2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

More and more citizens are interested in how to check the taxes of an individual by last name. Solving the problem is not as difficult as it might seem. It is advisable to have a TIN with you. This data helps to double-check the debts, as well as to make sure for 100% that there are no errors in the issued results. Citizens are provided with quite a few alternative solutions. Therefore, they should not be neglected. You can find out about debts without leaving your home. But how to do that? How to find out tax debts by last name? The instructions that will be offered below will help you understand the questions posed.

Preparation

The first thing to pay attention to is the preparation stage. It is recommended that you take this matter seriously. After all, proper preparation is the acceleration of the verification process several times.

The first step is to prepare a few documents. Namely:

- identity card of the citizen-applicant;

- F. I. O. of the payer(if there is no passport);

- TIN.

With this information, you can already find out 100% about your debts. However, quite often you can get by with either only the F. I. O., or the TIN. Here the citizen himself must decide what data to use.

According to receipt

You can check the taxes of an individual by last name using a receipt. At the moment, at a certain point in time, the tax authorities send a written notification regarding payments to each payer. Along with the letter comes the corresponding payment receipt.

As soon as the payment has arrived, it is worth checking the recipient's information. If the F. I. O. match, then the debt takes place. And in this situation, you just need to pay the invoice. And keep the receipt. He will be able to confirm the absence of debt if there is a delay in the receipt of funds by the tax authorities. Nevertheless, many are thinking about how to check the taxes of an individual by last name in the event that the payment is lost. What to do under such circumstances?

Call the tax office

For example, you can call the tax office. And in the help desk to clarify all the information of interest. To do this, it is recommended to name not only the recipient's personal data, but also his SNILS, as well as TIN.

It is necessary to make calls to the regional tax office. It is there that all questions will be answered. Moreover, if necessary, you can ask to send a new payment to pay the bill. It is not difficult, although, as practice shows, this option is notin demand.

Visit to the tax office

Tax debts of individuals by last name can be checked personally. More precisely, through a visit to the territorial tax authority. The method works 100%, but takes a considerable amount of time.

How to proceed? The algorithm is simple:

- Collect all identification documents. Namely: passport and TIN. You can take SNILS with you.

- Go to the county tax office and go to the personal service window.

- Write an application for the issuance of information about debts. Sometimes it is allowed to do without it - it is enough to verbally ask employees to provide the information of interest.

- Provide a passport and TIN for identification.

- Get result. As a rule, if there is a debt, the citizen is given payment slips to pay.

However, many continue to be interested in other ways, how to check the taxes of an individual by last name. After all, there are several more options.

Payment for public services

Now you can move on to more modern methods of verification. For example, each Internet user is invited to use the portal "Payment for public services". It helps not only to pay bills, but also to check debts.

How is it done? The algorithm of actions is simple:

- You need to go to the site oplatagosuslug.ru.

- Select menu item"Debt on taxes". Next, a data source is selected. It is very convenient to use the TIN.

- Enter the relevant data in the designated fields.

- Click on "Find". A few seconds of waiting - and the result will be displayed on the screen.

Fast, convenient, practical, safe. Perhaps this is one of the most popular verification methods. The main advantage of the service is that you can easily pay your debts without leaving your home.

Public Services

Checking an individual's taxes by last name is not that difficult. Especially with modern technology. The fact is that now all residents of the Russian Federation can use the Gosuslugi website. This service helps not only to process documents online, but also helps to check debts. For example, fines. So it's not just taxes that are checked this way.

Nevertheless, many citizens are wondering how to find out tax debts by TIN without using the portal being studied. Usually these are people who do not have their own account on the page. Registration takes a long time. Therefore, you should not consider such an offer if you urgently need to find out about the debt, but there is no profile on Public Services.

So how to check an individual's taxes? By TIN or F. I. O. - this is not so important. "Gosuslugi" offers the following algorithm of actions:

- Register on the portal gosuslugi.ru.

- Activate your account and complete your profile. It takes about 14days. After checking the user information, the citizen will receive a notification by e-mail.

