2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

On the eve of celebrations, most Russians spend a significant amount of time in shopping centers in order to make big purchases. We are talking not only about purchases for the home, such as furniture sets, decor items or electrical appliances, we should talk about presents, gifts, clothes, and in addition, about the grocery basket. From this, a logical question arises. How will it be more convenient and more useful to pay at the supermarket?

It's paradoxical, but most experts say that as a result of paying with a bank card, the consumer usually spends 30% more money than if he paid in cash, but in fact, it is the bank card that can be of great benefit to the user and become for it's a lifesaver in saving money.

Next, we should talk about purchases made with a worker's pay card. To begin with, it must be emphasized that it is profitable and practical to use this method. For you, you simply need to find out and remember the addresses of ATMs of your bank, and also, you need to know where it will be convenient for you to withdraw money in the absence of a commission. But numerous cases prove that people, despite their knowledge in the workplace, still confuse a salary card with the account to which they receive funds, say, according to a partnership agreement.

First meeting

It should also be said that if all employees use a salary card in a certain bank, then this determines the benefit of the organization itself, as well as more favorable conditions for all users. You need to know that if a person is an out-of-state employee and is going to open an account independently of the company, then in any case it is necessary to be aware of all applicable tariffs and prices. This is necessary due to the fact that the bank writes off a certain amount of money as a result of any operations or simply for service.

Now it's time to get to the heart of our question and talk about interest-free credit cards. Of course, it will not be a surprise for you that earlier you were already offered to issue a plastic card at the bank. It is worth understanding what the basic principles of a bank card are based on and what is its essence? For a certain period (generally thirty to fifty days) youyou can spend money from this card to purchase any things you need, after which you can return this money to the bank without an interest deposit.

This kind of action will be comfortable if you need to immediately purchase something, but funds for the purchase of this product will appear only after a certain time. The scheme is that you borrow from the bank before you have money, you will receive wages.

However, this type has two major disadvantages. With a card, it is possible to pay interest-free only for goods, and if you want to withdraw cash, you will have to pay a significant amount of money. In addition, if you fail to return the funds within the allotted time and deadlines, then you will receive only huge interest and no benefit.

Unfortunately, very often people find themselves in unpleasant situations: for months, and some even for years, they pay only interest on a loan and cannot get out of this debt hole.

Next, it makes sense to talk about paying in cash and the pros and cons of this type of funds. Firstly, with regard to paying in cash in shopping centers, then paying in cash is much more comfortable and cheaper - this is exactly what psychologists believe. But almost all these words are quite relative, since in most cases everything depends on the person himself, his preferences and tastes. And in these conditions there are pluses and minuses: when a person pays for purchases in small changeout of his wallet, he is rarely fully aware of how much and on what he spends. In general, the buyer does not attach importance to the little things, although they can be a significant amount.

Of course, it cannot be denied that when paying with a card, you can lose track of money and part with a fairly large amount of money. In order to control how it is cheaper and more profitable for you to pay in shopping centers, do some experiment with yourself. To get started, go to the supermarket with cash, and in the second case, take a bank card with you. It is not allowed to take the list of proposed purchases! Then compare the funds spent and decide which payment method will save you the most money.

The next, no less burning topic that will help us understand the issue is how to pay abroad? Most Russian travelers choose to pay by cards. It is very practical and expedient to do this abroad - in many states, cards are accepted, including in small shopping centers, cafe-bars and souvenir shops. Without exception, all issues can be discussed at the bank that provides services to you. A share of the funds must be taken in cash in order to pay for services, provide money for tips and pay for vehicles.

Sberbank card "Maestro"

In today's abundance of gadgets, technical devices and a variety of bank cards, it is very difficult to choose for yourself a convenient and really comfortable card that wouldcorresponded to all the preferences of the client, would coincide with his taste. We can say with confidence that every person at least once in his life experienced inconvenience associated with the method of payment for his purchases. Surely no one wants to experience the embarrassment of standing in a long line at a hypermarket with the inability to pay for a large number of products of your choice.

Sberbank's "Maestro" card is easy to use and saves its client from technical failures and malfunctions. This is a debit card, which is most often issued at work or in higher education institutions as a scholarship or salary. There is also a Sberbank Maestro pension card. I would like to add that the Maestro card has international status and is included in the MasterCard system, thereby expanding the scope of its capabilities, giving the client a new, more advanced range of services.

When a client issues a "Maestro" card, he becomes the owner of a debit card of the simplest level. From this very moment, a person can use his money through a cashless payment. This applies to paying for various purchases, money transfers, as well as managing your own account through the Sberbank-online telephone application. As for the tariff plan for the annual service of this card, it is quite budgetary and amounts to about 300 rubles a year, and the card is issued to pensioners absolutely free of charge.

