2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Voluntary liquidation of an LLC is a kind of official procedure. It is carried out in accordance with the Civil Code and other special laws. At the same time, many people who are going to close the work of a certain enterprise quite often do not know how to properly carry out this procedure and what it basically is.

When is it held?

In the overwhelming majority of cases, the main grounds for the voluntary liquidation of an LLC may be the following factors:

- Loss of interest on the part of the owners in the activities carried out by the organization. In most cases, this item is accompanied by the inability to sell the business.

- Loss ratio of the ongoing financial and economic activities of the company.

- Completion of the period for which a particular organization was created.

- Full achievement of the goals for which she wasopen.

- State of net assets in JSC or LLC.

Decision making

The decision, according to which the voluntary liquidation of an LLC is carried out, is made by a certain body. He receives the powers prescribed in the constituent documents of the company. In modern limited liability companies, this body is the General Meeting of Participants (members, shareholders or other representatives). At the same time, it is worth noting the fact that the voluntary liquidation of an LLC in the form of a non-profit foundation is carried out only if there is an appropriate court decision. During the meeting, the General Meeting considers the following issues:

- Decides on the liquidation of the LLC.

- Assigns an authorized commission. Specifies its chairman.

- Sets deadlines for cancellation, including also notifying all creditors of the cancellation.

From the moment a special commission was appointed, the procedure for liquidating an LLC provides for the transfer of all powers regarding the management of the affairs of this legal entity to it. There are no norms in the legislation that would be entirely devoted to the use of a specific mechanism for monitoring its work. In addition, the responsibility for the commission's actions remains unclear. After all, they can violate the rights of interested parties. It is for this reason that one must be extremely careful in choosing the right candidates for future members of the assembly.

In addition, it should be remembered that significantly changes independing on how difficult the liquidation of the LLC is, the price of this event. Often it starts from 25 thousand rubles. The composition of the commission that controls the abolition, it is customary to include the head, lawyer, chief accountant. It may also include representatives of various founders. In such a situation, the leader is elected mainly as chairman.

Notification authorities

A certain procedure is established, in accordance with which the liquidation of an LLC should be carried out. The price of such an event is negotiated at its first stage. In particular, the founders or a certain meeting of authorized people who make a decision to annul a particular legal entity must make a mandatory notification of their verdict to the state authorities in order to make the appropriate entry of data into the Unified State Register of Legal Entities. It should be noted that this notice must be provided no later than three days after the decision to liquidate the LLC was made.

To do this, the following package of documents is provided to the relevant registration authority, which is the tax office located at the location of the company:

- Notice of the beginning of the liquidation procedure with a notarized signature.

- Message that an authorized commission is being formed. The signature must also be notarized.

- Minutes of the general meeting, at which the decision was made to liquidate the LLC, andthe corresponding commission was also elected.

In the future, the authority will have to enter into the Unified State Register of Legal Entities information that the legal entity has begun the cancellation procedure. From this moment on, the possibility of changes that could be made to the constituent documentation is excluded. As well as any registration of legal entities, the founder of which is this company.

Notification of Funds

In accordance with current legislation, after the closure of an LLC was planned, certain funds must be notified of this procedure without fail. Namely:

- retirement;

- social insurance.

It is worth noting, however, that notice must be given no more than three days after the decision was made.

Notice to creditors

Immediately after the planned closure of the LLC, the relevant commission must place a specific publication in the State Registration Bulletin that liquidation is underway. In addition, the procedure and deadline for filing claims by the company's creditors is established. This announcement must contain the following information:

- Full name of the legal entity.

- His main registration state number.

- Tax payer identification data with registration reason code.

- Address where the person is located.

- Information that a decision has been made. indication of the authoritywho did it.

- Date and number of the decision.

- Terms, procedure, as well as telephone and address where creditors can submit their claims. It is possible to specify other additional information.

Ultimately, the commission, which carries out the independent liquidation of the LLC, takes measures to identify all creditors, and then notifies them in writing of the start of the liquidation procedure.

Commission work

During a certain period of time, creditors can present their claims. At the same time, the commission conducts its work in full accordance with the previously approved and developed plan. In particular, it should include the following list of activities:

- Inventory of all company assets.

- Preparation of information regarding the size and composition of the organization's assets, including the characteristics of the capital to be sold, its condition and liquidity.

- Collecting all the necessary data about the participants who have the right to receive one or another share of the company's property after the LLC is liquidated. The instruction provides for the issuance of shares only after settlements with creditors.

- Compilation of an extremely detailed description of the financial condition of the company at the time of its closure.

- Full dismissal of all employees.

- Establishment of all organizations in which a legal entity acts as a founder. Withdrawing him from their composition.

- Calculations for each territorial and federal payment are verified with the corresponding taxbodies and various off-budget funds.

- A detailed assessment and analysis of receivables is being carried out, as well as activities related to its collection are being developed.

- The characteristics of accounts payable are set.

- The procedure for the sale of all property of a closing company is determined. At the same time, it is grouped according to the degree of liquidity, conditions and opportunities.

- The exact procedure for making settlements with creditors, which relate to a single queue for satisfying claims, is preliminarily determined.

- Documents necessary to exclude the company from the Unified State Register of Legal Entities are being prepared.

Now you understand how the liquidation of an LLC should be carried out. A sample of the necessary instructions during this procedure is issued to the accounting department, as well as to all other services and departments of the enterprise.

