main areas of professional activity.

Every day this type of service is gaining more and more popularity inentrepreneurial practice. They have already occupied their niche in the management of organizations, maintenance of production, ensuring the functioning of offices, transport services, advertising, security and many other areas of modern business. And there is a completely logical explanation for this - a lot of advantages, including accounting services, accounting restoration, and many other areas.

What is outsourcing and "what does it eat with"?

The word itself was borrowed from English. Literally translated, it refers to the use of a third-party external resource or source. In reality, this concept involves the transfer of rights to perform certain business processes (for example, the restoration of tax accounting) from one legal entity to another. And don't confuse outsourcing service with support and maintenance services - there is one significant difference between them - time. Support and service can be provided once or for a short period of time, for example, a reporting period, while the contract for outsourcing work is valid for at least one year. Over the course of 12 months of close cooperation, professionals from a third-party company not only restore accounting for previous periods, but also professionally work on current documentation.

Advantages of outsourcing in the field of business accounting:

• No costs for the arrangement and maintenance of workplaces.

• Savings due to the absence of the need to purchase and maintain fixed assets, office equipment and MSHP.

• Reducing the amount of liabilities for taxes and compulsory social insurance funds.

• Checking and restoring tax records for previous periods.

• Efficiency in the provision of any reporting in order to monitor the implementation of the business process.

• Using the latest technologies and software to improve the enterprise management system.

Due to all the above advantages, the use of accounting outsourcing services is the most profitable option for managing an enterprise. Restoration of accounting, ongoing management of the enterprise, consulting services in accordance with applicable law are just a small part of the privileges that a business owner will receive by signing an agreement with an outsourcing agency.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Formation of accounting policy: basics and principles. Accounting policies for accounting purposes

Accounting policies (AP) are specific principles and procedures applied by the company's management for the preparation of financial statements. It differs in certain ways from accounting principles in that the latter are rules, and policies are the way a company adheres to those rules

Tax accounting is The purpose of tax accounting. Tax accounting in the organization

Tax accounting is the activity of summarizing information from primary documentation. The grouping of information is carried out in accordance with the provisions of the Tax Code. Payers independently develop a system by which tax records will be kept

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation

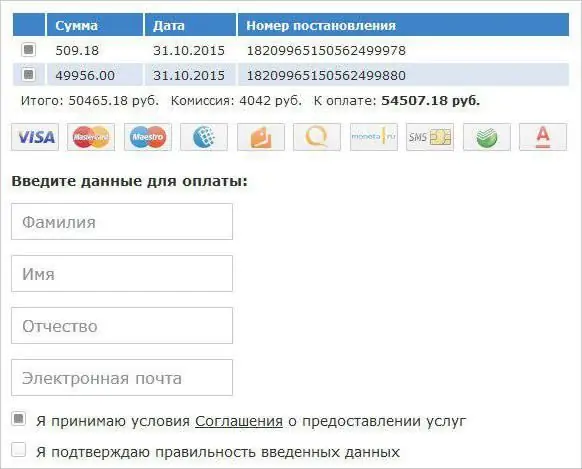

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way