Social card "Maestro"

Starting a conversation about what the Maestro social card of Sberbank is and to whom it has the right to be issued, it should be said that not all categories of the population can acquire this version of the card. In order to receive a social card, you need to have the right to receive a pension either for old age or as a result of any other life situations: disability, loss of a breadwinner in the family, and so on. The Bank has the right to issue a card to a needy citizen over the age of 14, if this person has Russian citizenship, permanent registration in the region where the card is issued to him. If there is no registration, then the right to choose and make a decision remains with the bank issuing the Maestro social card of Sberbank.

Next, you should specify what needs to be done and what documents to issue in order to be able to get a social card. If you have a certificate for receiving a pension, you need to contact a branch convenient for working with Sberbank and make a request for the creation of a Sberbank Maestro pension card. You also need to show a passport of a citizen of the Russian Federation and a pension certificate. Next, you will need to fill out all the necessary documents, an application and, finally, submit papers to the pension fund and wait for the social card to be ready.

As for the interest on the Maestro card of Sberbank, they are credited to the pension card in the amount of 3.5 percent per annum on the remaining funds of the card. But it should be added that interest will not accrue every month, but after every third month from the date the card was createdand opening an account. Thus, the Sberbank Maestro card becomes very profitable for pensioners.

How to make transfers to the card

A necessary function, which is very relevant in the modern fast pace of society, is the transfer of funds to clients of various banks. There are many different ways to transfer funds to the Maestro card of Sberbank. One of the most common is an ATM transfer, where the client only needs the card number to which he wants to transfer a certain amount of money.

Also, often clients make transfers through bank cash desks, but for this a person will already need a passport of a citizen of the Russian Federation, which is a little more difficult than in the first case. Money can be transferred to the Sberbank Maestro card both at home and at work, as they say, "on the spot." This can be done through the mobile application on the phone "Sberbank online" or by sending a message with the text "Transfer" to number 900. This procedure saves a lot of time, allowing the user to complete the entire procedure easier and simpler, without spending much effort.

Loan on "Maestro" card

Now you know how to transfer a sum of money to the Maestro card of Sberbank. As it turned out, the translation procedure is not so complicated, if you look. But no less relevant is the issue of a loan to the Sberbank Maestro card. Let's take a closer look at this, no less exciting for many customers.question. It is worth noting the fact that loans are widespread in the modern world.

It is not difficult to get a loan these days, and there are also no problems in transferring this same loan to a Sberbank Maestro card. Organizations do not require too much from customers, there are no strict restrictions on obtaining a loan of up to 15 thousand rubles. The client must be over 18 years old and must have a passport at the time of execution of the contract. The payment for such a loan is the interest rate. In Moscow and the Moscow region, it is about two percent per day.

Having filled in all the necessary papers and received consent to issue a loan to the Sberbank Maestro card, the user provides the card details and receives the amount of money in non-cash funds. You can apply for a loan both in the MFC and online. Organizations issuing permission for these loans work on weekdays and holidays, which makes issuing a loan a convenient, simple, but no less effective procedure.

Maestro Card Benefits

After getting acquainted with the Sberbank Maestro card and deciding how to transfer money to it, it is worth talking about other advantages of cashless payments on this card. The first and most important plus of the Maestro card is that it has low tariff plans for customer service, which helps to save a decent amount of money.

Also, a significant advantage of the Sberbank Maestro card is that salarycards do not charge commission payments, like many other types of bank cards. The card is good because it makes it possible to pay for products and things at the terminals of retail chains, and also, the client can withdraw money from the Maestro card at terminals abroad. As mentioned earlier, this is an international card, which makes life easier for its owner and gives more and more opportunities.

Disadvantages of the Maestro card

All things, one way or another related to technology, have their advantages and disadvantages. Without it, nowhere. We learned about the benefits. Cons of the Sberbank Maestro card will be described below. Speaking about the strengths, we said that the Maestro card is accepted for payment abroad, but, unfortunately, in some countries, for example, in Chile, it will not be possible to pay with it. This is the weak point of this card. Also, if you have an unnamed card, then be prepared to present an identity document, for example, when buying real estate, a car.

It should be added that this type of card does not have the possibility of emergency cash withdrawal, so, once abroad, it is unlikely that a person will be able to quickly withdraw the amount of money he needs. But despite this, a large number of people who are satisfied with the service use the card.

What is the Sberbank card "Mir Maestro"?

The "World of Maestro" card of Sberbank appeared relatively recently, but today it has gained popularity among users of non-cashcalculation. One of the advantages of this card is that it has a chip and is free to maintain. It is also quite possible to urgently issue a card and free statements on your personal account. But, unfortunately, there are also disadvantages on the World map.

Firstly, the card itself has a rather short validity period, which is 2 years. It should be said that this type of card has a restriction on withdrawing the amount in cash, which complicates the use of the card. But it is impossible not to add that the card still has more pluses than minuses. That is why this type is increasingly being transferred to salary cards.