Debt collection

In order to recover the debt, the liquidation commission sends letters to debtors. They indicate the requirement for the immediate payment of money or the return of some property. If the debtors refuse to make payment at the moment, then in this case an appropriate lawsuit may be filed in court. Moreover, the members of the liquidation commission will be directly involved in representing the interests of the organization. When a receivable is statute of limitations, it may be included in non-operating expenses, as a result of which it is written off as a loss.

Inventory

In accordance with applicable law, the Commission's duties include inventory of all property owned by the company. When a zero LLC is being liquidated, the procedure is no different from the standard one. In addition, a full review of all positions of liabilities and assets is also carried out. Identified discrepancies between the actual availability of a particular property, as well as accounting data, should subsequently be reflected in the relevant accounts.

Settlement with employees

The fact that a person is going to be fired due to the closure of the company, the employee must be warned by the employer at least two months before the immediate dismissal. Accordingly, he has the right to familiarize himself with the document in which the decision to liquidate the LLC is approved. A sample (it can be seen below) must be shown to all employees. With the written consent of the employee, the employer will be able to terminate the employment contract with him without warning him of the dismissal during this period. But at the same time, he is obliged to pay additional compensation in the amount of the average earnings for two months.

In case of termination of the employment contract due to the liquidation of the company, the dismissed employee must receive severance pay. Its size is equal to the average monthly earnings of a person. But that's not all. The former employee has the right to retain his average earnings during the period of further employment, but not longer than two months from the date of dismissal. Besides,the employee must also be paid compensation for the fact that he could not use his own vacation. In accordance with the laws, the administration of the company must pay the dismissed employees on the last day of their work. If they are absent, then the money is paid to them the next day after the appeal.

Paying taxes

According to the law, the obligation to pay taxes on the part of a liquidated company is assigned to the collected commission from the funds that come in the process of selling the company's property. If she sold certain assets, then she must pay taxes associated with the sale. And the liquidation commission is obliged to provide the tax authorities with the relevant declarations for each individual fee that is payable to the budget until the moment the organization is closed.

But there are other situations. For example, if the funds of a liquidated company, including those received from the sale of its property, were not enough to fully fulfill the obligation to pay fees, taxes, as well as fines and pen alties due, then the founders should be responsible for repaying the remaining debt. But only within the limits and in the manner established by the current legislation.

Tax audit

After receiving notice of the start of the liquidation, the inspection, which represents a potenti althe creditor of the organization in case of underpayment of taxes, begins its own audit. It is carried out for all taxes, regardless of the time at which the checks were carried out earlier. It should be noted that in this case the procedure has been carried out for the last three years. She is visiting.

If such a need arises, all persons who have been authorized by the tax authorities and are engaged in such an audit can conduct a full inventory of the organization's property. And also to inspect warehouse, retail, industrial and other premises or territories that the payer uses to generate income. Or if they are related to the content of any objects of taxation. Based on acts of reconciliation with state bodies, as well as protocols for documentary verification of settlements, the total amount of the organization's debt is established. Now you know how the liquidation of an LLC is carried out (with one founder or several), what it is. The information presented in the article will be useful and instructive for everyone.

Recommended:

Voluntary he alth insurance. Voluntary medical insurance policy

Voluntary he alth insurance is now more preferable than compulsory, as it provides a wider range of specialist services

Voluntary certification. Voluntary certification system

In today's market conditions, the relationship between producers and consumers has reached a new level. A large abundance of different products makes the buyer think and carefully weigh everything in order to choose a quality product. In such cases, confirmation by a third independent party of the conformity of the product to the declared requirements is required. Provides this mandatory and voluntary certification

Liquidation is Briefly about the liquidation of an organization

Sooner or later, the activities of many organizations cease. What is the liquidation procedure? What points are important to observe when liquidating a legal entity so that there are no difficulties?

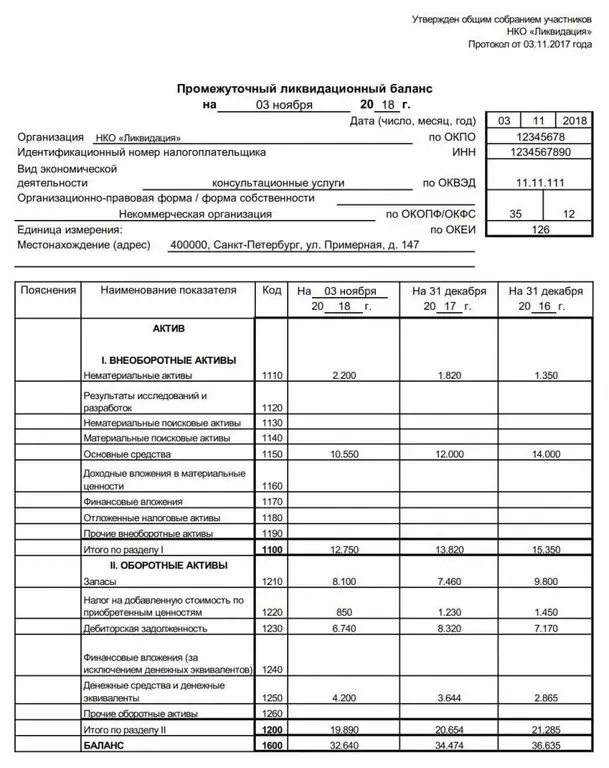

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

How to close an LLC? Step by step instructions 2017

When the owner of an organization asks the question: “How to close an LLC in order to avoid problems with the tax office and law enforcement agencies?” - then, first of all, it is worth understanding for what reason the owners of the organization make the appropriate decision. In each case, the sequence of actions will be different