2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:25

A car for some residents of the Russian Federation plays the role of vital property. But sometimes it's time to get rid of the vehicle. For example, if the owner plans to purchase a new vehicle. Do I need to pay tax on the sale of a car? And if so, how to do it? What are the benefits in this or that case? By answering these questions, a person can easily sell his movable property. Otherwise, serious problems with the FTS may arise. They are fraught with certain sanctions. We will talk about them later.

Right or duty?

First, consider the key points of the topic. Do I need to pay car sales tax at all?

According to the legislation in force in Russia, when making a profit, a citizen is obliged to pay tax on the established scale. The exact amount depends on the money transferred.

It's about income tax. And therefore, ideally, when selling property (including a car), the owner gives part of the income to the state treasury. It is the duty of the taxpayer.

Nevertheless, taxation on the sale of vehicles and real estate does not always take place. Preferential conditions in Russiaconcerning taxes have been present for a long time. And almost everyone can use them. A little later we will figure out when and how it is allowed not to pay for the sale of property.

Amount of payments

What tax on the sale of a car will a citizen transfer? It's about VAT. For different categories of the population, the amount of deductions will be different. Especially when it comes to specific numbers.

We found out what tax the sale of a car is subject to. The amount of payments is determined as follows:

- 13% of the amount under the contract - for residents of the Russian Federation;

- 30% of funds received - for foreign citizens.

No more precise information can be given. After all, as already mentioned, a specific tax on the sale of a car is set depending on the value of the property.

Due date

Until when do I have to pay due taxes?

In this matter, everything is much simpler than it seems. Personal income tax for individuals is paid before July 15 of the year following the one in which the transaction is concluded. That is, if you sell a vehicle in 2017, you will have to pay for it before 2018-15-07. This rule is regulated by the RF Tax Code.

It is important to remember that a person must report their income before paying tax. This is done by filing a declaration with the local authority of the Federal Tax Service. The declaration of the population's profit is carried out until April 30 of the year following the period in which the money for the transaction was transferred to the seller.

Consequences of non-payment

When concluding a contract for the sale of a car, pay taxwill almost always have to. But there are exceptions. We'll meet them later.

First, let's find out what the concealment of income and non-payment of personal income taxes is fraught with. A citizen may face the following pen alties:

- pen alty of up to 20% of the amount of the debt, if the report occurred, but the money was not transferred;

- accrual pen alties;

- pen alty up to 30% of the payment if the declaration is not submitted.

In addition, the owner may be called to the Federal Tax Service to write an explanatory note. All this brings a lot of trouble. Therefore, it is better to find out the basics of Russian tax legislation. Then there will be no problems when selling a car.

New owner and vehicle sale

How much car sales tax will I have to pay? Citizens of the Russian Federation pay 13% of the amount under the purchase agreement. Under no circumstances will there be a lower payout.

Now let's look at different scenarios. Suppose a person has bought a vehicle and wants to sell it. The car has been owned by the seller for less than 3 years. What then?

In this case, ideally, taxation is present. Under current legislation, the tax on the sale of a car less than 3 years old is levied without fail. 13% of the proceeds will have to be given away.

Long-term ownership and sale

And what to do if the vehicle has been owned by a person for more than 36 months? This option is more common in real life.

Taxes on the sale of a car owned for more than 3 years do notcharged. This is a kind of benefit that everyone can count on. The main thing to remember is that 36 months will expire on the same day after the purchase of the car.

In other words, if 3 full years expire on the day after the transaction for the sale of movable property, the old owner of the vehicle will have to pay the tax in full. And in the case of the conclusion of the operation on the next day after the expiration of 36 months - no.

Many people prefer to wait for the specified period and only then sell the car. This technique is often used with real estate to avoid taxation.

Small amounts

How much is taxed when selling a car? Are there any benefits in this regard?

Yes. The fact is that there are preferential conditions that allow owners not to transfer personal income tax for a transaction. The rules will apply even if the car has been owned for less than 36 months.

For example, the amount of tax on the sale of a car will be zero if the amount of money transferred under the contract is no more than 250,000 rubles. These funds are not subject to personal income tax under any circumstances.