- Log in to the portal.

- In the search bar in the "Services" item, type "Taxes by TIN" or "Taxes by last name".

- Select the corresponding row after the search results are returned.

- Dial the necessary data in specially designated places and confirm the information.

- Wait for test results.

In this regard, the site "Payment for public services" is in great demand. All this due to the lack of the need for registration. But through "Gosuslugi" you can find out your tax debt of individuals by last name.

Inland Revenue website

As an alternative solution, it is proposed to use the site nalog.ru. There is a so-called "Personal account of the taxpayer". It has a debt check feature.

Quite popular and reliable way. How to check the taxes of an individual by TIN? To do this, you need:

- Get a login and password from the tax service for authorization on the official website of the Federal Tax Service. To do this, you must submit an appropriate application.

- Go to the "Taxpayer's Personal Account" on the nalog.ru page. The authorization field is located on the right side of the window.

- Select "Debt check" function.

- If the system requires, then enter data about the payer. Most oftenthis is either a surname and a first name with a patronymic, or only a TIN number.

- Wait for scan results.

Nothing more is required from the citizen. Everything is pretty easy and simple. However, the possibilities do not end there. How to find out tax debts by last name or TIN? There is another good way to check. But it should be noted that it is not suitable for everyone. Typically used when there is a long delay in payment.

Site of bailiffs

The fact is that if a citizen is thinking about how to check the taxes of an individual by last name, you can go to the website of the bailiffs of the Russian Federation. And, accordingly, search for information about yourself in a special database of debtors.

The challenge is brought to life in several ways. Or a citizen is looking for information by TIN and last name or by the number of the executive office work. The first option is the most common.

This requires:

- Go to fssprus.ru/iss/ip.

- Enter the requested data about the payer.

- Click on the "Find" button and wait for the result of the check. If there is a debt, a notification will appear on the screen.

That's it. There are no other significant ways that will help answer how to find out the tax debt by TIN. Although you can use the "Debt Check" service in electronic wallets and Internet banking. But there the process is exactly the same as when using"Gosuslug" - data on a potential debtor is entered and the result is expected. Tax debts of individuals by last name or other data are checked without much difficulty.

Recommended:

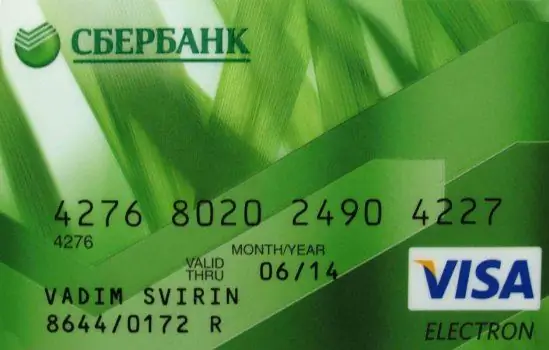

How to find out the pincode of a Sberbank card if you forgot: step by step instructions, recommendations and reviews

The popularity of cash payments is gradually declining, and users prefer plastic cards. This is quite convenient, as it eliminates the need to carry money with you, and if you lose it, your savings will not be affected. After all, a bank card can be restored. Seemingly solid benefits

Tax deduction when buying an apartment for an individual entrepreneur - step-by-step instructions for registration and recommendations

Tax deductions are a government "bonus" that many citizens can count on. Including entrepreneurs. This article will talk about property deductions for individual entrepreneurs. How to get them? What will be required for this? What are the most common challenges people face?

How to issue a TIN for an individual - a step-by-step description, documents and recommendations

This article will tell you everything about how to get a TIN. What kind of document is this? How and where can it be done? What features of obtaining a TIN do you need to know?

Check the OSAGO policy for PCA - step by step instructions and recommendations

The article describes how to check the authenticity of OSAGO on the official website of the PCA. The main types of false policies are also considered

How to check the balance of a bank card via the Internet - a step-by-step description and recommendations

You need to be able to work with bank cards. One of their main functions is to check the status of the account. This article will tell you how to check the balance of a bank card