Card difference

Visa and Maestro cards of Sberbank have differences in use, which are reported by users and customers of banks. Describing what the Visa card is, it must be said that it is the product of a transnational corporation headquartered in the United States. This company annually develops new technologies that occupy the main, leading positions in the market, so this type of card is accepted in many countries to pay for purchases. That is, the "Visa" card is a whole, regulated payment system that has its own tools, and, in turn, the "Maestro" card is just one of the types of MasterCard cards.

But it's really hard to find differences in how these cards work, because in operation they are almost identical, except for small features. For example, if you travel to North American countries, it is better to take a "Visa" with you. And if you are going to visitEuropean countries, it is better to use the cards of the MasterCard system.

Final conclusions about the operation of the "Maestro" card

Based on all of the above, we can conclude that the Sberbank Maestro card is very common in use. Its operation gives an advantage to users, it is easy and convenient to work with. Comfort from using the card and the fact that people are not tormented by the question of how to transfer money to the Maestro card of Sberbank, since all this can be done quickly, without much effort.

This type of card is suitable for different age categories of users, from students to pensioners. Moreover, each client may see a different personal benefit.

Of course, the "Maestro" card has its drawbacks, but they are also present in other types of cards, so they do not interfere with working with this type. It is also adapted for withdrawing money abroad and abroad, which allows you not to think about currency exchange, worry about where to put money, so as not to forget it or be a victim of a thief, a criminal. Summing up, it should be said that the recommendations for purchasing the card can be considered justified.

In closing

We hope that our article was useful to you in many ways. Now you have a clear idea about the Sberbank Maestro card, its main nuances, advantages and disadvantages.

Employees of the popular and one of the largest banks in Russia, Sberbank, are always ready to help their clients inissuance of debit cards. It all depends on you, the choice is yours, which cards to give preference to.

Recommended:

Welsumer chicken breed: description, content, advantages and disadvantages, reviews

For personal household plots, the breed of chickens is not always chosen by productivity, for some, appearance is important. It is beautiful when birds with bright plumage walk around the yard, which do not need special care. It's even better when external beauty is combined with excellent performance. These requirements are met by the Welzumer breed of chickens. She has many positive qualities, which is why she is often grown in private backyards

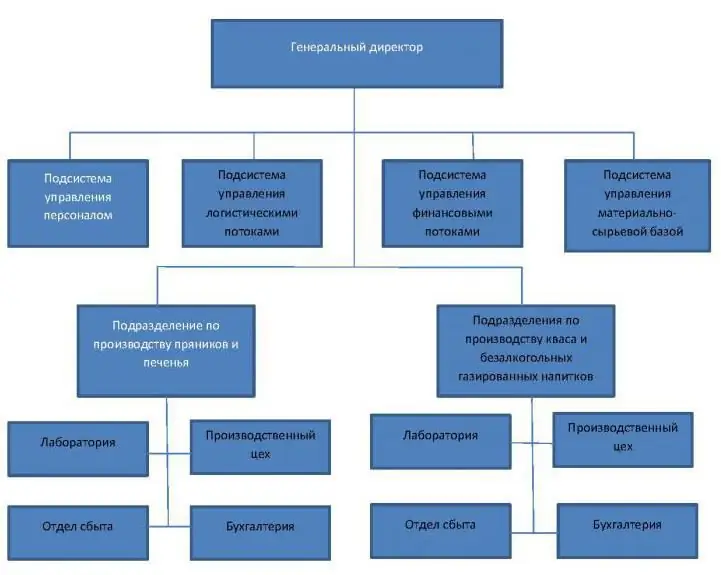

The organizational structure of an organization is Definition, description, characteristics, advantages and disadvantages

The article reveals the concept of the organizational structure of an enterprise: what it is, how and in what forms it is used in modern enterprises. The attached diagrams will help to visually illustrate the use of different types of organizational structures

MasterCard Gold plastic card: service, advantages and disadvantages

MasterCard Gold are prestigious premium gold cards that open up a lot of opportunities for their owners. This is an excellent service and ease of use, no matter where in the world the owner is located. MasterCard Gold provides holders with many pleasant bonuses in the form of discounts, an increased withdrawal limit and high-quality service in restaurants and hotels around the world

Cumulative card: advantages and disadvantages

As practice shows, depositors' confidence in bank deposits during crises falls sharply. In order not to lose their customers, they created a new financial instrument - a savings card. What is a savings card, as well as its advantages and disadvantages will be discussed in this article

Cucumbers Prestige: variety description, cultivation, advantages and disadvantages

Cucumbers are well-deservedly popular with summer residents and farmers. An easy-to-grow crop, it allows you to have fresh vegetables all summer long. Great for pickling and pickling. In winter, this is a great addition to the menu. Even a small garden bed allows you to fully provide the family with this product