That is, there is no tax on the sale of a car in respect of transactions for which a citizen receives no more than 250 thousand rubles. Most often, a similar alignment occurs in relation to old cars.

Losses to the owner

But that's not all. There are other benefits related to the topic being studied.

We found out when the sale of a car is tax free. The last exception aretransactions made at a loss to the owner. We are talking about a seller of movable property.

In other words, if a person bought a car for 3 million rubles and sold it for 2,000,000, taxes would not need to be paid. In any case, the seller will be exempt from personal income tax. The benefit is related to the fact that a person initially makes a deal at a loss, in fact, without receiving real profit.

How to reduce fees

In Russia, there are many secrets that help legally reduce the car sales tax. What exactly is it about?

For example, a seller of movable property can reduce the amount of personal income tax on the amounts allocated for the maintenance and service of a car. The main thing is to prove that the costs were borne by the previous owner of the vehicle.

Under certain conditions, you can make a tax deduction. Citizens who work officially are en titled to a refund of 13% of the costs incurred when selling the vehicle.

Documents to reduce payment

Tax on the sale of a car (less than 3 years of ownership) will be charged, but it can be reduced. Let's use the cost of maintaining the car.

The owner-seller will need not only to submit a declaration to the Federal Tax Service on time, but also to present:

- passport;

- sales agreement;

- documents for the car;

- receipts for repairs;

- checks for the purchase of spare parts and parts of the vehicle;

- maintenance agreement.

This is the main package of documents that will help reduce the tax in the finalas a result. Let's take a look at the deduction below. The first step is to figure out how to file your tax return.

About filing a declaration

The amount of tax when selling a car is calculated taking into account the profit received under the contract. To do this, you will need to submit a declaration in the form of 3-NDFL.

The corresponding paper is always sent to the Federal Tax Service - both if it is required to pay taxes in the end, and when using benefits.

The seller will have to act like this:

- Collect a package of papers of the established form. Their list is presented below.

- Fill out the 3-personal income tax form.

- Submit a package of documents to the local authority of the Federal Tax Service (according to the seller's registration) within the time limits established by law.

That's it. There is nothing difficult in this. You can bring the idea to life:

- personally;

- by mail;

- in electronic form (on the website of the Federal Tax Service or on "State Services").

Today, a personal appeal to the tax office is in the greatest demand. Therefore, we will focus on this scenario.

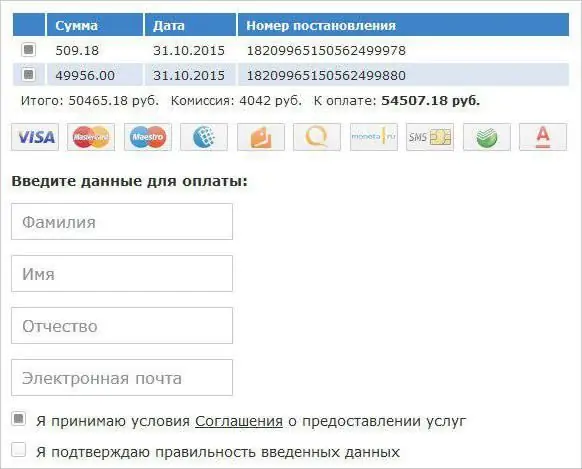

If using electronic filing, the user will:

- Enter the service of the Federal Tax Service or "Public Services".

- Find an income tax filing service.

- Fill out the request form by following the prompts on the screen.

- If possible, attach screenshots/photos of good quality papers available.

- Make an appointment with the Federal Tax Service.

It remains only to come on the appointed day to the tax office with a pre-assembled package of papers. Nothing else is required. Everything is not sohard as it seems at first.

Documents for declaration

Filing a declaration plays a huge role in taxation when selling a car. This is a key moment that affects the situation as a whole.

To submit the 3-personal income tax form to the Federal Tax Service, you need to prepare a number of documents. The car dealer will need:

- identity card;

- sales agreement;

- receipt of receipt of money for the transaction;

- documents for the car;

- contract of purchase/donation/inheritance of the vehicle to the seller;

- other papers to help reduce or get rid of the tax.

As practice shows, the preparation of papers does not provide for any hassle. In addition, it is better to attach a copy of the buyer's passport. This technique will save you from any problems in the future when studying the documentation of the Federal Tax Service. It will be clear who bought the car and from whom.

Transport taxes

There is another issue that worries many citizens when purchasing a car. In particular, if a vehicle is purchased from hand, that is, a used car is purchased.

This is a transport tax. When selling a car, do you have to pay it or not? And how long will the former owner have to pay for the sold movable property?

Directly when selling a car, the seller does not have to pay transport taxes. But the timing of the transaction will be taken into account when calculating the amount for car ownership in the end.

Another year after the sale of the vehicle, the former owner of the movableproperty will transfer the tax on transport. This phenomenon is connected with the fact that taxpayers pay for property a year after its acquisition. This means that when selling a car in 2016, the transport tax is paid for the last time in 2017. This will be the payment for the previous year.

There is one more feature worth paying attention to. This is the procedure for calculating the tax on transport. When selling a vehicle, the seller, one year after the conclusion of the relevant transaction, will pay for the said transaction, but in a smaller amount than usual. The amount of transport tax when selling a car is calculated taking into account the full months of ownership of the vehicle.

Important: rounding up to a month is carried out if the owner sold the car on or after the 15th. Otherwise, the holding time decreases.

Assume that the transaction was made on June 16, 2016. Then the seller will pay in 2017 the tax on the car, calculated for 6 months. If the sale operation is carried out on June 14, you will need to pay for 5 months. All this is not so difficult to understand.

Due date for paying vehicle tax

Now a few words about how long you have to pay transport tax. More precisely, when citizens have to pay for the sold movable property not according to the declaration.

Notifications of the payment of transport taxes are sent, as a rule, before November 1 of the year following the period of acquisition (or sale) of the property. And payment of the receipt is required until December 1 inclusive. Beginning December 2pen alty calculation. And the corresponding payments will not affect the new owner of the car.

Advice to owners

The sale of a car is not taxed if a citizen sells property that he owns for more than 3 years or when making a transaction in the amount of not more than 250 thousand rubles. These are the most common scenarios.

Here are tips to help citizens prepare to pay taxes when selling vehicles:

- Keep all documents indicating the purchase of the machine and its contents. These papers will come in handy when declaring income.

- If a person wants to sell a car that has been owned for a little less than 3 years, it is better to wait a bit. After 36 months of ownership, there will be no taxation for the transaction.

- When paying, be sure to ask the buyer for a copy of the passport, as well as issue a receipt for the receipt of funds.

- Pre-filing income tax returns and paying due taxes. Delays are fraught with additional costs in the long run.

It is important to remember that the verification of transactions for the sale of cars is carried out by the Federal Tax Service very quickly. Such operations are recorded in the traffic police when registering vehicles for a new owner. Therefore, you should not hide income. And look for workarounds to dodge taxes, too.

Results

We figured out all the features of taxation when making transactions for the sale of cars. Now this topic will not cause any trouble. Especially if you prepare in advance for operations.

Ideally, citizens pay taxes on carsupon sale of the relevant property. But under certain circumstances there is no taxation. The described principles apply throughout the territory of the Russian Federation without exception. And therefore, it will be possible to be exempt from taxes for a transaction only in exceptional cases.

Based on the foregoing, we can conclude that the seller of the vehicle will have to focus on the following time limits:

- submission of the declaration - until April 30;

- payment of personal income tax under the contract - until July 15;

- receipt of tax notices on transport tax - until November 1;

- payment of tax on the car - until December 1.

In all cases, the year following the period of the transaction is implied. There is no need to make the corresponding payments instantly. You can take your time with these tasks. The main thing is to meet the allotted time. With timely preparation, it is not so difficult.

Recommended:

Active sales - what is it? Nikolay Rysev, "Active sales". Active sales technology

In the business environment, there is an opinion that the locomotive of any business is the seller. In the United States and other developed capitalist countries, the profession of "salesperson" is considered one of the most prestigious. What are the features of working in the field of active sales?

When does the car tax come? How to calculate car tax

Most citizens of the country either have their own transport or are thinking about purchasing it. But you will have to fork out for a car not only when it is purchased or regularly refueled at the station. It is also necessary to pay a substantial amount for taxes. According to the tax code, they are not subject to any taxes at all

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way